6 Best Low Market Cap Cryptocurrencies with Huge Potential in 2024

While every cryptocurrency investor should have some major cryptocurrencies like Bitcoin and Ethereum in their portfolio, there are also arguments to be made that a small allocation to low-cap coins is a worthwhile investment.

To help you find the lowest market capitalization cryptocurrencies you can buy, we have selected those outside the top 100 that are likely to grow in the future. We focused on cryptocurrency assets that already have significant demand based on exchange listings, trading volume, and other key indicators.

Here are the best low market cap cryptocurrencies to buy in 2024.

How did we choose the best low market cap cryptocurrencies?

When choosing the best small-cap cryptocurrencies, we focused on those that already have a market capitalization of over $100 million but have the potential to grow further and join the ranks of the largest cryptocurrencies on the market.

There are several reasons why we did not feature “small” cryptocurrencies when selecting the best small-cap cryptocurrencies with potential. Microcap cryptocurrencies generally have poor liquidity. This means that trading can be difficult and have much higher volatility than you already expect from cryptocurrencies. They are also more susceptible to market manipulation because they require smaller amounts of capital to move prices materially.

When looking at cryptocurrencies with very low market capitalizations (less than $10 million), it is common to see cryptocurrency projects that are either in a very early stage, do not have a notable development team or credible roadmap, or have already been abandoned. In summary, if a cryptocurrency’s market capitalization is extremely low, there may be a reason for it.

Meanwhile, the cryptocurrencies introduced in this article are readily available on several cryptocurrency exchanges, have ample liquidity for trading, and are still actively under development. We have selected cryptocurrencies from various sectors of the cryptocurrency market such as decentralized finance, privacy, real assets, layer 1, AI and distributed computing, and of course meme coins.

Best low market cap cryptocurrencies in 2024

Now that we’ve explained what we looked out for when choosing the best low market cap cryptocurrency, let’s get started with our picks for the best low market cap cryptocurrency in 2024.

1. Radium (RAY)

Raydium is a project on the Solana blockchain that offers all the features you would expect from a cutting-edge DeFi platform. Raydium supports token swaps, yield farming, liquidity pools, and a launchpad called AcceleRaytor, which allows users to support new projects on the Solana Network and receive tokens in return.

What sets Raydium apart is the fact that it acts as an automated market maker (AMM) while also providing the traditional benefits of order book-based exchanges. Through this hybrid model, Raydium provides on-chain liquidity to a central limit order book, connecting users and liquidity pools to the liquidity and order flow of the OpenBook ecosystem.

Raydium also has a native token called RAY. Holding these tokens allows you to earn a portion of protocol transaction fees and access the AcceleRaytor launchpad. Additionally, the Raydium team is developing a governance structure that will allow RAY token holders to influence important decisions about the future direction and development of the protocol.

2. Cats in a Dog’s World (MEW)

MEW (Cat in a Dogs World) is a meme token on the Solana blockchain. Like most other meme tokens and coins that have achieved recent success, MEW has no roadmap and the team behind it has no plans to provide any additional utility to the token (at least publicly).

MEW’s token supply is 88.8 billion. This may possibly be a reference to the number 8, which is associated with luck and prosperity in Chinese culture. The name of the token refers to the current state of the memetic crypto landscape, with most tokens and coins using dogs as their mascots.

Although not much can be said about MEW from a fundamental perspective, the token has gained considerable popularity. MEW is listed on major cryptocurrency exchanges, including KuCoin, Bybit, and OKX, and is one of the most actively traded tokens on Solana-based decentralized exchanges.

3. iExec RLC (RLC)

iExec RLC is a blockchain-based project that aims to disrupt the cloud computing industry by creating a decentralized marketplace for computing resources. The project leverages blockchain technology to allow users to buy, sell, and trade computing power, data, and applications securely and efficiently.

At its core, iExec RLC focuses on providing a decentralized infrastructure that allows individuals and organizations to share idle computing resources. This approach not only maximizes resource utilization but also allows users to monetize unused processing power. iExec RLC leverages the power of blockchain to ensure transparency, security, and reliability in the marketplace.

iExec’s solutions enable the monetization of AI assets. At the same time, creators of these assets can retain ownership and keep their valuable information confidential. Confidential computing allows the system to run AI models without administrators having access to the running code. In particular, the iExec project is a member of Intel’s AI Builder Program.

4. NYM

Nym is a project that leverages a cryptocurrency-based incentive system to create a global network of nodes that allows users to browse the web and interact with applications while protecting their privacy. Nym is positioning itself as a better alternative to other privacy technologies like Tor and VPNs.

Nym is developing a full-stack solution for privacy that leverages mixnets, which are designed to make metadata invisible to outside observers. The data Nym protects includes your IP address, the device you are using, your location, and more.

With NymVPN, users can benefit from Nym’s privacy technologies, which allow users to choose from a variety of privacy technologies depending on whether they prioritize speed or privacy. Users who require maximum privacy can choose the 5-hop mixnet, while those who prioritize performance can choose the 2-hop secure WireGuard decentralized VPN.

Nym features the NYM token, which helps maintain the decentralization of the Nym network and is also used to incentivize mixnet node operators and Nym blockchain validators to provide their services. The token also prevents spam attacks because it makes sending spam to the Nym network economically unfeasible.

5. Zeta Chain (ZETA)

ZetaChain is a project that allows developers to create decentralized applications (DApps) that run on multiple blockchain platforms. The chain is equipped with smart contracts that can manage assets, data, and liquidity across multiple blockchain networks, including networks that do not support native smart contract functionality like Bitcoin.

ZetaChain’s omnichain smart contracts can monitor and respond to events across various blockchain networks. These smart contracts act as a unified source of information, maintaining a consistent state of assets and data across all connected chains.

ZetaChain’s unique design allows it to connect to any blockchain or layer, such as the Ethereum mainnet, as well as any layer 2 blockchain above it, such as Arbitrum and Optimism. According to the ZetaChain team, the overarching goal of the ZetaChain blockchain is to enable a seamless web3 experience where users don’t have to worry about linking or converting assets between blockchains.

6. Centrifuge (CFG)

Centrifuge is a protocol designed to bridge the real-world assets (RWA) and decentralized finance (DeFi) realms.

Centrifuges allow companies to access capital through a decentralized system without having to go through intermediaries such as banks. Meanwhile, lenders have access to a variety of options to obtain returns backed by productive real assets such as real estate, invoices, revenue-based financing and other sources.

The Centrifuge protocol has been used to tokenize over 1,400 assets and has raised over $550 million in assets.

The Centrifuge protocol has a native token called CFG that performs several roles. This gives holders access to the protocol’s governance processes and is also used to pay fees on the Centrifuge Chain, a custom blockchain specifically designed for real-world asset financing.

How to find cryptocurrencies with low market capitalization?

Our article covers only a few small cryptocurrencies that we believe have strong potential for the future. Of course, there are hundreds of other potentially attractive low-cap coins on the market, and there are a variety of tools you can use to find them.

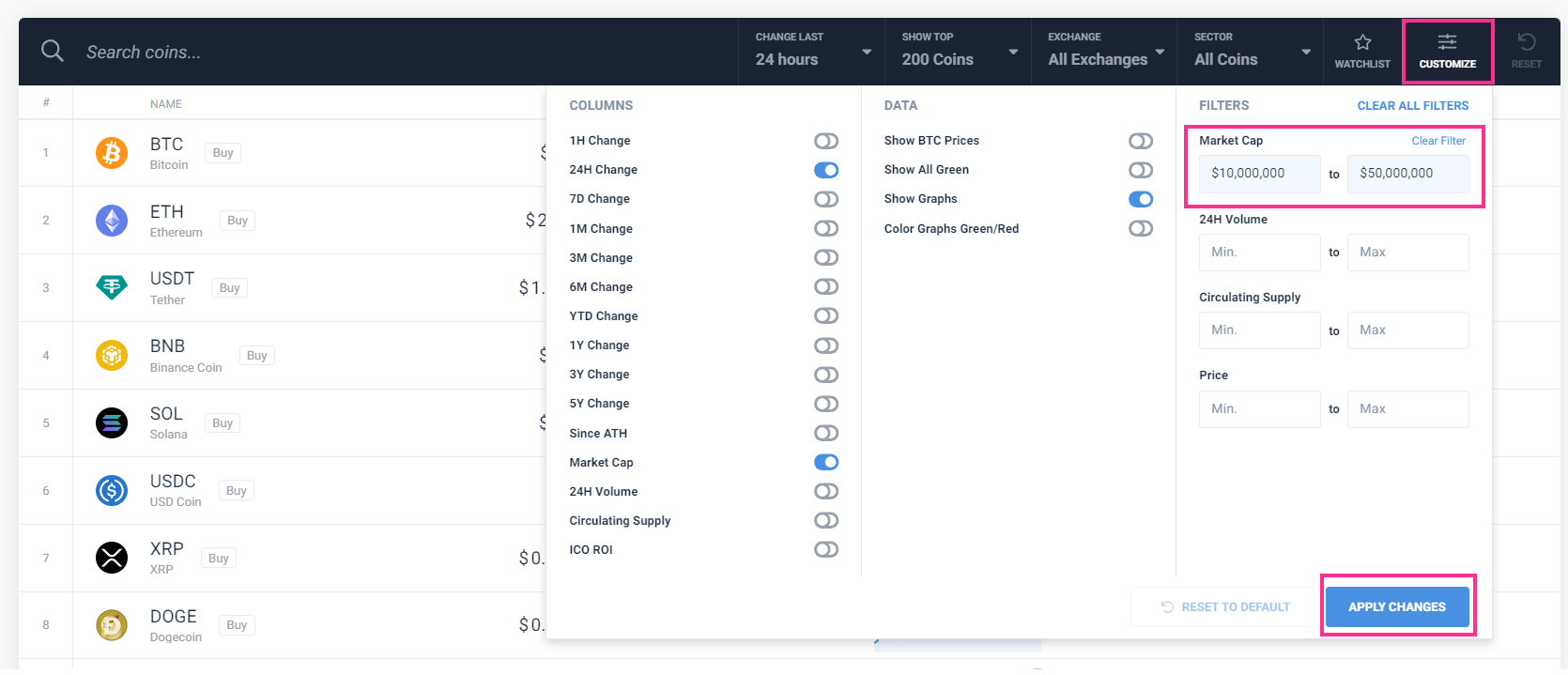

CoinCodex allows you to conduct custom searches to find cryptocurrencies that fit your specific criteria. You can use the “Customize” option on our front page to filter the thousands of cryptocurrencies we list.

For example, here’s how to find cryptocurrencies with a market capitalization in a specific range: We chose the $10 million to $50 million range, but you can choose whichever range interests you.

Another way to find cryptocurrencies with potentially low market capitalization is to use a cryptocurrency whale tracking tool. This allows you to see what types of cryptocurrencies large cryptocurrency holders are holding and trading.

There is also a lot of overlap between newer cryptocurrencies and those with lower market capitalizations. To help you get started, we’ve provided a comprehensive guide on how to buy new cryptocurrencies before they are listed on exchanges.

What are considered low market cap cryptocurrencies?

There is no clearly defined market capitalization range for cryptocurrencies that are considered low market capitalization cryptocurrencies. In this article, we focused on cryptocurrencies that are not in the top 100 cryptocurrencies and have a market capitalization between approximately $100 million and $400 million.

Although these cryptocurrencies are relatively small compared to coins like Bitcoin and Ethereum, they do not suffer from some of the most common problems associated with microcap cryptocurrencies, such as low liquidity and low project quality.

Is low market cap a good thing in the cryptocurrency market?

A low market capitalization can be either good or bad depending on the circumstances. The biggest advantage of low market capitalization cryptocurrencies is their higher upside potential. However, just because a coin’s market capitalization is small, it does not mean that its price will rise significantly in the future.

For example, a cryptocurrency with a market capitalization of $10 million could easily see its price increase 10 times more than Bitcoin, which is already valued at over $1 trillion. On the other hand, a cryptocurrency with a market capitalization of $10 million could easily see a massive collapse rendering it virtually worthless.

When evaluating a cryptocurrency, it is important to ask yourself why its market cap is so high. Is it a project that is actually attractive but not properly valued by the market, or is it simply a low-quality project with a small market capitalization?

conclusion

Hopefully, our list of the best low market cap cryptocurrencies will help you identify interesting opportunities in the fast-growing cryptocurrency market. If you want to explore more cryptocurrencies, take a look at our list of the best cryptocurrencies you can buy right now.