Dramatic bearish bias shift in major market indices this week | decision point

(This is an excerpt from Subscriber Only. Decision point warning (from DecisionPoint.com)

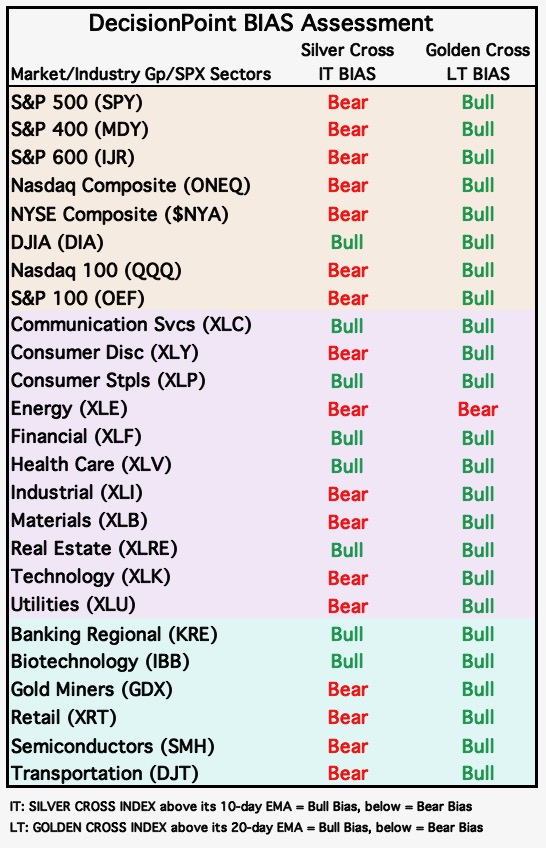

This week the market experienced a dramatic shift in bias. We measure medium-term bias using the Silver Cross Index (SCI). SCI measures the number of stocks that have a “silver cross” within an index, sector, or industry group, such as their 20-day EMA above their 50-day EMA.

When SCI moves below the signal line, the bias moves to BEARISH. This week we have seen every major market index we follow move into Bearish Biases except for the Dow Industrials. Similar activity has been observed in the sectors and industry groups we follow.

Once again, the bias change occurs because the Silver Cross index crosses below the 10-day EMA. This means that some stocks within a particular market index are experiencing a crossover below their 20/50-day EMA. If the 20-day EMA is lower than the 50-day EMA, the stock is at least in correction mode. The chart below is one I use every day to track bias changes. Obviously, most indices still have a high percentage of stocks holding silver crosses, but the current bias is bearish due to the move below the moving average.

conclusion: There is a new bearish bias in almost every market index we follow based on the Silver Cross index moving below the EMA. These bearish changes often precede longer downtrends. The weakness of these indices means that further collective declines will continue in the future.

If you want to know your bias in all three time zones every day, take advantage of our free trial. As a subscriber, you will also have access to exclusive ChartLists. Use coupon code DPTRIAL2 at checkout.

Learn more about DecisionPoint.com:

Try it for 2 weeks with a trial subscription!

Use coupon code DPTRIAL2 at checkout!

Technical analysis is a windbreaker, not a crystal ball. –Carl Swenlin

(c) Copyright 2024 DecisionPoint.com

disclaimer: This blog is for educational purposes only and should not be construed as financial advice. You should not use any of our ideas and strategies without first evaluating your personal and financial situation or consulting a financial professional. All opinions expressed herein are solely those of the author and do not in any way represent the views or opinions of any other person or entity.

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletter, blog or website materials should not be construed as a recommendation or solicitation to buy or sell any security or to take any particular action.

Useful DecisionPoint links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

DecisionPoint Chart Gallery

trend model

Price Momentum Oscillator (PMO)

balance volume

Swenlin Trading Oscillators (STO-B and STO-V)

ITBM and ITVM

SCTR Ranking

Bear market rules

Erin Swenlin is the co-founder of the DecisionPoint.com website with her father, Carl Swenlin. She started the DecisionPoint daily blog with Carl in 2009 and currently serves as a consulting technical analyst and blog contributor at StockCharts.com. Erin is an active member of the CMT Association. She holds a master’s degree in information resources management from the Air Force Institute of Technology and a bachelor’s degree in mathematics from the University of Southern California. Learn more

Carl Swenlin is a veteran technology analyst who has been actively involved in market analysis since 1981. A pioneer in creating online technical resources, he was the president and founder of DecisionPoint.com, one of the leading market timing and technical analysis websites. knitting. DecisionPoint specializes in creating stock market indicators and charts. Since DecisionPoint merged with StockCharts.com in 2013, Carl has been a consulting technology analyst and blog contributor. Learn more