5 ways you should use ChartList starting today! | a cautious investor

As a technical analyst and having used many technical analysis platforms, I can tell you that StockCharts’ ChartList feature offers excellent features to help you identify investment opportunities and manage the risk of your portfolio.

After setting up a portfolio or watchlist using the ChartList function:With these five powerful tools, you can analyze your list of stocks or ETFs, identify patterns of strengths and weaknesses, and predict where your next opportunities will arise!

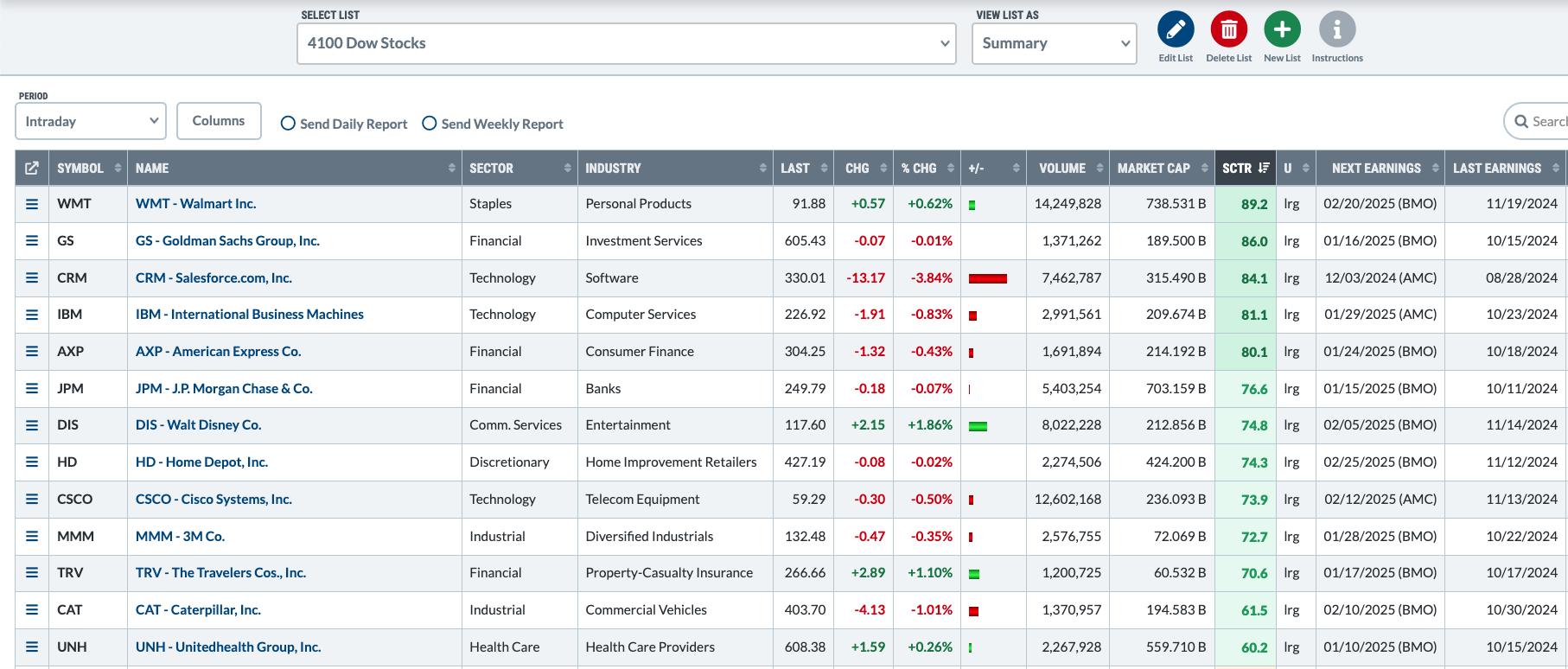

Summary view to identify outliers

The summary view is a great starting point, a top-level menu for all the things you can do with this list of charts. All columns are sortable, so you can group similar stocks by sector or sort by market cap to find patterns and relationships.

One of my favorite things to do is sort by “Next Earnings Date.” Whether you’re a long-term investor, a swing trader, or something in between, you’ll want to know when your profits can suddenly move in either direction!

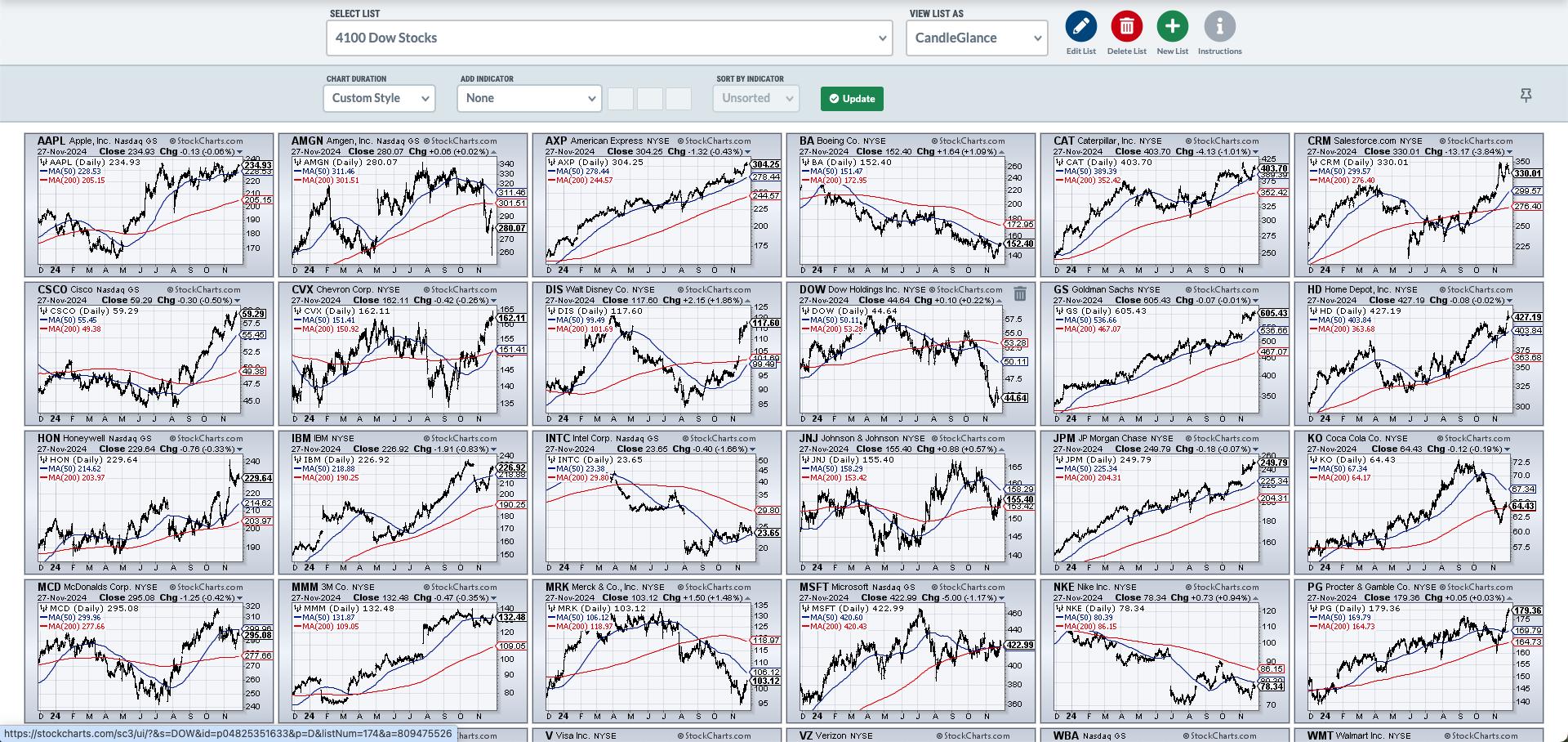

ChartList View for technical pattern analysis

After I’ve used the summary view to give a general assessment of the stocks in the list, I like to use the ChartList view. Review each chart one by one. This view uses the alphabetical order of the chart titles, so if you prefer a specific order, you’ll need to add a number before the ticker.

Especially when reviewing a long list of quotes, use the ChartList view to look at multiple charts and jot down quotes in Notepad for further review later. Converting any chart to a different ChartStyle is easy. This is useful if you want to switch to a weekly or monthly chart, for example. Select one of your charts, change the chart style, then look for the link at the bottom that says “Apply chart style to all”!

CandleGlance View for separation into buckets

When I worked at a large financial institution in Boston, I would print out a bunch of charts showing the holdings of a particular fund and then spread them out on the conference table. Look for similar patterns and structures and begin to separate your charts into bullish, bearish, and neutral piles. From there, I could focus on the most actionable charts.

The CandleGlance view provides this functionality without having to print all the charts! Similar patterns and signals can be easily detected, allowing you to spend your time on the most actionable charts within the larger list. I can’t tell you how much time this one feature has saved me in terms of efficiently sorting my chart list! Don’t forget that you can customize the ChartStyle you use for this view.allows you to apply your own charting approach to this visualization.

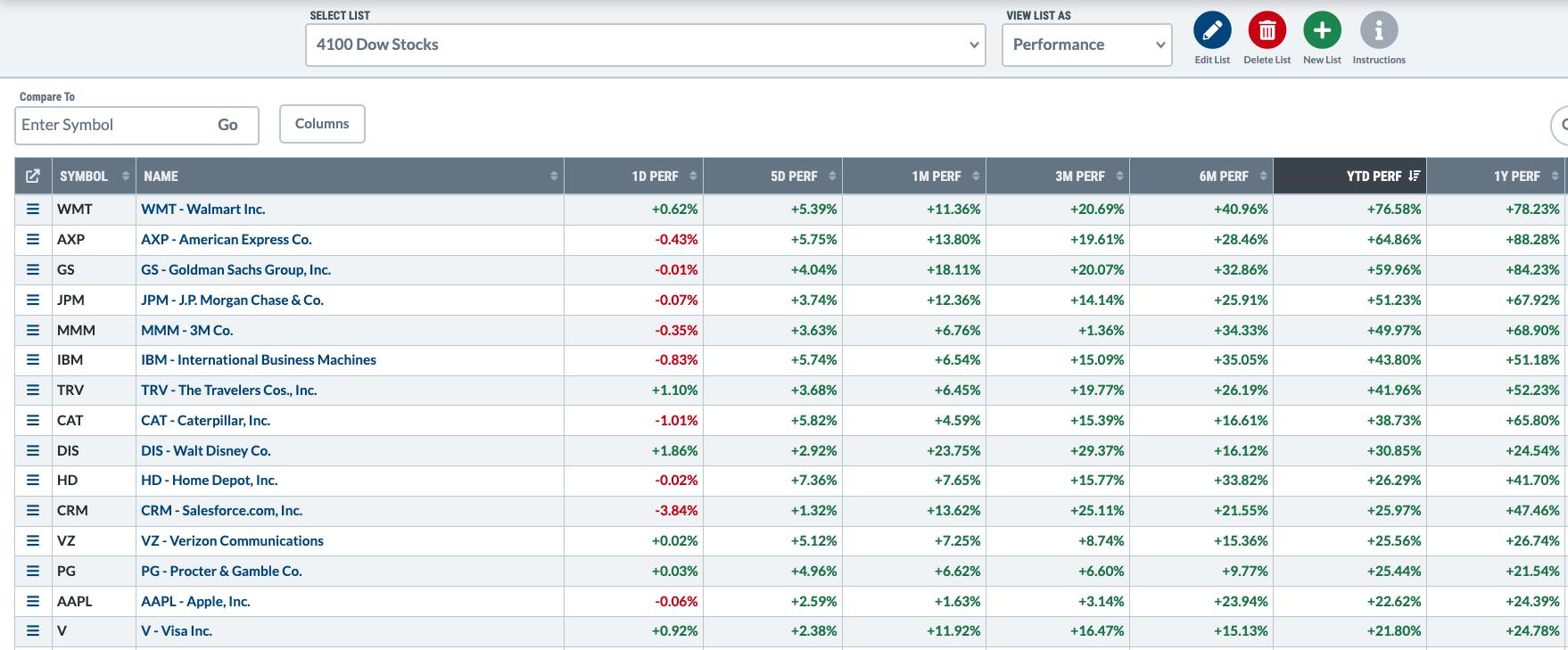

View performance focused on consistent winners

What if you want to analyze the performance of a group of stocks or ETFs to better understand which charts were the most and least profitable over a certain period of time? The Performance view displays a series of time periods in a tabular format, allowing you to focus on top and bottom periods across multiple time periods.

This can be a fantastic way to analyze your portfolio, helping you better understand which positions are helping your performance and which are actually hindering it!

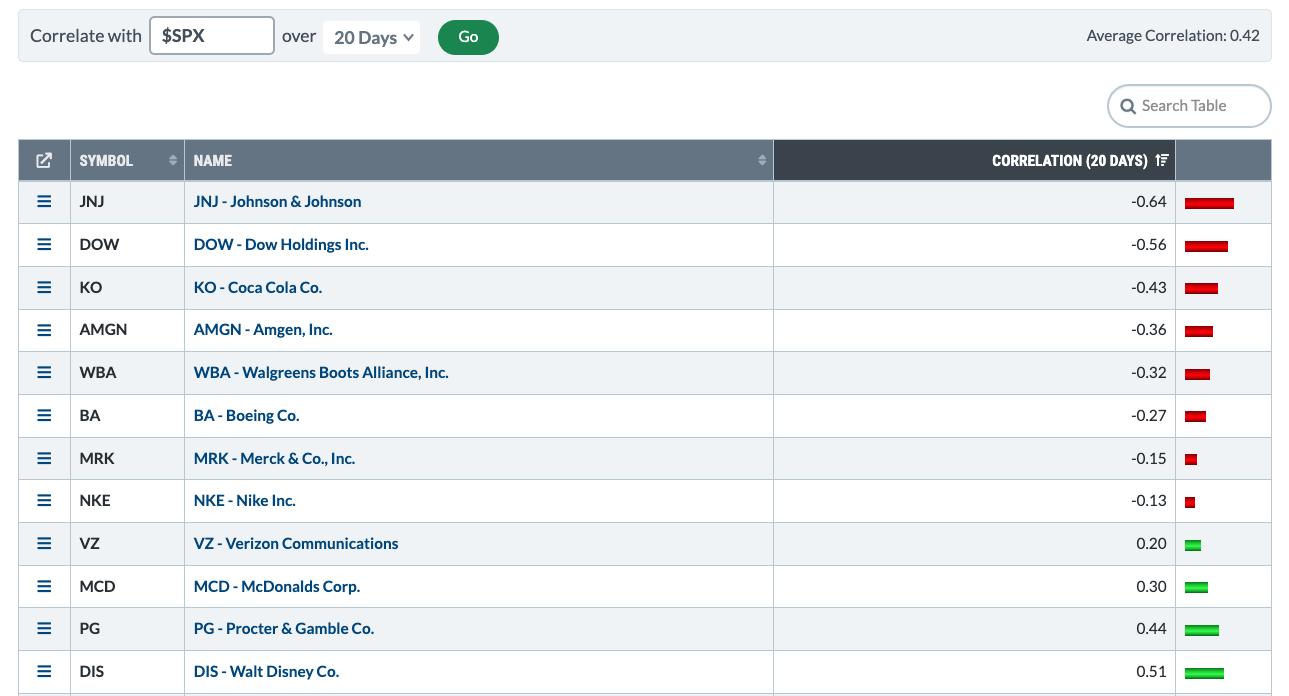

View correlations to understand price relationships

Lastly, let’s look at one of the most underutilized features of ChartLists: the Correlation View. This allows you to better define the relationship between two different data series and identify which stocks or ETFs can help diversify your portfolio.

I like to sort this view in ascending order by 20-day correlation as a starting point. Which stocks have a very different return profile than the S&P 500? When you feel like all your stocks are doing pretty much the same thing, using this feature can help you quickly identify outliers and positions that could help you improve performance through diversification.

I found the ChartList feature to be one of the most powerful features of the StockCharts platform. We hope that once you get into the habit of using these amazing list management and analysis tools, you will enjoy more market awareness in your life!

RR#6,

dave

PS- Are you ready to upgrade your investment process? Check out our free behavioral investing course!

David Keller, CMT

President and Chief Strategist

Sierra Alpha Research LLC

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. You should not use any of our ideas and strategies without first evaluating your personal and financial situation or consulting a financial professional.

The author had no positions in any securities mentioned at the time of publication. All opinions expressed herein are solely those of the author and do not in any way represent the views or opinions of any other person or entity.

David Keller, CMT, is President and Chief Strategist at Sierra Alpha Research LLC, where he helps active investors make better decisions using behavioral finance and technical analysis. Dave is a CNBC contributor and on his YouTube channel ‘Market Misbehavior’ he summarizes market activity and interviews leading experts. A past president of the CMT Association, Dave is also a member of the San Francisco Society of Technology Securities Analysts and the International Federation of Technology Analysts. He previously managed the renowned Fidelity Chart Room as Managing Director of Research at Fidelity Investments, and continued the work of legendary technology analyst John Murphy as Chief Market Strategist at StockCharts. Learn more