you will return to dust

Consider a doomsday scenario. You’ve spent the last few years diligently averaging your dollar costs and withdrawing them to your wallet. You have a very small UTXO.OneAnd Bitcoin transaction fees are so high that your Bitcoin will turn to dust.2. Bitcoin is no longer available. For some Bitcoin users, this is not a doomsday scenario, it is a reality they have experienced over the past six months.

In 2023, Bitcoin transaction fees have seen very large fluctuations, as have Ordinals.three There has been a surge in new Bitcoin users and a significant increase in demand for blockspace. Despite positive reports about the Bitcoin Spot ETF approval, users are facing serious challenges due to high transaction fees, especially for those holding small UTXOs. In some cases, UTXOs were useless and turned to dust. These transaction fee issues have led many people to ask the question, ‘How do I know if my UTXOs are at risk?’ In this article, we will look at where dust is created and try to help you create at least a plan to mitigate these risks.

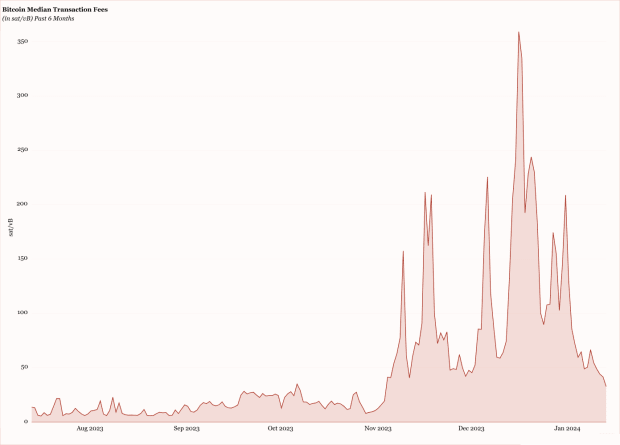

Bitcoin median transaction fees based on sat/vB over the past 6 months

Over the past six months, we have seen the median Bitcoin transaction fees fluctuate significantly. We have seen mempools clearing out to 0 sat/vB and soaring to over 350 sat/vB. This may not mean much at face value, but it could mean major difficulties for users sending multiple small SegWit UTXOs in a single transaction. In fact, some users have seen their UTXOs turning to dust. This clearly caused panic and, for some, a costly lesson in UTXO management. This article does not explain UTXO management strategies. This article is trying to say that you absolutely want large UTXOs. If Bitcoin works the way we think it does, multiple UTXO transactions as small as 0.001 BTC may be impossible to spend in a high-fee environment and you can wave goodbye to the dust.

Before looking at your data, you need to define what you want to see. We are trying to understand whether UTXOs are consumable or dust (non-consumable). For this you will need:

- Total of UTXOs transferred

- gross weight unit4

- Transaction fee sats/vB

Using this information, we can create a formula that shows how much value is transferred in a Bitcoin transaction after removing transaction fees.

Transferred Value = Transferred BTC – ( ( ( Total Weight Units / 4 ) * Transaction Fee in sats/vB ) * 0.00000001 )

If the transmitted value is negative, it means there is dirt, and the UTXO sum costs more to transmit than it is worth. Calculating Bitcoin transaction weight units is somewhat complicated, so we will use realistic scenarios to build our tables, assumptions, and recommendations.

This example uses five basic SegWit (P2WPKH) financial transactions using the following weight units:

- Single input, single output, single signature, single public key, SegWit transaction (P2WPKH script) total weight units is approximately 440 weight units.

- Five inputs, single output, single signature, single pubkey SegWit transaction (P2WPKH script) total weight units is approximately 1,528 weight units.

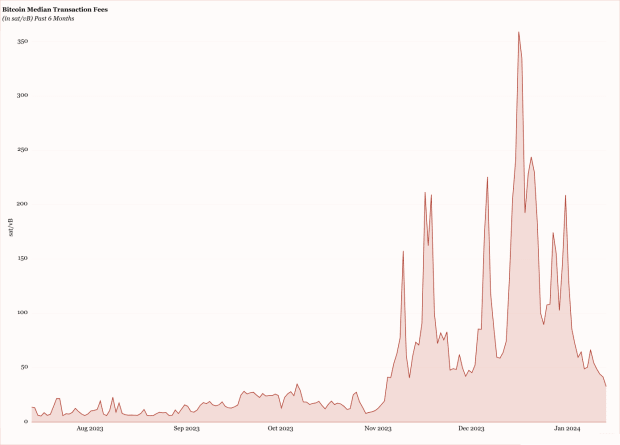

Using the above formula and a SegWit transaction with 5 inputs of 1,528 weight units, we built the following dust table:

dust table

The dust table was calculated as 1,528 weight units.5 SegWit inputs the example above.

The Dust Table shows some important information. Dust is a reality, and the threshold is lower than you think. As transaction fees continue to rise, higher value UTXOs become more risky. When transaction fees were at their peak over the past month, our example transaction, even .001 BTC, would have been dusted. In current market conditions, that’s just under $50. I think it’s really unbelievable. 100,000 vomit suddenly turned into dust. All written. Unable to write. This is truly terrible.

Although this example scenario may not affect everyone, the lesson is very clear. Create a big UTXO! For long-term storage, UTXO should not be kept smaller than 0.01 BTC. Last year we saw over 300 sat/vB fees and this will become increasingly the norm. In that fee market, multiple UTXO transactions smaller than .001 are dust. Don’t be that person.

Today dust may be an afterthought. We are blessed with returns under 50 sat/vB fees, but dust can become a costly problem in the future if not taken care of today. By understanding the relationship between UTXO weight units and transaction fees, you can gain valuable insight into the lower limit size of UTXO.

extreme dust

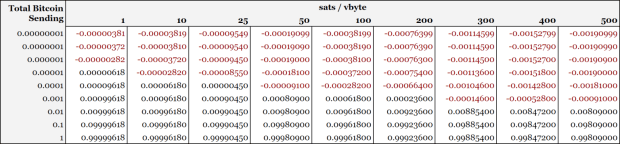

Modeling the dust threshold for UTXOs is an interesting experiment. Because it shows how crazy things have to happen and at what point BTC turns to dust. The table below uses the same data described above, namely 5 input SegWit transactions of 1,528 weight units.

This table shows the fee rate at which the amount of BTC transferred in a 1,528 weight unit transaction would turn to dust.

UTXO signature

Another key finding in all of this research is the cost of signing a single standard (P2PKH) UTXO. This is extreme on the small side because it is one of the smallest transactions you can make. For this example, we are going to use a standard script (non-segwit). This is because standard scripts are the heaviest of the script types. The specific details are as follows:

- Standard (P2PKH) script type

- 1 input

- 1 public key

- 0 output

- 632 weight units

economics signature

Economics of signing a single standard UTXO with one signature, one public key, and 632 weight units of zero output.

This information will help you understand the minimum cost of a Bitcoin transaction.

Key Takeaways

- Dust threshold is lower than you might think. This is especially true in markets with high trading fees.

- When withdrawing BTC from an exchange, we recommend waiting until your balance is above 0.01 before sending it to storage.

- If you have many small (< 0.001 BTC) UTXOs, you should consolidate them into larger UTXOs when the fees are lower.

You don’t have a crystal ball and there is only so much you can control. BTC price, block space demand, hash price, hash rate and Bitcoin in general are out of our control. You are in control of your keys, and the best thing you can do is prepare for the inevitable high fee market. Either that will happen or Bitcoin will fail. I don’t make the rules. Prevent your precious Bitcoin from turning to dust. Remember this: If we do nothing, we will return to dust.

By the sweat of your face you will eat meat until you return to the earth, for out of it you were taken. For you are dust and to dust you will return.

-Genesis 3:19

footnote

- UTXO (unspent transaction output): (n.)

A component of a Bitcoin transaction that represents an amount of digital currency that has not yet been used and can be used for future transactions.

The output of a blockchain transaction that can be used as input for a new transaction, representing the amount of cryptocurrency remaining after the transaction has been executed. ↩︎ - In the Bitcoin protocol, dust refers to a small amount of currency that is lower than the fees required to use it in a transaction. Although “economically irrational,” dust is often used to achieve disruptive side effects rather than exchange value. ↩︎

- The ordinal epitaph as a phenomenon has been around for a little over a year now and has made waves in Bitcoin. They are melting some people’s brains, but it will eventually come at a price. ↩︎

- Unit of weight (n.) (Bitcoin)

A unit of measurement used in the Bitcoin network specifically introduced with the Segregated Witness (SegWit) protocol to calculate the size of transactions and blocks.

It is a composite measure that takes into account both non-witnessed data (e.g. transaction inputs and outputs) and witness data of the transaction (e.g. signatures). In this system, non-witness data is given greater weight than witness data.

SegWit is a standard that enforces block size limits in the protocol, with a maximum weight unit of 4,000,000 per block, allowing block space to be allocated efficiently and flexibly. ↩︎ - Use Lopp’s open source trade calculator. Link ↩︎