280K New Addresses for Dogecoin – Traders, Is This a Buy Signal?

- New demand for DOGE hit record highs this week.

- Memecoin’s MVRVA ratio also hinted at a buying opportunity.

According to IntoTheBlock, Dogecoin (DOGE), a memecoin leading the cryptocurrency market. major spikes to new demands. on May 2, 28,000 new addresses were created for DOGE transactions. This figure represents a 102% increase over DOGE’s monthly low for new demand set on April 29.

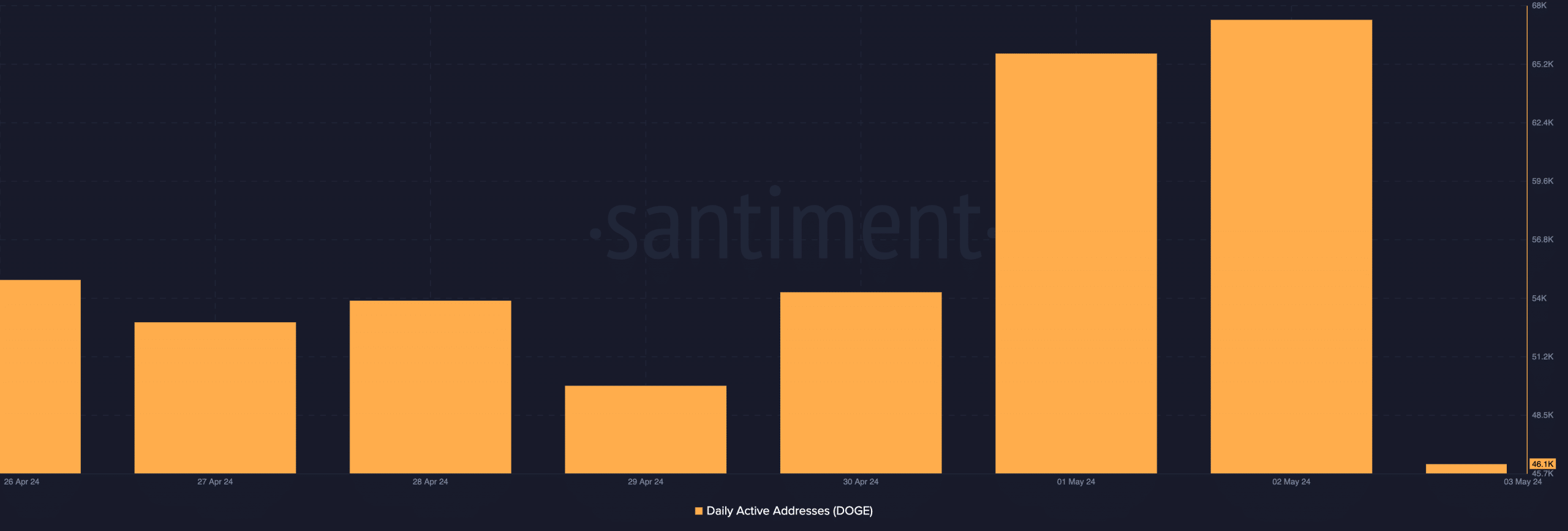

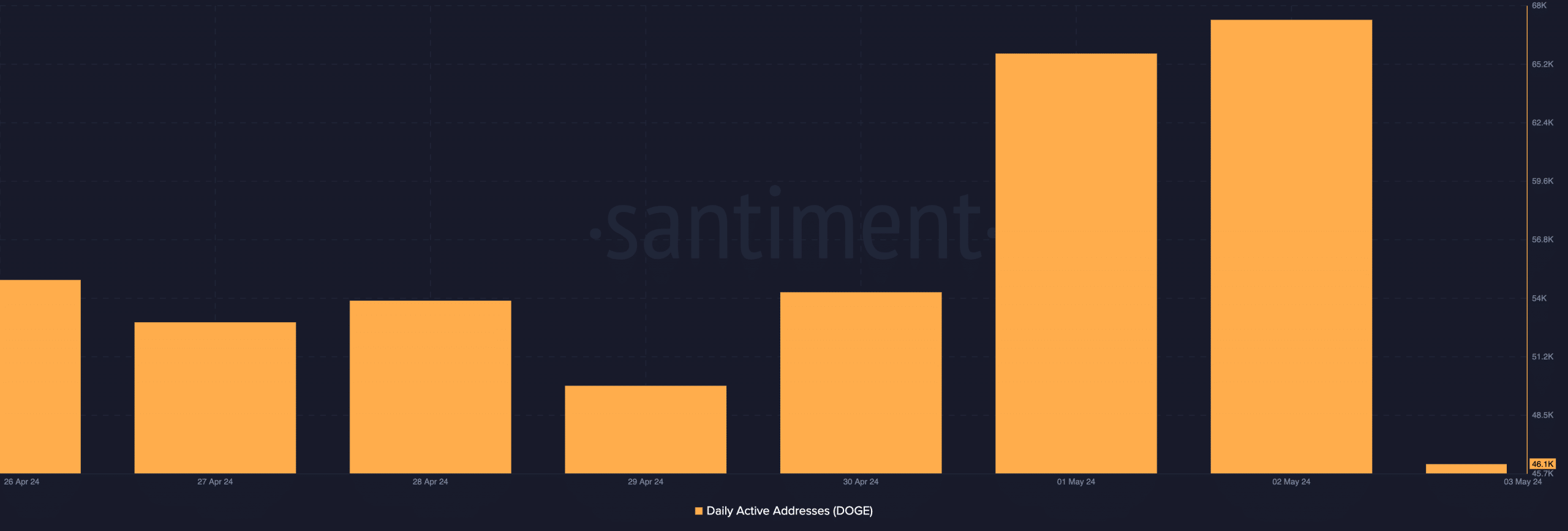

The number of daily addresses involved in DOGE transactions has also rebounded over the past week as new demand has increased. In fact, data from Santiment shows that memecoin’s daily active addresses have increased by 27% in the past seven days alone.

Source: Santiment

Here is DOGE’s response:

Increased network activity for an asset often precedes price increases. But that wasn’t the case with DOGE. Continued demand for altcoins over the past week has prevented their prices from rising significantly.

At the time of this writing, DOGE was trading at $0.15. According to CoinMarketCap, it recorded a price increase of just 2% over the week, with most of that coming in the last 24 hours. DOGE’s slight rise over the past seven days reflects the overall market decline seen over that period. In fact, the low trading recorded during the period under review caused the market capitalization of the cryptocurrency market to fall below $2.3 trillion as of May 1 before rebounding.

However, the rise in DOGE over the past 24 hours is a sign of bullish sentiment.

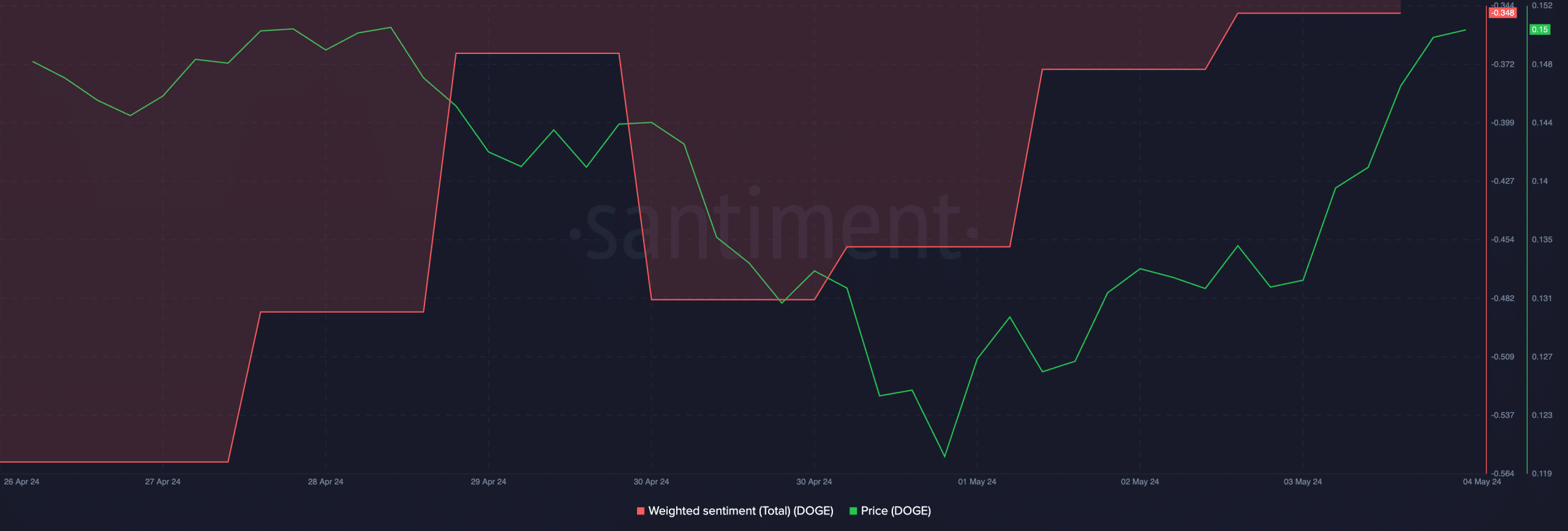

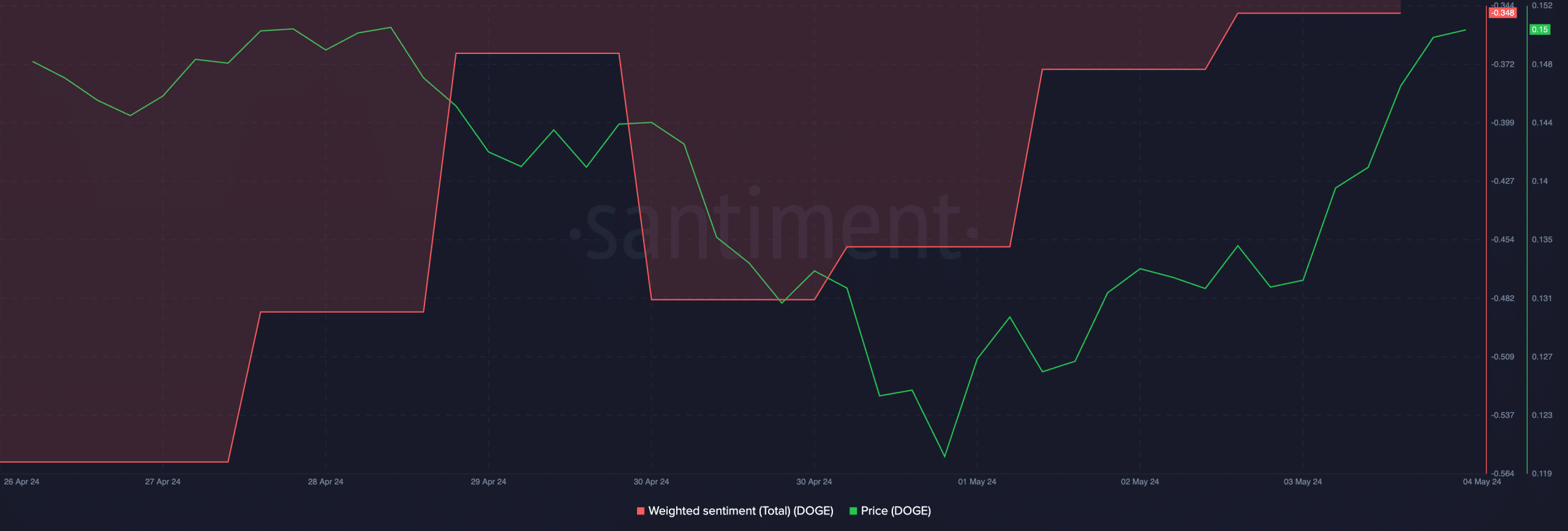

Additionally, according to Santiment, DOGE’s weighted sentiment is now poised to breach the center line in an uptrend.. This indicator tracks general market sentiment towards cryptocurrency assets. If it returns a value greater than 0, market sentiment is positive. Conversely, market sentiment is mainly bearish when values are below the zero line.

At press time, DOGE’s weighted sentiment was -0.348. As trading activity increases and DOGE expands its profits in the short term, the value of this indicator increases.

Source: Santiment

Realistic or not, DOGE’s market cap in BTC terms is:

Maybe now is your time

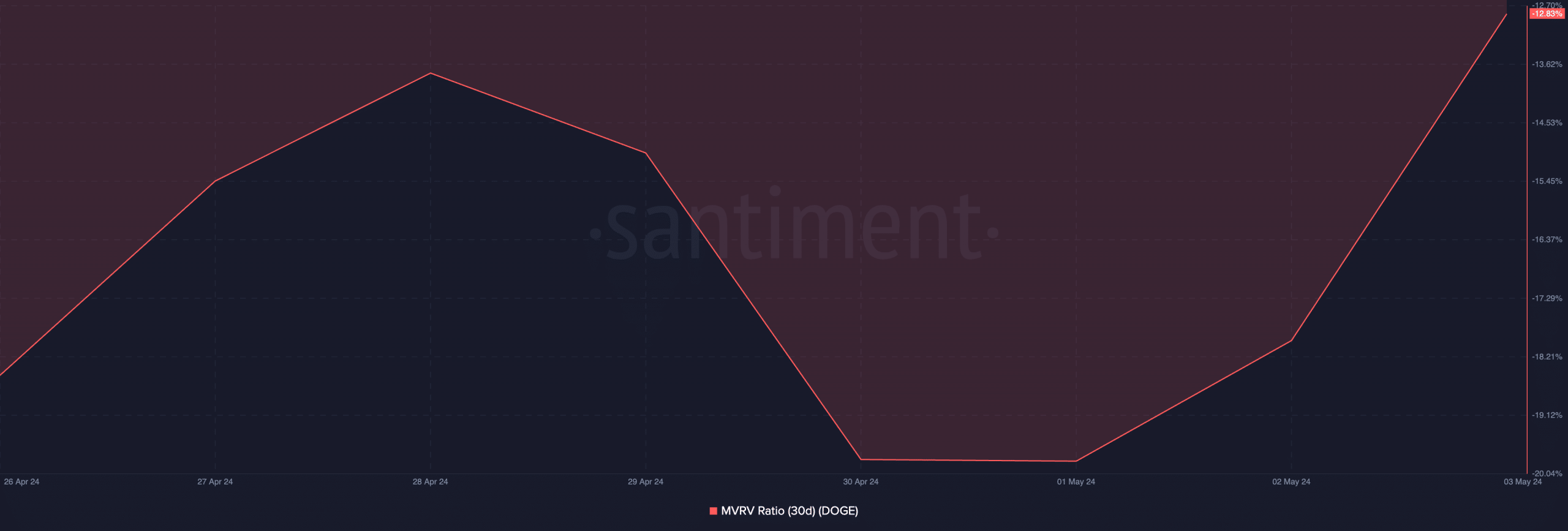

AMBCrypto evaluated DOGE’s Market Value to Realized Value (MVRV) ratio and found that it is currently sending a buy signal. This indicator, evaluated through a 30-day moving average, returned a negative value of -12.83% at press time.

Source: Santiment

The MVRV of an asset tracks the ratio between the asset’s current market price and the average price of all coins or tokens acquired for that asset.

If the value is above 1, the market value of the asset is much higher than the price at which most investors acquired the holding. When this happens, the asset is said to be overvalued.

On the other hand, if it returns a negative value, it says that the asset is undervalued. The market value is lower than the average purchase price of all tokens in circulation.

Traders interpret a negative MVRV ratio as a “buy the dip” signal in anticipation of a price rise.

Source: https://ambcrypto.com/dogecoins-280k-new-addresses-traders-is-this-a-buy-signal-for-you/