6 Common Pitfalls of Self-Directed and Checkbook Bitcoin IRAs

Original published date unchained.com.

Unchained is the Official US Co-Managing Partner of Bitcoin Magazine and an essential sponsor of related content published through Bitcoin Magazine. Please visit our website to learn more about the services we offer, our storage products, and the relationship between Unchained and Bitcoin Magazine.

The term ‘Roth IRA’ isn’t often trending online, but in 2021, tech investor Peter Thiel made headlines by creating a $5 billion tax-free Roth IRA piggy bank. How did he do it? The answer is alternative investment. He has invested several times in early-stage technology companies using his self-directed IRA. Is it a loophole? if. But what happened did attract attention, and the IRA structure in question could come under further scrutiny.

“Thiel made a $5 billion windfall in 1999 by securing a retirement account worth less than $2,000.” – ProPublica (2021)

Let’s look at six common risks associated with self-directed and checkbook IRAs, how these risks may apply in the context of Bitcoin, and why regulation may increase in the future. But first, we need to define terms and distinguish between IRA structures.

Various IRA Structures

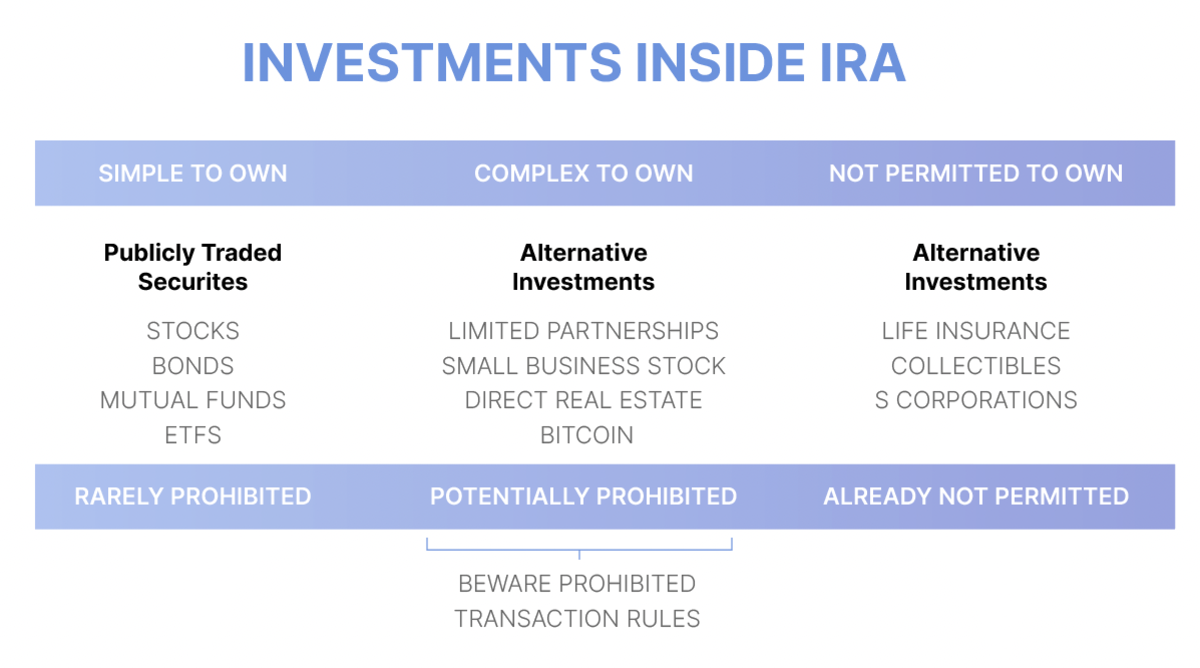

Various IRA structures can work in a “all squares are rectangles, but not all rectangles are square” ways. IRAs can be Traditional (pre-tax) or Roth (after-tax) regardless of custodianship/structure. All IRAs are administrative. In the context of an IRA, a custodian is a licensed financial institution that oversees and manages the IRA.

Brokerage and Bank IRAs

Brokerage and bank IRAs are the most familiar and common types. Brokerage and bank IRAs allow investors to invest in stocks, bonds, ETFs, mutual funds, and other securities, as well as banking products (CDs, savings accounts, etc.). Examples include the typical Fidelity, TD Ameritrade, or Charles Schwab IRA. Unchained IRA is the closest to this structure in this hierarchy.

Self-Directed IRA (SDIRA)

A self-directed IRA is a managed IRA that allows the custodian to expand investment options beyond the typical brokerage and banking assets (stocks, bonds, CDs, etc.). Self-directed IRA owners can invest in non-traditional assets such as real estate, businesses, personal loans, tax liens, precious metals, and digital assets. The IRS doesn’t have a definitive list of investments that are allowed, but there are certainly a few that are not allowed (collectibles, life insurance, certain derivatives, S-Corps, etc.).

Checkbook IRA

Checkbook IRAs are a subset of self-directed IRAs. The term “checkbook IRA” is not standard, but refers to a self-directed IRA that gives control of investments to the account holder, usually through a checking account through an LLC conduit. The account holder can then invest with IRA funds by simply writing a check (“checkbook control”). With the added freedom of additional investment choices comes added management responsibility and legal ambiguity as to whether the structure still qualifies as a tax-exempt IRA.

Non-Checkbook Self-Directed IRA

A subset of self-directed IRAs in which a custodian approves transactions before investments are made. Investors must wait for the custodian to review each potential investment and formally accept ownership of the underlying assets. These have been commonly used for real estate and private equity investments and are beginning to regain popularity as additional legal uncertainty arises about checkbook IRAs in late 2021 (discussed in Section 4 below).

Risks to watch out for when using a self-directed or checkbook IRA

1. Liquidity

Unfortunately, self-directed assets often lack liquidity, making them difficult to sell quickly. Examples include real estate, sole proprietorships, and precious metals. If you need cash for distributions or internal expenses, selling assets quickly can be problematic (which can lead to other problems, such as inadvertently commingling funds). Self-directed IRA owners should conduct thorough due diligence on asset liquidity before deciding on an investment strategy.

2. Establishment and legal structure

When forming a checkbook IRA, a Self-Directed IRA LLC is established first. The LLC then opens a checking account like any other business. Next, the LLC is funded by sending IRA funds to your checking account.

With the proper legal structure, the IRA owner can become the sole managing member of the LLC and have signatory authority over the checking account. However, improper legal structure, registration, or ownership can all cause serious problems with an IRA’s tax-advantaged status. Many checkbook IRA facilitators are competent, but errors can always cause problems and result in disqualification/loss of your entire IRA.

3. Falsely reporting transactions

Within a checkbook IRA, owners can fund investments quickly and freely, but they are responsible for properly following the rules and self-reporting their transactions.

At the end of each year, LLC owners must provide full transaction details to the IRA custodian and submit fair market value (FMV) information. If you do not supervise each trade you make, it is more likely that your custodian will misreport the income on your investments. Always make sure your manager has accurate information to avoid accidentally breaking the law.

4. “Deemed distribution” processing

Customers looking to purchase precious metals, real estate, or digital assets should be aware of the risks of “deemed distribution” processing. A recent U.S. Tax Court case, McNulty v. The Commissioner case illustrates the significant risks of maintaining a checkbook IRA. In the McNulty case, the taxpayer used an IRA LLC checkbook to purchase gold from a precious metals dealer. She stored the LLC’s gold in a private safe at home. The court ruled that her “unlimited control” of the LLC’s gold, without third-party supervision, resulted in a deemed taxable distribution from the IRA.

It is impossible to know how much “deemed distribution” treatment the Tax Court will apply to any particular transaction or investment within a checkbook IRA. For checkbook IRA owners who hold the keys to their Bitcoin in an unsupervised structure, the McNulty decision risks making their entire IRA taxable. Additionally, with the recent (2015) addition of alternative investments to IRS Publication 590, it is possible that the IRS and Congress may apply more scrutiny to checkbook IRAs in the future. Learn more about the McNulty story and its implications.

5. Prohibited transactions

All self-directed IRA owners are prohibited from mixing personal assets with IRA assets at any time or using personal funds to enhance IRA assets. “Self-dealing” is one of the most common pitfalls for self-managed account owners. For example, if you use your IRA to purchase real estate, you cannot use any of that real estate yourself. You can’t live there, you can’t stay there, you can’t rent office space there. Do-it-yourself repairs or providing “sweat equity” are also not permitted.

It’s not just the IRA owner who can’t engage in “self-dealing,” so can their spouses, children, and grandchildren. They are considered disqualified individuals and the punishment is severe. This is a strict rule and breaking it can result in huge tax consequences. I don’t mean to crush any dreams, but investing your 401k/IRA in an Airbnb vacation home on the lake and having you or your family stay there even once is a bad idea. Nor do we buy rental properties and rent them out to family members. For more information, see the IRS’ list of prohibited transactions here.

Below are some examples of how the prohibited trading rules may apply to digital asset investors.

- A mix of personal and IRA wallets

- Use without repaying loans

- Invest in specific collectible NFTs1

6. Financing

Raising funds within a self-directed IRA is also more complicated for a number of reasons.

- Buying real estate typically requires a non-recourse loan and a larger down payment.

- Unexpected costs and fees can add up quickly and eat into your profits.

- Active corporations owned by IRAs may face unrelated business income tax (UBIT) issues. This also affects the duplication of Bitcoin mining within an IRA.

- All income and expenses must remain within the IRA structure and not commingled with personal funds. For example, if the water heater goes out (real estate) or payroll needs to be paid (business), the IRA itself must pay for that service with the IRA’s own cash. IRA owners may be tempted to temporarily commingle funds as they seek short-term liquidity to address cash needs.

What does this mean for Bitcoin IRAs?

The self-directed IRA space has many potential risks if not managed properly. The IRS and Congress have paid particular attention to how these structures are used and abused. Combine this with interest in digital asset regulation, and it seems like a situation that warrants further investigation. Bitcoin IRAs therefore require a unique approach to mitigating these pitfalls.

The Unchained IRA is not a checkbook IRA.

If you want to store real Bitcoin in an IRA account, you should consider Unchained IRA. It is not a “checkbook IRA” where transactions must be self-reported, and Unchained uses those keys in a pooled custody setup to track inflows and outflows from your IRA vault. This visibility mechanism allows custodians to actively monitor their IRAs, ensuring users remain compliant with current IRA rules and regulations.

No self-reporting is required and the non-checkbook structure helps mitigate the risk of potential risks (McNulty, misreporting of transactions, etc.). If Bitcoin appreciates as many investors hope and expect, holding coins appropriately in an IRA structure will be of utmost importance.

This article is provided for educational purposes only and should not be relied upon as tax advice. Unchained makes no representations regarding the tax consequences of any structure described herein, and all such questions should be referred to an attorney or CPA of your choice. Jessy Gilger notes that at the time this post was written she was an Unchained employee, but she now works at Sound Advisory, an affiliate of Unchained.

1Although not technically part of the prohibited transaction rule (Internal Revenue Code Section 4975), collectibles are separately prohibited from being held in an IRA under Section 408(m).

Original published date unchained.com.

Unchained is Bitcoin Magazine’s Official US Co-Managing Partner and an essential sponsor of related content published through Bitcoin Magazine. Please visit our website to learn more about the services offered, our storage products, and the relationship between Unchained and Bitcoin Magazine.