$ 1.2B -Strong accumulation signal from Etherium withdrawal from CEXS

Reason to trust

Strict editing policies focused on accuracy, relevance and fairness

It was produced by an industry expert and examined three severely.

Best standard of reporting and publishing

Strict editing policies focused on accuracy, relevance and fairness

Lion’s soccer prices and players are soft. Each Arcu Lorem, all children or ULLAMCORPER FOOTBALL MATE is Ultricies.

This article is also provided in Spanish.

Ether Lee is tagging $ 2,739 and setting up a new region’s high level that has reached invisible prices since the end of February. This rally means ETH’s powerful comeback earlier this year. Now, the wider passwords wake up and the capital flow returns to Altcoins, and the bulls seem to be decisively controlled.

Related reading

Analysts are calling for potential Altseason with Ether Leeum’s relative strengths and investor trust in Bitcoin. As Bitcoin became close to a record high, Ethereum has gained the opportunity to increase the level of major resistance and excellent performance through guilty rulings.

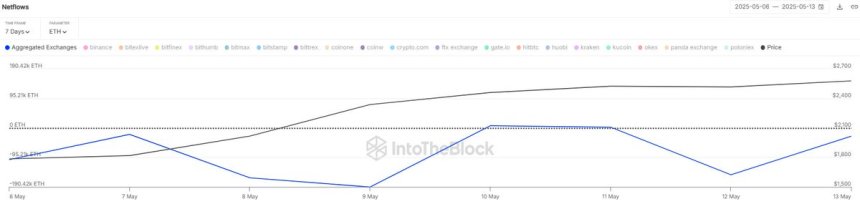

According to data from Sentora (previous INTOTHEBLOCK), which supports this story, $ 1.2 billion worth of ETH has been withdrawn from the central exchange over the last seven days. This continuous trend of net leaks suggests continuous accumulation and sales pressure.

As the price measures are heated and investor feelings change, Ethereum can prepare for major evacuation. If the bull maintains control, the 3,000 to $ 3,100 area can be tested as the next major resistance area. The Altcoin market shows signs of life, so all eyes are now in ETH.

Ethereum builds momentum by accumulating Exchange leakage signal.

Ether Lee is making more than an important level as conferencing conjunctions continue to increase. After moving slowly for a few weeks, ETH has been worth more than 50% since last week. This rapid movement of the rise has had hope for Altseason, and many analysts see Ether Lee’s escape as a potential trigger of the wider Altcoin market intensity.

Ether Lee now has a firm $ 2,600, which has been a strong resistance for several months. This exemption, which increases the amount of momentum for Bitcoin, suggests that the bull is restoring control. Traders are closely at the next major resistance area between $ 2,900 and $ 3,100, which can serve as a major test of Ether Leeum’s rise.

In addition to the strong case, Sentora’s data shows that ETH for $ 1.2 billion worth of ETH has been withdrawn from the central exchange over the last seven days. This trend has been strengthened since early May, pointing out the increase in investor accumulation and decrease in sales pressure. Large exchange leaks are often considered to be a signal that the holder stores ETH exchange, reducing immediate supply and supporting upward price movement.

As the market sentiment is responsible for strength and Ether Leeum, all the eyes explain whether ETH can maintain momentum and lead the Altcoin market to a new growth stage. If the accumulation trend persists and the bulls maintain the main level, the route for Ether Lee’s $ 3,100 can open the door to a wider market rally.

Related reading

Price behavior details: ETH test key level

Ether Lee’s weekly chart shows a powerful escape after a few weeks of weakness, and ETH is currently about $ 2,599.14. The recent surge has surpassed two important long -term trend indicators: 200 weeks EMA ($ 2,259.65) and 200 weeks of SMA ($ 2,451.55). Reclaiming this level has renewed the signal of the strong momentum and the strong change of emotion.

The brake out candle itself is one of the largest weekly green candles for more than a year, and the buyer’s attention is rapidly introduced and potentially indicates the main reversal point after a few months of falling. In particular, this movement has taken the ETH to invisible level since February, reaching the highest price of $ 2,739.05 per week.

During this movement, the volume increased significantly, confirming the strength of the assembly. However, Ether Leeum is now faced with overhead resistance near 2800 to $ 2,900, which is the area that has been supported before the failure in early 2024. If the bull maintains a momentum and finishes more than $ 2,600 this week, you can open the door for the $ 3,100 resistance zone test.

Related reading

Disadvantages, the main support of the clock is about $ 2,450 and matches the 200 week SMA. If you do not maintain that level, you can invite $ 2,250 re -examination. At present, the trend is optimistic, but it is important to follow next week.

DALL-E’s main image, TradingView chart