10X Genomics Stock: Revenues Are Growing Fast, But So Are Costs (NASDAQ:TXG)

Concept cafe

10x Genomics (Nasdaq: TXG) specializes in medical devices, instruments and software for biometric data collection and analysis. The company is a growing company with impressive revenue growth, but is struggling to make a profit due to excessive operating expenses (particularly R&D and expenses). Marketing), despite the recent sell-off, the valuation is still somewhat high.

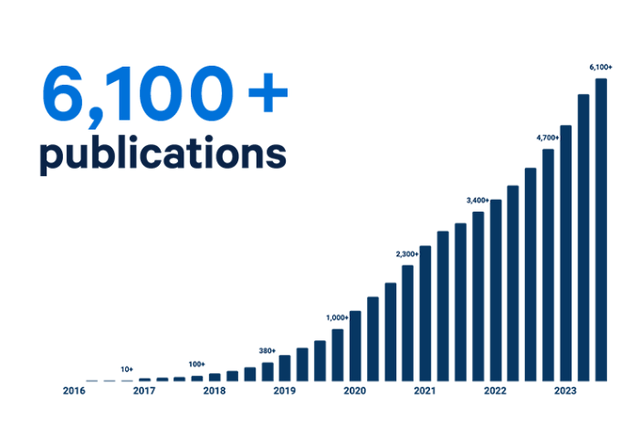

Since 2016, the company’s products have been used in extensive medical research, publishing more than 6,100 journal articles. It took about three years to reach the first 1,000 publications, only a year to reach 2,000+ publications, and less than a year to reach 3,000+ publications. The use of the company’s products in research has not only increased, but actually accelerated over the years. In addition to more than 6,000 publications, the company’s tools have helped scientists generate more than 2,200 medical patents. Medical professionals and newly developed technologies could help fight many diseases in the future.

Research publications using the TXG tool (10x Genomics)

The company’s products are used in a variety of research areas, including but not limited to oncology (cancer research), neuroscience, immunology, drug discovery and infectious diseases. Each area also has several subdisciplines. For example, oncology has subcategories such as tumor heterogeneity, tumor microenvironment, immuno-oncology, and therapeutic development. Among other things, the company’s products allow it to create 3D images of tumors, showing how they develop, how they grow, how they interact with the rest of the body and different cell types, and ultimately using a variety of methods. We can research ways to fight tumors. Treatment approach.

Research focus areas (10x Genomics)

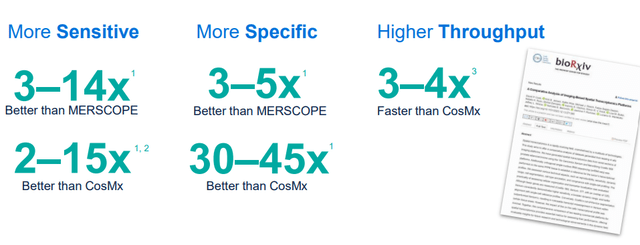

Last year, the company launched a new product called Xenium (simply put, a fully integrated, highly specialized healthcare platform that includes the visualization and analysis of cellular-level data in a highly detailed way not thought possible for several years). I) I got a very good response. Having sold about 250 systems to date, the feedback the company has received has been very positive. This is interpreted as a significant improvement over existing products in that it is 3 to 15 times more sensitive, more specific, faster, and more efficient than competing products, based on data collected from the product’s first users.

Xenium vs. Competitive Products (10x Genomics – Customer Data)

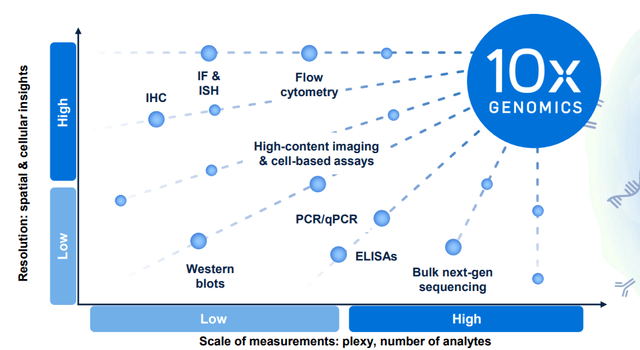

10x Genomics’ product line is considered highly disruptive. There are many competing products and systems on the market, including many legacy products and systems produced many years ago, but most offer either high resolution or high measurement scale, but not both, while the 10X product offers both high resolution and high measurement scale. It appears that it does. Measurements of resolution and high scale that can put a company in a unique position and allow it to steal market share from other companies in a disruptive way.

competitive landscape (10x Genomics)

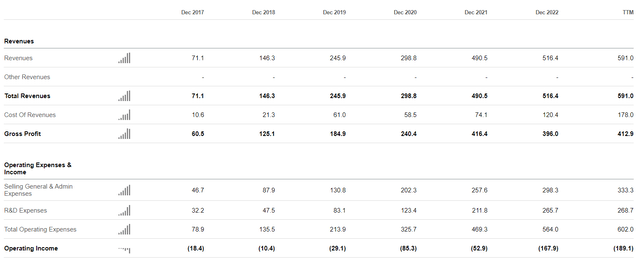

The company’s financials are interesting. On the one hand, we are seeing very impressive growth in revenue as well as gross profit. From 2017 to last year, TXG’s revenue increased from $71 million to $591 million, and gross profit increased from $60 million to $413 million. This is a great growth story with few signs of slowing down. At the same time, the company’s operating costs are also increasing at an alarming rate, especially R&D spending and management costs. This means that this growth comes at a huge cost and the company is spending a lot of money developing and marketing new products and products. In fact, operating losses are increasing. Over the past 12 months, the company posted an operating loss of $189 million, its highest ever. To become profitable, a company must scale faster than its costs can increase.

operational finance (Look for alpha)

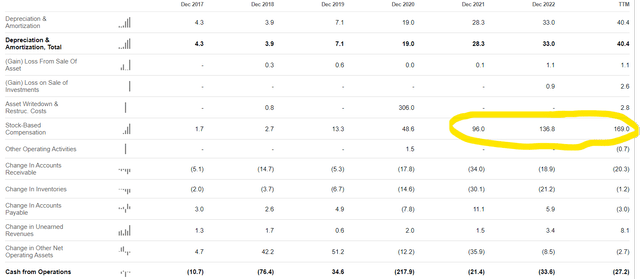

By looking at a company’s cash flow statement, you can see where most of its operating losses occur. In 2021, 2022, and last year, the company spent $96 million, $137 million, and $169 million on stock-based compensation, respectively. Strip that out, and the company’s operating cash flow is actually very close to breakeven, representing a much smaller loss of $27 million over the past 12 months. Although stock-based compensation does not directly affect a company’s cash flow, it can affect other factors such as dilution, so investors should not ignore it.

cash flow statement (Look for alpha)

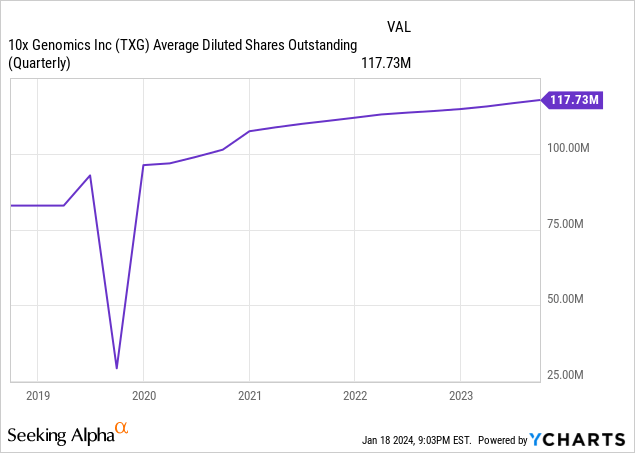

Since going public about five years ago, the company’s diluted share count has increased about 42% to 117.7 million shares. This trend is likely to continue to grow, as companies rely heavily on stock-based compensation to reward their employees. Investors may not look favorably on a company’s growth rate if its growth does not outpace the growth of its share count. The positive thing is that the company has about $350 million in liquid assets (including cash) and no debt, so its cash management isn’t too bad.

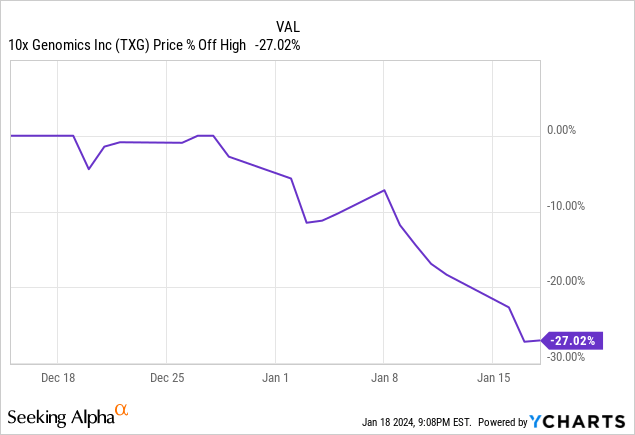

Earlier this month, the company announced preliminary results for the fourth quarter and full year of last year. During the quarter, the company recorded revenue growth of 18%, slightly slower than its previous growth rate of 20%. Even more impressive is that the company’s equipment revenue increased 72% year-over-year, and service revenue increased 129%. Overall growth this year reached 20%, as expected. The company only provided sales figures and did not provide details on profitability. Investors apparently didn’t like these results, as the stock has sold off by more than 20% since then.

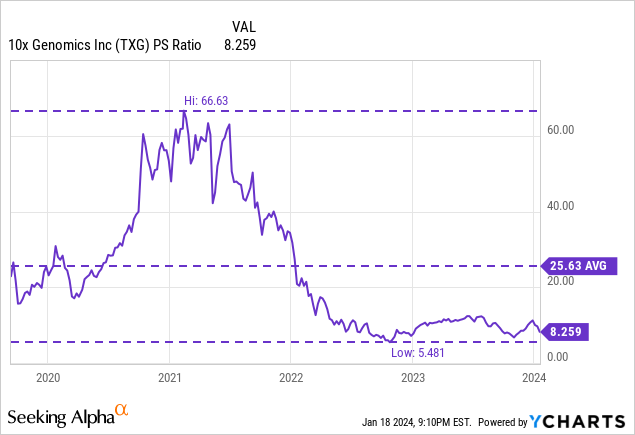

It is difficult to find a good valuation as it has not yet made a profit. TXG is currently selling for 8.2 times its annual sales. In the past, they have sold for between 5.4 and 66.6 times sales, with the average being 25.6 times. A quick look at the company’s price to sales revenue shows that it’s trading at a lower valuation than before, but that doesn’t tell us much on its own, as the stock has traded at a fairly large premium in 2021 and is simply trading cheaper than it did in 2021. Don’t set the bar high enough. Looking at industry averages, TXG’s peers currently trade at an average of four times their price to sales, so the company is trading at a premium compared to its competitors.

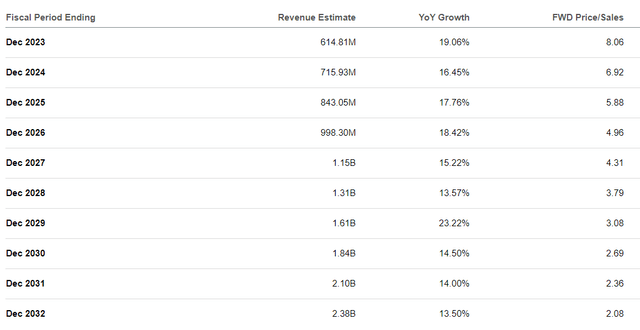

Going forward, analysts expect the company’s impressive growth story to continue in the near future, hitting growth rates of 16-18% over the next five years before slowing to 13-15% growth rates until at least 2032. Increase company revenue from $600 million to $2.4 billion range.

Analyst Revenue Estimates (Look for alpha)

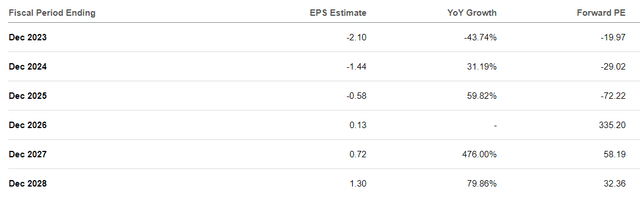

Meanwhile, the same analysts are not optimistic about the company’s profitability situation. It is expected to record a deficit for the next few years and then reach the break-even point in 2026 and then record a surplus. Even applying the 2028 estimate, we’re still projecting a forward P/E of 32, which excludes any stock dilution that will occur between now and then. Nonetheless, 11 out of 15 analysts covering the stock currently rate it a “buy” or “strong buy” rating, with just one giving it a “sell” rating.

Analyst Profit Estimates (Look for alpha)

The company shows a lot of promise, but the stock isn’t cheap at all. Additionally, the reason the company’s healthy gross margin cannot be converted into operating profit is because it spends too much on stock compensation for its R&D and marketing personnel. This may be fine as long as the company is growing and expanding, but at some point it has to slow down for the company to become profitable. Because of stock-based compensation, investors should also be wary of dilution, which has been an ongoing problem for the company since its IPO.

I have personally purchased small speculative positions in my portfolio, but I do not recommend this to all investors. If your investment philosophy is more on the conservative side, you may want to avoid it or wait for a better pricing opportunity. This stock is for those who are adventurous and don’t mind taking risks, but even such investors should make this stock only a small part of their overall portfolio.