Is the ‘Vibe-Cession’ for American consumers disappearing?

TommL

By Eric Winograd.

Falling inflation has not yet translated into good feelings among U.S. consumers. This may change based on the latest data.

Over the past few months, analysts have coined a new term to describe this chaotic America. Economic environment: “Atmosphere transfer”. There appears to be a wide gap between economists’ optimistic assessments based on incoming data and the stubborn pessimism among consumers. To put it bluntly, consumers aren’t feeling it.

We think there’s a very simple reason for the gap. Plus, I think the door is starting to close now.

By most economic indicators, 2023 has been an exceptionally good year. Headline inflation growth, as measured by the Consumer Price Index, has cooled noticeably, and this has been done without the recession that many forecasters had deemed necessary to rebalance inflation just a year ago. Unemployment remained below 4%, wage growth outpaced inflation, and The stock market ended the year at an all-time high.

Despite all the good news, most measures of consumer confidence remain subdued at best, which poses a conundrum of sorts. But we see explanations and solutions.

Inflation is a matter of perspective

First of all, economists and policymakers view inflation very differently than households do.

Monthly inflation data measures the rate of change in price levels. So even if inflation falls from 9.1% to 3.4%, as it has over the past 18 months, prices will still rise, but at a slower pace. There are good reasons why policymakers focus on the rate of change rather than the level of prices. Because nothing can be done today to deal with yesterday’s prices. They can only affect tomorrow. To do this, you need to look at how much the price changes. Not how high.

Financial markets naturally monitor inflation over much shorter periods of time. The market’s rebound in recent weeks has come as three- and six-month inflation rates have fallen back to the Fed’s target inflation rate. These developments suggest that interest rate cuts will occur in the coming months.

Households experience inflation in very different ways.

Some inflation components (notably rent and housing) are more important to households than contributors to the overall price index, and these components were particularly high. It also made clear that while markets can only look back a few months and policymakers perhaps a year, consumers have a much longer memory for the past few months.

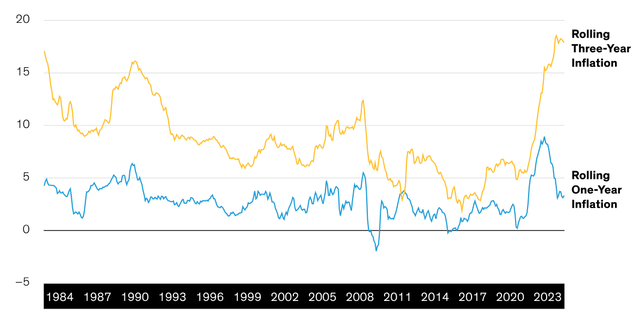

This distinction creates a much different perspective on pricing. Looking back over a one-year period, inflation may seem somewhat normal today, but over a three-year period, prices rose more than at any time since the early 1980s.Denote). It is understandable that households remain skeptical about the growing confidence of policymakers and the market’s belief that inflation has already been crushed.

From a three-year perspective, inflation is still at a 40-year high.

Consumer Price Index, percentage change

Past performance does not guarantee future results.

Until December 31, 2023

Source: LSEG Datastream and AllianceBernstein (AB)

Signs of improving consumer sentiment are encouraging

The most important questions for the economic outlook going forward are: How long does a consumer have a memory?

Policymakers are not interested in lowering prices. Deflation will almost certainly lead to a deep recession and, in the long run, will have a more destructive effect on economic growth than inflation. The best they can do is to restore inflation to normal rates, but that has not yet left households feeling good about the situation. Because household consumption accounts for about two-thirds of gross domestic product (GDP), moderating pessimism is critical to promoting economic growth.

Recently, encouraging news was reported in this regard.

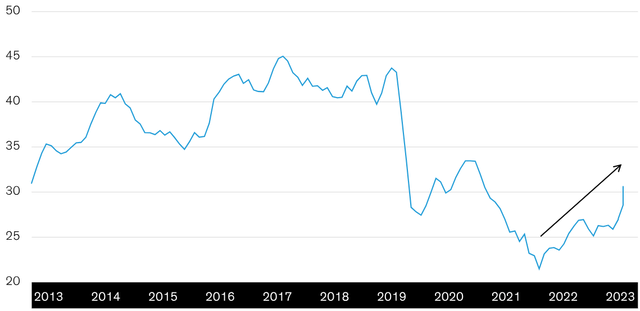

Consumer confidence has risen, particularly in relation to households’ assessment of the future state of the economy and their finances. The share of households expecting their financial situation to get better over the next six months is still below pre-pandemic levels, but has increased by nearly 10 percentage points over the past few quarters.Denote).

Households are feeling better about their financial prospects

Percentage of respondents who expect their financial situation to have improved in one year

Past performance does not guarantee future results.

Combine the responses “somewhat better” and “much better.”

Until December 31, 2023

Source: LSEG Datastream and AllianceBernstein (AB)

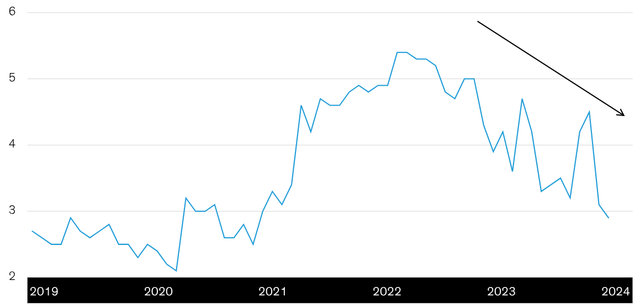

This increase in optimism is consistent with a clear downward trend in consumer expectations about future inflation rates (Denote), which suggests that there is a statute of limitations. past The inflation rate may be coming to an end. It appears that households are paying more and more attention to the price fluctuation rate according to the ‘new normal’ price level.

Consumer inflation expectations are on a clear downward trend.

Consumer inflation expectations one year from now (%)

Current analysis does not guarantee future results.

Until January 19, 2024

Source: LSEG Datastream and AllianceBernstein (AB)

Falling inflation expectations provide as much positive news as rising overall consumer sentiment. The reason is that inflation expectations tend to be self-reinforcing. Actual future inflation is greatly influenced by the extent to which individuals, businesses and governments expect inflation. Because expectations drive economic decisions.

What should we think about all this? It is clear that we have not yet reached the end of inflation. However, recent data shows that our forecast that inflation will continue to decline from 2024 to 2025 remains the most likely outcome. As that scenario unfolds, the consumer may feel better or the “vibe” may disappear. This would be good for the US economy.

The views expressed herein do not constitute research, investment advice or trading recommendations and do not necessarily represent the views of the entire AB Portfolio Management team. Views may be modified over time.

original post

Editor’s note: The summary bullet points for this article were selected by Seeking Alpha editors.