York Water: A well-regarded, steadily growing small water service company.

Aerial view of modern water cleaning facility at urban wastewater treatment plant. A purification process that removes undesirable chemicals, suspended solids, and gases from contaminated liquids.

villanol

York Water, which has water service franchises in three Pennsylvania counties (NASDAQ:YORW) is a local small business that is growing steadily. The company has increased dividends for 27 consecutive years, making it a dividend aristocrat. York Water We can provide water services to customers in acquired areas at lower prices than before. This fact makes the company more competitive in terms of new acquisitions. Currently, the company’s stock is trading at a relatively favorable valuation.

business overview

Founded in 1816, The York Water Company is the oldest investor-owned water utility in the United States.

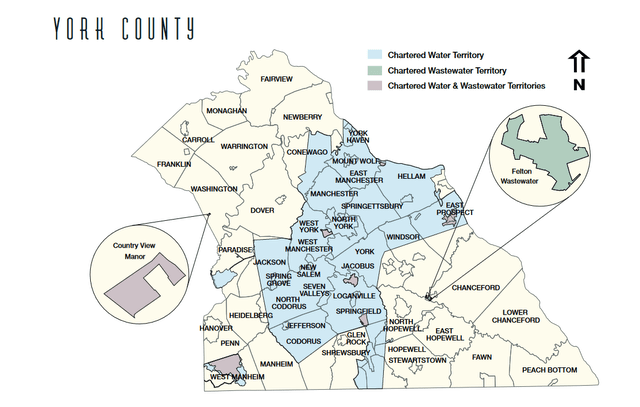

YORW’S WATER AND SEWER SERVICE AREA (YORW Annual Report 2022)

YORW’S WATER AND SEWER SERVICE AREA (YORW Annual Report 2022)

The map above shows the three southern Pennsylvania counties where York Water Company’s franchise service area is located. YORW owns two reservoirs. Located in Williams Lake and Redman Lake. The company has three wastewater collection systems, eight wastewater collection and treatment systems and 15 miles of pipelines. As of the end of 2022, York Water’s average daily water availability was 40.3 million gallons. However, the average daily consumption by customers was 21.1 million gallons.

The population of the franchise’s service area is 208,000. This number has increased over time. For example, in 2015, the franchise area had only 190,000 residents. Both the number of inhabitants and the territory area increased. Currently, water services are provided to 54 municipalities, but only 48 of them in 2015. Customers include private homes and apartments as well as businesses and municipalities. If about 1,000 new customer contracts were added this year, about 3,500 new customers were added in 2022. In total, the company currently has more than 71,000 customer contracts. Adding new customers and expanding franchise territory are key factors for investors.

Long-term review of YORW results

The best insight into a company’s stability, success, and growth prospects can be gained by looking at long-term data. First, let’s look at earnings per share.

| year | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | In 2013 | year 2014 | 2015 |

|

YORW earnings per share |

2.80 | 2.91 | 3.17 | 3.10 | 3.19 | 3.23 | 3.28 | 3.56 | 3.67 |

| year | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | TTM |

| YORW earnings per share | 3.70 | 3.78 | 3.75 | 3.98 | 4.13 | 4.22 | 4.30 | 4.76 |

YORW earnings per share (USD) 2007-2023 Source: roic.ai

Growth was stable. There was a slight decline in 2010 and 2018, which is probably due to the delayed increase in water rates. The average annual sales growth rate between 2007 and 2023 was 3.37%. The sales CAGR over the past 10 years has been slightly higher at 3.79%. However, the CAGR over the past five years is 4.88%. Although these growth rates are not very high, it is a good sign that growth is steady and that sales growth has increased slightly in recent years. Let’s take a look at the EPS growth rate below.

| year | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | In 2013 | year 2014 | 2015 |

| YORW Basic EPS | 0.57 | 0.57 | 0.64 | 0.71 | 0.71 | 0.72 | 0.75 | 0.89 | 0.97 |

| year | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

| YORW Basic EPS | 0.92 | 1.01 | 1.04 | 1.11 | 1.27 | 1.30 | 1.40 | 1.59 |

YORW EPS per share 2007-2023 Source: roic.ai

The EPS CAGR during the period 2007-2023 was 6.62%. The EPS CAGR over the past 10 years was 7.80%. However, over the past five years, the EPS CAGR has increased to 8.86%. As you can see, EPS growth has continued to increase over time. Additionally, EPS growth has consistently been higher than revenue growth.

| year | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | In 2013 | year 2014 | 2015 |

| YORW Dividend | 0.47 | 0.48 | 0.50 | 0.51 | 0.52 | 0.53 | 0.55 | 0.57 | 0.60 |

| year | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

| YORW Dividend | 0.62 | 0.64 | 0.66 | 0.69 | 0.72 | 0.75 | 0.78 | 0.81 |

YORW Dividends 2007-2023 Source: Dividend.com

The company’s dividend growth rate has been slower than its profit growth rate. From 2007 to 2023, YORW’s dividends grew at a CAGR of 3.46%. This suggests that York Water is focused on growth and acquiring new businesses rather than increasing its dividend.

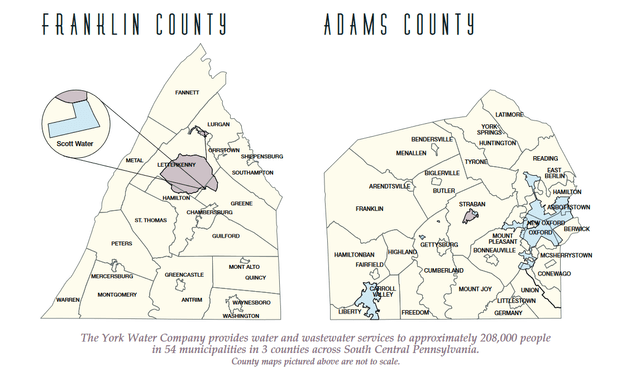

Improved profitability

Over the past decade, YORW’s net profit margin has steadily increased. In my opinion, this is evidence of improved efficiency. If in 2014 the company’s net profit margin was 22%, now this figure has increased to 33%. This figure is one of the highest among competing water service companies. This indicator is 230% higher than the utility sector median of approximately 10%.

YORW Net Profit Margin 2015-2023 (Look for alpha)

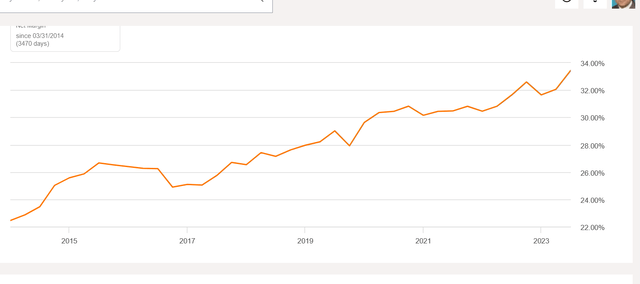

However, the ROE figure is very low, ranging between 9% and 12%. Nonetheless, the company’s current return on equity (ROE) of 10.78% surpasses the sector median of 9.10%.

YORW Return on equity 2014-2023 (Look for alpha)

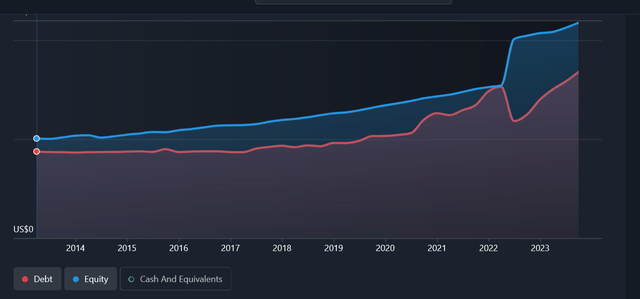

balance sheet status

York Water’s current debt/equity ratio is 77.2%. The company has capital of $217.7 million and total debt of $168.1 million.

York Water’s Debt/Equity Ratio 2014-2023 (Wall Street in a nutshell)

Is this company’s current debt/equity ratio of 77.2% high or low? Let’s compare this historically to the last 10 years of data for the same company.

| year | December 2014 | December 2015 | December 2016 | December 2017 | December 2018 | December 2019 | December 2020 | December 2021 | December 2022 |

| YORW Debt/Equity Ratio | 83.7% | 79.8% | 76.2% | 78.2% | 76.2% | 77.0% | 88.2% | 97.3% | 67.6% |

York Water’s Debt/Equity Ratio (2014-2022) Source: Simply Wall Street

YORW’s average debt/equity ratio over the past 10 years is 80.14%. The current debt/equity ratio is slightly lower than that. So, we can say that the company’s financial health is good, although the ratio has increased slightly in recent years. Additionally, compared to its competitors, YORV’s debt/equity ratio is one of the lowest.

| company | Yor | CWCO | our land | lecture | CDZI | MSEX |

| Debt/Equity Ratio | 77.2% | 1.20% | 79.99% | 222.19% | 126.73% | 96.71% |

Debt/Equity Ratio for Water Service Companies (TTM) Source: Seeking Alpha

YORW’s interest coverage ratio is currently 4.21. The company’s EBIT (TTM) was $27 million and total interest expense was $6.4 million. This indicates that the company can service its debt interest at 4.21 times its current EBIT. This strong debt coverage ratio allows the company to invest the money left over from interest payments to grow the company. Let’s take a look at York Water’s historical interest coverage ratio over the past 10 years. In my opinion, long-term interest coverage data should provide insight into whether a company’s financial health and growth prospects are sound, and whether management is aware of and acting on risks.

| year | year 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

| Interest expense, total | 5.2 | 5.2 | 5.3 | 5.3 | 5.5 | 5.1 | 4.7 | 4.9 | 5.1 | 6.4 |

| operating profit | 22.1 | 22.7 | 22.9 | 22.5 | 21.2 | 22.3 | 23.1 | 22.2 | 23.2 | 27 |

| Interest coverage ratio | 4.25 | 4.36 | 4.32 | 4.24 | 3.85 | 4.37 | 4.91 | 4.53 | 4.54 | 4.21 |

YORW Interest Coverage Ratio 2014-2023 Source: Seeking Alpha

The table shows that York Water’s interest coverage ratio has consistently been above 4 over the past 10 years. Except 2018. This confirms that management is conservative with its borrowing policy and that the company has sufficient funds for new acquisitions over the long term.

Third quarter results

The third quarter results announced on November 3 were as expected. EPS was $0.53, an increase of $0.13 year-over-year. The reason for the increase is the new water rates that took effect on March 1 and the increase in customers. However, the profit growth rate decreased due to increased operating and maintenance costs. Operating revenue also increased to $18.77 million as expected. In the same quarter last year, it was $15.81 million.

This is an amazing result, with sales increasing by 18.72% compared to the previous year. This shows how important water rates are to water service companies.

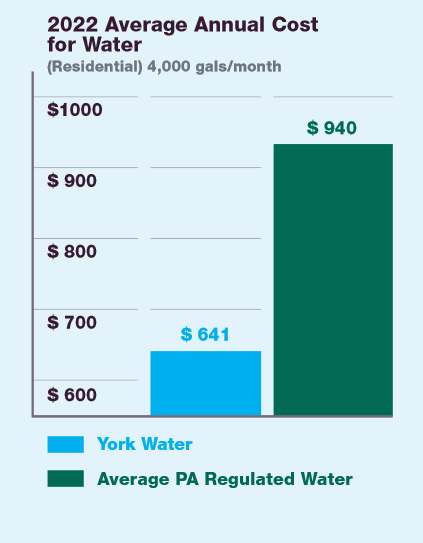

Competitive advantage over competitors

York Water can provide customers with the most affordable water service in the region. For example, in 2022, competing water companies in Pennsylvania had annual water bills of $940 for the average residential customer. However, York Water’s residential customers only pay an average of $641 per year for water. This means YORW customers can get their water service about one-third cheaper.

York Water Annual Report 2022 (yorkwater.com)

In addition, the number of complaints per 1,000 residents was recorded at the lowest level in the region, showing that customer satisfaction with water quality was quite high. We believe that this competitive advantage will allow us to expand our franchise area more easily in the future. This is because customers are interested in lower prices.

increase in number of shares

The number of York Water shares has increased over time. This is typical of a growing company. The average annual growth rate in the number of shares over the past 10 years was 1.23%. Of course, for investors this slightly dilutes earnings per share.

| year | year 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

|

total common Stock issuance |

12.8 | 12.8 | 12.9 | 12.9 | 12.9 | 13.0 | 13.1 | 13.1 | 14.4 | 14.3 |

York Water shares in millions, 2014-2023 Source: Seeking Alpha

evaluation

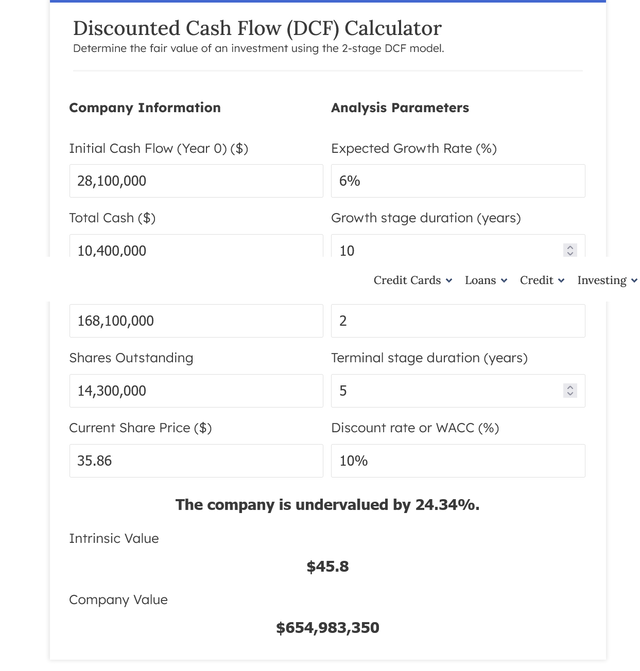

Let’s first evaluate the value of YORW using the DCF method.

Fair value of YORW under DCF method (Pin Master)

Even though the company’s EPS CAGR over the last 10 years was 7.80%, we used a conservative 6% as our projected growth rate. Considering the current high interest rates, a discount rate of 10% was used. According to this data, the fair price for YORW is $45.8, which makes the company undervalued by 24.34%.

York Water also appears to be undervalued, according to relative valuation metrics. The company’s P/E (FWD) of 22.55 is significantly lower than its five-year average P/E ratio of 33.35.

Additionally, YORW’s price-to-earnings ratio is favorable compared to its competitors.

| company | Yor | CWCO | our land | lecture | CDZI | MSEX |

| Price-to-earnings ratio (TTM) | 22.55 | 22.57 | 23.46 | 38.03 | -4.39 | October 31st |

P/E Ratios for Water Services Companies Source: Seeking Alpha

Of the 6-person tables above, only CWCO has better pricing than YORW.

danger

The main risk factor for York Water is that it is a local company. Expanding your franchise territory requires competing with other water service companies. Some of its competitors are large market players such as American Water Works (AWK) with economies of scale advantages. Additionally, new acquisitions are subject to regulatory approvals.

The rate of water prices depends on only one regulator. That’s what the Pennsylvania Public Utility Commission (PPUC) is for. If this regulator delays a decision or makes a decision unfavorable to York Water, it will have a negative impact on the company.

conclusion

I give York Water a Buy rating for the following reasons.

The company has grown steadily and remained profitable over a long period of time. YORW’s franchise territory and number of customers are continuously growing. Profitability is improving and financial health is good. Additionally, York Water currently enjoys favorable valuations based on both DCF methodology and relative valuation metrics.