The stock market starts in December. What does this mean for the rest of the year | chart watcher

key

gist

- The S&P 500 index closed at its highest level in 2023.

- The Dow Jones Industrial Average broke a new 52-week high.

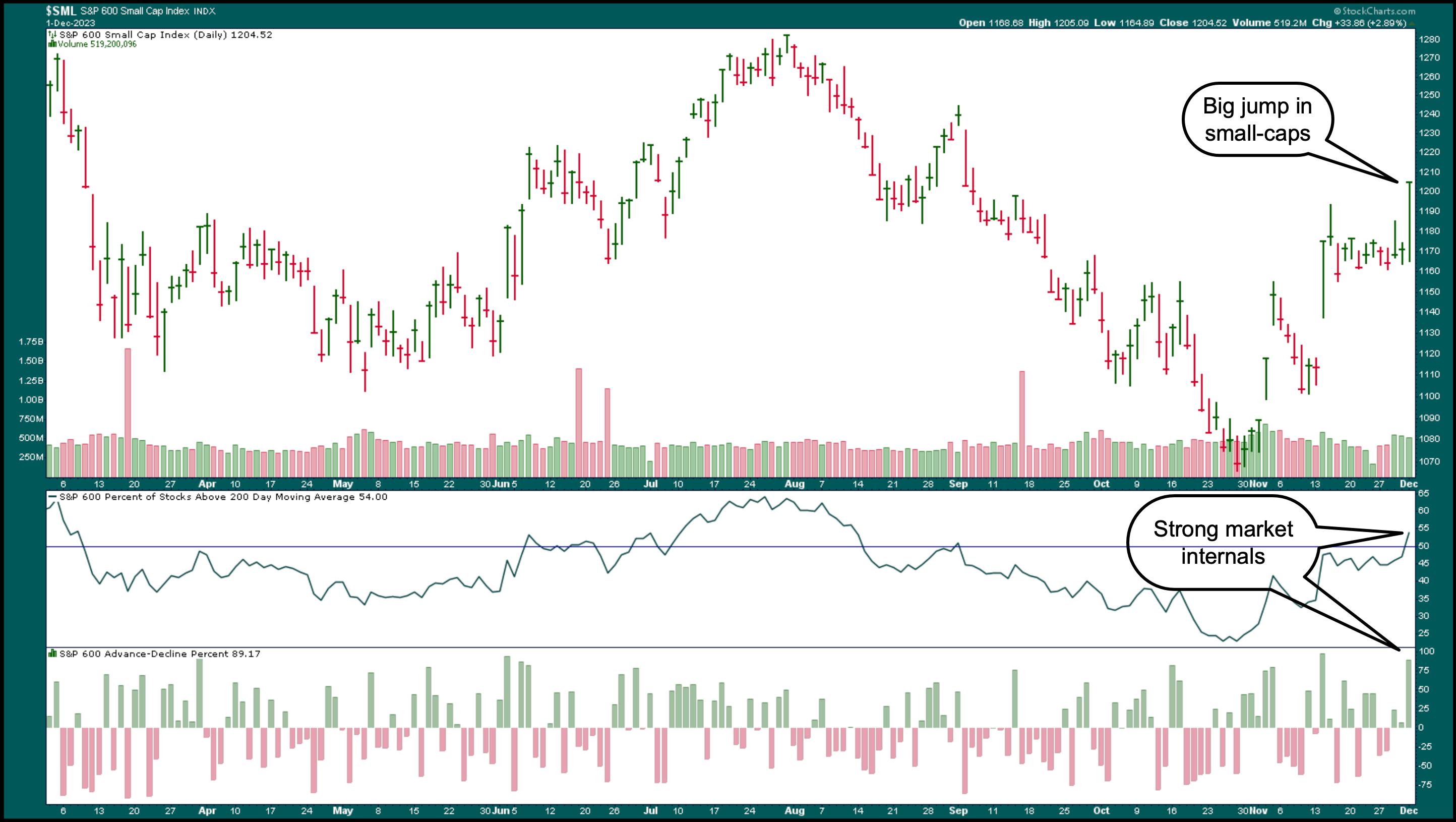

- The S&P 600 small-cap index led the rally, rising 2.89%.

The stock market got off to a good start on the first trading day of December. The S&P 500 ($SPX) closed at a 2023 high, the Dow Jones Industrial Average ($INDU) hit a new 52-week high, and the Nasdaq Composite Index ($COMPQ) also closed higher. Small-cap stocks led the rally, with the S&P 600 Small Cap Index ($SML) rising 2.89%. It is noteworthy that small-cap stocks are strengthening the internal structure of the market. The percentage of S&P 600 stocks above their 200-day moving average is over 50%, and the rising-drinking line is in positive territory.

Chart 1: Small-cap stocks rising. It is common for small-cap stock prices to rise in December. Keep an eye on how this asset group performs. This could indicate market performance in 2024.Chart source: StockCharts.com. For educational purposes.

November was a very good month for the stock market, with the broad indexes continuing their solid gains. The S&P 500 rose nearly 9% for the month, while the Nasdaq Composite ended November up 10.7%.

Much of the stock market rally can be attributed to stock market bets that the Federal Reserve will start cutting interest rates. Fed Chairman Powell’s comments on Friday were similar to what he has said in the past, further reassuring investors.

stock market seasonality

This type of market action is not uncommon in the stock market this time of year. In recent episodes final bar, David Keller, CMT, our Chief Market Strategist. Stock Trader’s Almanac, which describes typical seasonal patterns during the end of the year and the first few months of an election year. So far, the market is consistent with what the almanac predicts. If this situation continues, 2024 is likely to be a strong year for the stock market.

The only certainty when analyzing the stock market is that nothing moves as expected. So, as a trader or investor, you need to know that if things don’t go as expected, it’s an early sign that something is likely to go wrong.

The beginning of December tends to be stagnant for tax loss sales. The sell-off could unsettle some investors, especially after a strong November. However, December is an important month for seasonal patterns such as the January Effect and the Santa Claus Rally.

january effect

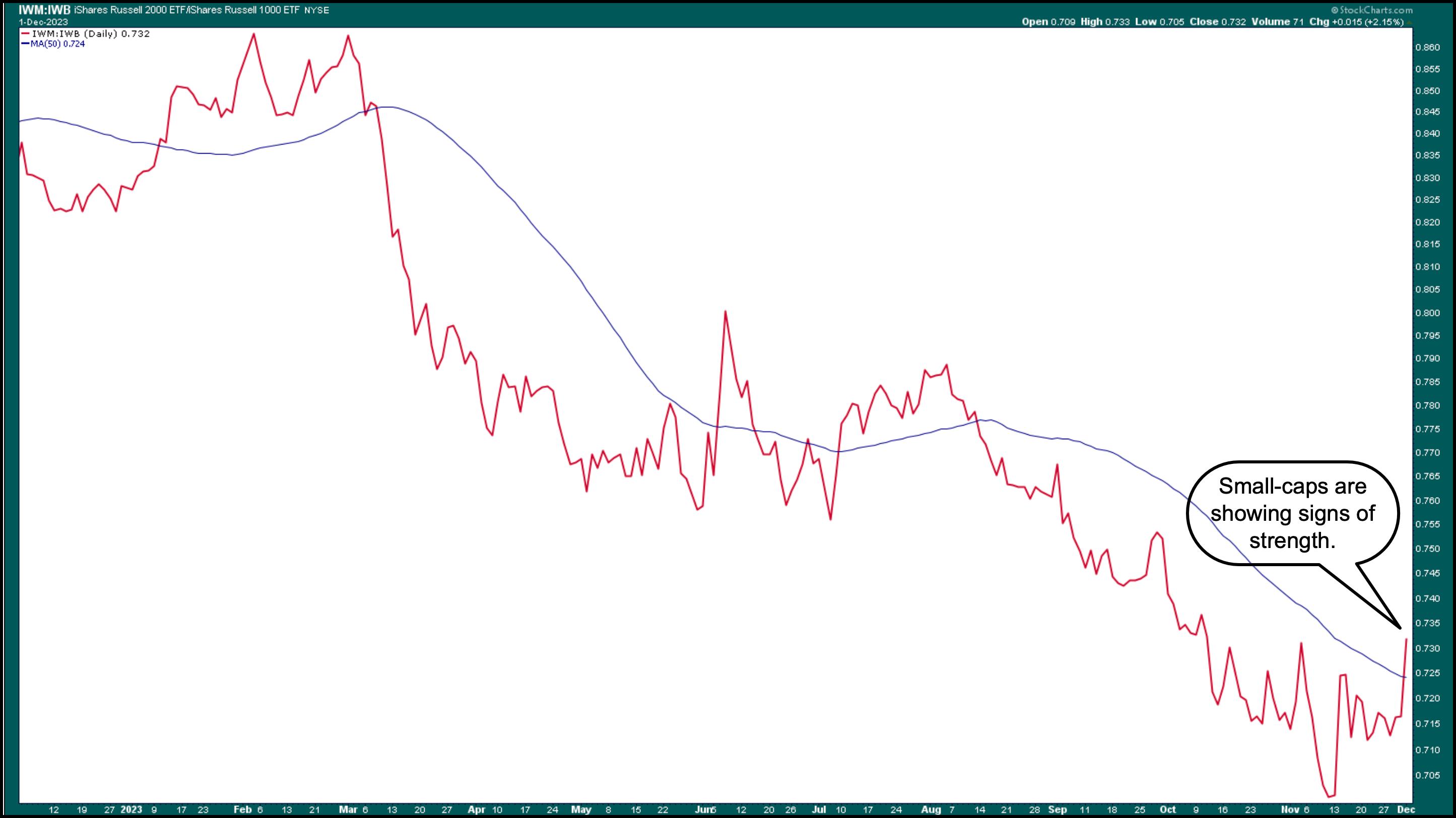

The January effect, which begins in mid-December, is a phenomenon in which small-cap stocks failed to participate in the bull market experienced by large-cap stocks. But they are showing signs of taking off. The chart below shows the ratio between the iShares Russell 2000 ETF (IWM) and the iShares Russell 1000 ETF (IWB). Breaking the 50-day simple moving average means that small-cap stocks, represented by IWM, are showing strength. Small-cap stocks are worth watching as we approach mid-December.

Chart 2: Small Cap VS. Big capital letters. Analyzing the ratio of small and large stocks, it appears that small stocks are starting to show strength.Chart source: StockCharts.com. For educational purposes.

santa claus rally

The Santa Claus Rally, held on the last five trading days of December and the first two trading days of January, is also important. If this brief rally doesn’t materialize, move with caution in 2024. That doesn’t mean you should sell your stocks. Instead, you can rebalance your portfolio based on market conditions. For example, if defensive sectors are outperforming other sectors, you may want to allocate more of your portfolio to defensive stocks, such as consumer staples, instead of aggressive sectors. Depending on how commodities perform, you may want to allocate more weight to energy or gold stocks.

january barometer

Next year is an election year, so the first half of the year will be important. The course of the year depends on your performance in January. that much Stock Trader’s Almanac We cover a variety of seasonal patterns you can expect early in an election year. Also look at the fundamentals, especially interest rates. Whether the Federal Reserve cuts interest rates will have an impact on the stock market.

conclusion

So, as we approach the last month of the year, watch penny stocks, note how the market moves over the last five trading days and the first two trading days of 2024, and watch how January plays out. If all goes as expected, 2024 will be an optimistic year.

weekend wrap up

US stock index rises; reduced volatility

- $SPX was up 0.59% at 4594.63, while $INDU was up 0.82% at 36245.50. $COMPQ was up 0.55% at 14305.03.

- $VIX was down 2.24% at 12.63.

- Top performing sector this week: Real Estate

- Worst performing sector this week: Telecommunications services

- Top 5 Large Cap Stocks SCTR Stocks: Coinbase Global, Inc. (COIN); PDD Holdings, Inc. (PDD); Vertiv Holdings, LLC (VRT); New Oriental Educational Technology Group (EDU); CrowdStrike Holdings, Inc. (CRWD)

On the radar next week

- Factory orders received in October

- October ISM Service PMI

- October JOLT recruitment notice

- November Nonfarm Payroll

- November Unemployment Rate

disclaimer: This blog is for educational purposes only and should not be construed as financial advice. You should not use any of our ideas and strategies without first evaluating your personal and financial situation or consulting a financial professional.

Jayanthi Gopalakrishnan is the Director of Site Content at StockCharts.com. She spends her time creating content strategies, providing content to educate traders and investors, and finding ways to make technical analysis fun. Jayanthi was the Editor-in-Chief of T3 Custom, a content marketing agency for financial brands. Prior to that, she served as editor-in-chief of Stocks and Commodities Technical Analysis magazine for over 15 years. Learn more