Sysco Stock: Reasonable Value (NYSE:SYY)

champion

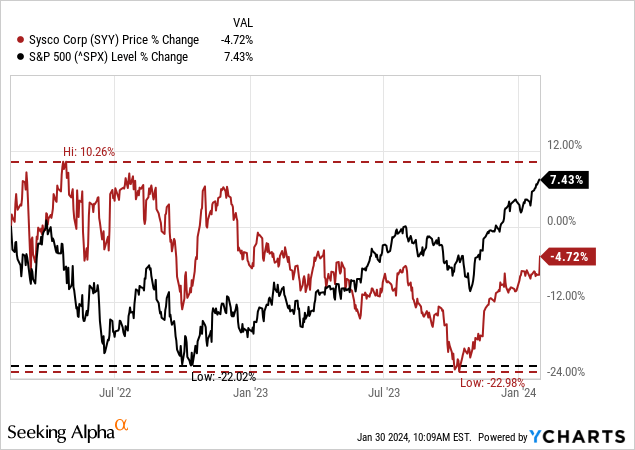

On Tuesday, Cisco Corporation (New York Stock Exchange: SYY) reported its second quarter fiscal 2024 results, and in the first hours of trading, it appears investors were quite satisfied with the results, with the stock rising nearly 4%. my last article The information about Sysco was released almost two years ago, in February 2022, and the stock hasn’t moved much since then. I rate the stock a ‘Hold’, which was probably the right decision since investors have only been collecting dividends.

And while the S&P 500 hasn’t invested much in the past two years, Sysco still underperformed the index. Let’s take advantage of the quarterly results to provide an update on Sysco and ask if the stock is still a “hold.”

2nd quarter results

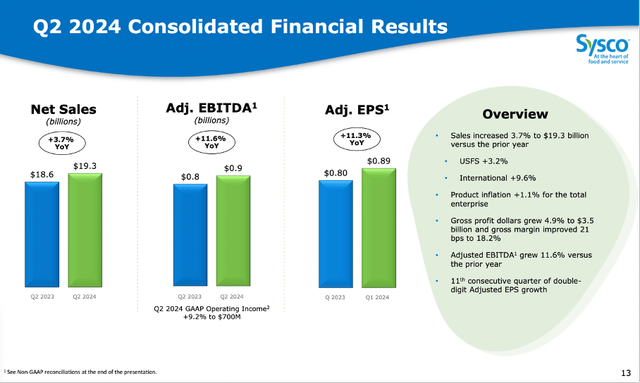

Here are the results reported by Sysco: less in line with expectations. Although revenue was slightly off, the company could slightly beat earnings-per-share expectations. But missing $30 million on $19.3 billion in revenue isn’t really worth mentioning, and you can see the results are in line with expectations.

Sysco 2/24 Presentation

Sysco’s revenue could increase 3.7% year-over-year, with revenue increasing from $18.594 billion in the second quarter to $19.288 billion in the second quarter. Operating profit increased from $641 million in the same quarter last year to $700 million this quarter. Finally, diluted earnings per share nearly tripled, from $0.28 in the second quarter of 2023 to $0.82 this quarter. But the reason for the jump in income can be traced to last year’s quarter, which included a charge of $315.4 million in pension settlement costs and other related costs.

Looking at adjusted earnings per share, we see an increase of 11.3% year-over-year to $0.89, which Sysco reported on November 11th.Day Delivered consecutive double-digit adjusted EPS growth.

Reaffirm the instructions

In addition to the results meeting analysts’ expectations, Sysco also reaffirmed its guidance for fiscal 2024. For the full year, management expects revenue of $80 billion and adjusted earnings per share in the range of $4.20 to $4.40. This will result in mid-single-digit increases in revenue and mid-single-digit increases in earnings per share.

Increase in share repurchase scale

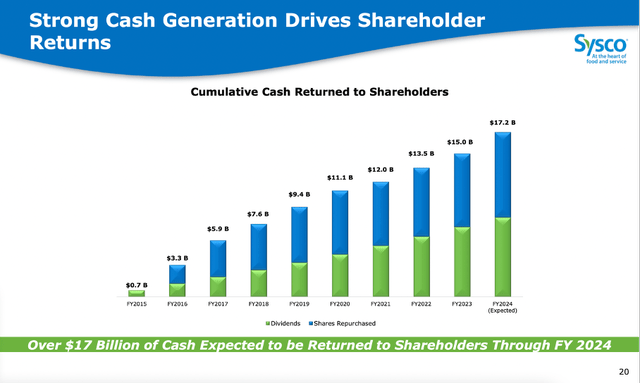

Management also announced that it will return approximately $2.25 billion to shareholders in fiscal 2024. And if Sysco pays about $1 billion in dividends each year, that would mean it would spend $1.25 billion on share buybacks. Previous buyback expectations were only $750 million, but given its current market capitalization of $38 billion, Sysco could repurchase approximately 3.3% of its outstanding shares in 2024.

Sysco has never purchased stock at an aggressive rate, but has consistently reduced the number of shares outstanding. Over the past decade, the number of shares outstanding has decreased from approximately 600 million shares to the current 507 million shares, while the cumulative cash returned to shareholders (dividends and share buybacks) has increased each year.

Sysco 2/24 Presentation

growing family

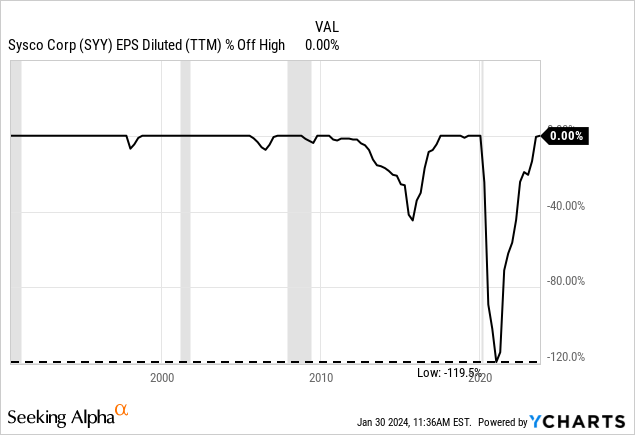

Looking at Sysco, we can be very optimistic about its long-term growth because the company appears to be benefiting from several long-term trends that are providing tailwinds for the company. The COVID-19 pandemic and subsequent closures were a shock to Sysco. This can be seen in the results and stock price charts, but many trends appear to be continuing on their “pre-COVID path.”

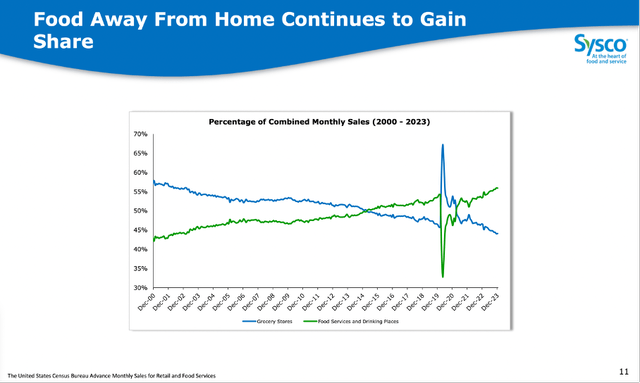

Sysco 2/24 Presentation

If we look at the percentage of grocery store sales versus food service and bar sales, we can see a clear trend over the past 25 years. While grocery stores continue to lose market share (except for a few quarters when grocery sales surged during COVID-19), food service and drinking venues have been gaining market share and currently already have a 55% market share.

Sysco 2/24 Presentation

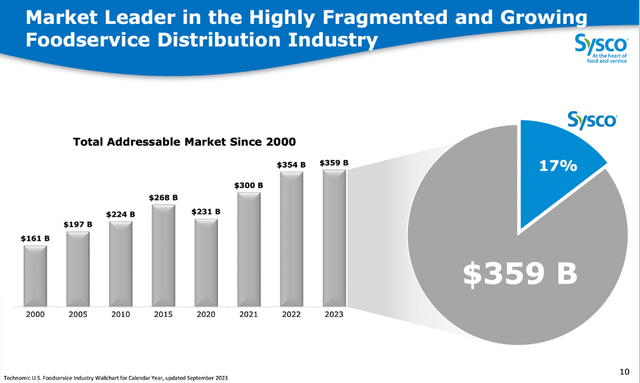

This has also resulted in the continued growth of Sysco’s overall addressable market over the past several decades. Once again, we will clearly see a COVID-19 impact in 2020, but the total addressable market exceeds pre-COVID levels and is now worth $359 billion, with Sysco holding a 17% market share.

And management doesn’t seem to be the only one optimistic about future growth. Analysts also expect high single-digit growth rates in the coming years. Analysts expect earnings per share to grow at a CAGR of 8.50% between FY 2023 and FY 2028.

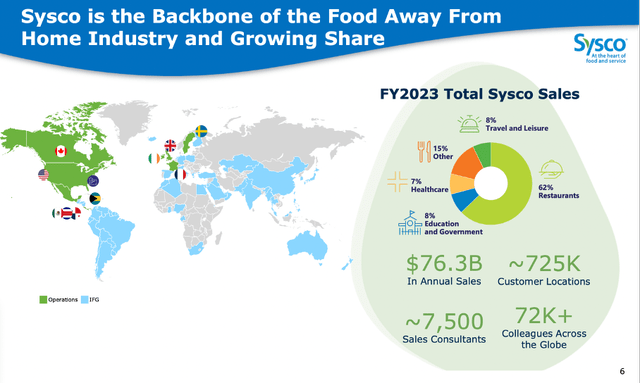

But I’m also cautious

I have now mentioned in several articles (see for example here and here) that I will be somewhat cautious in the coming quarters. If a recession occurs, Sysco may be one of the companies that could be hit hard. The largest portion of sales comes from distributing food to restaurants, and usually during difficult economic times, people visit restaurants less often. On the other hand, education, government offices, and hospital sectors are likely to have stable sales even in a recession (however, these two sectors account for only 15% of sales). And when we talk about restaurants, we must distinguish between expensive restaurants, fast food chains and cafeterias. If a recession were to occur, Sysco’s sales might not fall at all (but be cautious about high growth rates) because people might eat out less at expensive restaurants and instead dine at restaurants more often.

Sysco 2/24 Presentation

And looking at the charts, one could make the argument that the trend will continue and that a breakout will occur in the coming quarters. However, it seems likely that Sysco will not be able to break above the resistance level, currently in the $85-$90 range, and the stock could fall once again.

reasonable value

All in all, we could argue that Sysco is quite valuable at this point. When using discounted cash flow calculations to determine Sysco’s intrinsic value, as always, we calculate it at a 10% discount rate. We used the last four quarters of free cash flow ($1.999 billion) as the basis for our calculations, and looking at the numbers over the past 10 years, this seems like a reasonable assumption. We also calculate 507 million shares outstanding and assume 5% growth from now until forever. Using these assumptions, Sysco’s intrinsic value is $78.86, which means the stock is worth quite a bit at this point.

We could also argue that 6% annual growth for bottom lines is reasonable. All other assumptions being equal, Sysco’s intrinsic value would be $98.57, at which point the stock would be undervalued.

As already mentioned above, the valuation seems reasonable at this point, but these growth assumptions do not take into account the risk of a future recession. While Sysco has performed quite well during past recessions (2020 was an outlier rather than a “normal” recession), 5% or 6% annual growth may be too optimistic, so we should be somewhat cautious in the coming years.

conclusion

I would continue to view Sysco as a “hold” stock at this point and would rate it somewhat fairly. I think there is some upside potential, but given the level of resistance on the charts and the risk of a recession, I don’t think I would invest in Sysco at this point. It’s like trying to reduce your position without investing in many other stocks.