5 lit was cooked for purchasing

M & A is found to be mixed white for buyers. Sometimes there is a big synergy, and it is just a CEO who wants to manage a larger company at another time. But it is almost universal for the shareholders of the target. Purchasing premiums are often 10% -50% compared to the stock price of the target. One of the fastest ways to realize the fair value of discount investment.

The key is to discover and own the company before the announcement. We at 2 o’clocknd The market cap was a beneficiary of dozens of companies. Over the years, we have confirmed a specific function that increases the possibility of favorable M & A. In particular, the next 6 increases the likelihood that the company will buy.

- Discount to NAV

- Evaluation imbalance

- Hot asset type

- Real estate overlaps with buyers

- I’m willing to sell

- Fruit

The more functions of these features, the higher the opportunity.

Discount to NAV

Light is cheaper than usual now. The average equity Reit is traded at 86.4%of the net asset value (NAV). Thus, the entire sector is primated by a slightly increased purchase activity, but the value is distributed in Reit. They range from 31.1%of NAV to Hudson Pacific (HPP) to 200%of NAV to WELLTOWER (WELL).

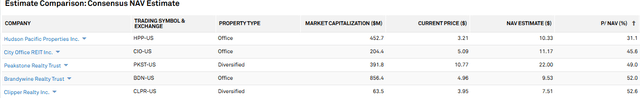

The NAV discount acts as a major financial incentive for purchase. Buying a company at a lower price than the property of the property can lead to immediate attachment. The larger the discount, the higher the value. Here are the most discounted five rEITs:

S & P Global Market Intelligence

Serious discounts are more likely to make these potential M & A goals, but there are more things.

Inexpensive people are not enough to inspire the buyer, and blindly purchasing a discount on NAV can be a dangerous strategy. We previously discussed the dangers of Peakstone.

The above company is overwhelmingly in the office, and we will work when we discuss evaluation imbalances and the desire of asset classes.

Evaluation imbalance

To buy a discounted asset, the buyer must have a good call. If a buyer is discounted to NAV and raises funds to the merger using stocks, there is no shortage.

In the case of the same office as shown above, the intermediate office is traded at 74%of the NAV. Thus, if you buy one of the fellow offices Reit, you will issue capital with their own values (74 cents of dollars). This greatly reduces the net NAV calculation of purchases.

Therefore, the M & A target should be discounted in absolute terms, as well as a significant discount compared to the potential entity.

In September 2023, we wrote the goal of purchasing Tricon residential.

The deep discount that TCN trades is an attractive target of private equity funds that are embarrassing SFR.

I thought the buyer would be a premium, but eventually I was a Blackstone that bought Tricon residential.

Private equity funds were essentially collecting capital at 100%of NAV, which created a delta between a significant discount of capital costs and high -TCN transactions. The purchase was also led by the single -family home rent is a custom asset class.

Hot asset type

Discounts often appear in asset classes that are often rejected, but M & A is much more likely to occur in the type of real estate that the company wants to increase exposure.

In the past, there were six data centers Reit, but I bought Switch, bought Cyrus One, and bought a Kore site. The division fell to 2.5 with Pure-Plays Equinix (EQIX) and Digital Realty Trust (DLR) and DLR (Digital Realty Trust), along with partial exposure of Iron Mountain (IRM). Each of these is very large and traded as a premium, so the M & A of the data center is less likely to learn from what happens.

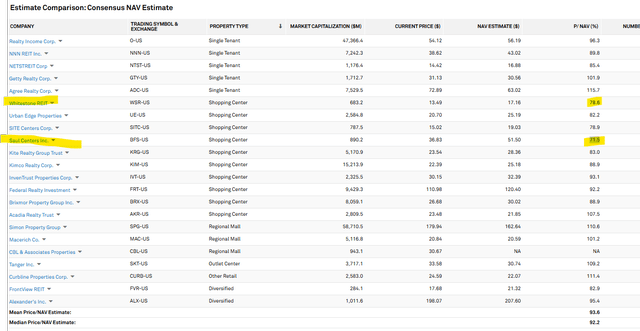

The shopping center is becoming a hot asset class. The private real estate market is already looking at the strengths of the sleeve, and large companies such as BLACKSTONE purchase quite a lot of shopping centers. The public REIT stock market is slow to catch up with strengths, so many shopping centers REIT has received significant discounts on NAV.

S & P Global Market Intelligence

The Saul Center is traded at 71.5%of the NAV despite the impressive asset portfolio. One of the larger REITs, such as Kimco Realty (Kim) or Federal Realty Investment Trust (FRT), can buy Saul very appropriately.

Whitestone Reit (WSR) was already a goal of M & A, but he refused to propose on the basis of too low. This leads us to the main side of the buy goal.

Willingness

If a purchase offer is provided, the most common answer will follow:

It is a board decision, but of course we will consider all suggestions.

We asked dozens of executives to ask this question, and more than 70% of them gave the same answer as the above. This is a stock answer that maintains all the company’s options.

But sometimes there will be few hints that certain companies are willing to sell than other companies. It can be a reversal in their voice or phrases, but you can usually feel the degree of will to sell. Companies are good at not violating REG FDs, so they often do it as an imported phone that is automatically regarded as public information to provide more direct answers.

The Paul Pittman of the Farmland Partner (FPI) will discuss the conference telephone on how many benefits will be beneficial from the company’s stock and fair value.

In addition to what management says, there are other factors that affect the ready way to buy a company.

- Poison or its lack

- Golden parachute

- How to participate with activist shareholders and management with them

- Calms of the contract or the tribe

- The age of the executive (do you want to retire?)

If the company is willing to sell it, the effectiveness of M & A is affected by synergy effect and the evaluation of buyers and sellers.

Synergy

Fruits to stop are technically bad. Companies that operate properly are likely to underestimate their potential, and if they do not continue to work properly, performance may be lowered. But this low -level fruit also shows opportunities for buyers.

The self -storage industry is one of the most divided industries inefficiently executed by small operators who are inefficiently executed without real estate expertise to maximize profits or to maximize profits. For decades, M & A has been prevalent in self -storage, and buyers can almost immediately improve their operations and make transactions much more.

The publicly traded companies are sufficiently investigated that the fruits with low jersey are slightly less widespread, but most of them still exist in the form of lower measures. As a publicly traded company, it requires about $ 3 million annually. This is an overhead cost that can be completely completely removed by integrating two companies into 1.

Property level operating costs or OPEX have low overhead costs per real estate if they provide more real estate in local real estate management offices. Therefore, if the two companies overlap the real estate map, M & A is likely to occur.

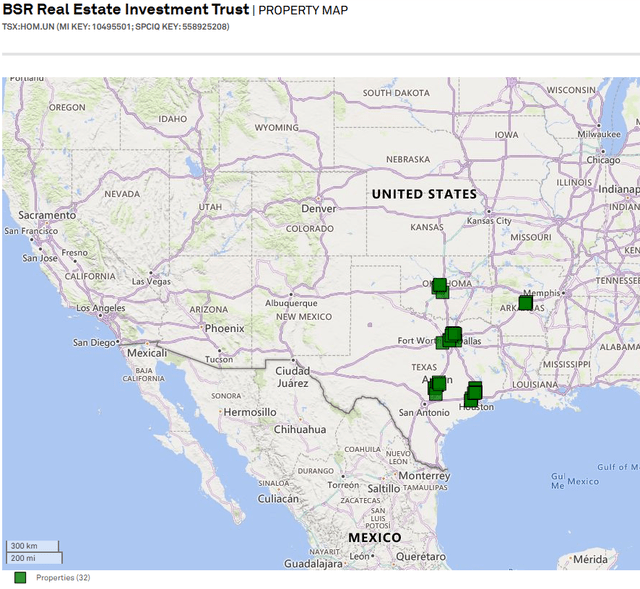

BSR Reit (otcpk: BSRTF) is an excellent example of potential savings in both company indirect and real estate overlap. They own apartments in major Texas major sub -markets, which are already exposed to larger Reit and wants more.

S & P Global Market Intelligence

OPEX and G & A savings will buy much more BSRTF purchases than NAV discounts already presented.

Top 5 Reit Buy Opportunity

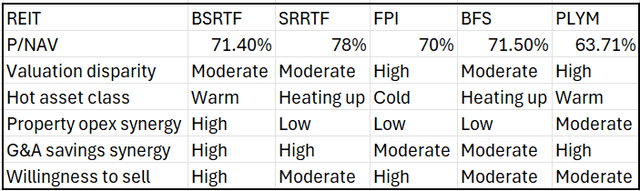

Although the future is not known, analyzing the above elements will provide insights to companies that can be subject to M & A. The following is a significant premium for the current stock price, which is more likely to be purchased more than most people.

In the table below, we rated each major M & A driver for each Reits.

2mc

Overall, I think this is the five rEits that are most likely to be purchased at a significant premium at today’s price.

Editor’s Note: This article explains about one or more securities that are not traded on major US exchanges. Learn about the dangers related to this stock.