2 REITs Likely to Deliver Alpha Performance in 2024

douglas ricing

As of now, it certainly seems like the odds are in the cards for commercial real estate in 2024. A key driver of this is the expected change in monetary policy direction from the Fed.

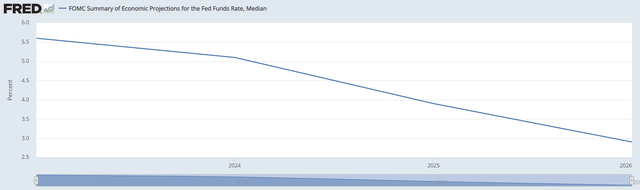

FOMC; st louis fed

Starting in 2024, the FOMC’s mid-range estimate projects SOFR to consistently converge back to the ~3% level by 2026.

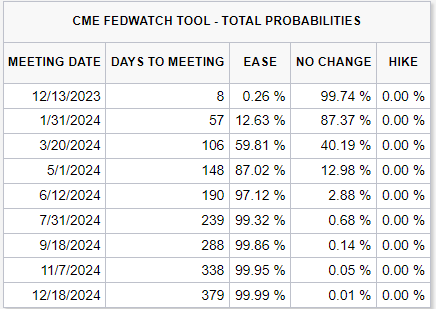

CME Group Inc

There appears to be some disagreement in the market about the exact timing of the first rate cut, but the consensus is close to 100% on experiencing a first rate cut in mid-2024.

It’s a combination of several factors that makes the market so aligned with the future trajectory of the federal funds rate. Clear inflation removal data, a weak jobs report, and a slowing economy all contribute to a meaningful basis for rate cuts.

Here’s what’s important in the context of REIT investing:

- Interest rates are likely to fall in 2024. The degree or number of cuts is not very important.

- Once the first cut materializes and the market begins to price further moves with more certainty, assets with more duration will react as if SOFR has fallen further.

So, considering the above, REITs with large exposure to the duration factor (cash flows loaded on the back end, similar to the characteristics of bonds) will perform very well in 2024.

Here are two duration-loaded REITs that investors who believe interest rates will decline in 2024 should definitely consider in their portfolios.

#1 SAFE – Unique Ground Rental REIT

Safehold (NYSE:SAFE) is a very unique REIT that operates in the ground rental sector and has a market capitalization of approximately $1.5 billion. The way SAFE creates value is by taking some of the CapEx pressure off real estate developers by purchasing land and leasing it to developers over the long term.

Through this mechanism, SAFE allows developers to effectively backend load CapEx requirements for (typically) 100 years with some built-in markup and periodic lease escalators.

For SAFEs, this ensures very stable cash flows, similar to long-term bond products. For example, SAFE currently has over 90 years of remaining life on its contracted leases, and these cash flows are supported by a rather sound underwriting policy (i.e. over 3.8x rental coverage).

Since cash flows are relatively fixed over very long periods of time (e.g. even longer than jumbo bonds), all of this translates into overexposure to the duration factor.

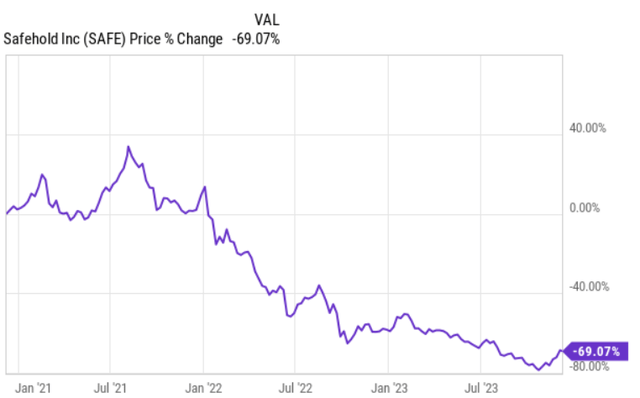

In the chart below, you can clearly see how SAFE has lost a ton of value since the FED began its restrictive monetary policy. Much of this is explained by sensitivity to period.

Y chart

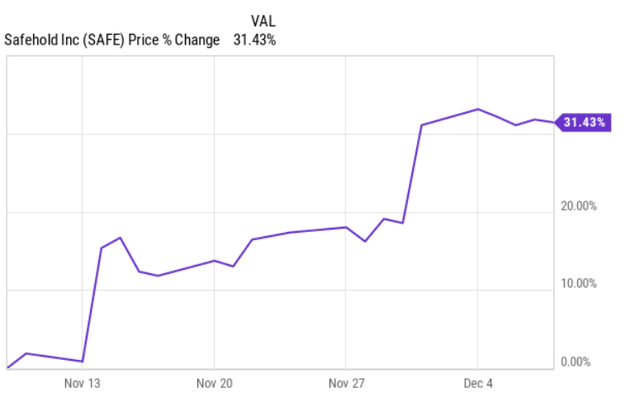

We can see this by looking at how SAFE has responded to recent news regarding a growing disinflationary environment.

Y chart

It is very clear that SAFE reacts in an expanded manner to each movement in interest rates. It is also clear that SAFE is about 70% below where it was before the Fed began its hiking cycle, meaning there is still a lot of room for upside.

Finally, experiencing some interest rate cuts will also push SAFE away from its fundamentals.

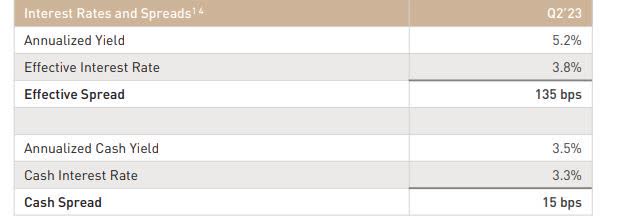

safe income

Higher interest rates have reduced SAFE’s cash spread to just a few basis points. If interest rates continue to rise, a SAFE’s underlying cash flows will become underwater.

Now that it is clear that interest rates will no longer rise and will likely undergo a gradual normalization, there could be further upward pressure on SAFE’s share price associated with the risk of negative cash spreads fading away.

#2 O – Reliable Dividend Aristocrat

Realty Income (NYSE:O) is a well-known REIT that is considered one of the best managed REITs and is a favorite of many retail investors.

It is classified as a Dividend Aristocrat and becomes the fourth largest REIT after the acquisition of Spirit Realty Capital, Inc. (SRC).

In addition to its attractive duration play, O embodies many other interesting traits, including:

- Top tier investment credit rating. Currently, O has an upper-mid investment grade credit rating of A3, which is unusual for an equity REIT. An A3 rating is useful in times of economic uncertainty to ensure optimal access to financing on reasonable terms that can be leveraged for increased M&A while other, more distressed REITs (or developers) sell.

- Defense Portfolio. O also has a portfolio of durable properties, most of which are leased on a net lease basis. More than 90% of rents come from somewhat defensive and counter-cyclical sectors of the economy, which makes the underlying cash flows more stable and predictable, as do bond products. Additionally, the overall rent coverage and O tenant balance sheet position are very healthy, further strengthening the defensive nature of O cash flow.

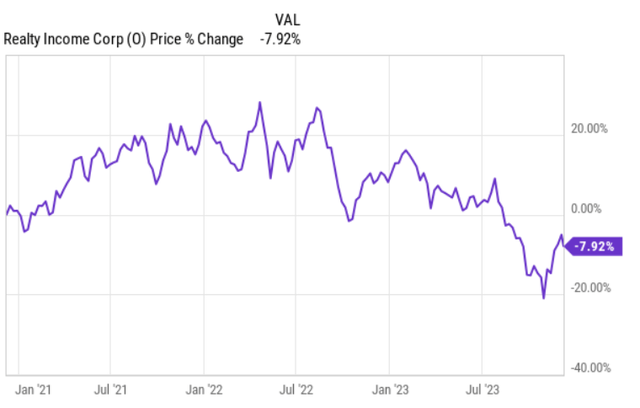

In the case of Company O, the decline in stock price since early 2022 has not been very large. Nevertheless, unlike SAFE, Company O achieved improved performance by strengthening FFO performance during this period. At the same time, O succeeded in acquiring a significant amount of real estate in addition to the SRC acquisition.

Therefore, all things being equal, O should experience a more pronounced rebound compared to a decrease when interest rates start to rise.

Y chart

The most important aspect contributing to further increasing the term profile is the weighted average rental structure. As of the third quarter of 2023, O’s weighted average lease term is close to 10 years.

Real Estate Income Investor Relations

Following the merger with SRC, this component will be improved or further expanded as SRC carries a significantly longer weighted average lease term profile (10.2 years).

conclusion

In my opinion, there is a clear possibility that interest rates will be lowered in 2024. While it is impossible to predict specific levels, the notion of interest rates falling and some initial cuts for the foreseeable future is enough to consider duration-loaded real estate. invest.

Companies like SAFE and O, which exhibit cash flow patterns similar to fixed income securities, should be able to deliver alpha performance relative to the overall REIT space, which will generate solid returns on their own in a declining interest rate environment.