The Dow Jones and S&P 500 closed at record highs. Is it time to add technology stocks to your portfolio? | chart watcher

key

gist

- The Dow Jones Industrial Average and S&P 500 closed at record highs.

- Technology stocks are receiving attention again, with the Nasdaq 100 index rising 1.95%.

- Keep an eye on momentum and volatility as earnings reports continue to pour in.

Technology stocks are rebounding after a rough start to the trading year. It may have been inconceivable at the time that technology stocks would lead a bull rally, but that story quickly changed. As yesterday’s strong rally continued today, stock indices rose, the Dow Jones Industrial Average ($INDU) and S&P 500 ($SPX) closed at all-time highs, and the Nasdaq Composite Index ($COMPQ) hit a new 52-week high. I did.

Chip stocks continued their upward trend after showing explosive gains yesterday, thanks to Taiwan Semiconductor (TSM)’s strong earnings announcement and positive guidance. Perhaps investors are optimistic that other tech stocks will follow suit as some big names report earnings next week and more companies report earnings next week. Early signs suggest that AI will continue to be a buzzword and stock market catalyst in 2024!

As far as economic conditions are concerned, the U.S. economy remains healthy. High consumer sentiment means that consumer confidence is very high. Earlier this week we received a better-than-expected December retail sales report showing that consumers are still shopping. There were concerns that the interest rate hike ahead of the holiday season would be a headwind for retailers, but the situation appears to be better than expected.

The euphoria surrounding the stock market spread to small and mid-cap stocks towards the end of the trading week. The risk landscape has investors interested in the technology, communications services and consumer discretionary sectors. Defensive sectors such as energy and utilities were the worst performers this week.

big picture

At a glance StockCharts Dashboard It allows you to see the big picture as a whole. Stocks led the rally, with all stock indices in the market overview panel showing in green. The only red is the CBOE Volatility Index ($VIX), which shows investors are becoming extremely complacent.

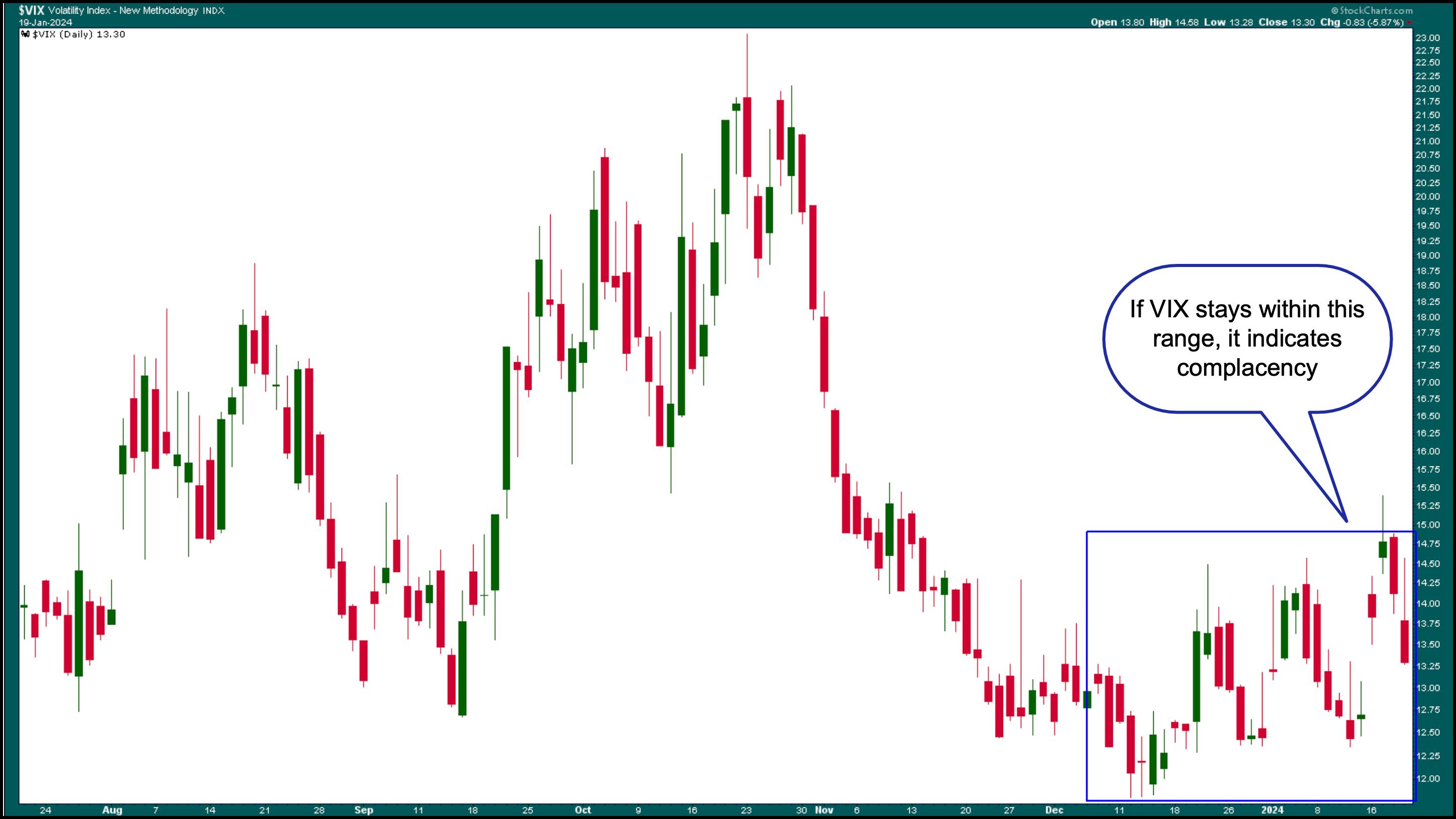

The VIX chart shows an interesting fluctuation pattern over the past few weeks (see chart below). Earnings season is an interesting time in the stock market, and it’s not uncommon to see volatility somewhat choppy. A low VIX means investors are not worried about portfolio hedging.

Chart 1. CBOE Volatility Index daily chart. A low VIX means investors are not worried about the stock market. Once the VIX starts to climb higher, it is time to be careful as it tends to spike quickly and without warning.Chart source: StockCharts.com. For educational purposes.

Considered a fear index, the VIX is key to identifying changes in investor sentiment, so it is a good idea to review this chart regularly as you conduct your stock market analysis. If you look back over 10 years, you’ll see that VIX tends to spike quickly, and the last thing you want to do is let your guard down.

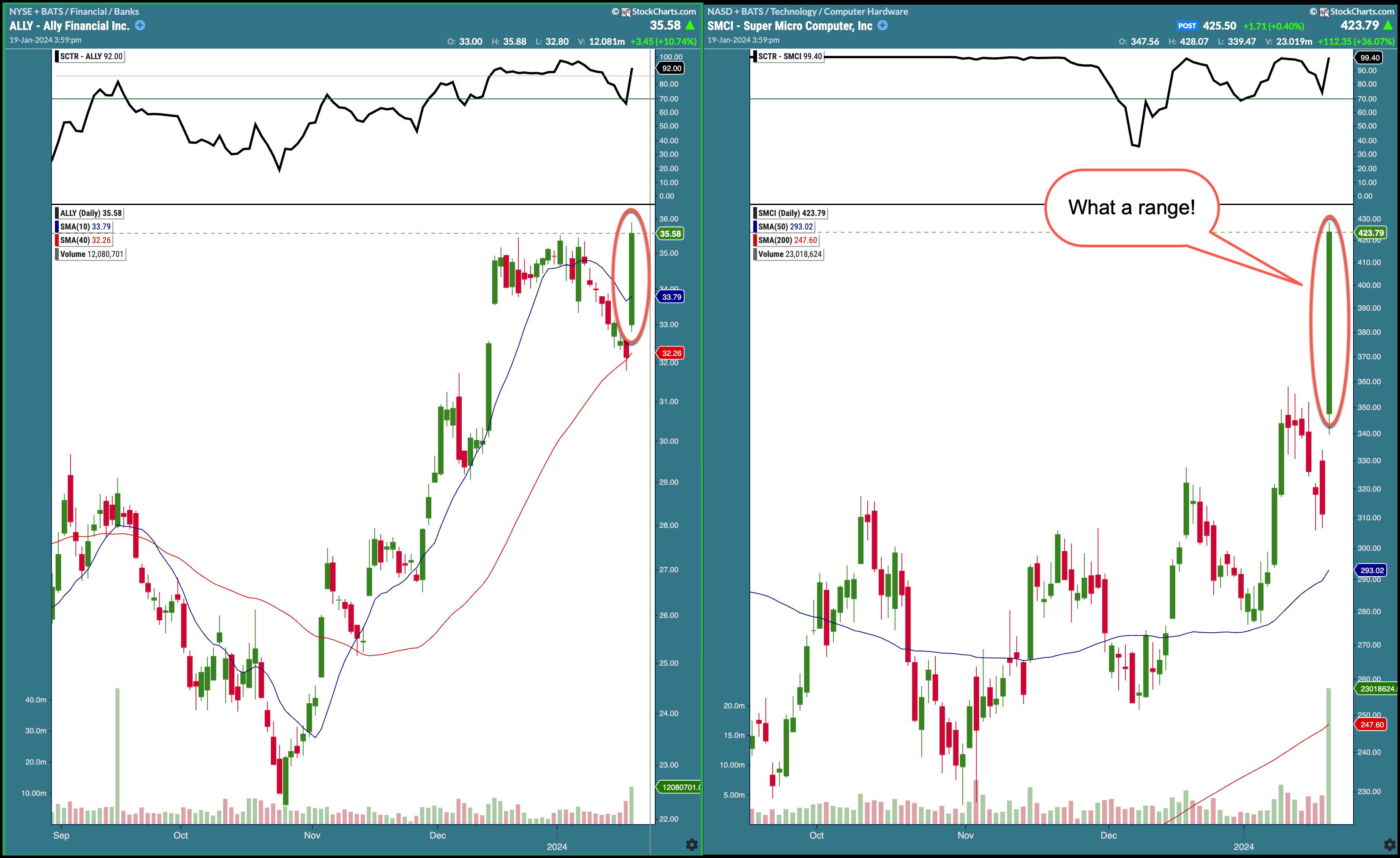

StockCharts Technical Rankings There were also stocks that rose more than 14 points. Ally Financial (ALLY) and Super Micro Computer Inc. (SMCI) are the top two companies in the Large Cap Top Up category. The charts for these two stocks (see below) show the scale of Friday’s moves.

Chart 2. Two big SCTR movers in Friday trading. Some stocks gained relatively large percentages. Here we see financial and technology stocks making significant gains.Chart source: StockCharts.com. For educational purposes.

So will investor optimism continue next week? There aren’t many economic indicators scheduled for release next week, except for the important PCE. What is more important is income. In addition to these reports, keep an eye on Momentum and VIX.

weekend wrap up

US stock index rises; Reduce volatility

- The S&P 500 rose 1.23% to 4839.81, and the Dow Jones Industrial Average rose 1.05% to 37863.80. The Nasdaq composite index rose 1.70% to 15310.97.

- $VIX was down 5.87% at 13.30.

- Top performing sector this week: Technology

- Worst performing sector this week: Utilities

- Top 5 Large Cap Stocks SCTR Stocks: Affirm Holdings (AFRM), Veritiv Holdings, LLC (VRT); Nutanix (NTNX); CrowdStrike Holdings (CRWD); Super Microcomputer (SMCI).

On the radar next week

- Earnings week continues on Wednesday with Tesla (TSLA) being the first Magnificent stock to report. Other companies reported included Netflix (NFLX), Intel (INTC), Lam Research (LRCX), KLA (KLAC), United Airlines (UAL), and Abbott Laboratories (ABT).

- December PCE Price Index

disclaimer: This blog is for educational purposes only and should not be construed as financial advice. You should not use any of our ideas and strategies without first evaluating your personal and financial situation or consulting a financial professional.

Jayanthi Gopalakrishnan is the Director of Site Content at StockCharts.com. She spends her time creating content strategies, providing content to educate traders and investors, and finding ways to make technical analysis fun. Jayanthi was the Editor-in-Chief of T3 Custom, a content marketing agency for financial brands. Prior to that, she served as Technical Analysis Editor for Stocks & Commodities magazine for over 15 years. Learn more