Gold ETF vs Bitcoin ETF

This week’s Bitcoin ETF approval is a landmark moment.

I must say I felt pretty good. After years of proclaiming the virtues of investing small amounts of Bitcoin in your portfolio, it’s satisfying to know that financial advisors everywhere will soon be recommending this strategy to their clients.

A famous union leader said:

First, they ignore you.

Then they laugh at you.

Then they attack you.

Then they build a monument for you.

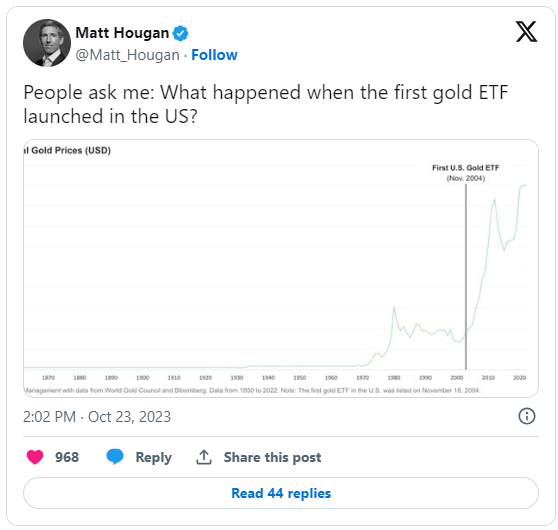

I explained the Bitcoin ETF in the Bitcoin analogy, but let’s look at the growth of similar products to predict what will happen here. Gold ETF.

Gold ETFs: You own gold, so you don’t have to.

Investors have always loved gold. (Same goes for pirates.) Gold retains its value. Because, as you know, gold doesn’t make gold anymore.

However, holding your own gold can be a hassle. You need to buy it from a reputable source and find a place where you can store it safely. You have to calculate that value manually. And like Kardashian, we have to question that purity.

The idea of a gold ETF was groundbreaking. Instead of hiding coins under the bed, investors could purchase shares of the fund as if they were buying shares of a company. The fund will hold gold so you don’t have to.

The first true gold ETF was launched in Australia in 2003, but the largest was SPDR Gold Shares, launched in the US in 2004. Demand was unprecedented, with 50 million shares traded on the first day. Major trading platforms failed to keep up with trading volume.

Gold prices have seen some short-term gains, but what we care about are the long-term results.

Gold ETFs will become a $270 billion industry by 2023, with SPDR Gold Shares remaining the largest. It changed the game for gold.

Bitcoin ETF: We hold the coins so you don’t have to hold them.

The similarities between Bitcoin and gold are striking. In fact, people call Bitcoin ‘digital gold’ and say they ‘mine’ it. and Both work outside the banking system, which provides an additional layer of trust. (The government cannot print more gold.)

Like gold, Bitcoin is cumbersome to purchase and hold. Private keys, cold wallets, risk of theft: Most people have trouble storing their private keys. browser tab group. Bitcoin is a black hole.

As I’ve said many times, the only way to grow your Bitcoin investment is to make it easier. Exchanges like Coinbase and Binance were making great strides, but they still required separate accounts, so nothing was integrated and there was no telling when the SEC would sue.

Now it’s even easier with Bitcoin ETFs.

You buy shares of an ETF just like you buy stocks. The fund manager holds the Bitcoin so you don’t have to. All your financial reporting is in one place. You can easily buy and sell Bitcoin online without having to deal with dodgy Bitcoin dealers in dark alleys.

Since gold and Bitcoin are very similar, I would say they will follow similar adoption and price trajectories. The truth is we don’t know. Bitcoin has defied expectations so many times that it might act differently.

Gold ETFs also had advantages over Bitcoin ETFs. Everyone already knew the value of gold.

So we continue to educate

Many financial advisors and portfolio managers still don’t understand Bitcoin.

But now they have a new incentive to learn. Commission.

If you’re a BlackRock advisor looking to diversify your clients’ portfolios, you might start recommending that they invest up to 5% in the BlackRock Bitcoin ETF.

Of course, this is exactly what we have been saying all along.

In fact, asset managers are already overextending themselves to offer the lowest fees, which is good news for us all. (“Announcement of the fee war,” he declares. wall street journal.)

This is why some are predicting massive inflows of money into Bitcoin ETFs from both individual and institutional investors, pushing the price of BTC to $100,000 or even $150,000 by the end of the year.

I think it’s too fast, too fast.

But what about in the next few years? Very possible.

If you’re following a consistent investment approach where you buy a little bit of Bitcoin every month, regardless of the price, as part of a balanced investment portfolio, congratulations! According to our latest quarterly report, you’ve outperformed the average investor.

If you haven’t followed our approach yet, we have good news. Getting started couldn’t be easier. Now you can do it all from one account. Stocks, bonds, and Bitcoin ETFs can all be purchased from online brokers.

Our dreams are one step closer to reality.