Bitcoin Price Prediction: Bernstein Calls Mining Stock’s Performance a ‘Buying Opportunity’ as BTC Cloud Mining Presale Heads for $9 Million.

join us telegram A channel to stay up to date on breaking news coverage

The price of Bitcoin rose slightly to trade at $42,842 as of 1:15 a.m. ET, with trading volume down 15%.

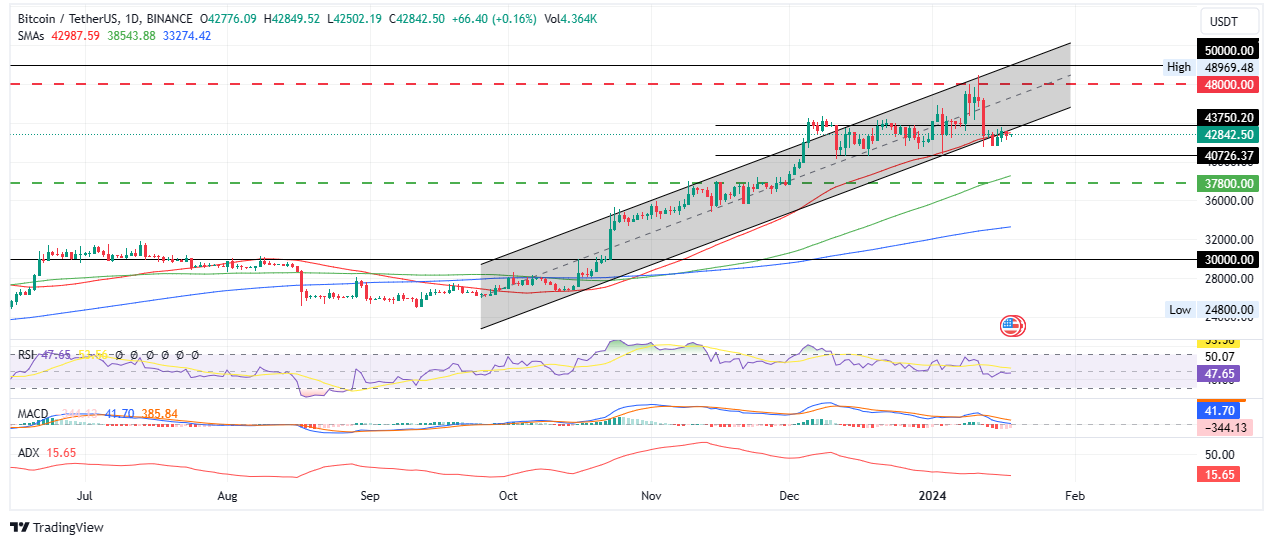

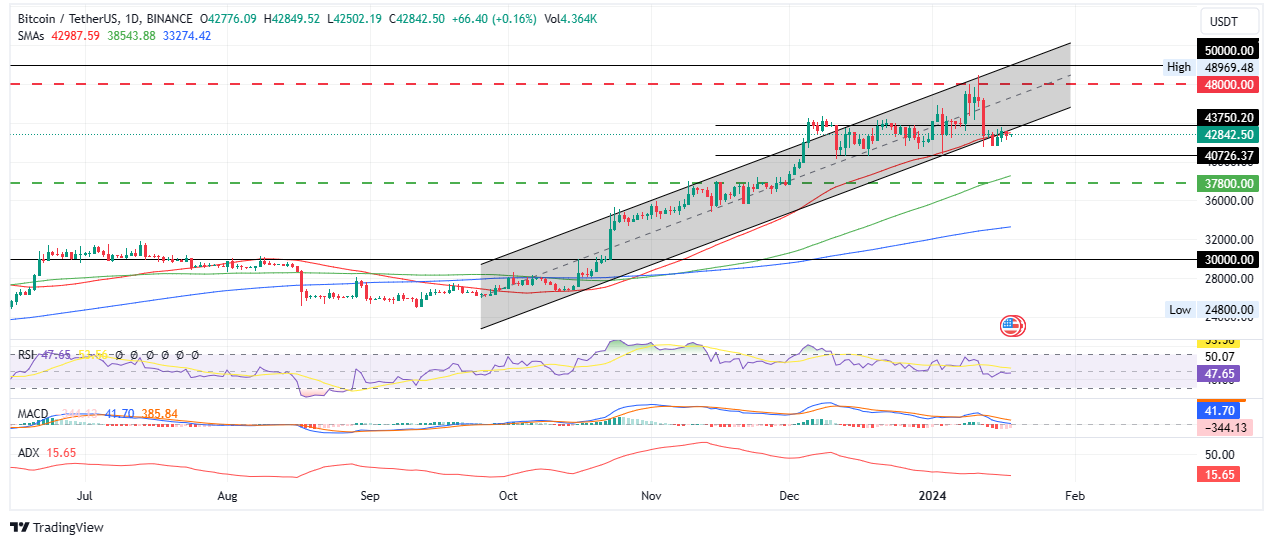

BTC remains outside the protection of the ascending parallel channel, which has remained the dominant technical formation since the cryptocurrency market’s strength in October.

The fall from grace occurred during the January 12 crash triggered by news of a selloff in Grayscale Bitcoin Trust (GBTC). This meant that GBTC holders would redeem their holdings and sell their BTC on the market.

As Bitcoin price attempts to return to the fold of the pattern, it faces stiff opposition as GBTC buybacks continue. On Wednesday, Grayscale Bitcoin Trust transferred $206.1 million worth of BTC to Coinbase Prime, less than a day after moving $370 million of BTC to the same platform. I moved it.

🚨https://t.co/gmayQo20LD pic.twitter.com/mgdsUC3j2C

— Shokiv Alfant (@ALfant_) January 17, 2024

According to blockchain security company Lookonchain, the Grayscale Bitcoin Trust wallet moved 18,638 BTC tokens worth approximately $795 million to Coinbase Prime. The security firm also confirmed that Grayscale has deposited up to 31,638 BTC worth $1.35 billion on Coinbase Prime since January 11, when the spot BTC ETF began trading.

that much #grayscale #Bitcoin Trust Wallet Deposits 18,638 $BTC(USD 795 million) ~ #Coinbase Re-prime before 50 minutes.

and #grayscale A total of 31,638 deposited $BTC(USD 1.35 billion) ~ #Coinbase After Prime #Bitcoin Spot ETF trading begins. https://t.co/ErT06jjwDL pic.twitter.com/jQsNv88mRc

— Lookonchain (@lookonchain) January 17, 2024

On this note, renowned economist Peter Schiff attributes the Bitcoin price’s difficulty in recovering back into a bullish chart pattern to the overhead pressure caused by GBTC buybacks. “People expected the new ETF to generate a lot more buying,” he said. “But that’s being offset by all the sales. Just pointing out where the selling is coming from to offset the buying.”

Why Investors Buy New Cars #Bitcoin ETF don’t raise prices #Bitcoin It is leaking from . $GBTC plus sales #BTC It exceeds the total inflows for 10 other Bitcoin ETFs. As initial ETF demand decreases, the price decline is expected to be greater.

— Peter Schiff (@PeterSchiff) January 17, 2024

Broker Bernstein sees a ‘buying opportunity’ for Bitcoin price as BTC mining stocks underperform.

Meanwhile, Bitcoin mining stocks have underperformed over the past few weeks due to the approval of a spot BTC ETF. Because I quoted l.Investors have a desire to use this as a proxy, and weBTC price fell, further underperforming.

Bernstein says he is buying dips in Bitcoin mining stocks ahead of BTC price ‘inflection’.

Bitcoin (BTC) mining stocks have underperformed in recent weeks, but near-term weakness signals a potential buying opportunity, broker Bernstein said in a research report on Monday.

— Bart Mahoney (@Top_Dog0) January 18, 2024

But this weakness presents investors with an opportunity to buy mining stocks cheaper, according to brokers.

Bitcoin price prediction when BTC sticks to the grass below the channel

With the Relative Strength Index (RSI) appearing to have subsided and moving horizontally while still below the 50 level, the Bitcoin price is sticking to the grass straw as it favors the downside. It faces immediate resistance from the 50-day simple moving average (SMA) of $42,987. This overhead pressure is exacerbated by the Moving Average Convergence Divergence (MACD), which has remained southward since crossing below the signal line (orange band) on January 12th. This reinforces the assumption that odds still favor the downside.

Increasing selling pressure could delay Bitcoin’s efforts to restore its price to an upward channel. Recognizing that the market tends not to wait that long, BTC could extend the decline, testing below the $40,726 support and 100-day SMA at $38,543.

In a worst-case scenario, the Bitcoin price could extend its decline to the critical support of $37,800, below which BTC could fall off a cliff, heading towards the psychological $30,000 level. A candle closing below this level invalidates the prevailing bullish outlook.

TradingView: BTC/USDT 1-day chart

converse case

On the other hand, if out-of-touch investors or subsequent traders seize the opportunity to buy the dip, the Bitcoin price may regain the support provided by the lower limit of the channel. This could see the $43,750 level turning into support again, giving BTC a starting point to target the $48,000 psychological level.

In a very optimistic case, the Bitcoin price could extend its gains by reaching the psychological level of $50,000 at its last test in December 2021.

Bitcoin price outlook from an on-chain perspective

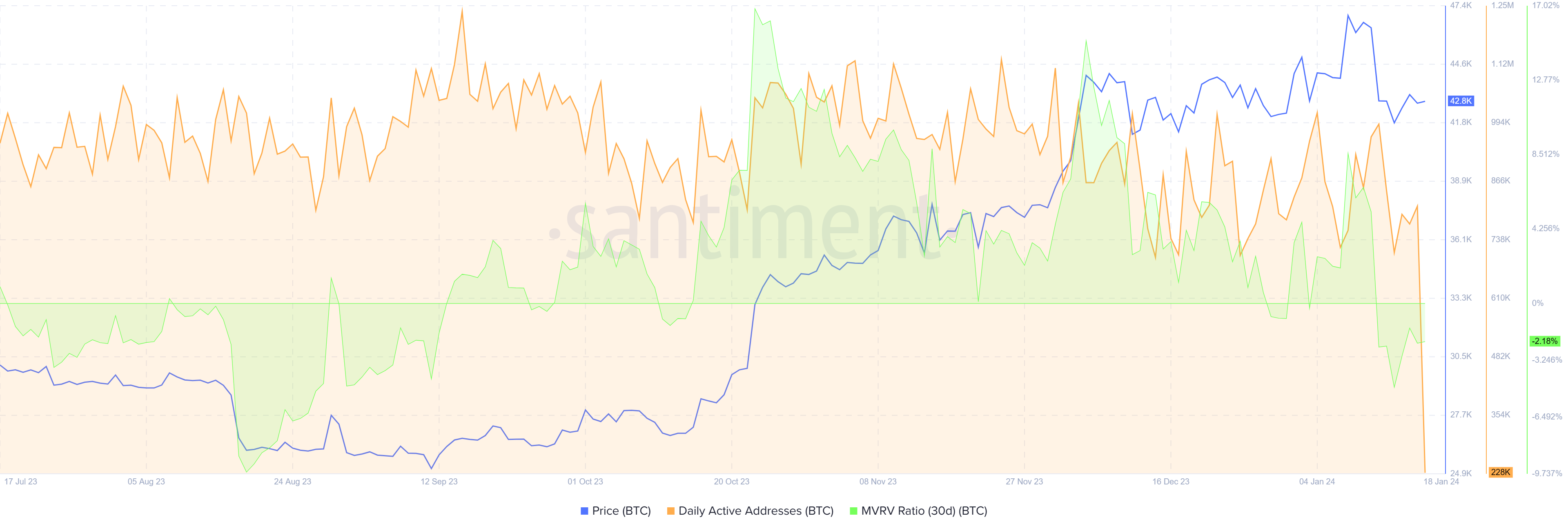

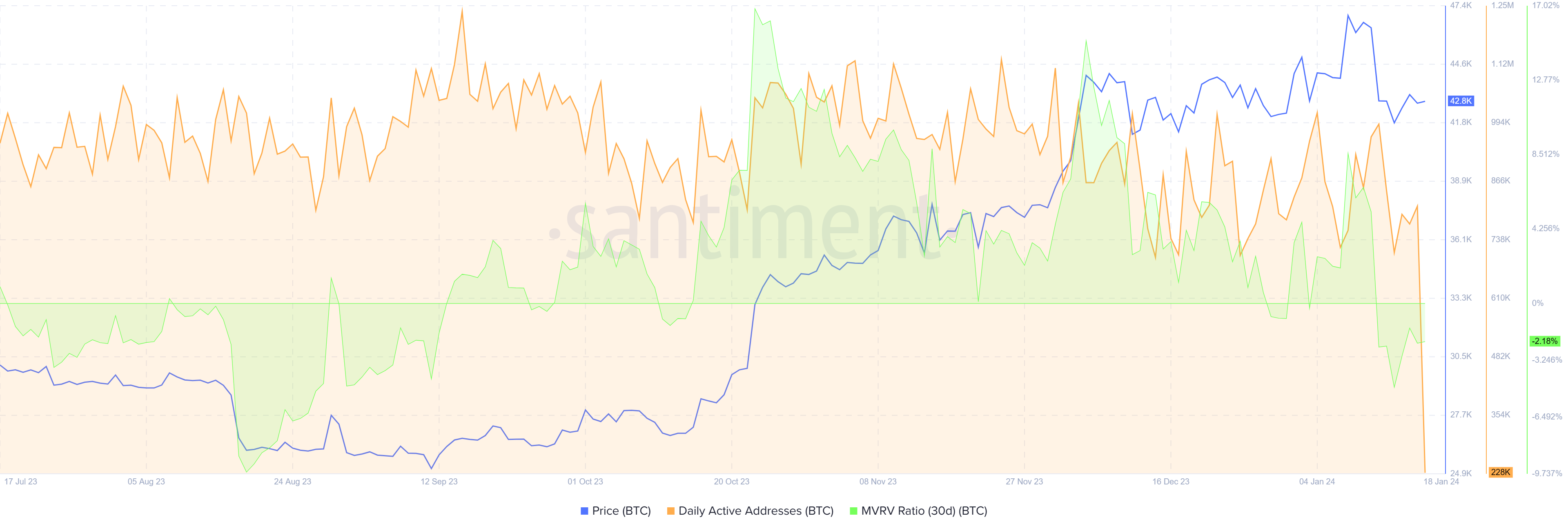

Market Value to Realized Value (MVRV) ratio is an indicator that evaluates the average profit or loss of investors who purchased an asset over a certain period of time. It shows that the average loss of investors who purchased BTC last month was 2.18%. Some of these investors may sell BTC once they reach the breakeven point.

This bearish outlook is further strengthened by the decline in daily active addresses. This means that there will be less crowd interaction or speculation on wBTC, especially among unique or new addresses.

BTC Santiment: Daily Active Addresses, MVRV Rate

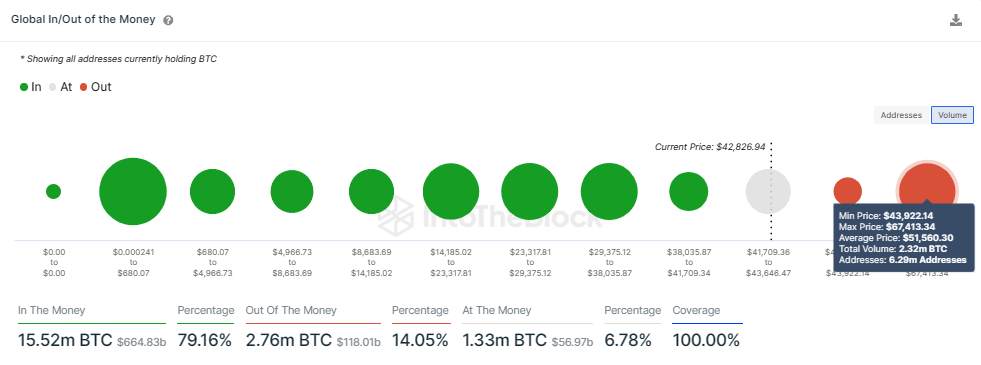

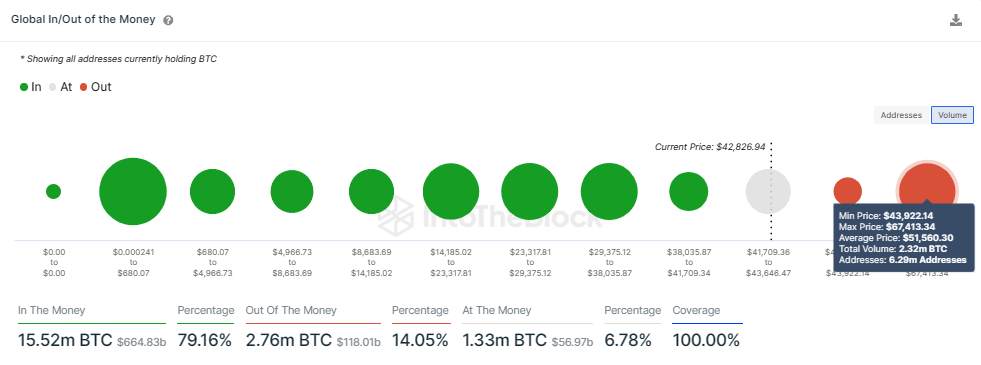

Elsewhere, the next largest hurdle for Bitcoin’s price lies between $43,922 and $67,413, with 6.29 million addresses at an average price of $51,560, according to on-chain aggregator IntoTheBlock’s Global In/Out of the Money (GIOM) indicator. 2.32 million BTC purchased with is in storage.

BTC GIOM

Any efforts to push Bitcoin price higher beyond this order block will be opposed by selling pressure from many addresses.

Nonetheless, the BTC community is now turning its attention to the upcoming halving event in April, which is exactly 110 days away. This event is expected to kick off the next upward cycle.

Ahead of this event, forward-thinking investors are already growing their BTC portfolios through the innovative cloud mining technology of the Bitcoin Minetrix ecosystem.

Experience easy entry into cloud mining. #BTCMTX! 💻⛏️

For cost-effectiveness, we utilize advanced equipment to avoid worrying about electricity bills or bulky installations.

No need to worry about resale. This is because mining companies can handle hardware upgrades. 🚀 pic.twitter.com/tT804GCHWu

— Bitcoin Minetrix (@bitcoinminetrix) January 17, 2024

A promising alternative to Bitcoin

Bitcoin Minetrix offers the best alternative to Bitcoin, BTCMTX. The tokens that power the ecosystem can be purchased for $0.0129, and this amount will increase over the next three days.

20 steps #Bitcoin Metrics Things are going well now!

How do you think environmental issues affect those around you? #Bitcoin Will mining affect the future? 🌍💭 pic.twitter.com/96Y3Oo7r4x

— Bitcoin Minetrix (@bitcoinminetrix) January 16, 2024

Pre-sale sales have reached over $8.728 million and the current target goal of $9,509 has been reached. If tokens sell quickly, sales could soar to $9 million by the end of this week. Don’t miss it!

great achievement #Bitcoin Metrics!

Exceeded $8,600,000! 🌐 pic.twitter.com/r3i9wdtSbg

— Bitcoin Minetrix (@bitcoinminetrix) January 17, 2024

For investors who already hold BTCMTX, there is no need to wait until the pre-sale ends. The same applies to anyone looking to buy BTCMTX. Build up your holdings for mining credits, then exchange or burn these credits for mining hash power.

This is the mechanism underpinning the project’s cloud mining approach, decentralizing and tokenizing the entire process for maximum user convenience.

A new era in cloud mining begins. #Bitcoin Metrics! 💎

Users earn money #BTCMTX Stake your credits and control your mining power.

Ethereum’s smart contracts provide automatically managed and decentralized allocations for a secure experience. ⛏️🔐 pic.twitter.com/m2QaOlXNlZ

— Bitcoin Minetrix (@bitcoinminetrix) January 16, 2024

Visit the Bitcoin Minetrix website to purchase BTCMTX in the pre-sale here.

Also read:

A new cryptocurrency mining platform – Bitcoin Minetrix

- Thanks to Coinsult

- Decentralized, secure cloud mining

- Get free Bitcoin every day

- Native token currently in pre-sale – BTCMTX

- Staking Rewards – APY 100% or more

join us telegram A channel to stay up to date on breaking news coverage