4 Financial Venturi Effects on Large Stock Market Profits

Tadamichi

What is driving these stock market crashes, which are playing out in the face of normal seasonal patterns and not backed by incredibly strong financial flows?

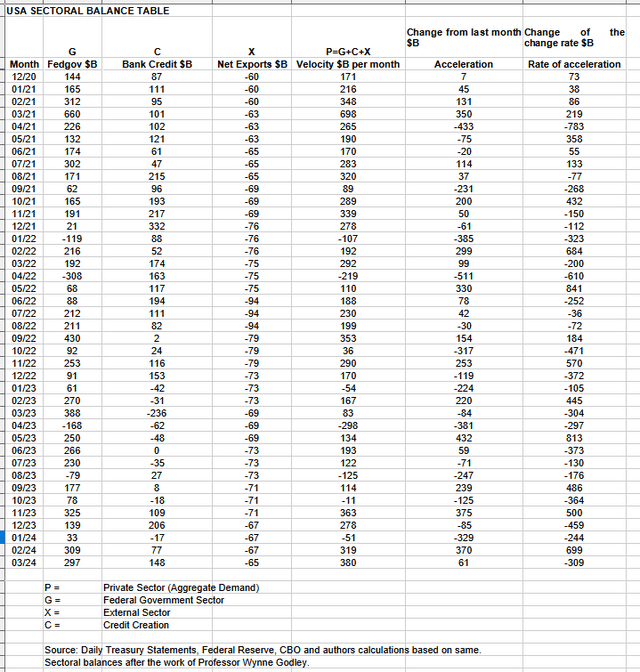

The table below shows U.S. sector balances as of recent. month. The information was prepared from the U.S. National Accounts.

U.S. Treasury and author’s calculations

In March 2024, the private sector recorded a surplus of $380 billion, which is a very positive result for asset markets because it increased the financial balance of the private sector and increased aggregate demand for goods, services and investment assets.

The table shows that the $380 billion private sector funding surplus came from a $297 billion injection from the federal government. This includes a new channel through which the Fed has injected about $8 billion in interest on direct reserves. Subtract the -$65 billion that flowed from the domestic private sector to foreign bank accounts at the Federal Reserve (External Sector X) in return for imported goods and services. Bank credit creation added $148 billion, more than double last month’s rate.

The numbers from the last six months or so are nothing special, like the 2020 COVID-19 emergency spending period and rapid stock market recovery shown at the beginning of the table. Financial flows alone cannot explain the steep and persistent collapse of the U.S. stock market.

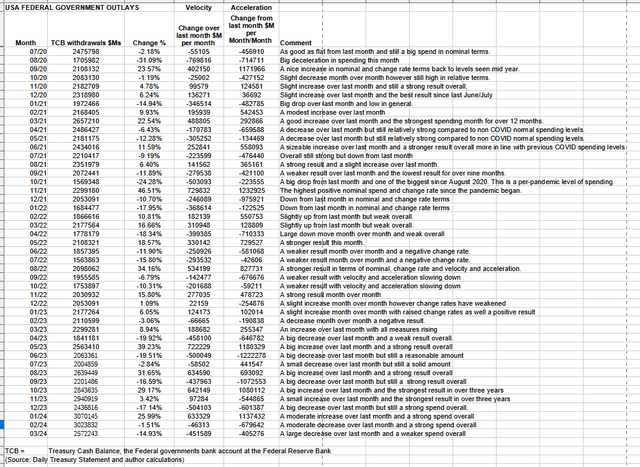

The table below shows the amount withdrawn by the federal government from its bank accounts at the Federal Reserve Bank. When the government spends money, it gives more money to the private sector and helps the stock market rise.

U.S. Treasury and author’s calculations

According to the table, total spending fell by nearly $5 trillion compared to the previous month, reaching about $2.5 trillion. This month, federal taxes, fees, charges and bond turnover could have left $297 billion of that spending in the private sector, creating a federal deficit equivalent to a private-sector surplus. Subtracting the current account deficit from this result leaves the domestic private sector balance at $228 billion. In terms of purchasing power, this improves again when bank credit creation reaches $148 billion.

Although this is a strong result, it is not strong enough to explain the strength in the stock market over the past six months.

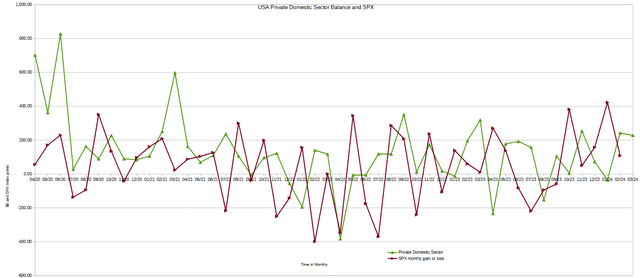

The chart below shows how rises and falls in the U.S. private-domestic balance tend to drive the SPX.

US Treasury and author calculations and SPX

Last month, the leader in private domestic sector balances against the (SPX) predicted that the (SPX) would end March higher than it started, and that is exactly what happened.

This month’s chart shows we expect the same result in April, given the continued strength of private domestic sector financial flows. This has been happening so far and I think it will continue to happen in the future.

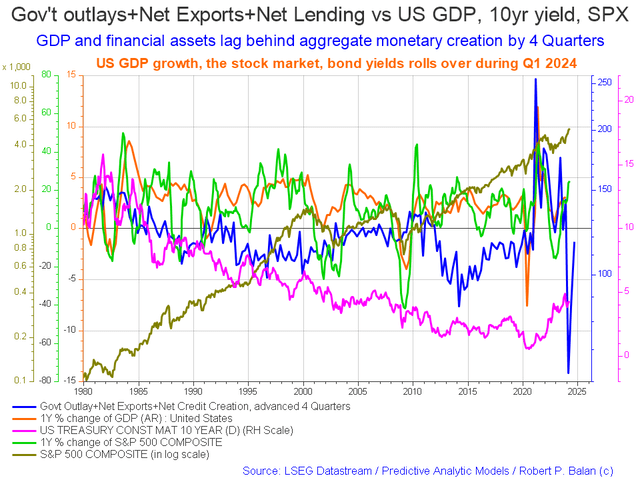

The chart below shows how the information in the U.S. Sector Balance Table changes over time, taking into account the lag in the impact of these changes. It’s like a tool that helps you see from afar what’s happening in the market.

Mr. Robert P Ballan

The blue line represents money spent by the government and credit generated by banks minus the current account balance. You can predict economic changes up to four quarters in advance.

The change over the past month is that SPX, GDP and bond yields have risen. The blue leading line continues to rise.

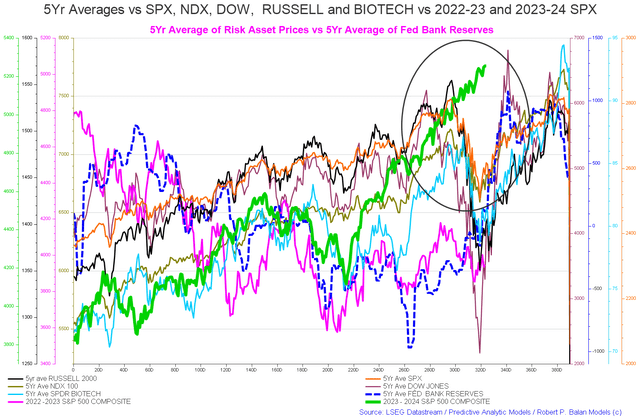

The chart below shows the five-year average of seasonal stock market patterns for the SPX (SPX), Nasdaq (NDX), Dow (DIA), Russell 2000 (RTY), and the Biotechnology Market Index. The black oval shows where we are currently.

Mr. Robert P Ballan

This chart clearly shows how the green line has defied the expected seasonal pattern established by the orange line. The orange line is the 5-year average for SPX. In fact, SPX should have fallen by the end of the first quarter of 2024, allowing for dip buying opportunities. There should have been at least two opportunities to buy into the seasonal dip this year, but that didn’t happen, and you start to ask why.

Four factors come to mind:

1. Treasury interest income due to high interest rates.

2. Global financial spending by world governments.

3. The peak of the real estate cycle is approaching.

4. Interest on reserve balances paid by the Federal Reserve to banks increases with the interest rate.

These factors are discussed in more detail below.

1. Treasury interest income:

One thing that has changed significantly over the past 18 months is the Federal Reserve’s stance and interest rate policy.

What is different from other years is that interest rates are currently high, which may simply result in increased treasury income being passed on to wealthy beneficiaries, who will then purchase paper assets on a narrow scale outside of their normal asset purchasing patterns.

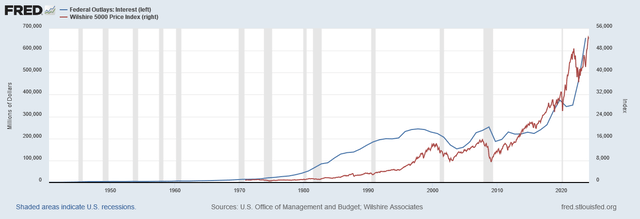

The chart below shows the very long-term, broad-based growth relationship between federal interest spending and the stock market.

fred

Federal spending on interest has outpaced the stock market by several quarters, and as Treasury inventories rise, the effect appears to have accelerated and made the curve steeper over time. The curve is now nearly vertical.

2. Confluence and rise of the lag effect of G5 financial flows.

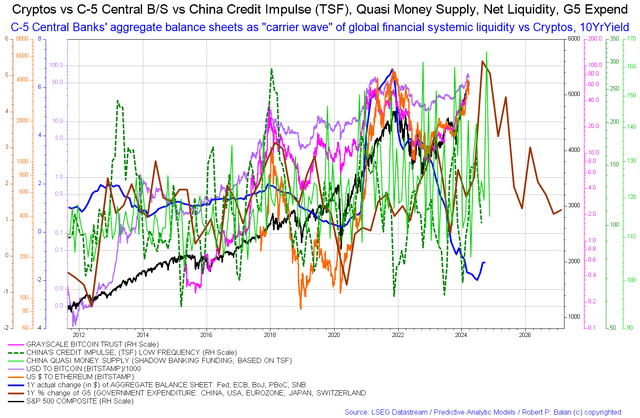

G5 flows are the sum of spending by the world’s five largest economies. C5 is the balance sheet of the world’s five largest central banks.

Mr. Robert P Balan of Predictive Analytics Model Investment Services

G5 and C5 financial flows influence what is known in fluid dynamics as the carrier wave, which is the basis for all other financial flows and market effects.

The chart above shows that the brown carrier wave is rising steeply until 2024, which will tend to cause asset markets to rise as well.

The brown line in the chart above represents this carrier wave. The next chart shows this in a more detailed format, but doesn’t go as far as the chart above.

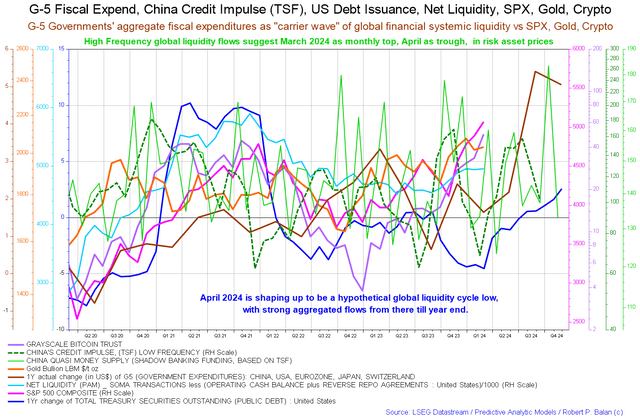

Mr. Robert P Balan of Predictive Analytics Model Investment Services

A short-term look at the same information shows the brown line falling in the first quarter of the year and then rising starting in the second quarter.

This chart is not very detailed and the macro uptick in G5 flows may have arrived earlier than expected, explaining the unusual buoyancy in the market. It also points out that things are likely to get better rather than worse as the years go by.

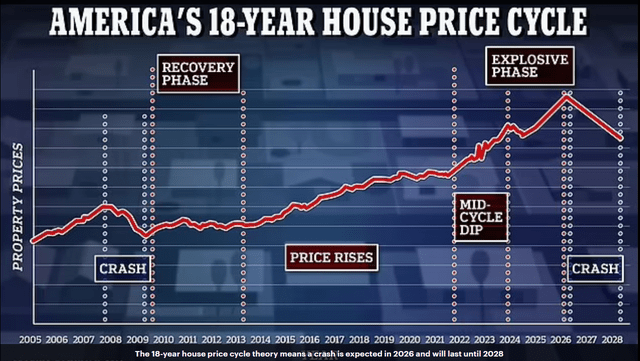

3. The economic rent effect that occurs during the last frenzied Winner’s Curse phase of the real estate cycle.

Mr. Fred Harrison

The chart above shows the course of the real estate cycle and how it is now entering its final, most explosive and speculative phase. Rising property prices are creating a concentrated wealth effect among property owners and represent the peak of price growth since the recovery began in 2009. After 15 years of land price growth, it reaches its peak, is monetized, and then enters the asset market.

Land prices have risen so much and reached their peak that the wealth effect begins to take effect based on the home equity values of ordinary people. Some of them will take out mortgage loans so they can cash out their suddenly increased wealth and spend it on paper assets, fueling a more concentrated stock market crash. Here we can see how rising land prices stimulate credit creation, bringing aggregate demand not only to urban magnates but also to ordinary people, and how this money flows into the stock market in a concentrated manner.

It is important to check the housing market regularly as it is closely related to the overall economy and is expected to peak in 2026.

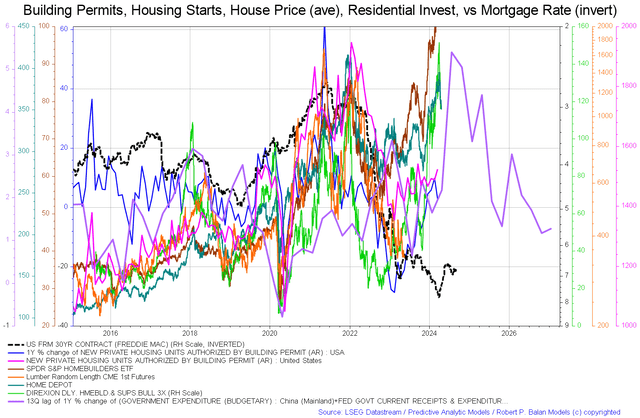

Mr. Robert P Ballan

The charts illustrate different aspects of the housing market. In this case, lumber prices (orange line, which tends to rise in good times) have bottomed out and are close to local lows, but still not rising. Now, it’s Home Depot, the homebuilding ETF, that’s falling each month. Nonetheless, housing starts and permits increased. Freddie Mac 30-year contract rates have fallen (this is generally appropriate for homes and may explain why permits and approvals have increased simultaneously as more people take out slightly cheaper loans and choose to build or buy). The purple government spending line rises for most of the rest of 2024, then falls until 2025, then rises again. This line is the same financial carrier wave that sets the overall trend for all other waves that follow and is shown in point 2 above. .

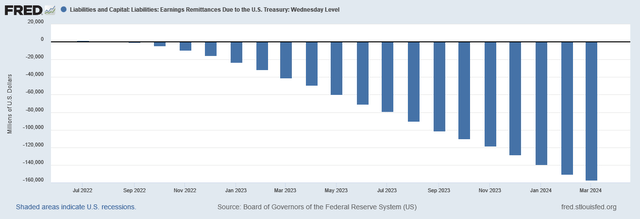

4. Fed Reserve Interest

Another important factor is interest on reserve income flowing directly to banks due to high interest rates, which is related to the first factor mentioned above. This is shown in the chart below.

fred

Banks tend to deploy extra income into income-producing paper assets such as stocks and bonds, at a rate of about $10 billion per month.

Four-Way Financial Venturi Effect.

The four factors described above support the thought experiment that, despite average financial flows, the current and ongoing stock market crashes are driven by the financial Venturi effect.

Wikipedia

Treasury interest income, IORB and monetized assets from real estate cycles are sources of income where the recipients are already wealthy. In their quest for returns and high levels of discretionary spending, recipients seek to invest this money in paper assets, creating stock market rallies that are out of scale compared to the true strength of current financial flows.

The background effect of an overall increase in the lagged impact of G5 fiscal flows supports and strengthens this Venturi effect.