E Split Stock: Enbridge’s Economic Moat Weakens (TSX:ENS:CA)

Erliffe

A few months ago, I worked with E Split Corp. (TSX:ENS:CA), which looks at the mechanics of the split stock company structure and some specific features of ENS. Because E Split Corp. is an inherently leveraged company, Enbridge Inc. (ENB), In this article, I will offer some thoughts on Enbridge’s prospects.

(Author’s note, figures in this article are in Canadian dollars unless otherwise specified.)

Brief fund overview

First, for those who are not familiar with the spin-off corporate structure, it is a unique structure found only in the Canadian capital market. Because I’ve never seen it anywhere else. Essentially, ENS is a closed-end investment fund that raises capital from investors and purchases Enbridge’s common stock.

But instead of holding Enbridge’s common stock, ENS itself is split into two share classes. It provides shareholders with fixed, cumulative preferred quarterly cash distributions and a preferred return of the original issue price of $10.00 at maturity. And there is a leveraged ‘Class A’ common stock class that provides shareholders with non-cumulative monthly cash distributions and capital appreciation opportunities through exposure to the underlying portfolio of ENB shares (Figure 1).

Figure 1 – ENS overview (middlefield.com)

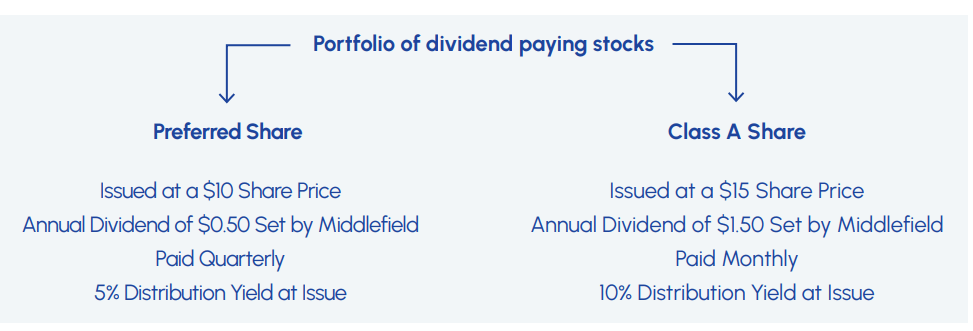

There are several key risks investors should be aware of when considering common stocks. First, the Class A shares are essentially a leveraged bet on Enbridge stock. If Enbridge performs well, the total return on its Class A stock will increase (Figure 2). However, if Enbridge underperforms, as it did in 2020, its Class A stock could also see a significant decline.

Figure 2 – ENS common stock is a leveraged bet on ENB stock. (ENS data sheet)

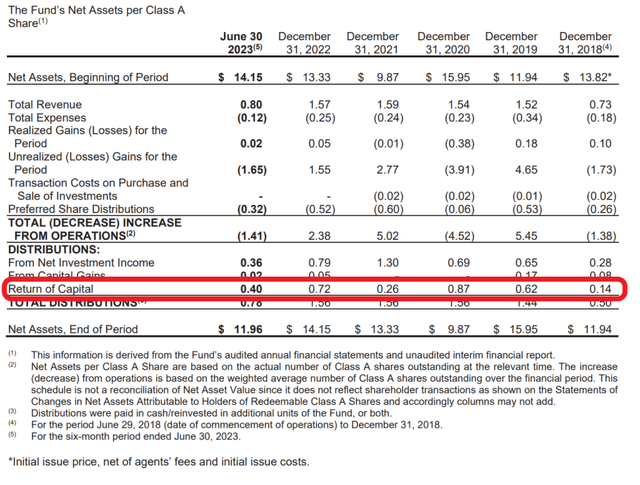

Another risk with ENS stock is that the distribution will not be funded entirely from underlying Enbridge stock dividends. In fact, ENS’ financial reports show that a significant portion of its distributions are funded by NAV amortized return on capital (“ROC”) (Figure 3).

Figure 3 – ENS distribution using ROC (ENS semi-annual report)

It is very important to track the ROC and the net asset value of the stock because if the NAV of the entire structure (preferred stock + Class A) falls below $15, Class A stock distributions will cease.

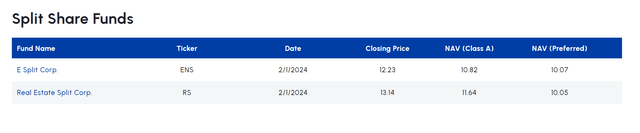

Investors can monitor the NAV of ENS on the manager’s website (Figure 4). Judging by ENS stock’s current market price ($12.23) and recent NAV ($10.82), ENS stock is trading at a 13% premium to NAV.

Figure 4 – ENS NAV (middlefield.com)

Enbridge – the dominant liquid pipeline company

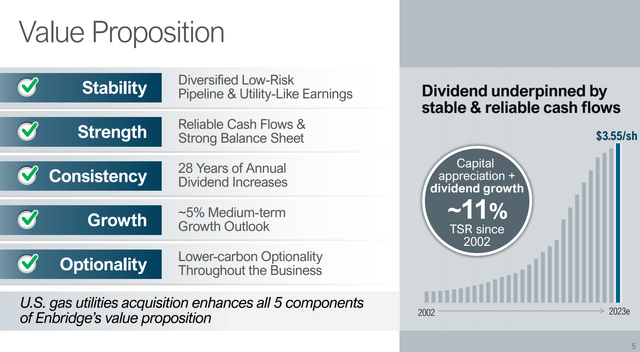

One of the main reasons I am hesitant to recommend ENS is because it is a leveraged bet on a single company, Enbridge. Enbridge is a diversified pipeline and utilities conglomerate that has achieved consistent dividend growth and capital appreciation for 28 years (Figure 5).

Figure 5 – ENB overview (ENB Investor Briefing Session)

But even though Enbridge remains dominant in its core pipeline business, risks are emerging.

Race to launch mainline service in coming months

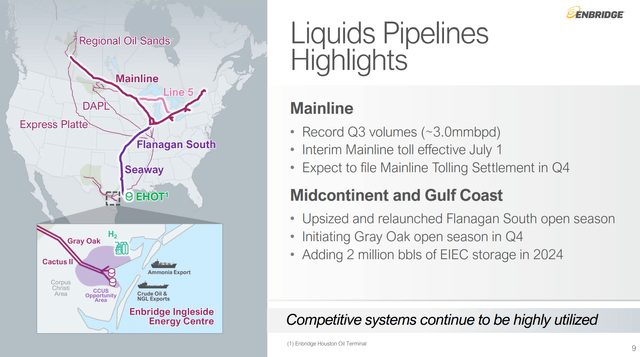

First, Enbridge’s most important asset is its mainline system, which controls more than 70% of Canada’s takeout capacity and connects to U.S. refineries on the Gulf Coast. Due to connections to refineries, demand on the mainline is fairly stable in the short and medium term (Figure 6).

Figure 6 – Mainline overview (ENB Investor Briefing Session)

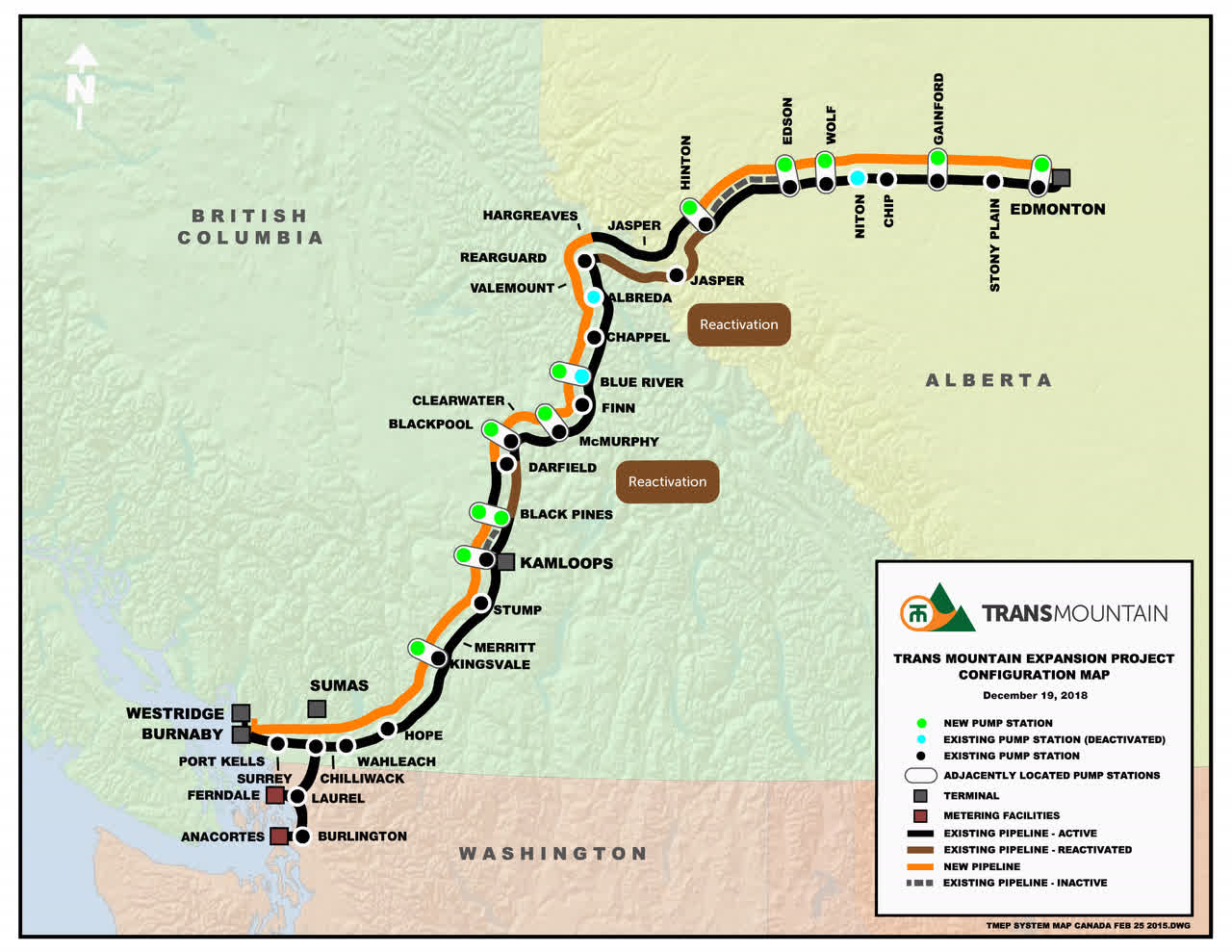

But there are two risks to the mainline. First, TC Energy’s (TRP) Trans Mountain pipeline expansion race is nearly complete and beginning to attract shippers’ attention (Figure 7).

Figure 7 – Trans Mountain Pipeline Overview (transmountain.com)

Trans Mountain will compete directly with Mainline for oil currently produced within Alberta. Historically, Canadian crude has traded at a steep discount to international blended crudes because takeaway capacity has been dominated by mainlines. This new pipeline will help Canadian oil reduce its discount to international benchmarks.

In response to this new threat, Enbridge has proactively reduced tolls on its mainline pipeline. This will allow mainlines to operate close to full capacity, but with a potential hit to profitability.

Will oil sands become a stranded asset?

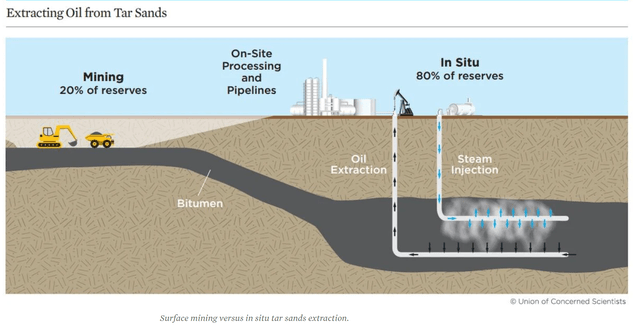

Moreover, both the Mainline and Trans Mountain pipelines transport Canadian heavy crude oil from the oil sands to the United States and around the world. As ESG issues become front and center, the world may turn its back on highly polluting oil sands (unlocking the hydrocarbons requires heating water and injecting it into the tar-like oil sands) (Figure 8).

Figure 8 – Exemplary oil sands extraction technology. (ucsusa.org)

In a few years, the Canadian oil sands and Enbridge’s Mainline could become stranded assets as the global economy transitions away from hydrocarbons.

Diversification into gas utilities could lead to strong buying

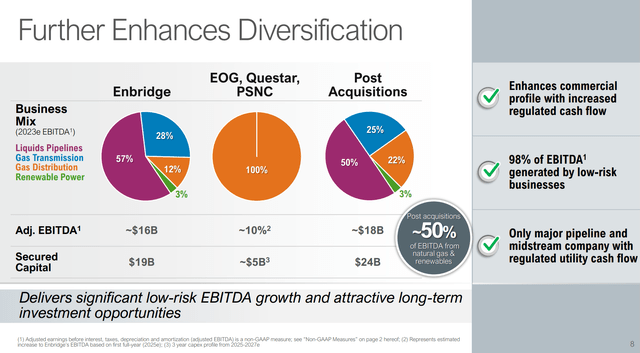

Recently, Enbridge announced plans to diversify its business by acquiring several gas distribution utilities from Dominion Energy. Enbridge will acquire Eash Ohio Gas Company (“EOG”), Questar Gas Company and Public Service Company of North Carolina (“PSCNC”) from Dominion for $19 billion in cash and assuming $6 billion in debt (Figure 9). ).

Figure 9 – Enbridge is diversifying into gas distribution. (ENB Investor Briefing Session)

The move makes strategic sense because it reduces Enbridge’s dependence on its declining liquids pipeline business, but it also increases the likelihood that Enbridge will overpay.

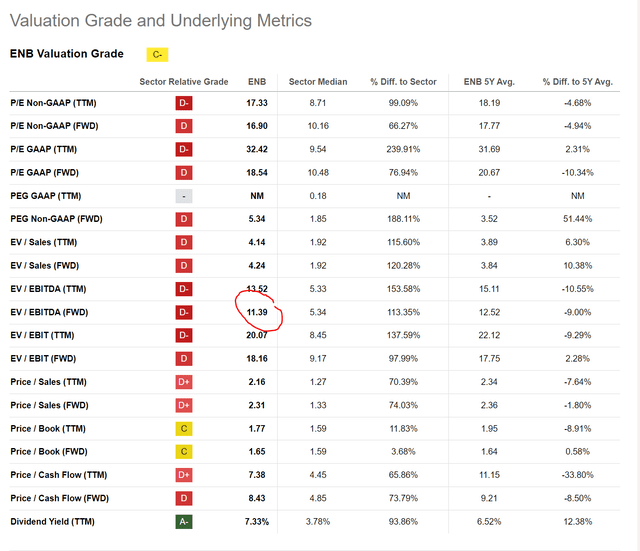

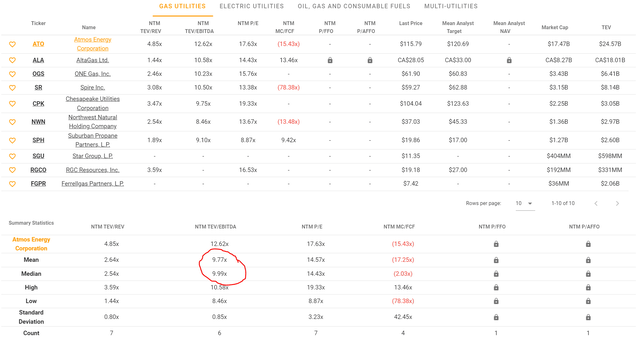

For example, according to Figure 9 above, Enbridge is paying $25 billion in cash + debt to add ~$2 billion to EBITDA, or 12.5x EV/EBITDA. However, Enbridge is trading at only 11.4x Fwd EV/EBITDA (Figure 10).

Figure 10 – ENB evaluation (Look for alpha)

Additionally, Enbridge’s purchase price appears high, with the gas utility group trading at only about 10x Fwd EV/EBITDA (Figure 11).

Figure 11 – Gas Utility Transactions have a 10X EV/EBITDA. (tikr.com)

5% growth outlook risk mitigation

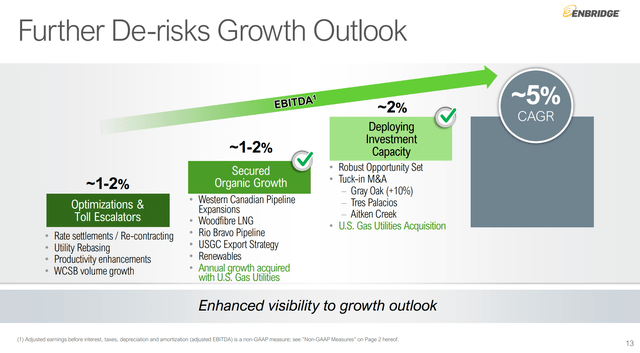

However, on the positive side, the addition of a gas utility expands the company’s organic growth opportunities (in population and rate-based growth) and improves its prospects for additional tucks, thus de-risking Enbridge’s long-term 5% growth outlook. -Arguments (Figure 12).

Figure 12 – ENB risk resolution growth outlook (ENB Investor Briefing Session)

conclusion

Overall, I continue to recommend caution with ENS common stock. Because this fund is essentially a leveraged bet on Enbridge. Although the forward distribution yield for Class A common stock is 12.7%, investors need to recognize that a significant portion of the distribution is simply a return on the investor’s own capital.

Moreover, Enbridge’s economic moat is weakening as new competing pipelines are scheduled to enter service. In the long term, Enbridge’s mainline is tied to oil production in Canada’s oil sands. If the oil sands are phased out due to environmental concerns, Enbridge’s assets could be stranded.

Finally, while Enbridge’s recent gas distribution diversification has reduced the company’s dependence on liquids distribution, there is a risk that Enbridge may be a ‘buy high.’

I personally do not like the reward/risk profile of ENS common stock and continue to rate ENS common stock. holding it