MSD: Emerging Markets Bond Forecast to 2024

Craig Hastings/Moment via Getty Images

MSD Overview

MS Emerging Markets Debt Fund (New York Stock Exchange: MSD) is a closed-end bond fund focused on emerging markets. Within EM, we invest in a variety of government, quasi-sovereign and corporate debt securities. The primary objectives are: If you are generating a high income, your secondary goal is to pursue capital gains. This mandate allows them to invest in local currency as well as U.S. dollar-denominated debt securities. However, MSD generally does not incur significant currency risk and does not utilize leverage. This makes it somewhat more conservative than some of its emerging market debt fund peers.

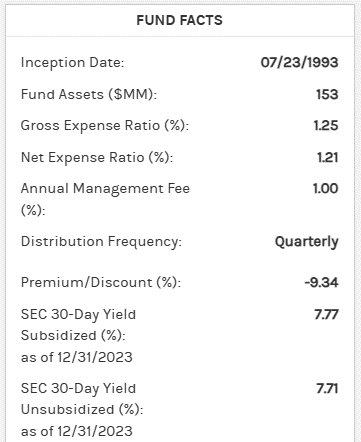

This fund has a very long history, having been around since 1993. Nonetheless, the fund size is small at $153 million. A key element of this is that, like other emerging market bond funds over the past decade, its performance has not met its targets. Generating high income through capital gains. An expense ratio of around 1.2% is acceptable, up to the extent to which we expect this to change, i.e. expectations that emerging market debt will perform strongly over the next decade.

MSD facts

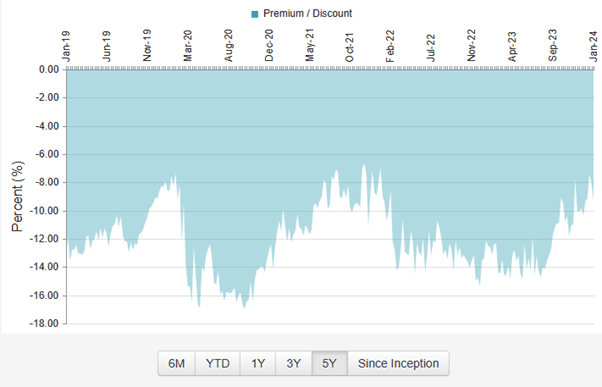

At various points last year, MSD was trading at double-digit annual returns and a discount to NAV close to 15%. Both offered yields and discounts to NAV declined following a significant rebound in emerging market debt in the final months of 2023.

morganstanley.com Emerging Markets Debt Funds Overview

MSD Past Performance

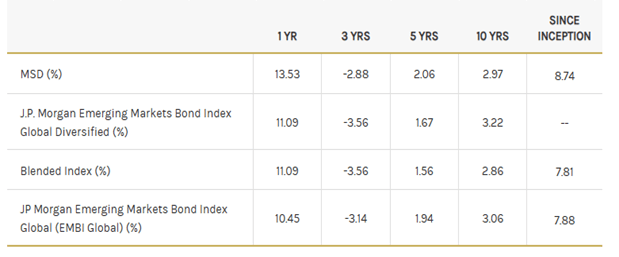

Emerging market debt has been a poor asset class over the past decade, and MSD has delivered similarly low returns in that time. Last year saw improvements, both nominally and benchmark-wise.

morganstanley.com Emerging Markets Debt Funds Overview Performance through December 31, 2023.

Given the discount to NAV at which it typically trades, MSD’s exposure to emerging market debt is worth considering.

However, since it is a fund that holds a lot of corporate bonds, it is questionable whether it is worth taking on this level of risk.

When I look at funds that have been around for this long, I like to see a variety of management changes. The fund’s website lists four portfolio managers with the note:Effective July 19, 2022, Akbar Causer, Kyle Lee and Federico Sequeda were added as portfolio managers to the fund. Warren Mar no longer serves as the Fund’s Portfolio Manager.” For what it’s worth, performance has been very strong since the mentioned dates and these major changes.

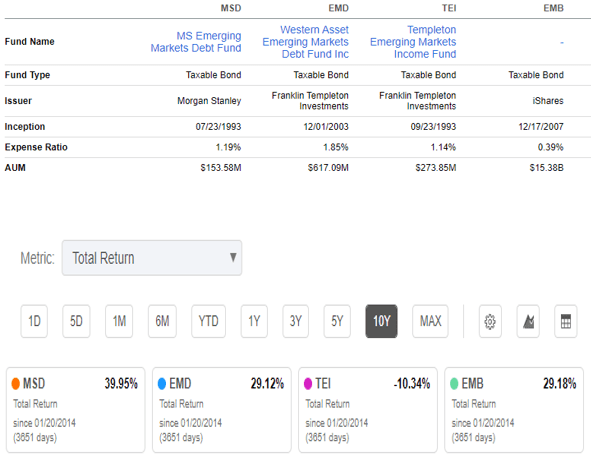

MSD Associate Analysis

Among other long-term EM debt closed-end funds, MSD performed better. This is backed up by the numbers, but I would like to reiterate a point I made earlier about the conservatism in taking currency and leverage risk.

Total Return 5 Years to January 20, 2024, Seeking Alpha.

For example, funds like Templeton Emerging Markets Income Fund (TEI) have performed much worse in recent years, with their currency bets taking a toll. Then there’s Western Asset Emerging Markets Debt Fund (EMD), whose numbers are much closer to what MSD has achieved over the past decade. However, EMD utilizes a significant amount of leverage and has higher exposure to the company’s debt.

Overall, I think MSD has performed better in this group over the past decade. Additionally (in terms of the other CEFs mentioned above), MSD performed better with less volatility and risk.

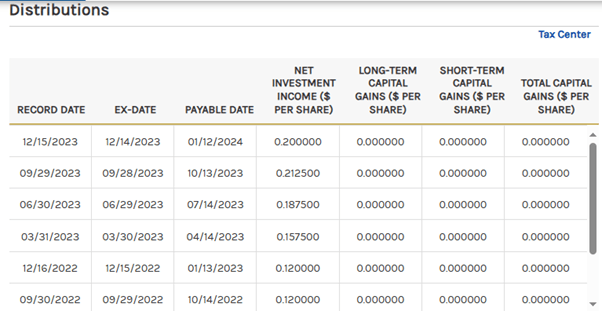

MSD Distribution History

Given that we witnessed a decline in emerging market bond yields late last year, the last two distributions should not be extrapolated. Returns on MSD’s underlying portfolio are now 1-2% lower than what we saw at the beginning of last year’s fourth quarter.

morganstanley.com Emerging Markets Debt Funds Overview

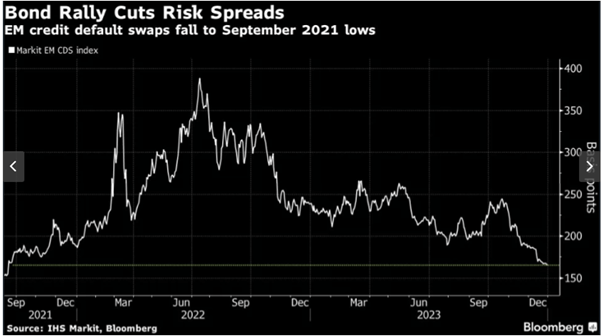

Emerging Market Bond Spreads

One of the reasons portfolios are yielding lower returns today compared to the end of last year is major movements in emerging market bond spreads.

IMS Markit, Bloomberg.

The chart above tempers my enthusiasm for the asset class. The fact that spreads have fallen since mid-2022 certainly makes sense given the inflationary shock experienced at that time. The extent of the spread of falling EM bonds is unclear. I am not convinced that the global economic outlook has improved significantly, and in the meantime geopolitical tensions remain heightened.

Moreover, with more than 40 national elections scheduled around the world in 2024, there is a lot of uncertainty. To quote the linked article directly, “Together, these countries account for more than half of global GDP,” says Joe Quinlan, director of CIO market strategy in the Chief Investment Office at Merrill and Bank of America Private Bank. In addition to the U.S., they include Taiwan, India and Indonesia. Wow Mexico.”

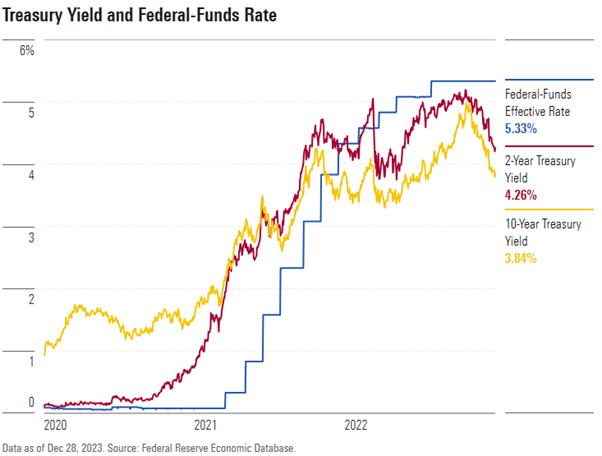

US interest rate outlook for 2024

It wasn’t just the decline in emerging market bond spreads that helped MSD’s performance rebound in the final months of last year. The backdrop of falling global government bond yields also helped.

Federal Reserve Economic Database

Since mid-October, U.S. interest rates, both long and short, have bounced around 100 basis points, which is a big move in a short period of time.

The duration of the MSD portfolio is as of November 30 last year, but is listed on the website as 6.85 years. That backdrop is helpful, but so are the risks if these trends reverse.

It certainly didn’t hurt, then, that the last few months had seen positive momentum pick up in the “everything rally.”

Overall, this aggressive movement in risk assets makes you want to at least avoid jumping into stocks like MSD, which is up 10% in just a few months.

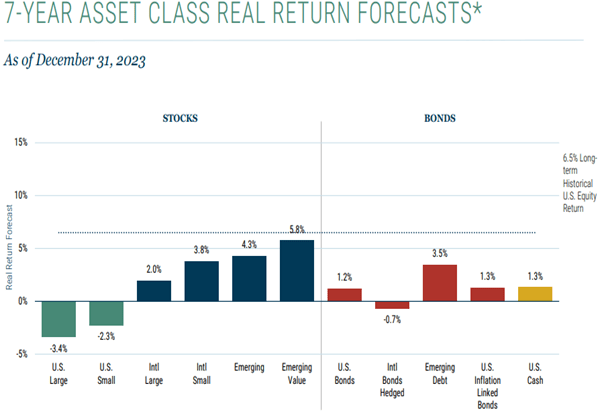

Can you buy emerging market bonds in 2024?

This question left me somewhat torn between the short term and the long term. As mentioned above, the asset class appears to be overbought in the near term.

More and more optimistic articles are coming out, predicting that the Federal Reserve will be able to handle the very difficult task of a soft landing. The article points out not only that this may be extremely rare, but also how the market is pricing in twice the amount of interest rate cuts signaled by Fed officials.

This combination puts some pressure on EM bonds in the near term, setting up a scenario in which it is very easy for markets to disappoint.

From a long-term perspective, I think it’s encouraging that emerging market bond yields are still quite high over the past decade. Even if the Fed cuts interest rates by less than the market expects, this still makes sense for the asset class over the long term. Inflation concerns from about a year ago appear to be subsiding, and the USD may have begun a long-term bearish trend starting in late 2022.

Looking out over a seven-year period, GMO’s latest forecast still points out that emerging market debt remains relatively attractive.

GMO

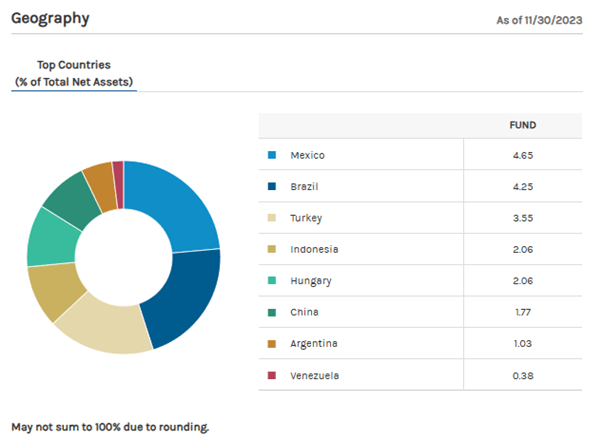

MSD Country Exposure

These funds are very diverse from a country allocation perspective. Therefore, I continue to expect MSD to be less volatile than its peers.

morganstanley.com Emerging Markets Debt Funds Overview

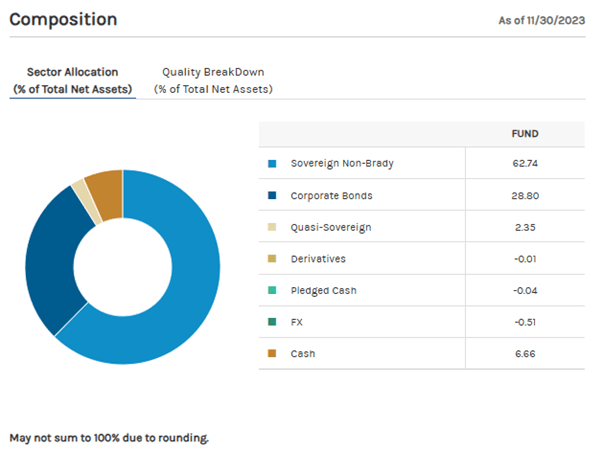

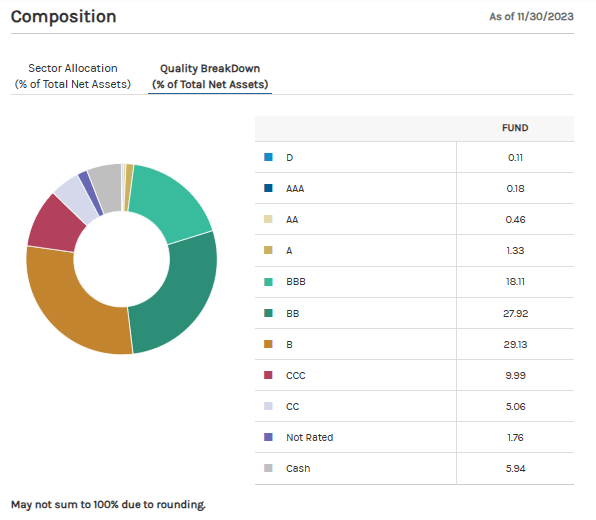

MSD Division Allocation

morganstanley.com Emerging Markets Debt Funds Overview

MSD exposure through credit rating

morganstanley.com Emerging Markets Debt Funds Overview

MSD Discount on NAV

CEFConnect

Discounts to NAV are not as attractive as they are now, having spent much of recent years in the 10-15% range.

Last year, emerging market bonds often traded at a discount of about 14% before a rebound in the past few months. The fund bought some stocks last year, but the amount was very small, about 1%, according to the data. Given the steep discounts, this could be considered disappointing. Still, that’s not too surprising, as they’re already concerned about shrinking smaller funds.

Activist Bulldog Investors recently listed MSD as part of its holdings. However, we do not expect MSD to be a priority activist target when the discount rate is less than 10%.

MSD risk

Key risks for MSD include a short-term correction of the strong rally late last year in emerging market debt spreads and global bond yields more generally. If this happens, the discount to NAV is expected to widen again to close to 15%, increasing short-term risks.

Additionally, uncertainty regarding the global economic outlook and geopolitical environment still exists. This is a year with many national elections scheduled around the world.

conclusion

Although the perceived short-term risk prevents me from considering investing in MSD right now, I think it would be a reasonable choice to add to my watchlist in case a correction occurs.

I prefer this fund over other EM debt funds and think it is a better space for observing one-year trades rather than long-term holding. In that respect, as with last year, volatility may present opportunities.

Early last year I covered another EM debt fund at TEI. I mentioned that I am relatively positive on emerging market bonds as an asset class in 2023 if I can get in after some adjustments. But I also mentioned that I’m not sure TEI is the best vehicle to use for such a strategy.

It now seems to me that a similar situation will unfold in 2024. Volatility like 2023 could once again provide a nice downside for buying exposure to emerging market bonds. MSD is one of the better choices for implementing such a strategy. However, with the market currently very bullish, I think MSD should consider buying at the lower end of the trading range it saw last year. This is also likely to coincide with a more attractive underlying yield in the 9-10% range. We also expect the NAV discount to be close to 15% in such a scenario. But for the time being, I view MSD as a hold at best.