Camel, Newport among brands that lost $34 billion

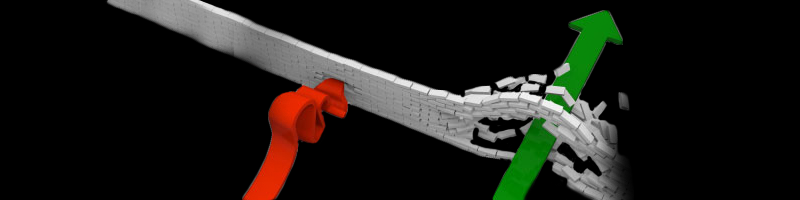

British American Tobacco announced Thursday that it would write down 27.3 billion pounds ($34.5 billion) in the value of its U.S. cigarette brands.

The tobacco maker has previously said it would take large write-downs, which it estimated in December would be around £25bn.

According to data from Calcbench, no U.S. public company has had a write-down of this magnitude since AOL’s $35.6 billion write-off in 2014.

In addition to the goodwill impairment from its 2017 acquisition of Reynolds American, BAT is writing down the value of Newport by more than 20 years and the values of Camel, Natural American Spirit and Pall Mall by more than 30 years.

BAT said that pre-Covid the cigarette market had been declining by around 5-5.5% per year and was fairly stable even during the worst of the pandemic, with the industry shrinking by 10.6% in 2022.

The company is transitioning to lead-free products more broadly and aims to achieve 50% of sales by 2035.

On an adjusted basis, sales grew 1.6% last year to £27.28 billion, and profits rose 3.1% to £12.46 billion. The new category portfolio was profitable two years ahead of target, it said, recording revenue of £398 million.

bat stock bat,

beatty,

It was up 5% in early trading but is down 19% over the past 52 weeks.

Although it did not commit to any share buybacks, the company said it would evaluate opportunities to return cash once leverage reaches the middle of its desired range and would consider sales and “non-strategic market exits.” Analysts at JPMorgan said this was a sign that at least some of its stake in ITC 500875 could be sold.

And stocks of large Indian companies fell.