5 things to watch out for in the energy market in 2024

bjdlzx

Written by Paul Wightman, Elizabeth Hui, Adila McHich, and Cameron Liao

At a glance

- El Niño is expected to be “historically strong” in 2024, which could weigh on natural gas markets.

- Jet fuel prices could rebound in 2024 as demand for air travel is expected to break records.

Energy markets in 2023 were calmer than 2022, but still not for the faint of heart. What will happen in 2024? From crude oil to biofuels, from the US to Asia, here are five things to watch.

OPEC floor shaking

OPEC+ received great attention in the crude oil market in 2023. OPEC+ action (or inaction) coincided with two of the three largest daily price movements. In 2024, demand for OPEC production is expected to decline as other production increases.

OPEC reported that U.S. production would increase by 1.2 million barrels per day by the end of the year, while demand growth was slowing.

Traders will be looking for clues about their plans as OPEC+ agreed to first-quarter production cuts that are scheduled to be eased “gradually depending on market conditions” after March.

Can OPEC agree to cut production enough to support oil prices? Or will the market lose its “OPEC low” that lasts until 2023?

El Nino in natural gas

El Niño is something to watch for in 2024 due to weather-dependent heating demand and natural gas prices. When an El Niño event occurs, surface waters in the eastern and central Pacific become warmer than normal and cause changes in precipitation, pressure, and winds. .

NOAA’s forecast for December put this El Niño event at a 54% chance of ending up as a “historically strong” event, potentially putting it in the top five on record.

This weather pattern is causing drier than average conditions in the northern United States, while wetter than average conditions are expected in northern Alaska, parts of the West, the southern Plains, Southeast, Gulf Coast, and lower mid-Atlantic.

2023 ended with above-normal temperatures in major natural gas consuming markets. Robust storage and record production further strengthened bearish sentiment in the natural gas market.

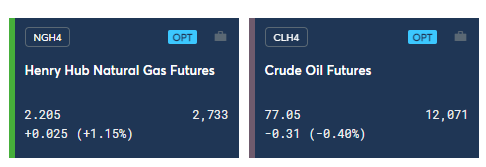

Will the expected “historically strong” El Niño continue to put downward pressure on Henry Hub natural gas futures prices in 2024?

biofuel boom

Bioenergy production is booming, fueled by government subsidies and global regulations such as the U.S. Inflation Reduction Act.

U.S. renewable diesel capacity tripled between 2021 and 2023 through new production facilities and the conversion of oil-based refineries, and could double again by 2025, reaching 17.4 million tons per year.

A similar trend is expected for European hydrotreated vegetable oils (HVO). The rapid growth of bioenergy, extending into biodiesel and sustainable aviation fuels, poses feedstock challenges as producers pursue limited supplies of environmentally friendly waste oil while also moving away from unsustainable fuels such as palm oil.

Bioenergy uniquely connects agricultural markets with energy, bringing both new players and new supply-demand variables, and also impacts markets for renewable credit, such as Renewable Identification Numbers (RINs).

2024 could see volatility in all three as both feedstock and traditional fuel markets adapt to the rapid growth of bioenergy.

jet fuel rebound

Jet fuel demand is estimated to fall more than 10% in 2023 from 2019 levels, lagging the global demand recovery from COVID-19. But this is changing.

According to the Official Aviation Guide (OAG), overall aviation capacity increased by $300 million, an increase of 15.8%, over the winter of 2023 compared to 2022.

Strong career growth in Asia, including Hong Kong, China and Korea, has helped support this upward trend. This sets the stage for change in 2024, where jet fuel could potentially see a sharp rebound.

According to the International Air Transport Association (IATA), air travel demand resilience is expected to reach 4.7 billion passengers in 2024, surpassing the record 4.5 billion passengers in 2019.

These changes could be reflected in the diesel, gasoline, and crude oil markets in 2024 as refiners adjust production to meet growing jet demand.

Prices related to Brent crude oil are falling due to increased inflow from the US.

2023 was a record year for U.S. energy production and exports. WTI Midland cargoes were added to the Dated Brent assessment in mid-2023 as Europe imports more light sweet US crude than is produced in the North Sea.

The change links the Brent benchmark to U.S. crude oil, clarifies WTI’s role in determining global prices, and is sparking a shift in market participants that is just beginning.

European refiners are starting to price their supplies directly linked to WTI, and producers who have historically linked their crude sales to Brent are examining the impact of WTI Midland on their profits.

The implications for Asia should not be overlooked. The region also imported record levels of U.S. crude, despite competition from the Russian crude it replaced.

This trend is not limited to crude oil. As U.S. LNG and LPG exports also reach record highs, the importance of Henry Hub Natural Gas and Mont Belvieu LPG price benchmarks is expected to increase in 2024.

The five items above are taken from a long list of shifts for the coming year.

Change occurs constantly in energy markets, creating endless opportunities and challenges for businesses, consumers, traders and investors. No matter where you are in the energy market, 2024 looks set to have something for everyone.

original post

Editor’s note: The summary bullet points for this article were selected by Seeking Alpha editors.