#9- “Institutions cannot overcome basic purchases and possessions” -MEB FABER Research

Since 2000, the annual return on the pension fund has been the same as the simple 60-40 index portfolio.

It seems somewhat expected, but how about the true cream de la cream, the best institution? Obviously, can they overcome simple purchases and allocation?

They cannot actually do it. Below, we remember the article, “Do Calpers fired everyone and buy ETFs a few years ago?”

“He was a soft politician in the US class. This is the only way you can survive in that job. It has nothing to invest.”

That’s how Institutional investor Recently, we explained the previous CIO of the California civil service retirement system, also known as Calpers.

This explanation is especially interesting considering that “I” of “CIO” represents “investment”. This increases the eyebrows on how to have a role that is not related to investment.

Readers who are not familiar with Calpers manage more than a million officials, retirees and their families. They supervise the largest pension fund in the country, more than $ 45 billion.

Many of the assets are conducted on how the assets are deployed. The role of CIO managing this pension is one of the most famous and powerful things in this country. Institutional investor‘S interest. Obviously, it is also one of the most difficult roles. This position has average average CIO every year over the past decade.

Now this article will not spend much time for Calpers Governance. In addition, the dramas surrounding the pension will not end endlessly and will be a new twist until we publish the article. (Fairly speaking, Harvard’s E -Dowing Problem is almost the same …)

Instead, we will use Calpers’ investment approach as a jump point for a wide range of discussions on portfolio assignments, revenue, fees and waste. And if we do things correctly, we hope we can feel a little less stress about our portfolio positioning until we end.

A tremendous waste of CALPERS market approach

The mission of Calpers is to provide retirement and medical benefits to members and beneficiaries.

Wherever this mission is to invest in many private funds and pay the expansion of numerous private equity and hedge fund managers. But this is what Calpers do.

Investment policy documents of pensions (and we don’t make this-) are 118 pages length.

Their investment and funding lists are 286 pages length. (Perhaps they must read a book.Index card”.)

Their structure was so complicated that CALPERS could not even calculate the cost of private investment. For this reference, the biggest contribution to high fees is Calpers’ private equity fund assignment, and they plan to increase their allocation. Is it a well -thought idea, or is it a hail mary pass after years of achievements? Recently, 0.49%were returned from 2000 to 2020, according to Calpers Venture Capital Portfolio.

It’s easy to criticize now. But is there a better way?

Let’s look at Calpers’ historical profits for some basic asset allocation strategies.

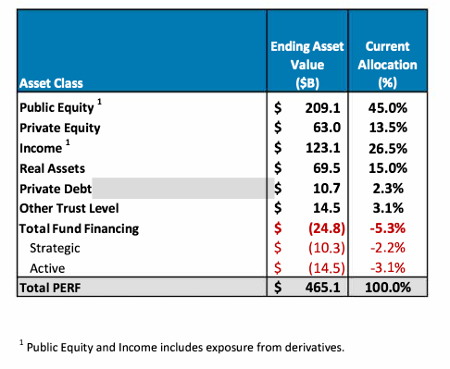

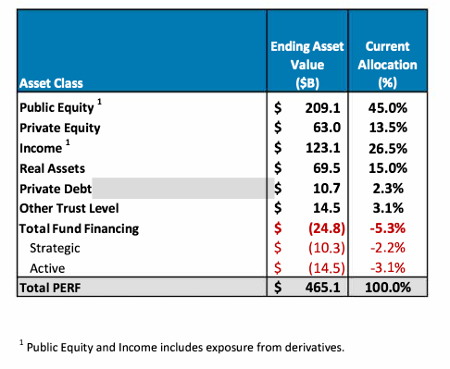

We will start with Calpers’ current portfolio assignment.

Source: CALPERS

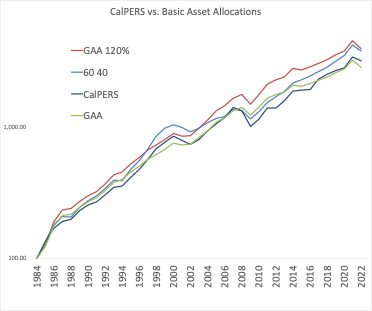

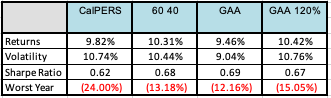

Now we know what Calpers is doing, so let’s compare the three basic portfolios that started in 1985.

- Classic 60/40 US stocks and bond benchmarks.

- Global Asset Allocation (GAA) Portfolio of our book Global asset allocation (Provided by free e -books). The allocation is similar to the allocation of the global market portfolio of all public assets in the world.

- GAA portfolio with some leverage because Calpers uses a lot of money and strategy.

Source: Calpers, Global Financial Data, Cambria

As you can see from the table, Calpers has not been different from the simple “do notification” benchmark since 1985-2022.

It is not a return to make it clear. bad. Not they are good.

Consider the meaning.

All time and money spent by the Investment Committee to discuss allocation…

All time and money to be assigned to sourcing and private funds…

All time and money sent to a consultant…

All time and money spent on hiring new employees and CIOs…

All the time and money required to collect endless reports to track thousands of investments.

Everything is absolutely wasted.

Calpers would have been better to launch the entire employee and buy ETFs. Should they call Steve Edmundson? It will definitely keep the record much easier!

It will also save hundreds of millions of dollars annually with operating costs and external fund fees. Over the years, the cost is billions of dollars.

Personally, I suggested that I would take the “I” part of the abbreviation very seriously and manage Calpers Pension for free.

“Pension funds, which are struggling with low performance, major costs, and heads, will be free to manage the portfolio for free. Buy ETFs. When you meet annual shareholders every year, write a review for one year.”

I applied for a CIO role three times, but whenever Calpers refused to interview.

Perhaps Calpers said, “We must update the mission declaration to provide members with retirement and medical benefits. CALPERS staff,,, Personal fund manager And their beneficiaries. ”

In this case, they will be strongly successful.

Is it just Calpers, or is it the industry?

Looking at the above results, you can conclude that Calpers is an overtake.

Critics said, “OK MEB, we will find out that Calpers can’t beat basic purchases and possessions. But let’s do it honestly. The government is the government! We define the government as ordinary. We must use Smart Money, a smart hedge fund manager.”

Fair point. Therefore, the analysis is widened.

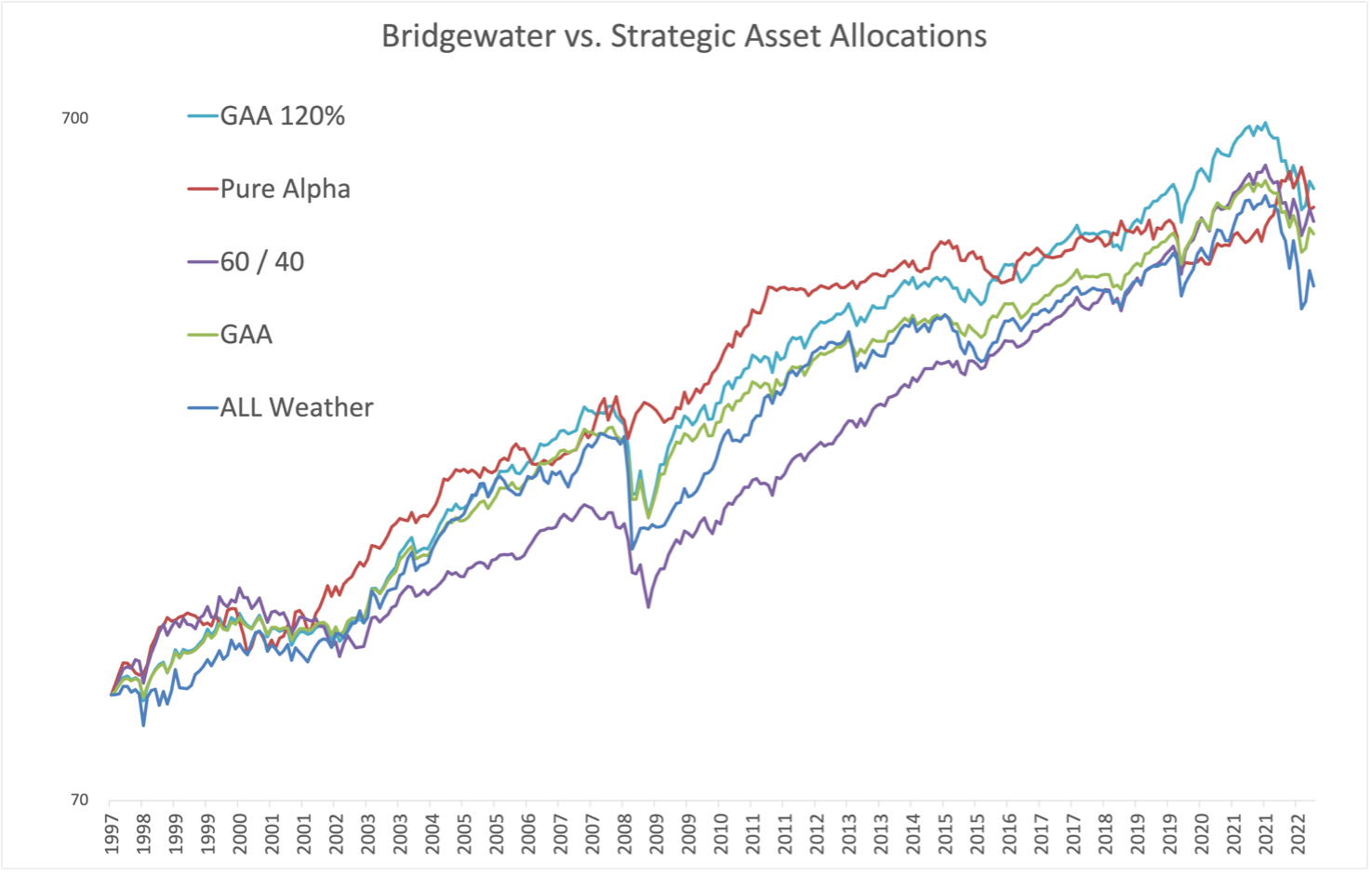

We will do so by investigating Bridgewater, the largest and most famous hedge fund manager. This $ 10 billion+ Money Manager offers two major portfolios: purchasing and holding “all weather” strategy and “pure alpha” strategy.

In 2014, we started Clone with Bridgewater’s Clone Bridgewater’s ALL WEATER. Bridgewater went through stress tests through two recessions, real estate foam and global financial crises.

Clones based on a simple global market portfolio made up of indexes helped to replicate Bridgewater’s offering when testing again. More importantly, to run the clone, the hedge fund management cost and lock would have been required, and the weight was not measured due to tax non -efficiency. Fairly, this back has the advantage of the fuss and does not pay for fees or transactions.

All weather portfolios focusing on dangerous parity do not necessarily have to accept pre -packaged asset classes when building a portfolio.

For example, it is essentially used in relation to stocks, and most companies have debts in the balance. Therefore, there is no reason to accept stocks as a conceptual value. One choice for “DELEVERAGE STOCKS” is to invest in half and half of cash in stocks. And the same is true for bonds. You can use them up or down to make them somewhat volatile.

This approach has been used for more than 60 years. This concept, which dates back to the era of Markowitz, Tobin and Sharpe, is an essentially very diversified buying and restructuring portfolio. Ray Dalio, founder of Bridgewater, said he would invest if he had passed away and needed a simple allocation for his children.

Obviously, should the world’s largest hedge fund be able to promote allocation that can be used for index cards?

Once again, since 1998-2022, I have learned that the basic 60/40 or global market portfolio is doing better than the world’s largest hedge fund complex.

Source: MorningStar, Global Financial Data, Cambria

“Okay, all the weather is considered a portfolio of purchases and holding. They claim low fees. You want good objects, pure alphas that are actively managed!”

How about a portfolio that is actively managed by Bridgewater?

Dalio separated All Weather Portfolio from Bridgewater’s Pure Alpha strategy.

His idea was to separate “beta” or market performance from “alpha” or add performance to average market revenue. He thinks that beta is almost something you have to pay (we’ve written that we should not pay anything).

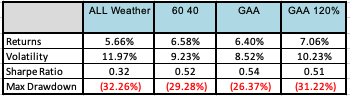

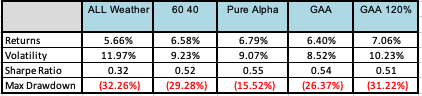

Now bring a pure alpha strategy to the mix. Below are compared with all weather, traditional 60/40 portfolios and Global Asset Allocation (GAA) portfolio. Finally, the danger parity strategy uses some leverage, so we tested with GAA and performed 20%of leverage.

The cloning strategy tested the performance of the portfolio between 1998 and 2022.

Source: MorningStar, Global Financial Data, Cambria

Once again, the pure alpha’s revenue was almost the same as the GAA and 60/40 portfolio and less than 0.5%. And don’t miss that Pure Alpha has traced the leverage version of the GAA portfolio.

Again, this is not bad. It’s just bad.

Some said, “But Dalio and the company did this in real time with real money in the 1990s.”

We absolutely till our hats, and pure alphas seem to take a different return path than other allocation, and provide diversification of non -correlation on traditional assets. The benchmark also acknowledges that it contains a particularly powerful trailer for US stocks.

There is a problem here. Many of these hedge funds and private equity fund strategies will cost 20%of final investors 2 and 20 or 2%. Therefore, 10% annual total performance is reduced to 6% after all fees.

Yes. Perhaps Bridgewater and other funds can produce some alphas. The problem is that they keep them all.

Nevertheless, I am pleased to know that it can be able to duplicate a huge amount of strategy by purchasing a global market portfolio with ETF and reassembling it once a year, avoiding huge management fees, paying additional taxes, or requiring a tremendous minimization.

Relationship with portfolio

It takes this from school and is related to money and portfolio.

If you are declaring a year -end article that proclaims a method of placing a portfolio for monster 2024 through the year -end article, or if you are more likely to take into account the preference of experts for idiots and destiny, there is a high possibility of a huge recession and conflict that causes a huge recession and conflict.

“Is it even important?”

What is the opportunity if the largest pension fund and the largest hedge fund cannot surpass basic purchases and assets?

All pension funds and End Dowment A proposals are pleased to design a strategic asset allocation for free. You can save a million dollars of basic and bonuses for the Calpers CIO role. What we ask is probably that we meet once a year and re -adjust and share some drinks.