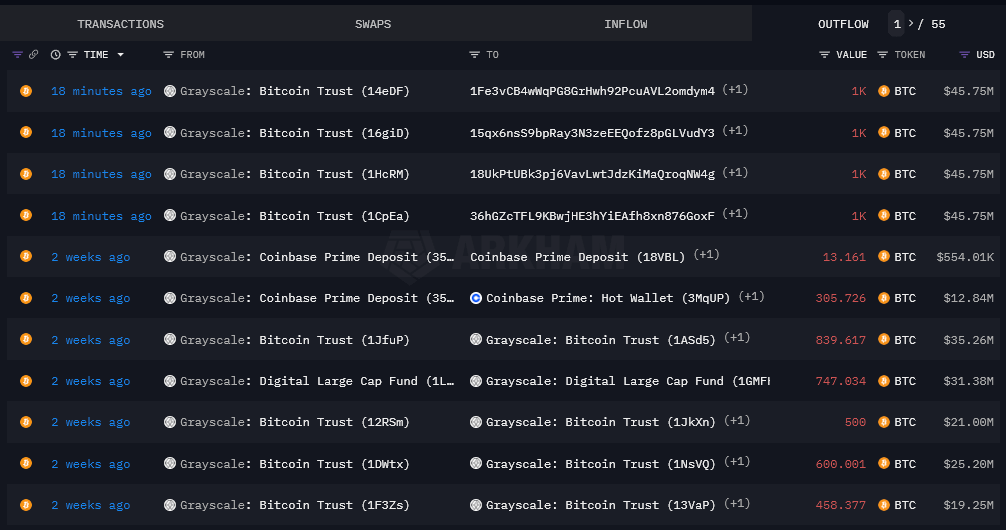

Grayscale moved $200 million worth of Bitcoin to Coinbase Prime, hinting at possible ETF redemption activity.

Grayscale began sending Bitcoin off trust to Coinbase on January 12th at 2pm GMT. As of press time, a total of 4,000 BTC (about $200 million) had been transferred, with all Bitcoin going to Coinbase Prime. It is one of the main participants in the Bitcoin ETF series launched yesterday.

Coinbase acts as a broker and counterparty for virtually all ETF issuers, including Grayscale. Therefore, this transfer is likely to represent an outflow from the trust resulting from yesterday’s sale. The last leak before today was again about two weeks ago, with several transactions in and out of the Grayscale Bitcoin wallet.

Spot Bitcoin ETFs track the Bitcoin price directly but do not require issuers to buy or sell Bitcoin in real time during trading hours. For example, in the Grayscale ETF, the key times to buy or sell Bitcoin in relation to the creation and redemption of ETF shares can be summarized as follows:

Create a basket (buy Bitcoin):

- Approved Participants will place a basket creation order with the Transfer Agent no later than 1:59:59 PM New York Time on any business day.

- Sponsor will determine the basket total net asset value (NAV) and variable fee as soon as practicable after 4:00 p.m. New York time.

- The liquidity provider transfers the total basket amount (in Bitcoin) to the trust vault balance at T+1 or T+2 depending on the order time.

Basket redemption (Bitcoin sale):

- Approved Participants will place redemption orders with the Transfer Agent by 1:59:59 PM New York time each Business Day.

- Sponsor will determine the total basket NAV and variable fee as soon as practicable after 4:00 p.m. New York time.

- The liquidity provider delivers the total basket NAV (excluding variable fees) to a cash account at T+2 (or T+1, as approved by the sponsor).

In both scenarios, the critical time to start your order is before 2:00 PM New York time on a business day. The actual transfer of Bitcoin (to the trust vault balance in the case of creation, or from the custodian to the liquidity provider in the case of redemption) occurs at T+1 or T+2, depending on the specific circumstances of the order.

These transactions could potentially impact the Bitcoin spot price, especially if large orders are placed. However, the exact impact on the spot price will depend on a variety of factors, including order size relative to Bitcoin’s average daily trading volume and market conditions at the time of the transaction.

The timing of Bitcoin transfers from the trust is consistent with the creation and redemption process, suggesting that after the first day of trading, Grayscale deemed that only $200 million would need to be redeemed. Although this is highly speculative, it is important to note that it is one of the possible reasons for the leak mentioned above.

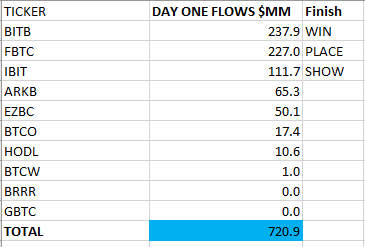

Bitcoin ETF flow.

Moreover, BlackRock’s first-day inflows were approximately $112 million and its seed capital was only $10 million. This indicates that the fund would need at least $90 million in Bitcoin to match its stock purchases.

Bloomberg’s Eric Balchunas estimated that about $720 million would flow into Bitcoin ETFs on the first day. But at the close of trading, he could not confirm how much of those flows could be offset by selling the Grayscale Trust, which has the highest fees among the new spot Bitcoin ETFs. Grayscale charges 1.5% per year, while others are as low as 0.2%, and some even offer commissions free during promotional periods.

As with Grayscale, the above inflows require funds matching Bitcoin and equities, but all equity creation must be in cash. This means that Bitcoin cannot be used to create stocks. If an investor sells shares of one ETF and buys shares of another ETF, one fund cannot give Bitcoin to the other fund if the funds flow out to the other ETF. Current SEC rulings require cash to be used for generation and repayment.

For all funds using T+2 settlement, Monday is a US bank holiday, so Bitcoin will not be settled until Tuesday, leaving room for some interesting weekend Bitcoin price action.

Source: https://cryptoslate.com/grayscale-transfers-200m-bitcoin-to-coinbase-prime-hinting-at-possible-etf-redemption-activity/