Binance CEO CZ resigns as part of $4 billion settlement

It’s never a boring day in cryptocurrency. Not long after SBF received the compensation it deserved, the U.S. government today settled the largest cryptocurrency lawsuit in history.

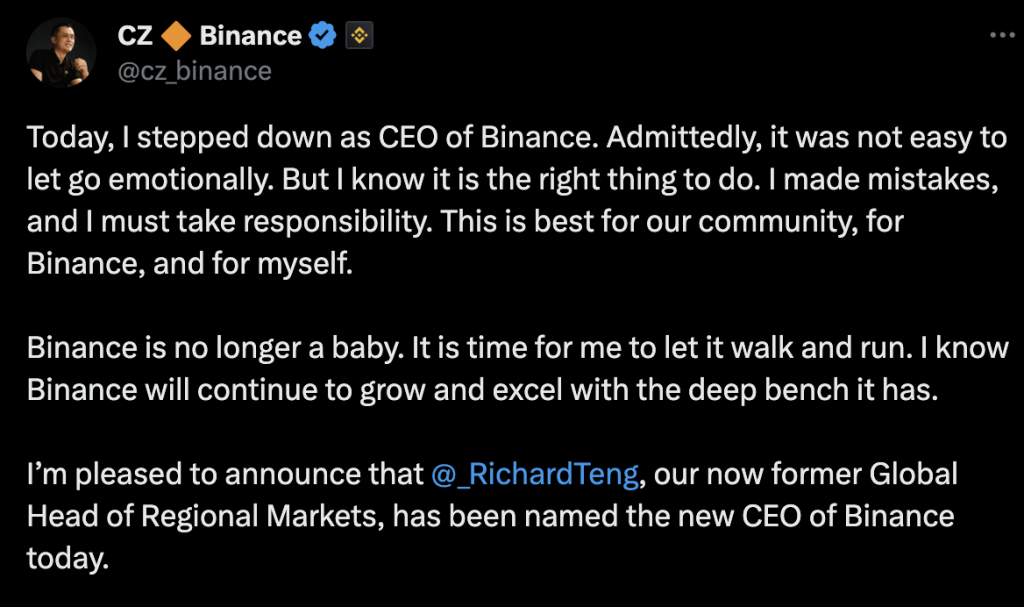

Changpeng “CZ” Zhao stepped down as CEO of Binance as part of a $4 billion settlement between the U.S. agency and the cryptocurrency exchange he founded.

The end of CZ

The announcement Tuesday by Zhao and several regulators caps a years-long investigation into anti-money laundering violations and sanctions violations by the Justice Department and others.

At X, CZ announced its resignation and appointment of Richard Teng as its new CEO. Click on the image below to view the full post.

In a press statement, Binance said it would take responsibility for not having adequate compliance controls in place. “When Binance first launched, there were no compliance controls in place for a fast-growing company.

$4 billion agreement

As part of the agreement, CZ appeared in federal court in Seattle on Tuesday afternoon and pleaded guilty to anti-money laundering and sanctions violations brought by the Justice Department. Binance also settled charges with the Department of Justice (DOJ) and the Commodities Futures Trading Commission. Through the Treasury’s Financial Crimes Enforcement Network (FinCEN) and the Office of Foreign Assets Control (OFAC), the Treasury has access to Binance’s books and records subject to a five-year surveillance period. “

Crime made Binance the largest cryptocurrency exchange in the world.” U.S. Attorney General Merrick Garland said at a news conference Tuesday. “Now Binance has paid one of the largest corporate fines in U.S. history.”

The Treasury Department said in a statement that it had taken “unprecedented steps” to hold Binance accountable for violations of U.S. anti-money laundering laws. Binance claimed it failed to prevent and report “suspicious transactions with terrorists,” citing both al-Qaeda and ISIS. The settlement includes fines of $3.4 billion to FinCEN and $968 million to OFAC, as well as compliance requirements and monitoring for five years.

“Binance ignored its legal obligations in its pursuit of profits. Deliberate failures allowed money to flow through the platform to terrorists, cybercriminals and child abusers.” Treasury Secretary Janet Yellen said at a press conference.

The CFTC did not respond to a request for comment at the time of publication.

previous event

The SEC previously indicted Binance and CZ in June on charges of operating an unregistered exchange and misleading investors by using Sigma Chain, a Swiss-based fund owned by CZ, to inflate trading volume on Binance’s U.S. platform. “Across 13 counts, we allege that Zhao and Binance entities engaged in widespread fraud, conflicts of interest, lack of disclosure, and calculated evasion of the law,” SEC Chairman Gary Gensler said in June. He said. The case is ongoing. The SEC declined to comment.

final thoughts

Will this incident wipe out the positive momentum that cryptocurrencies have had over the past few weeks? Or was this the last FUD that had to go away to make an open path to the moon?

Only time will tell.

If you need a new exchange for trading, you can support us by signing up for a Bybit account through our referral link. Don’t forget to claim your bonus if you buy/sell or trade cryptocurrencies.

You might also like our recent content on $ETH and $DOT trading.