‘Studio karaoke app in your hand’ SOMESING successfully launches beta service

October 26, 2023 11:07 UTC

| Updated:

October 26, 2023 11:11 UTC

Bitcoin, the digital currency that has sparked countless debates, discussions, and headlines over the past decade, has recently witnessed another significant price surge, pushing its value past $35,000. The recent upward trend was not another unexplained rise. This is particularly relevant to expectations and subsequent developments surrounding specific Bitcoin ETFs. Below is an in-depth analysis drawing on insights from a variety of sources that explains this surge.

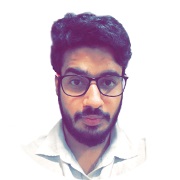

BlackRock’s Participation and NASDAQ Listing Marked on DTCC

Financial giant BlackRock announced a spot Bitcoin ETF, which has since been listed on Nasdaq. The involvement of such heavyweights in the financial world signals growing institutional interest in digital assets. Institutions typically bring in large capital inflows, which can move markets significantly. The listing not only expanded the accessibility of Bitcoin exposure to mainstream investors, but also gave legitimacy to the cryptocurrency.

On October 23, Bloomberg ETF expert Eric Balchunas commented on the The promising iShares spot Bitcoin ETF, denominated in IBTC, is being eyed for a possible listing on the Nasdaq stock exchange after filing for listing and stock trading last June.

Balchunas emphasized that this is the first spot ETF to be listed on DTCC and that no other ETFs are currently listed. He emphasized the importance of BlackRock’s active role, which typically handles preliminary steps such as seeding, ticker setting, and DTCC logistics prior to launch. He reasoned from this that BlackRock may have received an indication that approval was imminent or certain.

He also thought BlackRock may have secured SEC approval for an ETF listing or may be making preparations based on that assumption. According to BlackRock’s filing timeline, the SEC has until January 10, 2024, to finalize its position on approving or rejecting the ETF.

According to recent updates and information, this list has been in the DTCC since August 2023, but was highlighted by Balchunas on October 24, 2024.

ETF excitement

ETFs or Exchange Traded Funds are investment funds that trade on a stock exchange, similar to stocks. Bitcoin ETFs allow investors to gain exposure to Bitcoin without having to directly own the underlying assets. This means traditional investors can invest in Bitcoin in a more familiar way without having to deal with the technology of owning and storing the digital currency.

As soon as IBTC’s DTCC listing, i.e. the name of Blackrock’s Bitcoin ETF, Bitcoin price suddenly reached $35.2K.

This excitement stems from the belief that the launch of such ETFs will bridge the gap between the traditional financial world and the cryptocurrency ecosystem. Expectations of higher liquidity, broader adoption, and the possibility of more institutional investor participation often lead to optimistic sentiments in the market.

Other financial institutions have also applied for Bitcoin ETFs, including GreyScale, ARK Invest, Valkyrie, Global

DTCC controversy

An article from DL News pointed out an interesting development: BlackRock’s Bitcoin ETF was temporarily pulled from the DTCC site. DTCC or The Depository Trust & Clearing Corporation plays an important role in securities clearing and settlement. The exact reason for the temporary removal remains a subject of speculation, but such incidents often create buzz in the cryptocurrency community. While some may view this with skepticism, others may interpret it as an indication of high demand and the need for better infrastructure to accommodate new ETFs.

What it means for Bitcoin and other cryptocurrencies

The recent surge in the price of Bitcoin above $35,000 can be largely attributed to a combination of institutional interest, the connection between traditional and cryptocurrency finance through ETFs, and rumors fueled by market movements and speculation. As the cryptocurrency landscape continues to evolve, these pivotal moments once again highlight the importance of staying up-to-date on market developments and understanding the fundamentals driving price action.

The surge in Bitcoin price to $35,000 was accompanied by a flurry of activity across cryptocurrency markets. As the leading digital currency reaches this price milestone, various important developments and reactions have been observed. To paint a clearer picture, let’s take a closer look at the events described below.

BlackRock and the SEC

BlackRock, the world’s largest asset manager, was in the process of resolving $2.5 million in charges with the U.S. Securities and Exchange Commission (SEC). While this was going on, the cryptocurrency community was eagerly awaiting a decision on the Bitcoin ETF. BlackRock’s involvement in this space was seen as a positive sign, potentially paving the way for broader institutional acceptance.

Inflow into Bitcoin funds

As Bitcoin continued its upward trend, digital currency-related funds recorded an inflow of approximately $57 million. This is largely due to growing interest in potential Bitcoin ETFs. These significant inflows highlighted the growing interest and confidence of both retail and institutional investors in the market.

Germany and Canada were major contributors to these investments, with Germany’s ETC Group securing $24.3 million and Canada’s Purpose Investments securing $10.9 million. Additionally, 21Shares AG has amassed approximately $11.8 million. At the same time, a US appeals court directed the SEC to reassess Grayscale’s Bitcoin ETF application, intensifying competition among leading companies eager to introduce a physical Bitcoin ETF.

CFTC’s Spot Bitcoin ETF Acquisition

A member of the Commodity Futures Trading Commission (CFTC) further amplified expectations for Bitcoin ETFs, expressing sentiment that the market is ready to accept spot Bitcoin ETFs. Such confirmation from regulators is usually used as a strong indicator of a potentially favorable outcome and future developments.

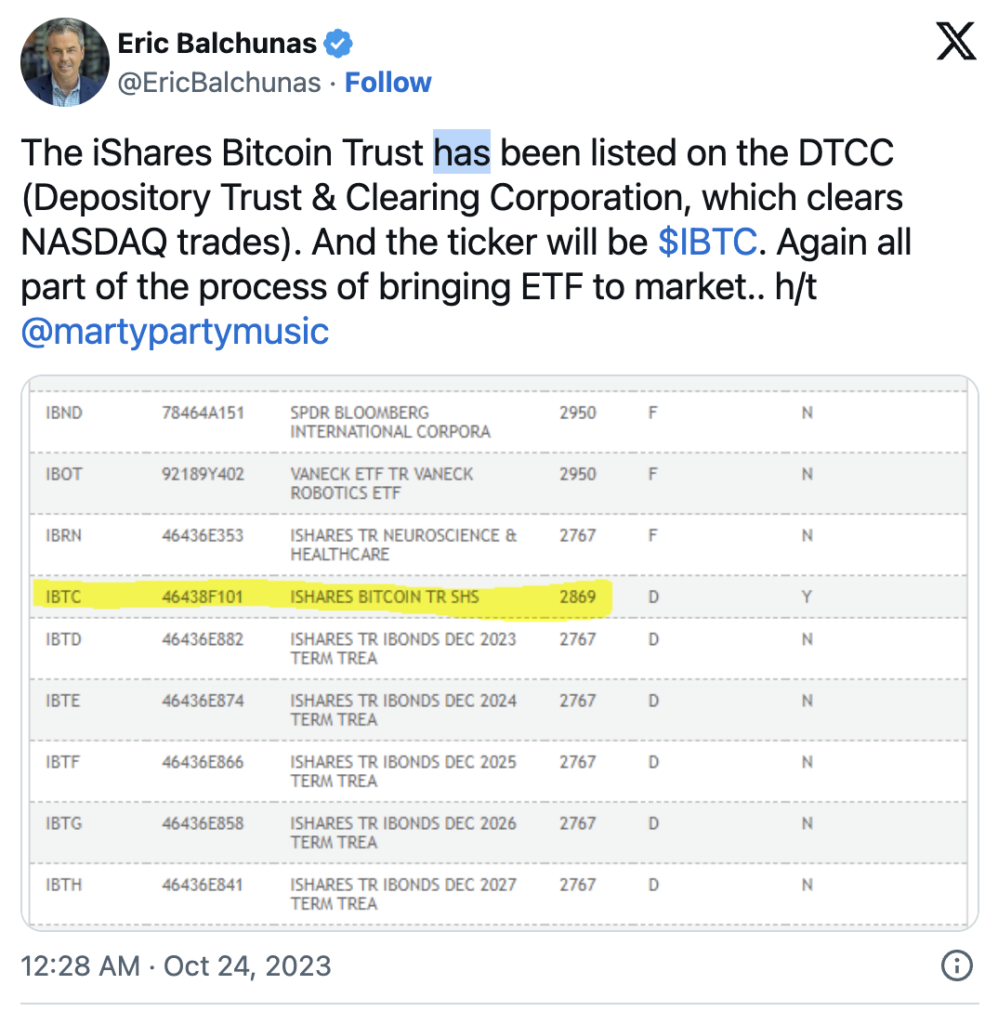

Cryptocurrency Market Sentiment

The overall sentiment in the cryptocurrency market has surged as Bitcoin approaches a noteworthy price range. This enthusiasm is not limited to Bitcoin. The ripple effect has increased optimism about various digital assets. This high sentiment leads to more investors participating in the market, thus continuing the positive feedback loop.

The current index is 72 out of 100, which puts it within the good greed ranking (6 points). It has been increased by 16 points from October 24, 2023. Rebound from 50 points. October 18, 2023 Neutral score.

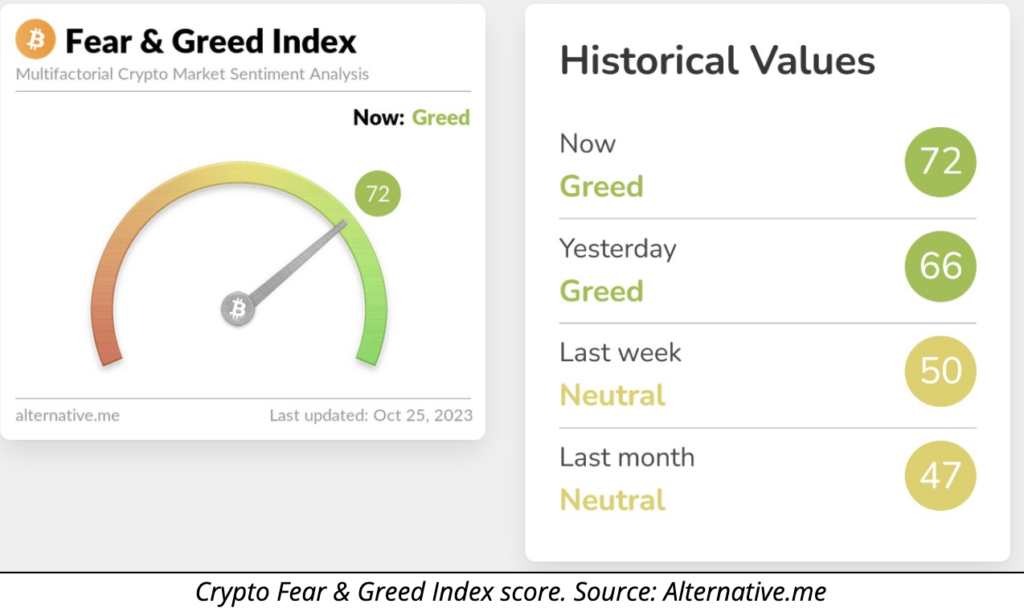

Liquidation after surge

Bitcoin’s surge to $35,000 sparked significant market movement, especially in the derivatives space. As prices rose, more than $221 million in liquidations were reported. Additionally, nearly $300 million in cryptocurrency shorts were liquidated as Bitcoin jumped to new levels, with 74.6% of traders liquidating their shorts, according to Coinglass Liquidations data. These liquidations can accelerate price movements as traders are forced to liquidate their positions.

Bitcoin’s surge to $35,000 was not an isolated event but the result of a combination of factors, from regulatory developments and institutional efforts to changes in market sentiment and significant trading turbulence. These episodes highlight the multifaceted nature of the cryptocurrency market and remind us that behind every price movement are intertwined events and stories.

If a Bitcoin ETF is approved, what will it mean for Bitcoin and the cryptocurrency industry?

A study by Galaxy Digital, a leading investment firm, on the potential market impact if a Bitcoin ETF is approved would raise $14 billion and push the price of Bitcoin up 74% based on link analysis. It appears that it will do so. Understanding the potential fallout:

1. Potential capital inflow:

Bitcoin ETFs could trigger significant capital inflows into the cryptocurrency market, according to research by Galaxy Digital. Researchers estimate there could be an astounding potential influx of up to $450 billion. This influx of capital would be an unprecedented event for the cryptocurrency industry and could lead to significant price increases for Bitcoin and potentially other digital assets.

2. Connecting traditional markets and cryptocurrency markets:

The approval of the Bitcoin ETF marks a harmony between the traditional financial ecosystem and the nascent cryptocurrency world. ETFs, well-known financial instruments traded on traditional stock exchanges, can serve as a gateway for traditional investors to access the cryptocurrency space without having to navigate the complexities of owning cryptocurrencies directly.

3. Improved reliability and legitimacy:

Regulatory approval for a Bitcoin ETF would act as a tacit endorsement from the authorities, lending improved credibility to the cryptocurrency space. This regulatory approval could further expand institutional and retail acceptance of cryptocurrencies, making them more mainstream.

4. Improved liquidity:

The emergence of Bitcoin ETFs could lead to a noticeable increase in liquidity in the Bitcoin market. Higher liquidity generally results in less volatility and lower bid-ask spreads, making the market more attractive and less risky for both institutional and retail participants.

5. Paving the way for other cryptocurrency ETFs:

Bitcoin is a leading cryptocurrency, but the approval of Bitcoin’s ETF could set a precedent for other digital assets. This could lead to a series of applications and potential approvals for ETFs linked to other major cryptocurrencies, further expanding the integration of cryptocurrency markets into the traditional financial system.

6. Impact on price:

Although speculative, the approval of Bitcoin ETFs, combined with expected capital inflows, could act as a powerful catalyst for a surge in Bitcoin prices. While markets will inevitably take into account a variety of other impacts, such institutional changes can provide significant upward price pressure.

7. Strengthening investigations and regulations:

On the other hand, integrating Bitcoin into the traditional financial ecosystem through ETFs may result in increased regulatory scrutiny. Regulators may introduce new guidelines or strengthen existing ones to ensure investor protection and market stability.

To summarize

Experts predicted that the spot Bitcoin ETF would attract $14 billion in investments in the first year, $27 billion in the second year, and $39 billion in the third year. Moreover, they predicted that Bitcoin price would surge 74% in the year following approval.

The possible approval of a Bitcoin ETF would be a watershed moment for the cryptocurrency industry. Beyond the immediate financial impact, it represents a convergence of evolving perspectives on digital assets, regulatory positions, and market maturity. While the exact future is still uncertain, there is no denying that such a move would be a monumental step in the cryptocurrency story.