320 million USDT inflows could trigger price surge

A wind of change is blowing around Ethereum (ETH), the world’s second largest cryptocurrency. The Ethereum network itself is active, but the price of ETH has plummeted in recent days, leaving investors scratching their heads.

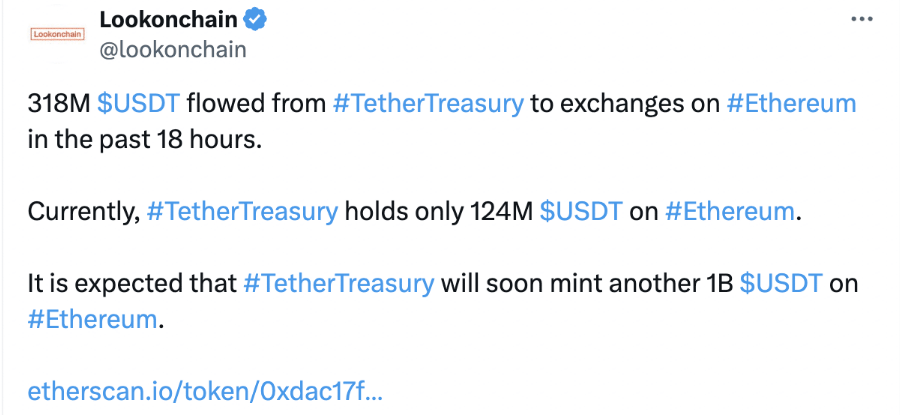

Tether (USDT)’s recent moves offer a glimmer of hope. Tether, the world’s most popular stablecoin issuer pegged to the U.S. dollar, transferred a whopping $318 million worth of USDT directly from its Treasury wallet to an exchange on the Ethereum network.

Source: X

These outflows point to potential expectations of increased demand for USDT, which in turn could be a sign of growing investor interest in the broader cryptocurrency market.

Historically, Tether has minted large amounts of USDT during periods of high cryptocurrency activity, and now there is speculation that another billion USDT will soon be minted on Ethereum.

But analysts warn against blind optimism. An increase in USDT activity may bode well for Ethereum, but it is not a guaranteed path to prosperity.

Other blockchains, such as Tron, can also process USDT transactions, providing an alternative method for investors.

Total crypto market cap is currently at $2.289 trillion. Chart: TradingView

Pricing issues and investor sentiment

Meanwhile, ETH price stubbornly refused to cooperate. As of today, ETH is trading below the important $3,000 mark, down nearly 3% in the last 24 hours.

Ethereum has lost 11% of its value over the past seven days, according to data from Coingecko.

Related Read: Toncoin Fuels DeFi Monster Growth: TVL Soars 300% in One Month

A further decline below $3,000 could trigger panic selling and further exacerbate the downturn.

The current situation presents a complicated picture for Ethereum. While Tether’s recent moves and steady network activity provide some optimism, price declines and NFT market corrections paint a contrasting picture.

Active despite price pressure

While the price of ETH is trending upward, the Ethereum network itself is highly active. In contrast to the recent slump in the non-fungible token (NFT) market, overall network usage has remained remarkably consistent.

This suggests a shift in focus within the Ethereum ecosystem. While the colorful world of NFTs is experiencing a temporary correction, other sectors within Ethereum are picking up the slack.

The rise in decentralized finance (DeFi) trading, stablecoin swaps, and general token activity could be the hidden force keeping the network busy.

Featured image from Pexels, chart from TradingView

Disclaimer: This article is provided for educational purposes only. This does not represent NewsBTC’s opinion on whether to buy, sell or hold any investment, and of course investing carries risks. We recommend that you do your own research before making any investment decisions. Your use of the information provided on this website is entirely at your own risk.