The ECB kept interest rates at record highs this week, but a policy shift is coming.

Markets have been bracing for a shift in monetary policy in recent months to cut interest rates from central banks representing about a third of the global economy.

But despite inflation in the U.S., the euro zone and the U.K., this year started well below the peak of the cycle and remains close to the 2% target, the European Central Bank announced at 8:15 a.m. on Thursday. Eastern will be the first high-profile currency defender to tell investors they should wait a little longer for interest rates to fall.

This shouldn’t come as a shock.

Derivatives markets are pricing in the fact that the ECB is highly unlikely to cut its record high 4% deposit rate this week. Likewise, traders see a 99.5% chance that the US Federal Reserve (Fed) will not cut borrowing costs at its next meeting on January 31. The Bank of England shouldn’t even budge the next day. (Note: The Bank of Japan is expected to raise interest rates next.)

The next few meetings are a different matter. To varying degrees they are considered potentially ‘alive’. In particular, a Fed rate cut is considered possible in March, and market punting on the ECB is expected to be curtailed in June.

As a result, ECB President Christine Lagarde will be the first to set the tone for the weeks leading up to this potential turning point.

Unfortunately, many analysts believe it is unlikely that Lagarde will change her stance on what she perceives to be an inflationary environment or provide any clues about the timing of a rate cut at her press conference.

“We expect Lagarde to suggest that it is premature to talk about interest rate cuts. But she will also emphasize that ECB decisions are made through meetings and rely on data,” said Mohit Kumar, chief European economist at Jefferies.

Arnaud Marès, Citi’s chief European economist, agrees: “(W)e do not expect anything significant or particularly new to come out of this week’s European Central Bank board meeting,” he said.

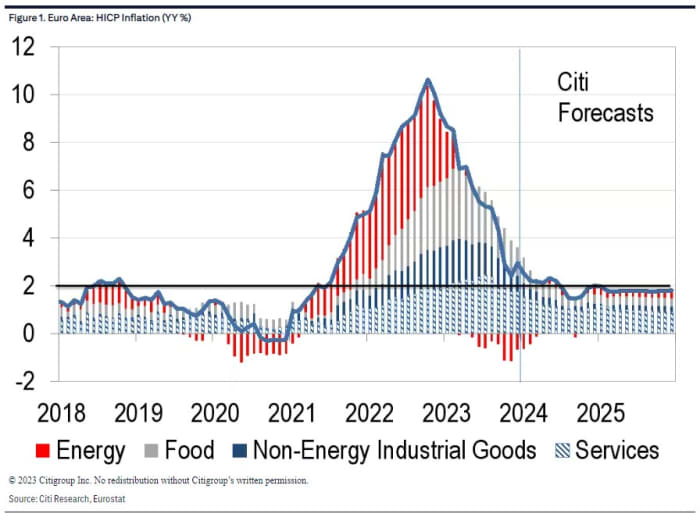

In fact, Marès does not expect eurozone inflation to fall quickly from the current 2.9%, while Barclays expects the January figure to fall slightly to 2.7% and believes policy easing may not occur until the summer.

Source: Citi

“As long as the ECB expects inflation to be above 2% in 2025, resistance to rate cuts is expected to remain strong. If these projections fall below 2%, the pressure for policy easing will become irresistible. We expect this to happen in June, but not before then,” Marès said in a note to clients.

In its latest forecast published last month, the ECB said the bloc’s economy would grow by 0.8% in 2024. This is an acceleration from the 0.6% expansion expected in 2023. Flexible employment – and export growth catches up with improving overseas demand.”

However, expected growth this year is lower than the 1% forecast in September, and the ECB may still lower its growth forecast given recent weak data such as the Purchasing Managers Survey.

Source: ECB Macroeconomic Outlook December 2023

Nonetheless, ECB officials have recently suggested that they, like their Fed colleagues, have been keen to push back against traders’ more optimistic timing of rate cuts.

“We therefore expect all policy parameters to remain unchanged at the upcoming meeting, and official guidance reiterates that interest rates will be set ‘at a sufficiently restrictive level as necessary,’” the Goldman Sachs economics team led by Sven said. “He said. Zari Stain.

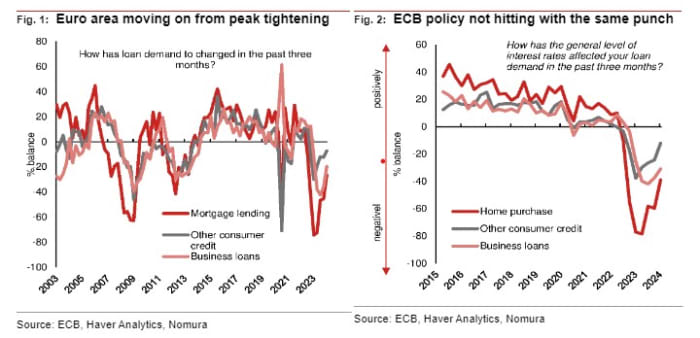

The ECB’s decision to stick to its stance on Thursday without hinting at an easing policy timeline could be supported by signs that the impact of previous rate hikes on bank lending has already eased significantly, according to Nomura.

Analyzing the ECB’s Q4 2023 bank lending survey released on Tuesday, the Nomura team led by George Moran observed that almost all the transfer from tight monetary policy to financial conditions has now occurred.

“For some hawks, this may be a concern and could potentially push for a rate cut when they believe it should be done,” Nomura said in a note to clients.

“However, we think the majority of (ECB) board members are satisfied with the degree of austerity that has already occurred and are pleased that the pace of transmission is slowing down. Therefore, a reduction is expected from June 2024.”

Source: Nomura. ECB’s Bank Lending Survey Chart for Q4 2023

But Goldman’s Stehn said the U.S. bank may cut interest rates because core inflation is lower than the ECB expects, wage growth has eased and transportation disruptions from wars in the Middle East have had less of an impact on inflation than people think. I think it could come sooner. .

“We therefore maintain the modal case for a 25 basis point cut in April,” Goldman said. “Waiting until April will give the board one more inflation report and provide further color for first quarter wage negotiations, which we expect will provide sufficient confidence that inflation will return to 2% in a sustainable manner.”

German 2-year bond yield BX:TMBMKDE-02Y,

Short-term euro zone benchmarks were little changed at 2.719% early Thursday. It’s down from around 3.3% in October on hopes of easing inflation and an ECB pivot.