6 Cheapest Cryptocurrencies You Can Buy for Less Than $1 Right Now, December 4

join us telegram A channel to stay up to date on breaking news coverage

Over the past 24 hours, the global cryptocurrency market rose 2.47%, reaching a total market capitalization of $1.52 trillion. At the same time, trading volume surged 87.51%, reaching $89.54 billion. especially, Decentralized Finance (DeFi) contributed $9.83 billion, accounting for 10.98% of total market activity.

Stablecoins accounted for $81.82 billion, or 91.37% of the total 24-hour trading volume. Bitcoin, the dominant player, currently holds a 52.92% share, reflecting a 0.65% increase in dominance over the day.

6 Cheapest Cryptocurrencies You Can Buy for Less Than $1 Right Now

These statistics show an active market driven by significant volumes of DeFi and stablecoins. Bitcoin’s increasing dominance indicates continued interest and investment in this major cryptocurrency.

1. Kronos (CRO)

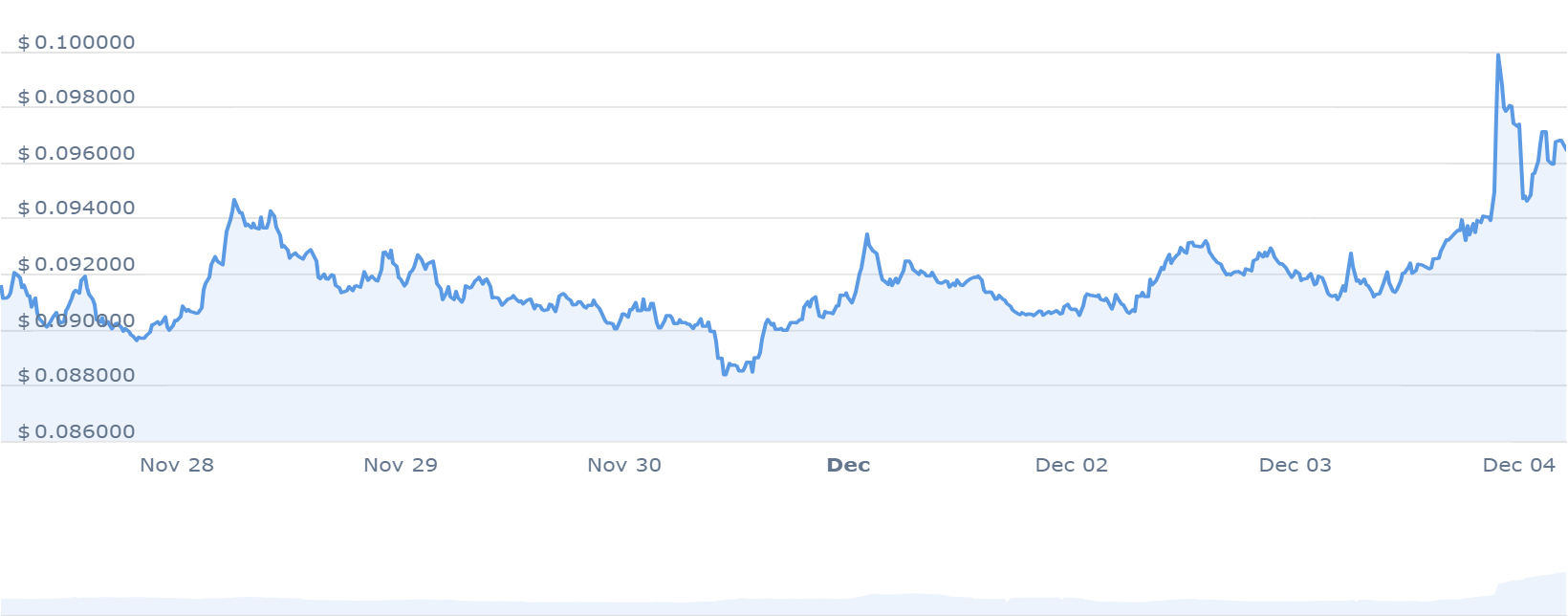

Cronos (CRO) has been on the rise recently, breaking the swing high barrier of $0.08000 on significant volume. This created positive sentiment and led to a rapid increase of 25% in just two trading sessions. The token hit a record high of $0.12264 this year, giving hope to investors.

However, after reaching this high, there was some profit booking that took it back to the breakout level. Buyers have been actively advocating for this support, spurring a consolidation phase after a significant rally over the past month.

Buyer activity is currently more prominent than seller activity, indicating that the token price is likely to rise. This suggests a bullish trend in the near term, potentially providing an opportunity for traders seeking modest profits.

Based on the latest data, Cronos is trading at $0.09742, up 5.47% intraday, despite low liquidity with a market cap to 24-hour volume ratio of 1.11%. The current upward trend in Crono price shows a market dominated by buyers, and any short-term correction to the EMA is expected to be absorbed by buyers.

This suggests that existing investors should consider maintaining their positions. Therefore, new investors may seek entry during potential downturns or favorable buying opportunities.

🌐 Introducing the new Cronos Mainnet Explorer 👉🏻 https://t.co/Cisr9gZC4z!

🎨 Improve your skills #CROFam Improved contact interaction and curated top CRC-20, CRC-721, CRC-1155 token list experience

🙌 Find out more: https://t.co/R83zbAtmmU pic.twitter.com/lsemtd33aG

— Cronos (@cronos_chain) November 30, 2023

Looking ahead, immediate resistance for bulls is $0.11032. A successful breach of this level could signal the start of the next phase of the rally. Given the continued bullish pattern, the analysis is leaning towards a favorable outlook for CRO price. However, it is important to note that investment decisions should be made carefully, taking into account market volatility and potential risks.

2. Shiba Inu (SHIB)

Recently, Shiba Inu (SHIB) has shown notable performance in the cryptocurrency market. This increase, which is approximately 10% each day, is influenced by several key factors.

The overall positive trends observed primarily across cryptocurrency markets have likely contributed to SHIB’s upward trend. In particular, if Bitcoin (BTC) had hit a 19-month high of $42,000, it could have been a favorable backdrop for SHIB’s rise.

Another factor influencing SHIB’s rally is the progress of the development of Shibarium, a layer 2 blockchain solution associated with the Shiba Inu project. Recent data shows that total transactions within the network have increased significantly, reaching nearly 30 million.

Moreover, this surge in trading activity peaked at 7.84 million on December 3, which contrasts sharply with the daily trading range seen throughout November. These rates typically fluctuated between 8,000 and 40,000.

🌌 Find out the latest cryptocurrency facts! Find out why CoinMerge supports Shibarium, ride the 2024 cryptocurrency trend wave, discover 10 future tech insights, and watch Shytoshi’s exclusive decentralization interview.

📖 Get excited: https://t.co/9xYQzFbhU3 pic.twitter.com/UEwL5SD0qR

— Shib (@Shibtoken) November 27, 2023

Additionally, SHIB’s price surge may be related to the successful execution of Shiba Inu’s token burn program. Shibburn reports that asset burn rates have increased by nearly 1,000% over the past week. This surge resulted in more than 527 million tokens being sent to inaccessible addresses. SHIB in particular witnessed significant token burns of over 1.3 billion in November and nearly 1.5 billion in October.

3. Bitcoin Minetrix (BTCMTX)

Bitcoin Minetrix We introduce a new concept where users earn cloud mining credits by staking BTCMTX tokens, decentralizing control for token holders and ensuring a safe mining experience. The project has received significant attention, with over 400,000 BTCMTX tokens staked.

Bitcoin Minetrix reportedly promises an Annual Percentage Yield (APY) of 103,225%. This noticeably high APY has attracted a large number of participants to the staking pool, making it a prominent player within the cryptocurrency landscape.

November turned out to be profitable. #Cryptocurrency Miners!#Bitcoin Sales soared to $1.16 billion. #Ethereum Validators earned $145 million, highlighting the resilience of the industry. 💰

Do you think the increasing dependence on transaction fees for miners’ revenue could affect their stability?

— Bitcoin Minetrix (@bitcoinminetrix) December 4, 2023

In particular, the project’s traction is evident in the ongoing BTCMTX presale, which has raised over $4,832,92 by selling tokens at $0.011 per token. During the pre-sale phase, 70% of the total token supply (2.8 billion out of 4 billion BTCMTX) can be acquired using ETH or USDT. This step was pivotal in gaining the attention of potential investors.

Visit Bitcoin Minetrix Pre-sale.

4. Tezos (XTZ)

Currently valued at $0.862978, Tezos is trading above its 200-day simple moving average, indicating a positive trend. In the last 30 days, Green Day is 20th, accounting for 67% of recent performance, indicating a dominant upward trend. The cryptocurrency boasts high liquidity, backed by a market capitalization of $830.36M.

In the last 24 hours, the price of Tezos rose 1.97%, reaching a trading volume of $59.64 million. Market power is 0.05%. The cryptocurrency peaked at $12.26 on December 17, 2017. It reached a low of $0.319784 on December 7, 2018, marking its all-time high and low respectively. The highest price recorded since the last cycle low was $9.08.

In the fifth episode @LigoLang Learn about booleans and conditionals in jsLigo in our tutorial series.

Watch the full video here: https://t.co/FDwE39lDdt

— Tezos (@tezos) November 30, 2023

Market sentiment is optimistic about the price prediction for Tezos, with the Fear and Greed Index reading at 74 (greed). With a circulating supply of 962.21 million XTZ out of a peak supply of 937.87 million XTZ, Tezos faces an annual inflation rate of 4.88%, generating 44.78 million XTZ last year.

5. EOS

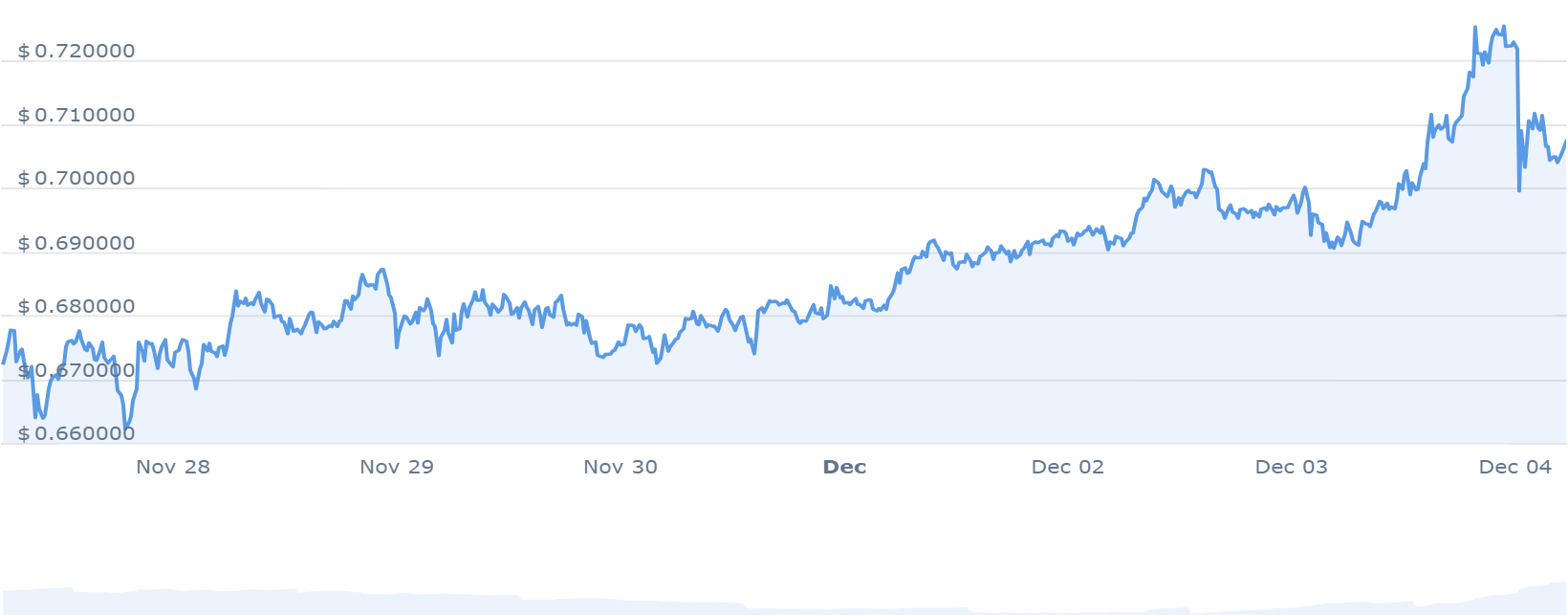

Over the past 30 days, EOS has shown positive growth for 18 days, accounting for 60% of that period, indicating a continued upward trend. Given its significant market capitalization, liquidity appears solid.

EOS price is $0.707473, up 2.21% in the last 24 hours, with a trading volume of $337.99 million. The market capitalization is $785.52 million and the market dominance is 0.05%. Additionally, current sentiment analysis indicates a bullish market outlook, with the Fear and Greed Index sitting at 74 (greed).

Last week, we announced an impactful partnership between our two companies. #EOS and @CoinTRpro 🤝

Check out the full details below to learn how this groundbreaking milestone will drive adoption. #EOS Network across Türkiye 🚀

Learn more 👇https://t.co/CDqn7HGa9k

— EOS Network Foundation (@EOSnFoundation) December 4, 2023

Regarding supply dynamics, the circulating supply of EOS is 1.11 billion out of a maximum of 1.06 billion. Maintaining an annual supply inflation rate of 3.27%, 35.12 million EOS were created last year. In the proof-of-stake coin category, EOS ranks 14th by market capitalization, 2nd by EOS Network, and 37th by Layer 1.

6. Conflux Network (CFX)

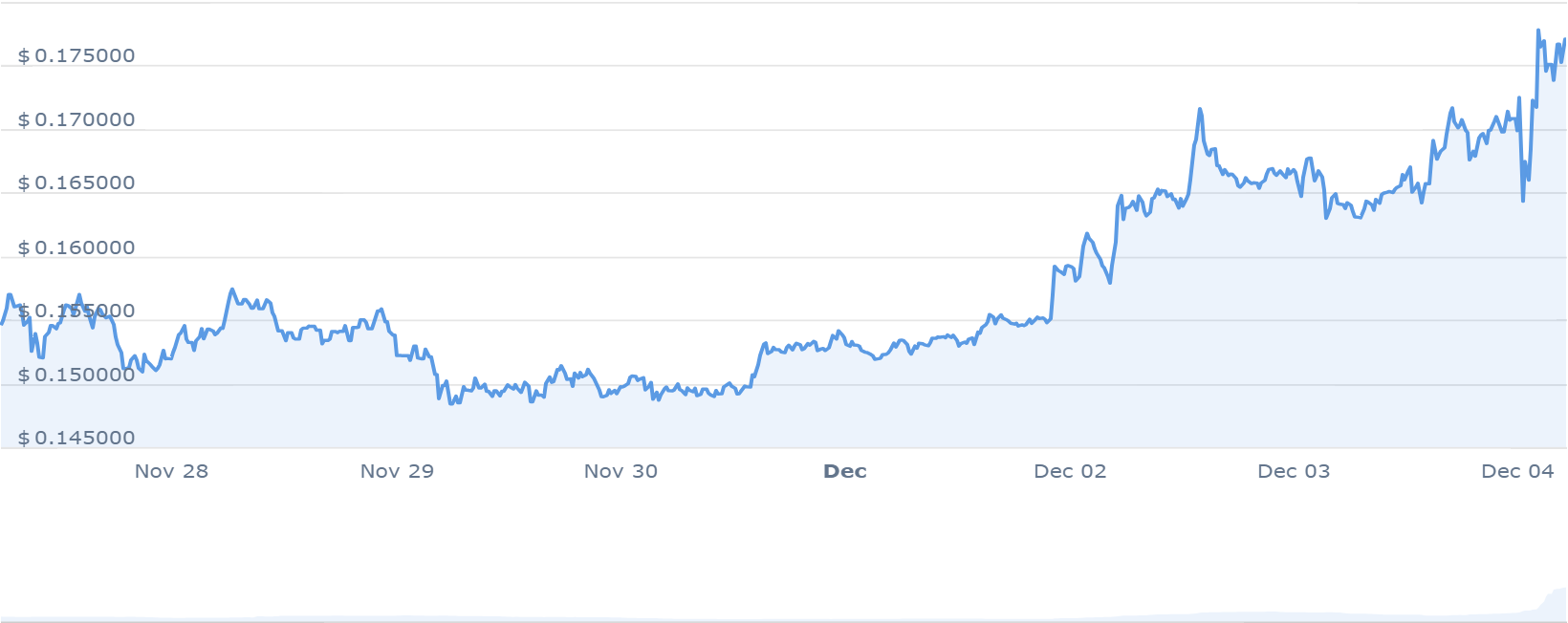

Conflux Network has seen a notable surge in price over the past year, recording a significant increase of 526%. This growth surpasses 96% of the top 100 cryptocurrency assets in the same period, surpassing Bitcoin and Ethereum. The current price is $0.183183, the market capitalization is $650.06M, and the 24-hour trading volume is $159.69M, indicating high liquidity based on market capitalization.

Additionally, the asset is trading above its 200-day simple moving average, a trend that indicates a positive trajectory. Over the past 30 days, Green Day was the 17th, accounting for 57% of the total period, showing a periodic upward trend.

📣 The November progress report is out!

🚀 Major updates:

🔹 Updated open API development for BSIM wallet, introduced BSIM account support, enabled message signing.

🔹 The first developer community call was hosted by: @ConfluxDevs

🔹Partnership… pic.twitter.com/7BUhD5Qd2h

— Conflux Network Official (@Conflux_Network) December 1, 2023

Conflux Network reached an all-time high of $1.720000 on March 27, 2021 and hit an all-time low of $0.021852 on December 30, 2022. The lowest price experienced since reaching ATH was $0.021852 (cycle low). The highest price since the last cycle low was $0.485454 (cycle high).

Learn more

A new cryptocurrency mining platform – Bitcoin Minetrix

- Thanks to Coinsult

- Decentralized, secure cloud mining

- Get free Bitcoin every day

- Native token currently in pre-sale – BTCMTX

- Staking Rewards – APY 100% or more

join us telegram A channel to stay up to date on breaking news coverage