3M Stock: Dividend Could Be Halved (NYSE:MMM)

enot-poloskun/E+ via Getty Images

3M First Quarter Earnings Report:

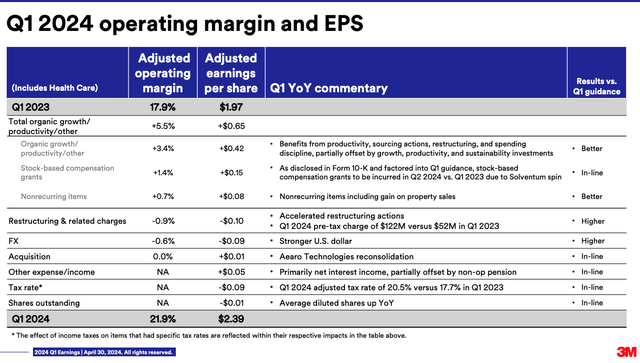

3M(New York Stock Exchange: MMM) reported its first quarter 2024 results this morning. Revenue was slightly ahead, with adjusted EPS coming in at $2.39 per share. The adjustments were many and significant. Therefore, I advise people to: Pass 3M’s quarterly presentation. The two biggest pieces were cost reductions, net of restructuring charges, and deferring inventory compensation costs to the second quarter.

3 Month First Quarter Revenue Adjustment (3M quarterly announcement)

The company issued EPS guidance of $6.80 to $7.30 for the year. Both the first quarter report and 2024 guidance consisted of net solvent (SOLV), 80.1% of which was spun off on April 1. I covered the spinoff and its potential impact in a previous article on 3M stock.

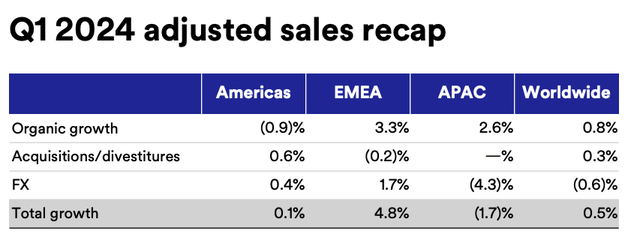

Adjusted organic sales were up 0.8%, which isn’t very exciting but is better than the previous year. The company has recorded organic revenue declines for most of the past two years. Most of the “improvement” in the sales situation comes from the electronics and automotive sectors, where the company has signed some contracts. Nonetheless, these adjusted numbers are a mixed bag. The Americas are still down, International is looking slightly better, but Asian FX is a big headwind.

3M Organic Revenue Analysis (3M quarterly announcement)

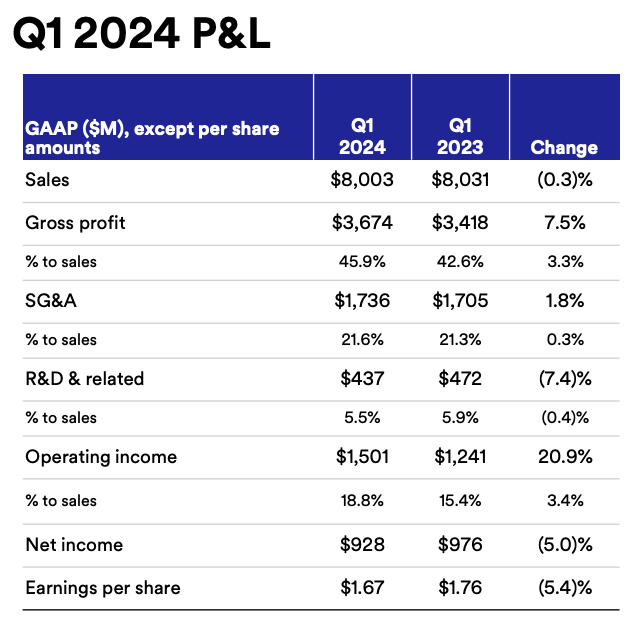

People (at least the Wall Street analysts on the conference call) seem most excited about the margin improvement. The company’s cost savings from last year are continuing into this year. Operating margins improved 400 basis points in the first quarter of ’24 compared to the first quarter of ’23 and are expected to be 200 to 275 basis points higher for the full year.

While higher gross margins and lower SG&A certainly helped margins, the company also reduced its R&D spending.

3M first quarter performance compared to the same period last year (3M quarterly announcement)

For companies with organic revenue issues, R&D is not where they want to cut costs. In fact, I had to laugh when CEO Mike Roman was asked on a conference call about the company’s expected growth. He answered:

What’s important is that what’s driving our growth is actually investing in the business. Organic investments have been the dominant driver of our growth as a company and we expect that to continue to grow in the future.

3M Dividend Cut:

I’ve been writing for over a year that 3M’s dividend following the SOLV spinoff would be unaffordable without destroying its balance sheet. The math is simple. The company could barely afford its dividend, even though SOLV generated cash flow. There was no way the numbers would work without SOLV or significant improvements in revenue and free cash flow conversion. I questioned whether 3M’s board would cut its dividend or maintain the dividend aristocrat status it has maintained for decades at the expense of its balance sheet. Well, they did the responsible thing. The new dividend has not yet been announced, but the company said it will be 40% of adjusted free cash flow.

I believe operating cash flow will be approximately $5 billion. at best ((estimated at $4 billion) Without SOLV. Capital expenditures will be approximately $1.4 billion. So free cash flow would be about $3.5 billion. That leaves about $1.4 billion in dividends, or about $3 per share, which is about half the annual value of $6.04 from the last dividend of $1.51.

Impact of MMM dividend cut:

As of this writing (noon on April 30), the stock price is up 3% despite this dividend cut. People are really keen on improving margins here and ending the decline in organic sales. At $95 per share, 3M’s stock is trading at less than 14 times the midpoint of its 2024 earnings guidance. But that’s far from the end of the story here.

Dividend cuts are almost universally bad for stocks. I can’t think of an example where a dividend cut was absorbed well. I’ve lost count of the number of people who commented on my past negative articles about 3M and seemed enamored with the dividend. But the number was huge. A dividend yield of ~6% seemed like the biggest attraction, even with federal funds exceeding 5%.

If these people still like the stock, I’d be very surprised if I’m right and the dividend is cut in half.

Environmental responsibilities still remain:

Although 3M has resolved its water utility PFAS liability and earplug mass misconduct, PFAS remain a problem. It seems almost certain that the EPA will designate PFAS as a hazardous substance in the coming months. This could cost the company billions of dollars in cleanup costs. There are also state AG lawsuits, property damage and personal injury lawsuits and liabilities against foreign countries suing the company for PFAS contamination.

The company will not put any kind of figure on these liabilities. I think it would be quite large. Margin improvement is good and could add $500 million to $600 million to the company’s pre-tax earnings, but debt could overshadow that improvement. Wall Street analysts currently appear to be focusing on what’s in front of them rather than large, unquantified liabilities.

3M Short Selling Risks:

The main risk in the short thesis is the bulk settlement of all PFAS liabilities. I don’t see that happening, but anything is possible. While the market may see debt as a problem, it may also be priced into the new $7 earnings profile.

conclusion:

I think 3M management did a lot more than it could have done for its position. In order to get more cash through the company, we worked out what we could agree to in an amount and over a period of time that would cut costs and not destroy the company. However, debt remains and the decline in R&D and capital expenditures indicates that earnings growth will be difficult to achieve. The market generally does not offer large multiples for companies seeking to cut costs, at least those with large potential liabilities.