100% moving after printing, Etherrium prices can be primed.

This article is also provided in Spanish.

Ether Leeum Price measures Over the last seven days, aviation candles have been created to be sent to other surges. In the next 8 to 12 weeks. This surrender candle attracted the attention of the crypto analyst Ted pillow.

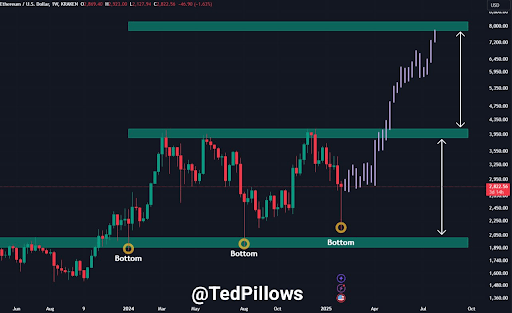

According to TED Pillows’ technical analysis, Ethereum printed aviation candles in early 2025 as in the first quarter of 2024 and in the third quarter of 2023.

Airline candle and Ether Lee Reeum historical pattern

TEDPILLOWS analysis highlights The price of Etherrium has passed three major surrender events over the past two years, and all of these prices have reached a significant price rebound. In particular, such a surrender was done during the weekly candlestick period when Ethereum Price witnessed strong sales pressure throughout the week. But according to the historical price playout, these surrender often marked the bottom before a large price rally.

Related reading

The first of these surrenders occurred in the first quarter of 2024, leading to 100% rally for the next three months, and Etherrium price reached $ 3,950. The second surrender took place in the third quarter of 2024 and caused a similar rise. As Ether Lee experience another surrender moment in early 2025, the analysts suggest that the pattern will be repeated. He thinks Ether Lee is once again forming a market floor and setting the stage. For aggressive upward movement.

100% price surge and potential peak of Ether Leeum

If Ether Lee follows the previous trajectory, it can bring significant price hikes despite the fact that major Altcoin is currently suffering from $ 2,700 for the next 8 to 12 weeks. After recent surrender, 90% -100% pump pushes the price of Etherrium. Past major resistance levels And more than the current maximum.

Related reading

According to TEDPILLOWS’s analysis, Ether Lee’s ultimate price target for surrender can reach $ 8,000. However, it is likely to have significant resistance near $ 3,950, which has historically been rejected in the past surrender cycle. If Ether Lee Rium struggles to break through this barrier, a temporary fullback may be on the horizon before the continuous movement increases.

Meanwhile, Spot Ethereum ETF is attracting a big inflow. Despite the drop in Ether Leeum. Institutional investors seem to use deep and increase their stake in ETH by anticipating a wider market rebound.

Spot Ett. ETF Recorded In the last six days, BLACKROCK took over $ 424.1 million, with the inflow of $ 553.8 million. This constant accumulation from institutional holders will increase the trust in Ether Lee’s long -term potential and lay the foundation for an increase of 100% for the next 8 to 12 months.

At the time of writing, Ether Leeum has decreased 4% to $ 2,725 over the last 24 hours.

The main image of Unsplash, the chart of TradingView.com