Global Gold Analyticals April 2, 2024 – Analysis and Forecasts – February 4, 2024

Weekly Gold Technical and Fundamental Analysis – February 3:

Last week, global gold ounces gained momentum, reaching around $2,065, the highest since early January 2024. However, it gave back some of its profits just before the end of the working day, ending the week at $2039.

Now, with no significant economic news coming next week, gold could be affected positively or negatively depending on what U.S. central bank officials say.

Events in the gold market last week:

Global gold prices rose about 0.69% to $2,037 at the start of the foreign exchange trading day last week due to heightened geopolitical tensions and a drop in the US 10-year Treasury yield.

Fears are growing that the crisis in the Middle East is escalating following news that a drone strike on a U.S. military base near the Jordan-Syria border killed three people and wounded more than 20 soldiers.

Gold initially rose to around $2,048 on Tuesday, a day before a formal meeting of Federal Reserve officials, but has since given back much of the gain.

Wednesday has finally arrived, as markets await the first Federal Reserve meeting of 2024.

As expected, the Federal Reserve on Wednesday kept interest rates unchanged in a range of 5.25% to 5.5%.

Then, while reading the Fed statement, an interesting and rare event occurred. For the first time, U.S. Central Bank Governor Jerome Powell changed his tone and did not repeat that he would “raise interest rates if necessary.”

In general, Powell has always said in previous meetings that my colleagues are looking at future economic data to see how interest rates should continue to rise.

Instead, the U.S. Federal Reserve said it would continue to monitor “the impact of information received on the economic outlook” to evaluate bank decisions.

The initial reaction to the Fed’s stance put downward pressure on the US dollar and helped XAU/USD rise.

Then another interesting incident occurred. In response to a reporter’s question about the possibility of a future interest rate cut at a press conference after this meeting, Jerome Powell said, “Based on today’s meeting, I don’t think we will cut interest rates in March.”

After Chairman Powell’s remarks, major Wall Street indices plummeted, the U.S. dollar began to strengthen, and gold, which had been strong, began to decline, returning a significant portion of its profits to the market.

Powell also acknowledged that he and his colleagues could cut interest rates sooner if unexpected weakness is observed in the job market.

Gold prices rose in markets on Thursday as U.S. Treasury yields fell following turbulent market changes resulting from the Federal Reserve meeting.

In fact, the yield on the 10-year U.S. Treasury note fell more than 2%, falling to its lowest level since late December, below 3.9%, after poor U.S. employment data.

This pushed global gold above $2060.

And then Thursday arrived. It was a day when markets were waiting for the first weekly US jobless claims report.

The U.S. Department of Labor reported 224,000 initial claims for unemployment benefits for the week ending Jan. 27, compared to market expectations of 212,000.

Friday finally came. A day when markets await the important US jobs report, or NFP.

According to the latest report, non-farm employment in the United States increased by 353,000. This number significantly exceeds market expectations of 180,000! In fact, the number of people in November increased from 216,000 to 333,000.

Annual wage inflation, as measured by the change in average hourly earnings, also increased by 4.5%.

Following this news, 10-year Treasury yields also began to rebound above the critical level of 4%, causing global gold prices to begin to fall to around $2027.

Events in the forex and gold markets next week:

ISM Research Institute is scheduled to release U.S. services sector Purchasing Managers’ Index (PMI) on Monday. Investors may not react to the labor sector if there is no significant difference in the PMI reading, which is expected to rise to 52.0 from 50.6 in December.

The employment index decreased sharply from 50.7 in November to 43.3 in December, suggesting a contraction in wages and salaries in the service industry. It is important to note that a further decline in this sub-index could have a negative impact on the US dollar, while an improvement above 50 could help the dollar find buyers.

But despite all this, market reaction may remain short-term following the January jobs market report.

CME Group, a popular interest rate forecasting tool, found that about 20% of market participants believe the Fed will cut rates in March, despite Chairman Powell announcing that he has no plans to do so.

Current market conditions indicate that the US dollar will have more room to rise if Federal Reserve officials once again hint at a possible rate cut next week.

But when Federal Reserve officials open the door to rate cuts in March next week, the greenback will come under downward pressure and gold will strengthen.

However, the very strong numbers for the U.S. job market make that last scenario seem unlikely.

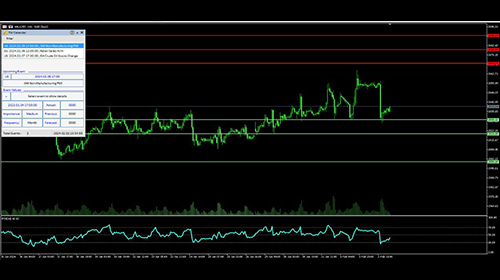

Weekly Gold Technical Analysis: An Overview of Global Gold Ounces:

Overall market conditions on the daily time frame are optimistic.

Last week, the lower and upper limits of the gold price were $2018 and $2065. If you open today’s daily chart right now and draw the RSI indicator, you can see that the high point of the indicator is pointing downward, indicating 52.

Fortunately, gold’s trend has been strong over the past week and the recent market decline in the last trading day is only a temporary correction from a technical perspective unless further declines in gold begin next week.

Key support levels in global gold ounces analysis:

If gold falls, the first important support level will be the important area of $2030. If gold falls below this area, the next major price level is $2020. If market weakness pushes gold lower, the next important level would be $2000.

Key Resistance Levels in Global Gold Ounces Analysis:

If gold moves higher, the first important resistance level will be $2060. If gold successfully breaks above this area, the next major level is $2070. If market strength pushes gold prices higher, the next resistance levels would be $2,080 and $2,090.

May the pips be in your favor!