Brilliant Earth: Waiting for earnings to show as revenue (BRLT)

peterschreiber.media/iStock (via Getty Images)

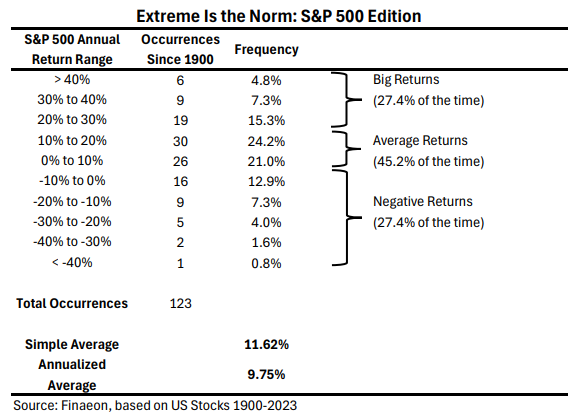

After writing about the jeweler Brilliant Earth (NASDAQ:BRLT) The stock price rose 12% in October last year. I gave it a Hold rating at the time, but it was clear even then. The stock price was at a point where there was a possibility of a rebound.

price chart (Source: Seeking Alpha)

The turnaround depended on increased sales growth based on two factors. First, the relatively weak base in the second half of 2022 (second half of 2022) can naturally lead to higher growth. Next, the festive season in the last quarter (Q4 2023) had special potential as the company invested in new stores and collections throughout the year. Brilliant Earth also upgraded its adjusted EBITDA target, which, if realized, would be positive for its price-to-earnings (P/E) ratio.

Why did you do that? Price rise?

As it happens, improved sales growth became visible in the third quarter of 2023, boosting the numbers for the first nine months of the year (September 2023). Gross profit is also estimated to have increased due to easing inflation. As soon as the company announced its earnings in November, its stock price began to rise slightly. Highlights from the earnings report include:

- Net sales increased 2.5% in the third quarter of 2023, pushing the growth rate to 0.6% in the first nine months (September 2023) after a 0.5% decline in sales in the first half of 2023.

- Orders also increased by 16.7% in the third quarter of 2023 and by 19.2% in September 2023 from 15.9% in the first quarter of 2023.

- Adjusted EBITDA margin remained flat in the first half of 2023 at 6.4%. This is higher than the 5.7% expected in 2023 at the midpoint of the previous guidance range.

- Gross margin soared to 58.5% in the third quarter of 2023 (Q3 2022: 54.7%), bringing the 2023 9m margin to 57.1%, up 440 basis points year-on-year.

Brilliant Earth’s $20 million share buyback program announced in December may also have played some role in keeping prices at higher levels. However, since the proposed share buyback represents only about 6.2% of the company’s current market capitalization and will be carried out over the next two years, we will not emphasize this factor too much. However, there may be slight differences in stock prices.

Outlook for the remainder of 2023 is mixed.

Despite the positive trends for the third quarter of 2023, the company’s future is still not entirely clear, considering that Brilliant Earth lowered its net sales and adjusted EBITDA forecasts in its latest earnings update.

Net sales are now expected to be in the range of $444 million to $450 million, compared to previous forecasts of $460 million to $490 million. A downward revision of 5.9% is expected at the midpoint. The company is expected to see growth of 1.6%, but that’s still a significant decline compared to 2022’s 15.7% increase.

Adjusted EBITDA is now expected to be in the range of $22 million to $24 million, compared to the previous forecast of $22 million to $35 million. At the midpoint, it was down 19.3%. Needless to say, this represents a much larger decline in our profit measure, at 41% compared to the 27% decline we saw earlier. Adjusted EBITDA margin is now expected to be 5.1% compared to 6% previously, with both figures down from 8.9% in 2022.

Adjusted EBITDA margins are expected to be unusually small at 1.7% in the fourth quarter of 2023, but that’s not all bad. The net sales growth estimate is 4.5%, which would be Brilliant Earth’s best growth quarter in 2023.

Forecast beyond 2024

Analysts expect sales growth to further increase to 5.1% in 2024, while earnings per share (EPS) also expect a sharp recovery of 39.4%. For perspective, GAAP diluted EPS decreased 80% over the nine months of 2023, while adjusted diluted EPS decreased 27.8% during that period.

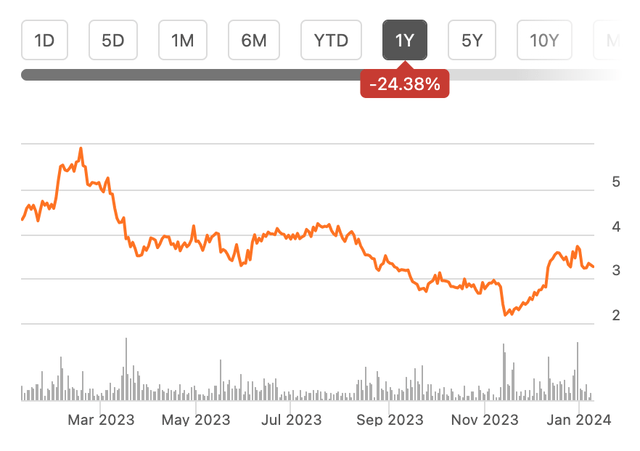

The company itself also has ambitious long-term goals in terms of revenue and adjusted EBITDA (see chart below). Although positive, it is currently unclear whether these goals can be achieved.

long term goals (Source: Brilliant Earth)

Growth through expansion

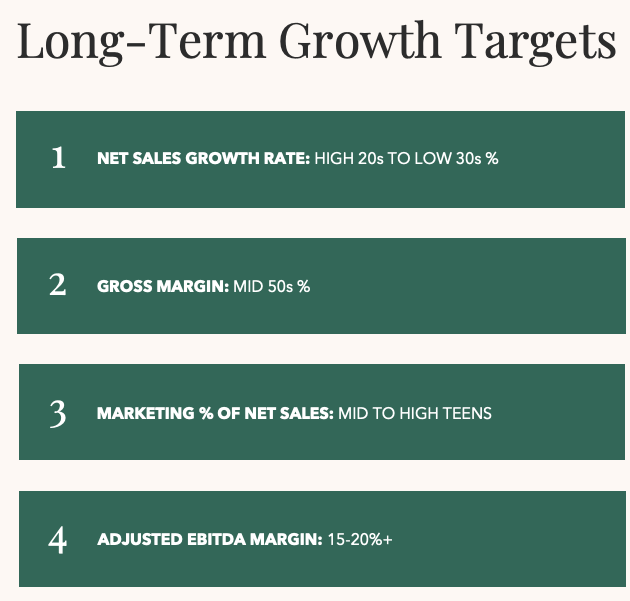

Potentially supporting the improved expectations for the company are store openings. In the third quarter of 2023 alone, we opened five new showrooms, and we have already exceeded our annual target by opening 37 new showrooms, bringing the total capacity up to 9 million units in 2023. The company also said some of these are “showing strong incremental growth.”

Showroom scheduled to open in 2023 in 9 minutes (Source: Brilliant Earth)

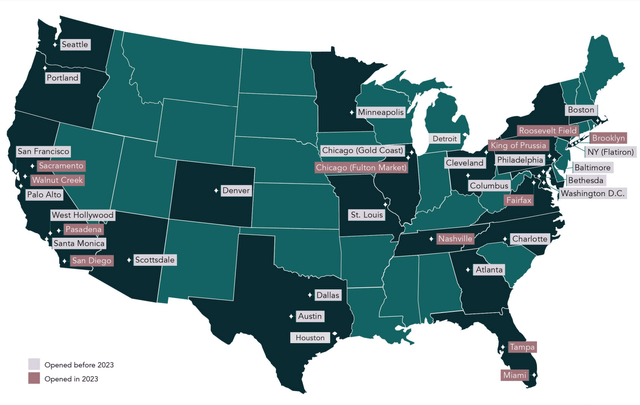

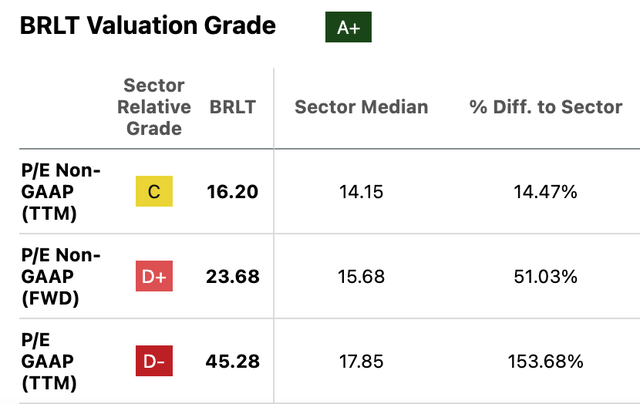

Market multiples are high

The positive outlook for 2024 results in a forward non-GAAP P/E ratio of 17x, which, like the rest of the P/E ratios, is still higher than the Consumer Discretionary sector’s 15.7x (see table below). Notably, its non-GAAP forward P/E, along with other multiples, is significantly higher than its immediate peer Signet Jewelers’ (SIG) ratio of 9.75x.

Source: Seeking Alpha

What’s next?

Against this backdrop, it’s hard to escape a Buy rating on Brilliant Earth despite the recent price rise. Of course, there are signs of improvement. Sales growth has turned positive and the fourth quarter of 2023 is expected to be the best quarter of the year. The sales outlook for 2024 is also positive.

But the revenue picture is lacking. Profits fell significantly this year. This is understandable given the investment in store openings this year, but the recent downward revision to adjusted EBITDA expectations is disappointing. However, it is encouraging to see that analysts expect the forward P/E to be relatively more attractive due to expected earnings growth in 2024.

But for now, I’d rather wait to see the company’s outlook for the year when it releases its full-year 2023 results in March. This could help determine whether Brilliant Earth can actually see a good 2024. By then, prices may have adjusted from current highs to create a better market multiple. We are maintaining a hold rating.