First Guaranty: A Solid Regional Bank At A Huge Undervaluation (NASDAQ:FGBI)

sshepard

Investment Thesis

First Guaranty Bancshares, Inc. (NASDAQ:FGBI) is a U.S. regional bank based in Louisiana. The bank has been in operation since 1934 and has weathered multiple economic recessions and tricky macroeconomic environments.

While at first glance the bank’s profitability has suffered significantly in recent years, I do not believe any tangible damage has occurred to their fundamental banking operations.

The bank remains well capitalized and has focused on increasing loan originations at higher interest rates while their overall loan portfolio remains mostly secure in my opinion.

A massive 2023 selloff has left shares trading at around a 43% undervaluation and tangibly below book value.

I rate First Guaranty a Strong Buy.

Company Background

First Guaranty is a Louisiana state-chartered regional bank founded all the way back in 1934. The bank offers customers a wide variety of financial services such as checking accounts, savings accounts, loans and even some limited small-business banking products.

First Guaranty is surprisingly diversified geographically with the bank servicing clients through thirty-six branches located in Louisiana, Texas, Kentucky and West Virginia.

First Guaranty has focused on building resilient customer relationships in order to build a loyal customer base to benefit their business.

First Guaranty’s historic presence and ability to weather multiple different financial conditions that have faced the U.S. economy over the last century further suggest that the bank’s fundamental ethos and strategies are robust and profitable.

Current CEO Alton Lewis continues to steer the First Guaranty in what I believe is a positive direction regarding the bank’s long-term profitability and stability.

Lewis’s focus on reducing operating expenses while increasing loan origination levels should allow First Guaranty to begin expanding their NIM once more and continue to expand their banking operations further.

FGBI FY23 Q3 Presentation

I also believe Lewis’ continued emphasis on the importance of building robust customer relationships will help generate excellent confidence in the bank moving forward.

The quality of First Guaranty’s products and services is perfectly illustrated by the bank having achieved a three-year streak of winning Newsweek’s Best American Bank award.

Economic Moat – In-Depth Analysis

First Guaranty operates with essentially no economic moat due to their small scale and relatively mute set of financial products on offer doing little to separate the firm’s business from competitors on a national scale.

However, on a state-wide scale I believe First Guaranty has managed to forge a narrow yet tangible economic moat thanks to their customer-oriented banking practices having built a reputable image and name for the bank.

First Guaranty regularly outscores other regional and nationwide banks in customer satisfaction surveys. This customer-centric approach allows First Guaranty to build stronger more sticky relationships with their customers which ultimately should increase the probability of repeat business for the bank.

The core business functions of taking in deposits at low interest expenses and offering loans at relatively higher interest rates in order to generate a profit through a net interest margin (NIM) leaves little room for most regional banks to begin differentiating from a product provision perspective.

Considering that most regional banks therefore offer what can only be considered to be a mostly homogenous product, the decision for First Guaranty to differentiate their services through a focus on excellent customer service appears to be a theoretically sound business objective.

Overall, I still cannot assign any real nationwide or globally reaching economic moat to First Guaranty. However, on a regional scale it appears the bank has emerged as a favorite among consumers for the quality and manner in which the bank provides their financial products and services.

This community-oriented attitude is a characteristic of First Guaranty which I believe has and will continue to generate a tangible positive effect on the bank’s overall business processes.

I also like CEO Lewis’ focus on cost control and efficiency which should in the mid- to long-term allow First Guaranty to outearn its peers from a net margin perspective thanks to an overall more cost-effective banking model.

Financial Situation – In-Depth Analysis

Over the last 5Y (spanning from FY22-FY18), First Guaranty has managed to generate average ROA and ROE of 0.80% and 10.45% respectively.

While these returns may not be industry-leading, I do believe that for their relatively small size, First Guaranty has managed to be a very profitable business indeed. I like believe that any business generating consistent ROEs of around 10-12% is quite a healthy and prospering enterprise.

The bank has operated for most of the past decade at an efficiency ratio of around 52-58% which is almost ideal. However, the past three years have seen a steady degradation in efficiency with a ratio of 58% in Q3 2020 degrading to 87% in Q3 FY23.

While this may initially seem concerning, I do not ultimately believe any tangible damage has been done to the bank. The ebbs and flows of the natural economic cycle will result in banks operating to varying degrees of efficiency.

The unrelentingly contractionary economic policy being pursued by the Fed has resulted in a difficult macro environment that has placed pressure on the profitability of most regional banks.

As interest rates rose rapidly, consumers quickly moved to higher interest-rate returning savings products as banks scrambled to retain customers from switching to other banks.

This quick increase in interest expenses meant that the relatively lower interest income yielding credit and loans provided by banks such as First Guaranty no longer provided a large NIM as they had done before.

However, the key ingredient required to change this imbalance in interest income and expenses is very simple: time. As rates are held higher for longer, regional banks such as First Guaranty are attempting to originate as many higher interest rate loans as possible.

This should allow NIM to return to pre-2023 levels somewhere around 2024-2025 which, when combined with First Guaranty’s focus on reducing non-interest related expenses should see the bank’s net income grow and net margins expand.

By analyzing First Guaranty’s FY23 Q3 report, it appears as though the bank may have turned the corner with regard to NIM and profitability degradation.

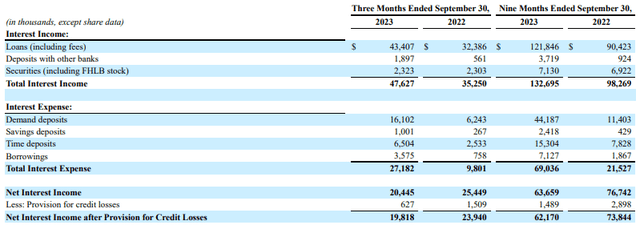

FGBI FY23 Q3 10Q

First Guaranty saw their FY23 Q3 interest income increase substantially to just over $476M compared to just $352M in the same quarter last year. This 35% increase is largely due to a significant increase in loan originations at higher interest rates thanks to the continued maintenance of higher rates by the FED.

The pace at which First Guaranty has managed to grow their interest income is impressive compared to some other undervalued regional banks illustrating the proactive approach to loan originations taken by First Guaranty.

Nonetheless, First Guaranty also saw their total interest expense grow massively with Q3 seeing a massive 176% YoY increase. This has been due to First Guaranty having to raise the interest rates offered to clients on deposits at a higher rate than loan originations due to the requirement to remain competitive in a mostly homogenous banking industry.

This has left First Guaranty with a significantly contracted NIM of 2.54% compared to highs of around 3.44% witnessed at the end of the calendar year 2021.

Still, I view their progress on originating loans at higher interest rates as positive with the bank ultimately producing $172M net income in Q3 FY23. While this is significantly lower than the almost $806M generated in Q3 of FY22, the bank has crucially achieved profitability once again which was a significant concern in their Q2 report.

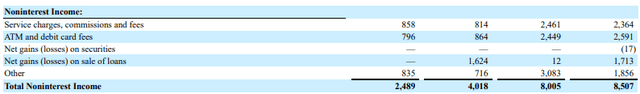

FGBI FY23 Q3 10Q

The bank also generated around $25M in non-interest income which was down significantly YoY due primarily to the significant number of loans sold during Q3 of FY22. This decrease is of little concern to me especially as their NII for the last nine months ended September 30 saw incomes flatline with no tangible decrease being present.

The bank has managed to maintain an efficiency ratio of 87% which while not stellar is still reasonable given the increase in deposit funding costs. The bank’s cost of funds has increased sharply to 4.19% but again I do not view this as surprising.

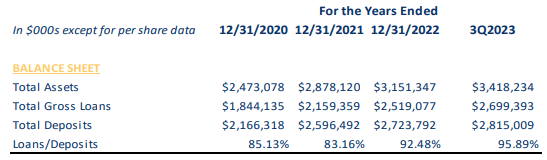

FGBI FY23 Q3 Pamphlet

Total gross loans continued to grow YoY by about 6% while the bank’s loan/deposit ratio continued to increase to 95.9%. While this ratio is a little above what I would traditionally like to see in a regional bank, it must be noted that the strategy of rapidly originating loans at higher interest rates in order to achieve greater profitability is the root cause of this increase.

FGBI FY23 Q3 Pamphlet

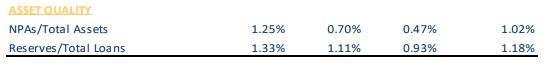

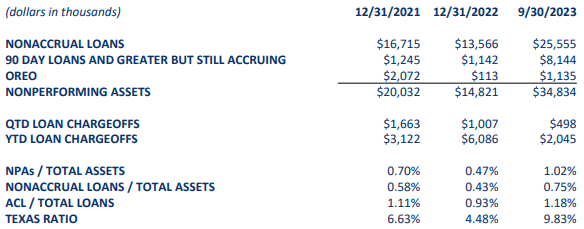

Nonperforming assets have increased quite significantly YoY with Q3 FY23 seeing a large $3.4M in total NPAs up from just $1.4M in Q3 FY22. The main rise has been in non-accrual loans and 90 days or greater but still accruing loans.

FGBI FY23 Q3 Pamphlet

The bank’s Texas ratio has subsequently increased to 9.83% from just 4.48% at the same time last year while the bank’s NPAs/total assets have increased from 0.47% to 1.02%. The increase in NPAs is regrettable to see despite being largely in line with most other regional banking peers.

I believe that the majority of First Guaranty’s loans remain reliable with the bank only having around 1.02% of NPAs relative to total net assets. While nonperforming assets have continued to rise YoY since 2021, I believe this to be mostly due to the current macroeconomic environment rather than any fundamental issues in the bank’s risk assessment operations.

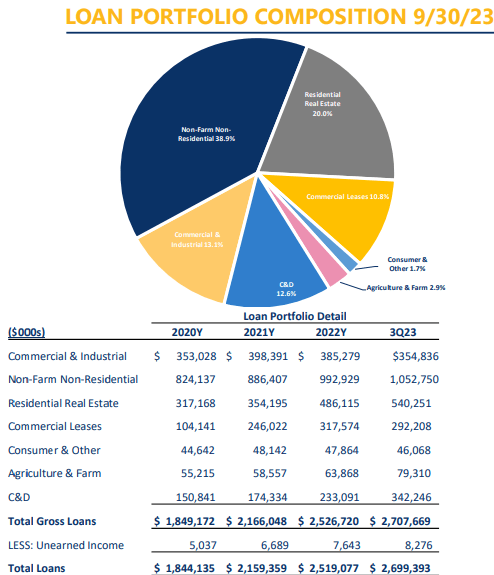

FGBI FY23 Q3 Presentation

First Guaranty’s loan portfolio is quite heavily exposed to CRE non-farm non-residential loans to the tune of 38.9% at the end of Q3. This comes as the bank has grown loans 11.7% YoY in order to increase their interest income with commercial leases representing 10.8% of the total loan portfolio.

Office space only accounts for 4.3% of the bank’s total loan portfolio which is good to see considering some of the difficulties witnessed in office occupancy rates. Nonetheless, I do not believe that offices will go completely vacant in the coming years with the troubles ahead for the sector potentially easing once interest rates begin to fall in 2024.

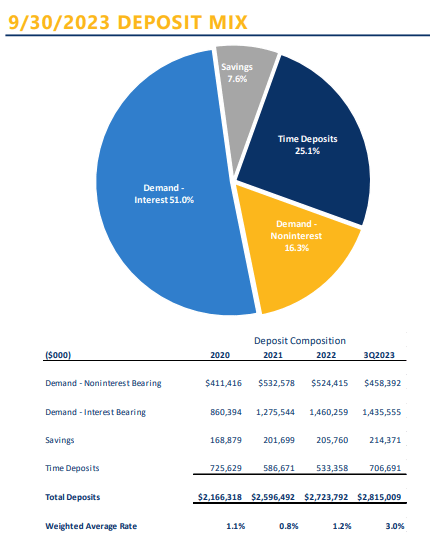

FGBI FY23 Q3 Presentation

First Guaranty has managed to grow their total deposits by 3.93% YoY. New deposit product specials such as a 3.50% yielding savings account and a 7-month CD at 5.15% have also spurred consumer deposits at the bank.

I view the bank’s deposit mix as quite solid with a nice 25% being allocated to CDs (time deposits). In general, I believe time deposits can work very well for banks with the guaranteed deposit periods increasing the reliability of cash flows for the bank.

The decrease in noninterest-bearing deposits has not been as pronounced as some regional banks which further suggests First Guaranty is doing well to attract business to their banking services.

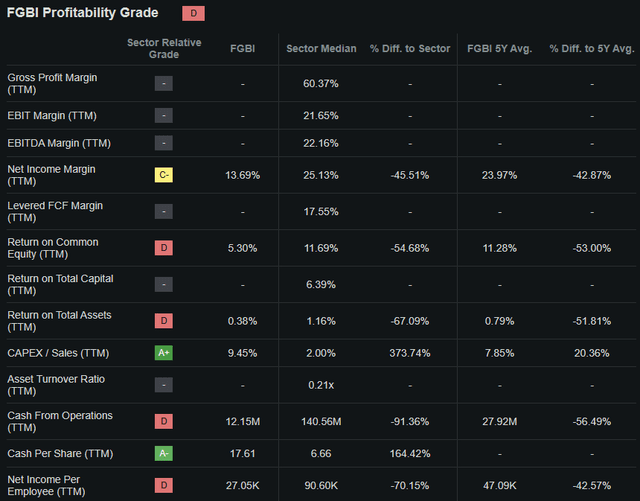

Seeking Alpha | FGBI | Profitability

Seeking Alpha’s quant assigns First Guaranty with a “D” profitability rating which I believe to be a slightly pessimistic view of the bank’s current health.

While on an absolute scale the bank is not producing profits like they did a few years prior, the situation is incredibly nuanced with simple valuation metrics not painting the full picture of the present macroeconomic environment.

Careful analysis of First Guaranty’s balance sheet is absolutely paramount to understanding what possible investment opportunity may lie in the bank’s shares.

At its very core I believe First Guaranty is one of a select handful of regional banks that has continued to maintain an excellent standard of capital allocation with their assets and liabilities appearing to be well managed despite the arguably stagflationary macroeconomic environment currently present in the U.S.

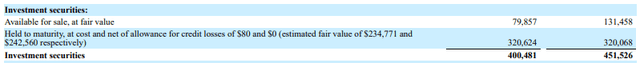

FGBI FY23 Q3 10Q

First Guaranty’s AFS investment securities decreased 39% YoY when assessed at fair value which mostly was due to the increased interest rate environment resulting in their bond securities losing value.

The bank has also chosen to report their HTM securities on their balance sheet as assessed at their amortized cost. I believe this strategy is fundamentally incorrect as the rapid rise in interest rates would mean most HTM securities have lost value when accounted for at their correct fair value in my view.

First Guaranty’s fair value assessment of their HTM securities shows us the paper losses the bank has incurred of about $90M. While these losses mean that the bank’s overall HTM securities have decreased by a quarter compared to their amortized cost, the YoY increase in paper losses is just $10m.

While these paper losses are regrettable, I believe that sound banking fundamentals continue to underpin the strategy being pursued by the management team at First Guaranty.

While some of the HTM and AFS securities held by First Guaranty may be relatively low-yielding government and state bonds, these securities still shield the bank well from an incredibly low interest rate environment which ultimately could manifest itself in the mid-term.

First Guaranty’s total assets (adjusting for fair value accounting of their HTM securities) amount to $3.3B while their total liabilities are just $3.18B. The bank also has excellent capitalization levels with their Tier 1 leverage ratio being a healthy 8.94%, their CET 1 capital ratio being 9.79% and their total risk-based capital ratio being 10.72%.

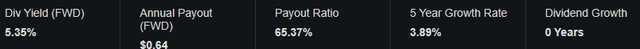

Seeking Alpha | FGBI | Dividend

First Guaranty pays investors a healthy dividend with a current FWD yield of 5.35%.

The bank’s FWD annual payout is expected to be $0.64 with a payout ratio of 65.37%. The 5Y growth rate is 3.89% which while not superb illustrates a continued desire to reward the bank’s shareholders.

First Guaranty appears to be a relatively well-run regional bank that has faced some cyclical troubles throughout their FY23. The difficult macroeconomic environment punctuated by both secular decline and a sudden hike in interest rates has placed most regional banks in a degraded profitability position.

This has sent First Guaranty’s shares into a massive decline with the bank seemingly being lumped together with other more concerning regional banks.

A more forgiving macroeconomic environment with lower interest rates and greater levels of economic growth should allow First Guaranty to return to excellent levels of profitability as the bank has seemingly not forgotten what constitutes basic and sound banking practices.

Time should also help First Guaranty return to greater levels of profitability as evidenced by their FY23 Q3 report which saw their strategy of increased loan origination at higher interest rates begin to tangibly increase their net interest income.

Valuation

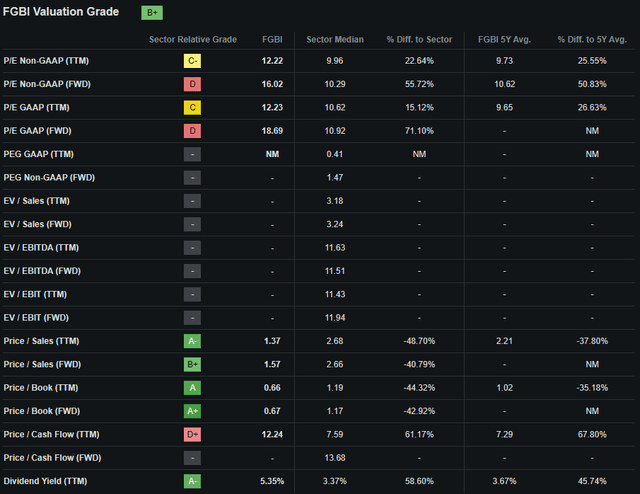

Seeking Alpha | FGBI | Valuation

Seeking Alpha’s Quant assigns First Guaranty with a “B+” Valuation grade. I believe even this relatively positive valuation letter grade is still an excessively modest evaluation of the value present in the bank’s shares.

First Guaranty currently trades at a P/E GAAP TTM ratio of 12.23x. First Guaranty’s TTM Price/Book of just 0.66x is incredibly suppressed with the bank trading well below their tangible book value per share.

Considering these key bank valuation metrics alone I believe First Guaranty should already start to appear undervalued given the stock’s historic averages and significant discount relative to book value.

Seeking Alpha | FGBI | Advanced Chart

From an absolute perspective, First Guaranty shares are trading at a significant discount relative to previous valuations with current share prices of around $12.00 representing a four-year low for the stock.

While a slight decrease in profitability at the tail-end of 2022 resulted in a slight drawback in share prices, the regional banking turmoil witnessed in early 2023 absolutely decimated the bank’s stock price.

When combined with lackluster profitability as a result of the suddenly contractionary monetary policy pursued by the Fed, it should really be no surprise that First Guaranty’s shares faced such a tough 2023.

However, I believe this selloff has been excessive with significant future shareholder value generation being present at the bank.

The Value Corner

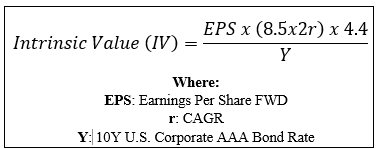

By utilizing The Value Corner’s specially formulated Intrinsic Valuation Calculation, we can better understand what value exists in the company from a more objective perspective.

Using First Guaranty’s current share price of $11.96, an estimated 2023 EPS of $0.75, a realistic “r” value of 0.10 (10%) and the current Moody’s Seasoned AAA Corporate Bond Yield ratio of 4.74x, I derive a base-case IV of $21.00. This represents a massive 43% undervaluation in shares.

When using a more pessimistic CAGR value for r of 0.06 (6%) to reflect a scenario where a globally spanning recession causes First Guaranty’s NIM to flatline, shares are still valued at around $15.10 representing a 21% undervaluation in shares.

It must also be noted that First Guaranty’s book value per share is around $18.10 which further illustrates just how cheaply the bank’s shares are currently trading.

Considering the valuation metrics, absolute valuation and intrinsic value calculation, I believe that First Guaranty is soundly trading in what can only be considered to be deep value territory.

In the short term (3-12 months), I find it difficult to say exactly what may happen to valuations. The general uncertainty regarding the future direction of both the U.S. and global markets as a whole means predicting the direction for most stocks from a qualitative side is essentially impossible in my opinion.

A continuously difficult macroeconomic environment in the U.S. moving further into 2024 could limit the appetite investors have to invest in the bank. However, given that shares are so massively undervalued, it is difficult to see how much further prices could fall.

In the long term (2-10 years), I see First Guaranty regaining great levels of profitability and continuing to grow into a reliable and stable regional bank. Their focus on core banking practices is great to see especially when combined with sound capital allocation strategies and a transparent management team.

Risks Facing First Guaranty

First Guaranty faces some tangible risks with the primary threat arising from a recessionary economic environment triggering significant deposit outflows and lower loan origination levels.

Quite simply, the biggest threat to any single bank is a sudden or prolonged stream of outflows resulting in dropping profitability and liquidity. First Guaranty is quite a very small regional bank which ultimately means that their consumer base is relatively more concentrated than that of larger international rivals.

A recessionary period in the United States would almost certainly result in ordinary consumers facing additional pressures on their pocketbooks thus limiting the ability to save and deposit money in banks.

This would result in a significant drop in profitability for the bank while simultaneously eroding the liquidity present on their balance sheet. A sudden shock to the economy (as seen with the fall of SVB earlier in 2023) could result in a run on the bank.

This would be quite catastrophic although I do not believe First Guaranty would become illiquid thanks to their well-managed AFS and HTM securities portfolios.

Recessions also tend to increase the amount of non-performing loans and assets present at banks due to consumers being unable to meet payment deadlines. This could further decrease the profitability of their loan portfolio.

From an ESG perspective, First Guaranty faces no real tangible threats or risks. I believe the overall lack of major environmental, societal or governance concerns would make First Guaranty an excellent pick for a more ESG-conscious investor.

Of course, opinions may vary and I implore you to conduct your own ESG and sustainability research before investing in First Guaranty if these matters are of concern to you.

Conclusion

First Guaranty is an interesting regional bank, and despite its lackluster profitability, remains a mostly solid financial institution. Their robust balance sheet should help the bank to weather the difficult macroeconomic environment with the opportunity for a return to significant long-term profitability a real possibility in my opinion.

A transparent management team and a conscientious approach to business which places the customer at the forefront of their banking operations should allow First Guaranty to remain competitive in what is otherwise a mostly undifferentiated market environment.

Quite simply, despite the bank’s recent results being much poorer than their historical averages, I believe First Guaranty remains a beautiful business both from a quantitative and qualitative perspective.

The massive discount currently present in shares both relative to the bank’s intrinsic value and even compared to the book value per share further increases the attractiveness of this regional bank in my mind as current valuations appear to offer a massive 43% margin of safety for deep-value oriented investors.

Therefore, I confidently assign a Strong Buy rating for First Guaranty and have initiated a position in the bank worth 8% of my total portfolio value. To put it shortly, I really like this regional bank.