10% stock downside risk as value drives | RRG chart

key

gist

- Value stocks are leading growth

- When value outstrips growth, the S&P 500 typically doesn’t perform very well.

- The strength of value is evident across all size segments of the market.

- Important areas of support for SPY at 480 and 460

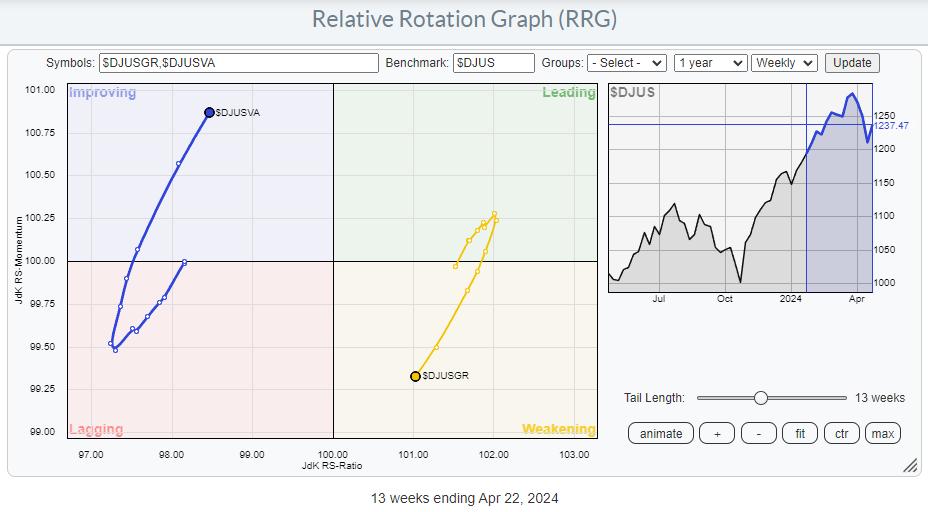

Values that lead growth

The weekly RRG above shows the rotation of growth and value stocks. The benchmark is the DJ US index. Recent cycles clearly demonstrate a materializing and reinvigorating cycle in value growth. Current growth is still located to the right of the RRG, but the $DJUSGR tail is rapidly heading towards the trailing quadrant in the negative RRG direction.

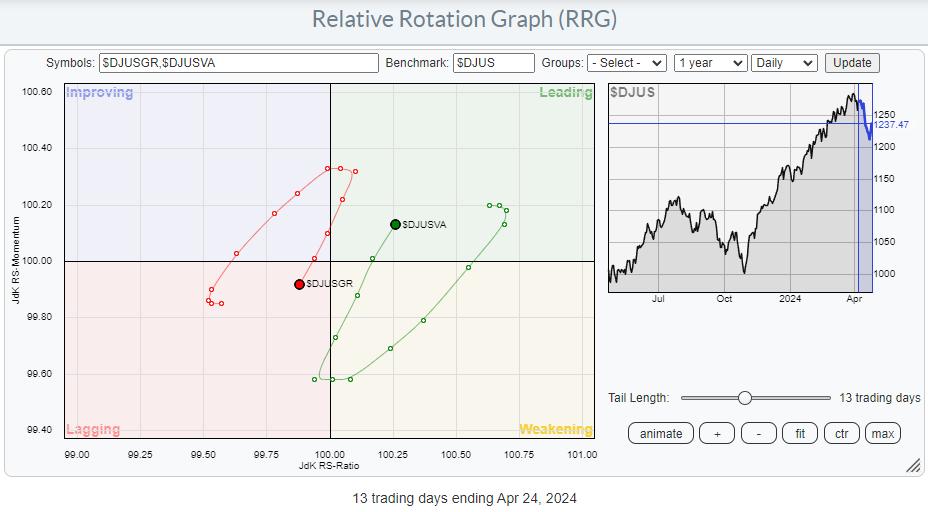

This daily version of RRG highlights its preference for value stocks.

The $DJUSVA tail fell into the weakened quadrant after passing through the leaders since mid-March, reconnected sharply within a day inside the lagging quadrant, and is now back in the leading quadrant, supporting further strengthening of the weekly value tail. period.

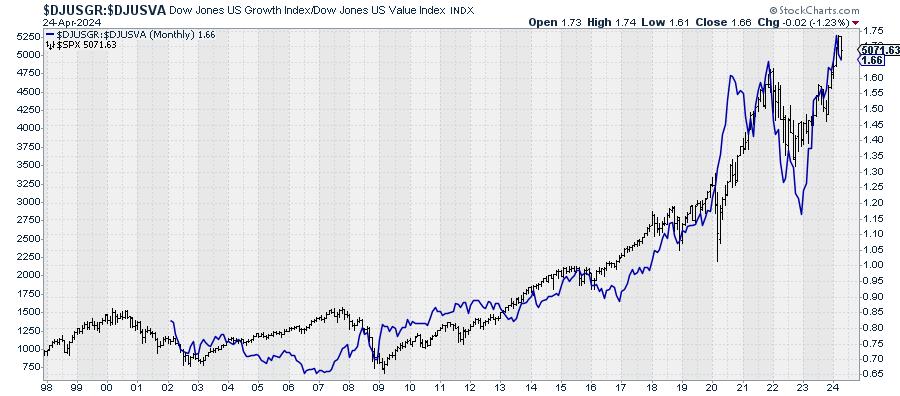

$SPX generally tracks growth/value ratios pretty well.

If you plot the growth/value ratios above the price chart for $SPX, you can see that they have tracked each other pretty well over time. Since this is a monthly chart, we are discussing long-term trends here.

The important point here is that the S&P generally performs well when the growth/value ratio goes up and performs poorly when the ratio goes down.

With RRG currently showing a strong preference for value stocks, caution is warranted as this could foreshadow further decline in the S&P 500 itself.

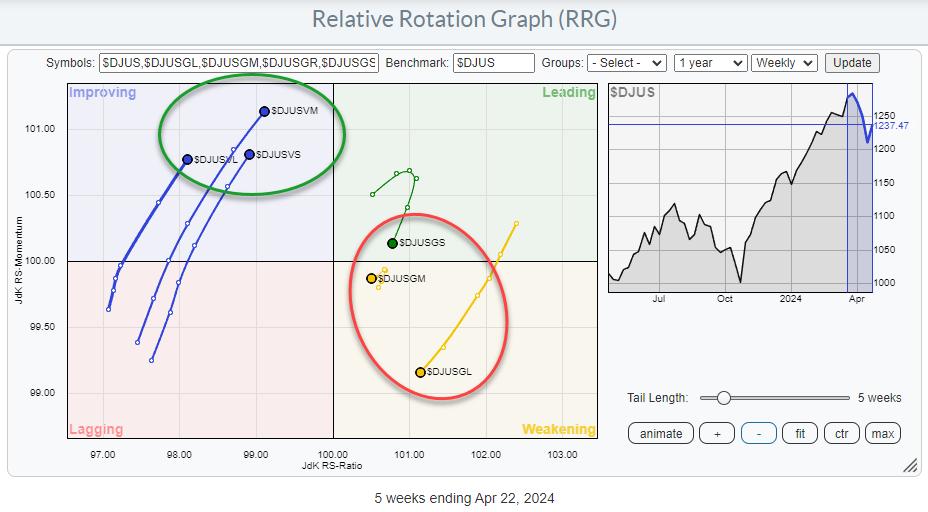

The preference for value over growth is evident across all size segments.

If we break down the growth and value segments into their respective size buckets, we get the RRG above. This shows that value outstrips growth across all size segments. The large-, mid-, and small-cap value tails are all within the improving quadrant and moving in the positive RRG direction.

The growth tail is slightly more split, but all three are in a negative RRG direction, with large-cap growth showing the fastest deterioration. Mid-Cap is the most stable, with a short tail just inside the weakening quadrant. Small-cap growth stocks rolled over within the leading quadrant and both measures began to decline.

Overall, this highlights the need for caution regarding price movements in the S&P 500 in the coming weeks.

5%-10% downside risk within a long-term uptrend

On the weekly chart, SPY found support at the previous upward resistance level of around 494. More important support is found at the January 2022 high at the 480 level, a break of which would provide the area around 460. Another solid area of support. With the long-term trend of rising highs and rising lows still firmly in place, we must conclude that the upward trend is still underway.

But at the same time, we must realize that a 5-10% decline is perfectly possible within an uptrend.

If you look at the more detailed daily chart of SPY, you can see that it is already showing lower highs and lows, falling from its recent high of 524 to a low around 495, one notch lower on the weekly chart. This is considered an uptrend within a downtrend until this structure changes again.

The green shaded areas represent the support levels mentioned on the weekly chart. Within a long-term uptrend, new buying opportunities begin to arise in this range.

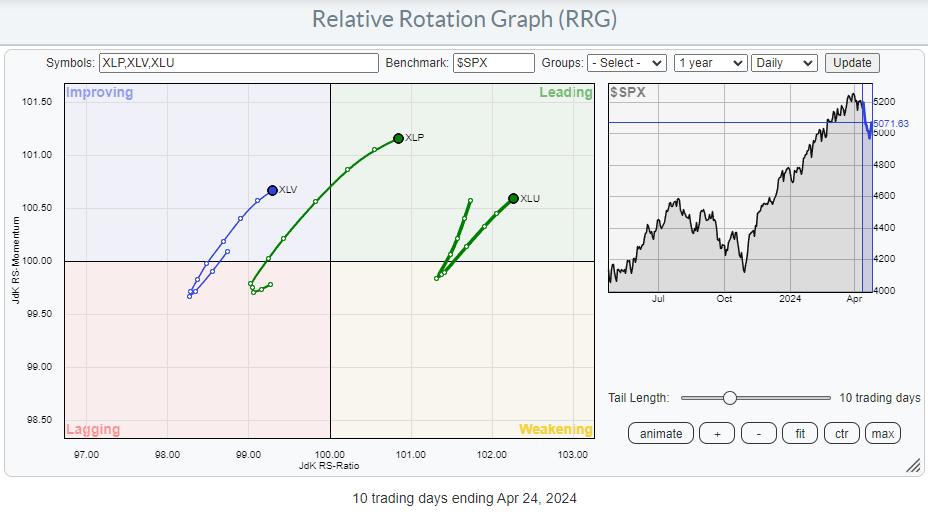

Rotation to the defense sector confirms risk aversion

Lastly, the Defense sector’s daily RRG has seen a rapid rotation into the Healthcare, Consumer Staples and Utilities sectors over the past two weeks of trading, confirming the need for caution in the coming weeks.

#StayAlert, –Julius

Julius de Kempenaer

Senior Technical Analyststockchart.com

creatorrelative rotation graph

founderRRG research

owner of: Spotlight by sector

Please find my handle. social media channels It’s under Bio below.

Please send any feedback, comments or questions to Juliusdk@stockcharts.com.. We cannot promise to respond to every message, but we will ensure that we read them and, where reasonably possible, utilize your feedback and comments or answer your questions.

To discuss RRG with me on SCANHey, please tag me using your handle. Julius_RRG.

RRG, Relative Rotation Graph, JdK RS-Ratio, and JdK RS-Momentum are registered trademarks of RRG Research.

Julius de Kempenaer is the creator of Relative Rotation Graphs™. This unique way to visualize relative strength within the world of securities was first launched on the Bloomberg Professional Services Terminal in January 2011 and made public on StockCharts.com in July 2014. After graduating from the Royal Netherlands Military Academy, Julius served in the Dutch army. Airmen of various officer ranks. He retired from the military in 1990 with the rank of captain and entered the financial industry as a portfolio manager at Equity & Law (now part of AXA Investment Managers). Learn more