Qualys faces a difficult 2024 as revenue growth slows (downgrade) (NASDAQ:QLYS)

multinational

investment prospects

I previously wrote: qualis (NASDAQ:QLYS) Expected to be put on hold due to slowing sales cycle in August 2023.

The company is losing Microsoft (MSFT) as a VMDR client, which will result in significant losses. It was decided to make up for it in 2024.

Even though the stock price has recently fallen 10%, the current valuation appears high.

My outlook for QLYS is Sell. That’s because the company is likely to have a lower growth trajectory and higher R&D and sales expenses beyond 2024 to replace significant revenue losses.

Qualys approach and model

Qualys monetizes a variety of applications through key capabilities that help enterprises address vulnerability detection, management, and related compliance requirements.

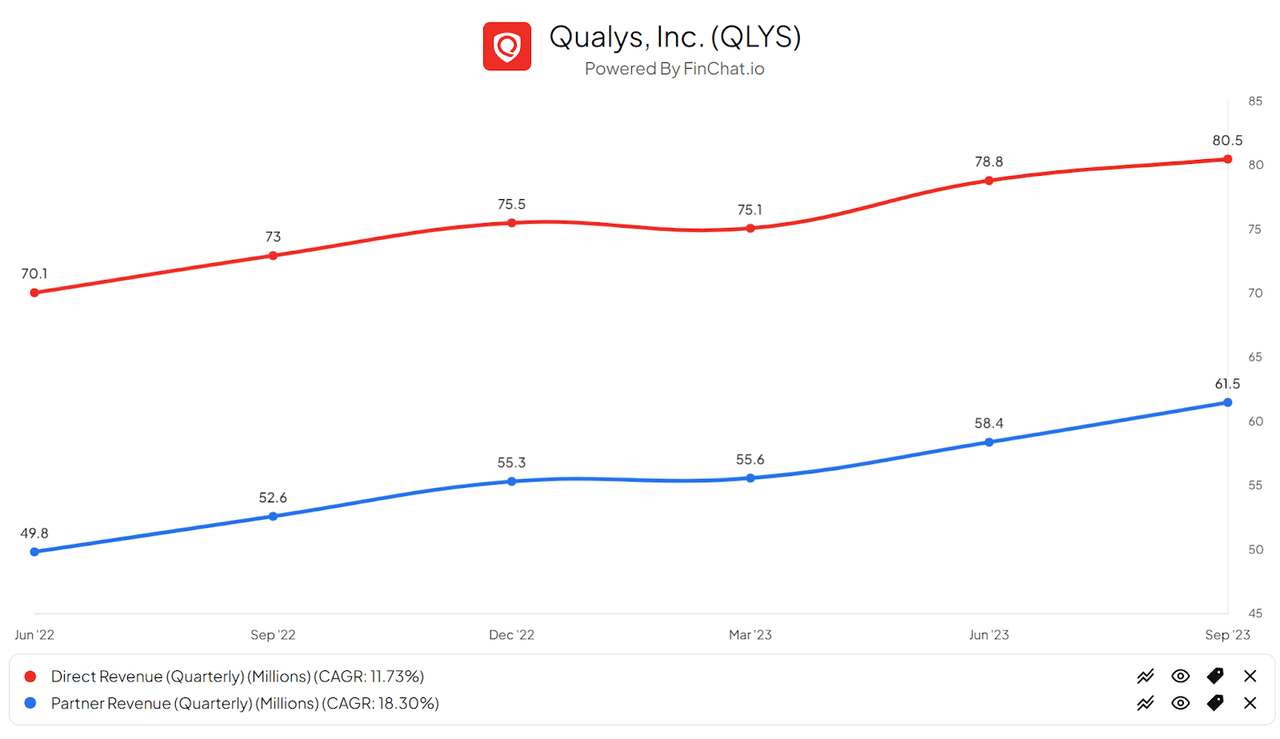

The company’s business model is divided into direct customers and customers through partners.

that much The chart below shows the split trend between the two channels. Direct revenue is the red line and partner revenue is the blue line.

FinChat.io

Direct revenue represents a high portion of the company’s revenue, but has been growing at a slower rate than partner revenue.

Recently, many enterprise software companies have placed greater emphasis on channel revenue through partners as a way to increase scale while maintaining their in-house footprint.

Qualys has been growing its partnerships over the years. So while your relationship with Microsoft may be lost or downgraded, you may not incur a noticeable loss that could account for 5-10% of your sales per relationship change report. This will be a huge challenge for the company due to its extensive efforts to create as many partnerships as possible.

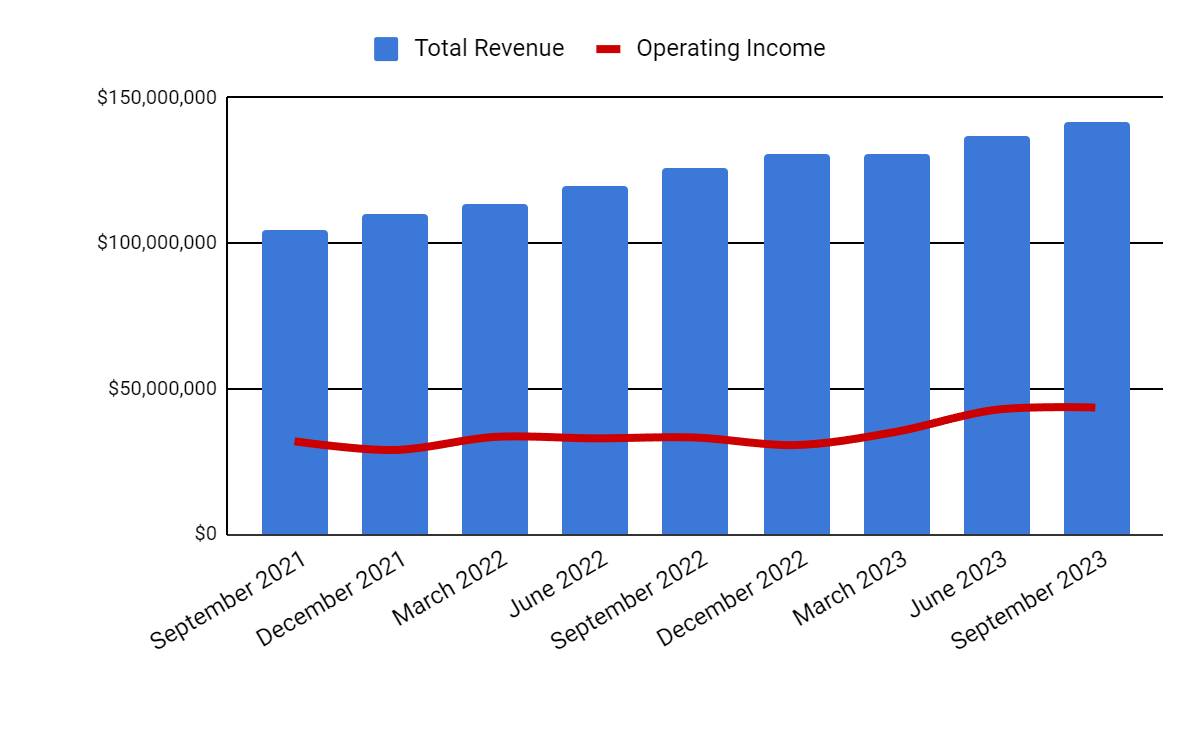

Recent financial trends and valuation

Total quarterly revenue continued to increase through the end of the third quarter of 2023, but we expect this growth to slow due to the MSFT situation. Quarterly operating profit (line) also increased in line with sales growth.

pursue alpha

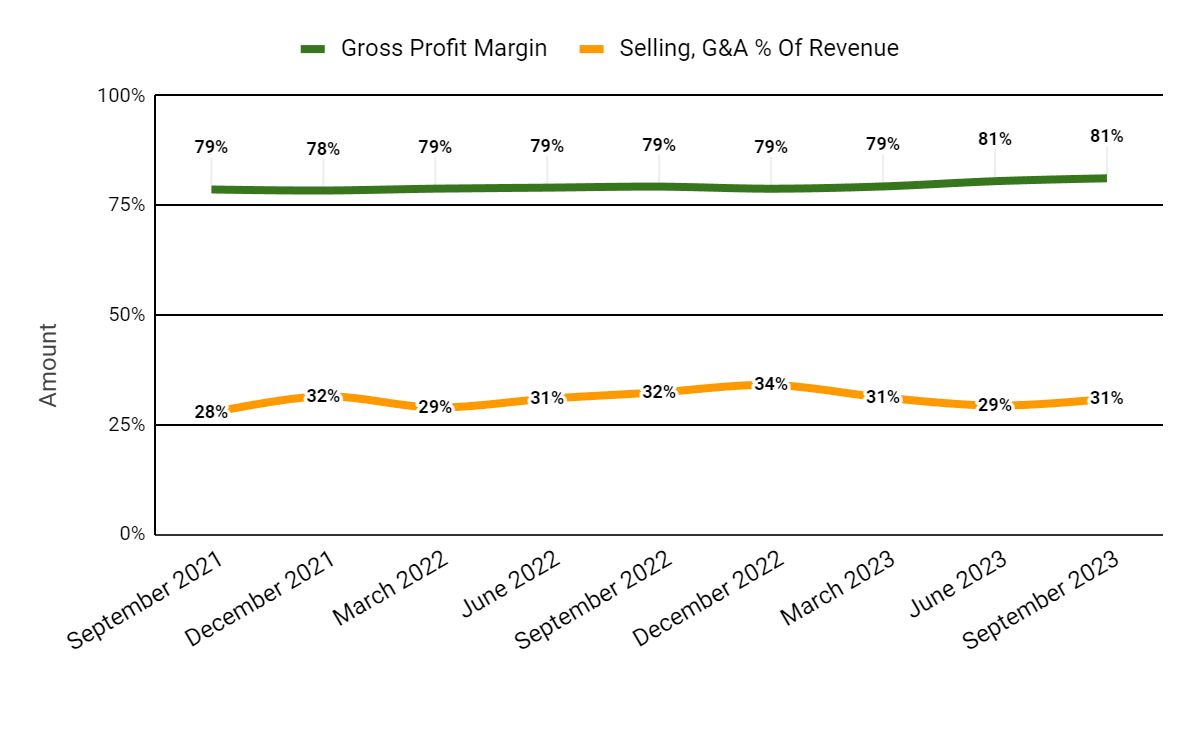

Quarterly gross profit margin (green line) has continued to increase as the company has grown partner revenue, while quarterly selling, general and administrative expenses as a percentage of total revenue (orange line) has trended downward in recent quarters due to cost management efforts. management.

pursue alpha

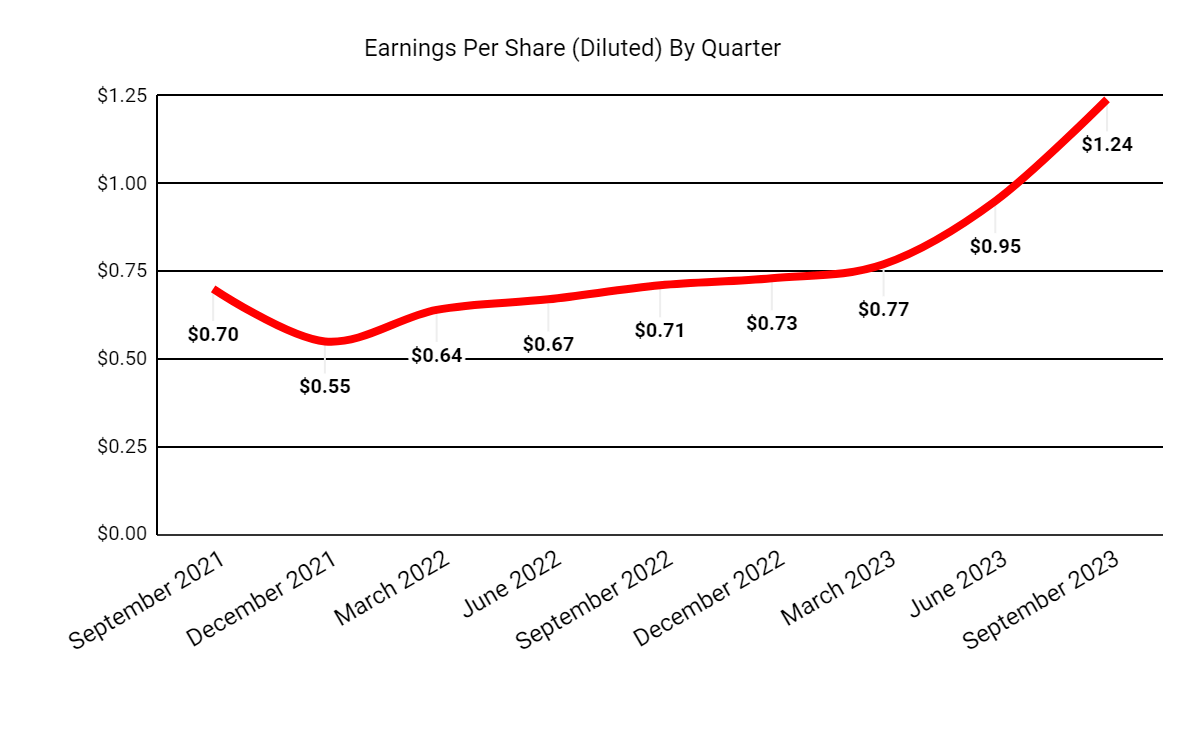

Earnings per share (diluted) have been growing very impressively in recent quarters, driven by higher revenues, higher gross margins, and lower SG&A expense ratios.

pursue alpha

(All data in the above chart is GAAP.)

Performance indicators and evaluation

Qualys’ current valuation metrics are shown in the table below.

|

metric system |

sheep |

|

EV/Sales (“FWD”) |

11.7 |

|

EV/EBITDA (“FWD”) |

25.6 |

|

Price/Sales (“TTM”) |

12.9 |

|

Revenue Growth (“YoY”) |

15.4% |

|

net profit margin |

25.8% |

|

EBITDA margin |

33.7% |

|

market capitalization |

$6,910,000,000 |

|

corporate value |

$6,480,000,000 |

|

operating cash flow |

$254,610,000 |

|

Earnings per share (fully diluted) |

$3.69 |

|

2024 FWD EPS estimates |

$5.32 |

|

Revenue Growth Estimates (“FWD”) |

14.5% |

|

Cash Flow/Share (“TTM”) |

$6.36 |

|

Find your alpha quant score |

Strong Buy – 4.72 |

(Source: Finding Alpha Data)

In particular, the company’s 40 Laws performance has been very strong, according to the table here.

|

Rule of 40 Performance (unadjusted) |

3rd quarter 2023 |

|

Revenue growth rate (%) |

15.4% |

|

operating profit margin |

30.7% |

|

gun |

46.1% |

(Source: Finding Alpha Data)

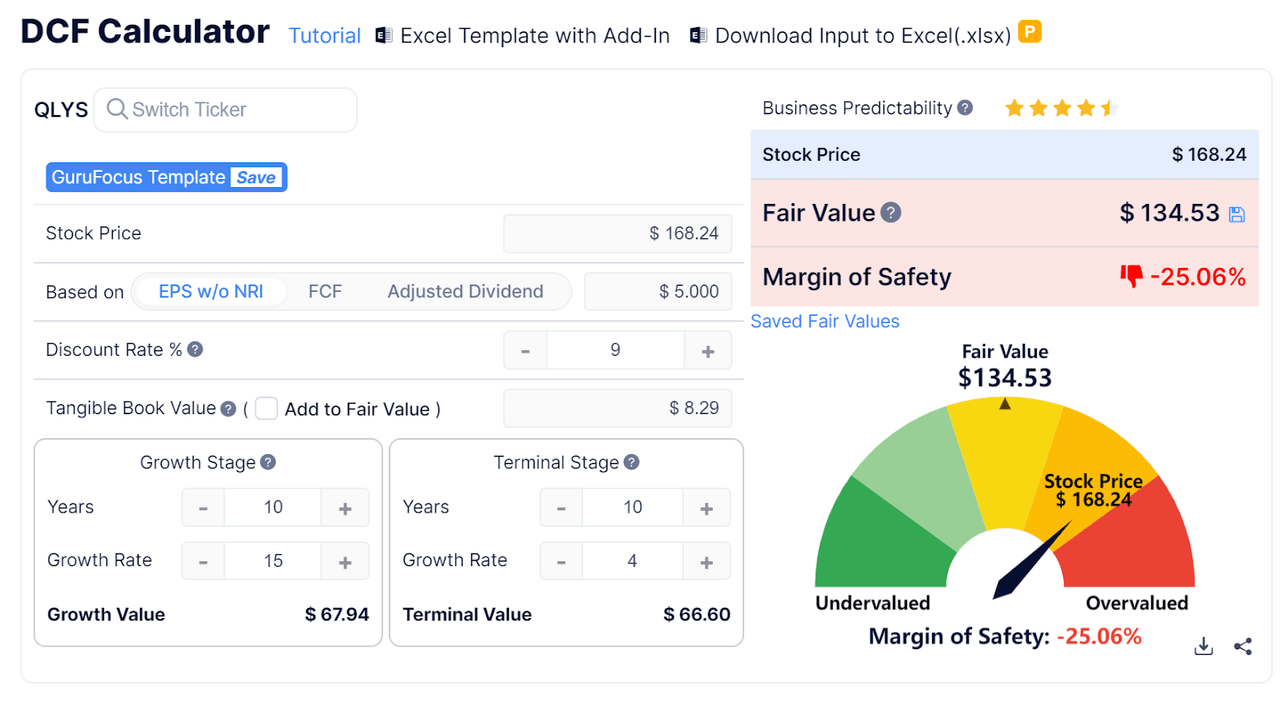

However, discounted cash flow calculations show that the stock is likely still overvalued, given its lower future earnings prospects.

Expert Focus

My calculations assume a generous future growth rate of 15% and a lower discount rate of 9%, and still suggest a price target below Morgan Stanley’s revised target of $150.

Therefore, I am bearish on Qualys despite the company’s strong cash flow and previous good Rule of 40 performance.

The company’s VMDR system is likely better than the more common version that Microsoft will replace, but Qualys will have to take a 5 to 10 percent revenue hit from replacing it with another major partnership or a more expensive and time-consuming direct version in-house. effort.

Additionally, with major partners like Microsoft bundling their own solutions, there may be pricing pressure on independent solutions like Qualys.

2024 is likely to be a ‘rebuild year’ as the company can continue developing its VMDR systems and spend more to differentiate itself from the pack.

But R&D spending stagnated in the mid-$27 million range in recent quarters, even as revenue grew.

Other software companies have cut back on R&D spending as they pursue higher profitability in a current market environment that rewards profitability over growth.

If cost of capital assumptions continue to trend lower, Qualys could benefit from a rising valuation multiple, but such macro possibilities are beyond management’s control.

Management may choose to reduce R&D spending to maintain profitability as revenues decline in 2024. Doing so may support the stock price in the short term, but may reduce long-term future growth potential as incumbents continue to develop integrated solutions.

Much will depend on how management responds to this major setback. Will profitability be sacrificed in the short term by spending more on revenue growth and R&D efforts?

Or will you continue to focus on growing partner revenue channels and reduce R&D spending to improve profitability?

We’ll hear more next week when the company reports its fourth quarter results (February 12th). I expect analysts to step up leadership with questions about the impact of Microsoft’s loss and expected reaction to the company’s earnings call.

In the meantime, we expect QLYS to be sold due to concerns about earnings growth and its high valuation.