5 Best Altcoins to Invest in Right Now January 1 – Klaytn, Maker, Kava

join us telegram A channel to stay up to date on breaking news coverage

Identifying promising tokens can be a game-changer for investors looking for a path beyond Bitcoin and Ethereum. This coin presents many innovative projects, each competing for attention and investment.

With constant market changes, choosing the best assets to invest in requires understanding which assets have the potential to outperform. This takes time and effort, which is why Insidebitcoins regularly compiles lists of the best altcoins to invest in. Therefore, this helps investors make better investment decisions.

5 Best Altcoins to Invest in Right Now

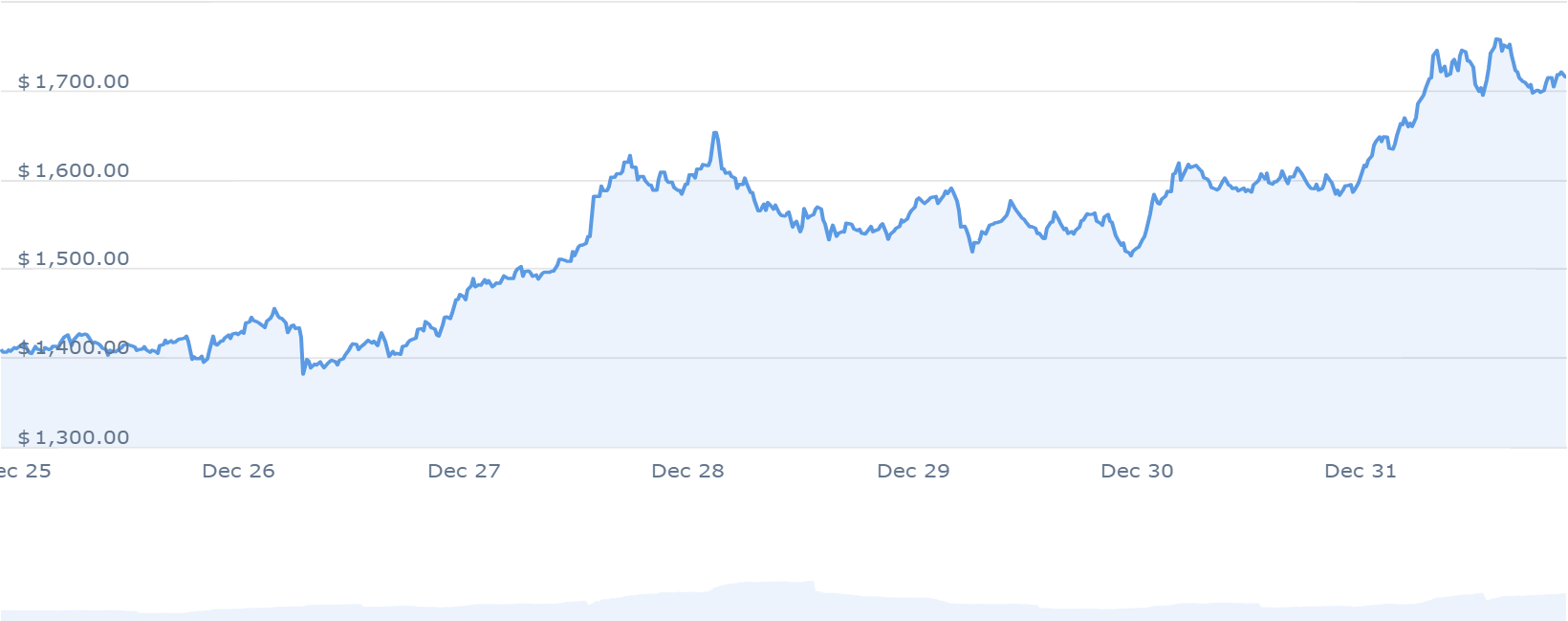

Over the past 7 days, Several altcoins We experienced a noticeable price spike. As reported by S&P Global Market Intelligence, BNB recorded a significant increase of 16%. Additionally, tokens from MultiversX and Optimism showed similar gains of 16%. Meanwhile, Theta Network is up nearly 10%.

1. Klayton (KLAY)

Integration of ERC3643 tokenization into the Klaytn network is being done in collaboration with Tokeny Solutions. This integration focuses on compliance with Real World Asset (RWA) tokenization standards. Additionally, this initiative aims to provide the latest compliant infrastructure for asset tokenization on Klaytn.

ERC3643, introduced by Ethereum, promises to change the way businesses utilize blockchain technology. Official recognition highlights Ethereum’s commitment to meeting user needs and setting industry benchmarks.

In terms of supply, Klaytn has 3.48 billion KLAY in circulation out of a total supply of 10.95 billion. Over the past year, 457.03 million KLAY has been created, which amounts to an annual supply inflation rate of 15.13%. Based on market capitalization, it currently ranks 42nd in the layer 1 sector.

ERC3643 tokenization will begin soon. #clayton.

with @TokenySolutionsAs our long-term RWA partner, we will ensure that all the latest RWA tokenization standards and infrastructure are implemented and available on Klaytn.— Klaytn Developer (@BuildonKlaytn) December 21, 2023

Additionally, Klaytn’s market performance fluctuated, reaching a high of $4.35 on April 2, 2021. Meanwhile, it hit a low of $0.055524 on May 6, 2020. The price is currently at $0.277573, up 55%. yesteryear. Klaytn is trading above its 200-day moving average. It also recorded 15 positive trading days out of the last 30 days, reflecting a 50% positive trading day rate. Additionally, liquidity remains high based on market capitalization.

2. Bitcoin Minetrix (BTCMTX)

Bitcoin Minetrix A cloud mining platform that aims to address concerns about third-party cloud mining fraud by introducing tokenization. The project boasts a decentralized approach to Bitcoin (BTC) mining that emphasizes security and transparency.

There is notable participation, with over 400,000 BTCMTX tokens currently staked. However, the advertised Annual Yield (APY) of 103,225% may decrease as more tokens are staked.

Regarding token allocation, 42.5% of BTCMTX tokens will fund mining operations and 35% will fund marketing and project growth. Additionally, 15% is allocated for community rewards recognizing active participation. Additionally, 7.5% is for BTCMTX staking rewards until the cloud mining platform is developed.

Even just for one day #Bitcoin Metrics Step 16 is over! ⏱️

What are some common misconceptions? #Bitcoin Have you ever experienced mining? 🤔 pic.twitter.com/7dzGrEFVxW

— Bitcoin Minetrix (@bitcoinminetrix) December 31, 2023

Additionally, pre-sales for the project raised over $7,114,646. BTCMTX It costs $0.0125 per token and 70% of the total token supply is available at this stage. Investors can acquire tokens using Ethereum (ETH) or Tether (USDT) with a minimum investment requirement of $10.

3. Maker (MKR)

As reported by market experts, Maker Coin has witnessed significant accumulation recently. Over the past week, three new wallets have purchased a total of $18.6 million worth of MKR.

Specifically, these buyers withdrew their tokens from Binance. This potentially signals an intention to self-storage MKR in anticipation of a price surge. Moreover, this accumulation trend before the end of 2023 suggests a potential bullish outlook for MKR heading into 2024.

Additionally, the circulating supply of MKR is 919,937 MKR out of a maximum supply of 1.01 million MKR. MKR experienced a negative annual supply inflation rate of -5.90%. This figure is equivalent to -57,694 MKR generated last year. In terms of market capitalization, Maker ranks 8th among DeFi coins and 17th among Ethereum (ERC20) tokens.

Meanwhile, the token’s highlights include MKR’s impressive 244% price increase over the past year. MKR is also trading above the 200-day simple moving average and near cycle highs. The project boasts high liquidity relative to market capitalization. Additionally, negative annual inflation rates add an interesting aspect to supply dynamics.

Even before the launch of SparkDAO, Spark demonstrated SubDAO’s superior operational efficiency through innovative product development and execution of growth strategies.

What can we expect from future SubDAO developments? pic.twitter.com/WYOiIBiKmD

— Maker (@MakerDAO) December 5, 2023

MKR has historical price fluctuations and reached a high of $6,244.44 on May 3, 2021. However, the coin reached a low of $171.27 on March 16, 2020. After the previous low, prices ranged from $503.28 to $1,762.18. Market sentiment is leaning towards a bullish trajectory for MKR, with the Fear and Greed Index reading at 65 (greed).

4. Akash Network (AKT)

Over the past year, the AKT token has skyrocketed significantly, increasing its value by 12x. This surge indicates positive sentiment towards the token within the cryptocurrency community. The price trend indicates a potential challenge to the key resistance level of $6. This therefore positions it as a contender for the upcoming bull market cycle.

Looking back at the price history, Akash Network hit its highest point on April 6, 2021, when it reached its highest value of $8.04. Conversely, the lowest recorded price occurred on November 21, 2022, when it fell to $0.166008, marking a cycle low. Notably, the token reached its highest post-cycle low at $2.61.

Moreover, the prevailing market sentiment is strongly bullish regarding Akash Network’s price prediction. Likewise, the token recorded a fear and greed index of 65, reflecting its “greed” state.

Mixtral-8x7B is now available on Akash Chat.

Mixtral is one of the best-performing models currently available, outperforming Llama 70B on most benchmarks and delivering 6x faster inference.

Now available on Akash Chat. Try it now:

→ https://t.co/O0kUSzM10T pic.twitter.com/PDPglUCiGp— Akash Network (@akashnet_) December 29, 2023

In comparison, Akash Network showed excellent performance metrics. This includes a price surge of 1,229% over the past year, outperforming 98% of the top 100 cryptocurrency assets. Moreover, the token has consistently traded above its 200-day simple moving average.

AKT also showed positive performance compared to the token sale price. It also recorded 17 positive trading days in the last 30 days, accounting for 57% of the observation period. Additionally, AKT ranks 17th in the proof-of-stake coin category and 6th in the AI cryptocurrency category by market capitalization. These metrics highlight Akash Network’s prominence and traction within the cryptocurrency landscape.

5. COFFEE

Kava has been bullish on price predictions and scores 65 on the Fear and Greed Index, indicating the state of greed among investors. Over the past year, the price has surged 66% and is currently at $1.314440, a notable increase from the previous cycle’s low.

Regarding market positioning, Kava ranks 10th in the DeFi coins category and 38th in the layer 1 category. In particular, it is continuously trading above the 200-day simple moving average. Additionally, it has experienced 15 positive trading days in the past 30 days, accounting for 50% of the period.

📣Staking Rewards Updates

From January 1, 2024, all #Kava Staking rewards are provided by Kava Strategic Vault.

Zero inflation = no new coins issued. Fixed supply 🔒

— KAVA (@KAVA_CHAIN) December 26, 2023

Another strength of Kava lies in its high liquidity, which is reflected in its market capitalization. This liquidity can have a significant impact on price stability and trading volume within the market.

Learn more

A new cryptocurrency mining platform – Bitcoin Minetrix

- Thanks to Coinsult

- Decentralized, secure cloud mining

- Get free Bitcoin every day

- Native token currently in pre-sale – BTCMTX

- Staking Rewards – APY 100% or more

join us telegram A channel to stay up to date on breaking news coverage