#3: “How long can stocks do not have foreign stocks?” -Meb Faber Study

In our final work, we have investigated how long American stocks can earn American bonds. The answer was much longer than most people could handle.

But what about assets similar to stocks other than the United States?

American stocks have driven out foreign stocks as long as anyone can remember. As podcast Alum Edward Mcquarrie pointed out, it can only be “right chart bias”. At that time, when assets have been well performed, there may be a lot of results, but it always seems to be excellent in performance.

The following is an example of US stock bonds.

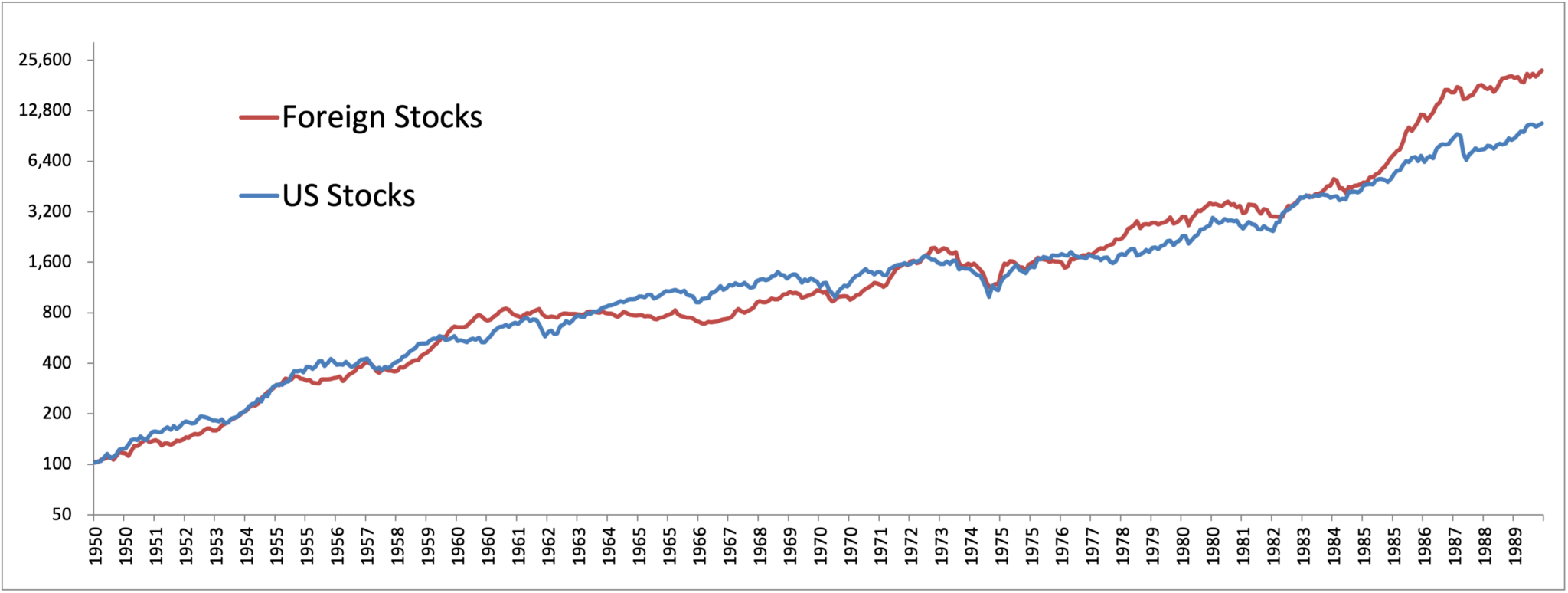

Which of these is related to us and foreign stocks? Well, after GFC in 2009, I felt that US stocks could not be wrong and made more than 900%. For foreign stocks, it is about 300%.

The United States was a global stock ball. But history has an interesting way to humble the recent trends forever.

Kicker is as follows: American stocks can realize foreign stocks for decades.

Let’s wrap the tape. Many people have called “lost 10 years” for US stocks from 2000 to 10 years in 2010. The S & P 500 actually lost money.. Meanwhile, foreign advanced markets (Europe, Japan, etc.), especially emerging markets (Hello, BRICS!), Have a solid profit. It was a classic example of a tree that does not grow into the sky.

The attached chart ruins this house. If you were sitting at a US -only camp for a certain period of time, you would have tracked a variety of portfolios around the world for one mile. And it is not just cherry picking. We have been stretching for decades.

It was 40 years from the 1950s to the 1980s. In the 1800s, foreign stocks were better than the United States for 60 years.

What happens if the performance persists every year? Imagine for 5-6 consecutive years! Can you never get up? Literally, about 20 years ago, it happened in the LOL and the 1980s. Investors often tend to be outlined from the past for the past 15 years, surpassing foreign markets for the past 12 years. Is the bear market of diversification with a significant foreign performance this year?

Important lesson? Diversification is not a cute slogan, but a survival tactic.

Our homeland prejudice keeps us notice.If you have been loaded with American stocks after 15 years of operation, the right feeling is what the lizard brain says. History must be careful. Evaluation is important. And if the foreign market faces the basement while the US cape ratio reaches the stratosphere, the return on the future tends to follow the reverse route.

Solution? We own hay piles as well as American needles. Global value tilts that are regularly resized are the same when leadership changes, as always.

If the portfolio is 100% of the US allocation, it can be time to expand. There is literally the world.