Emotional one-sidedness – is it a problem? | decision point

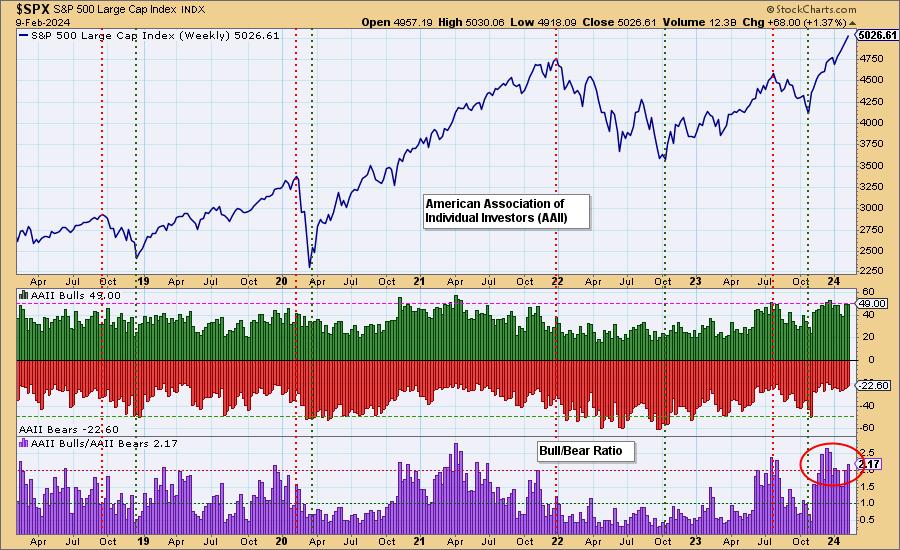

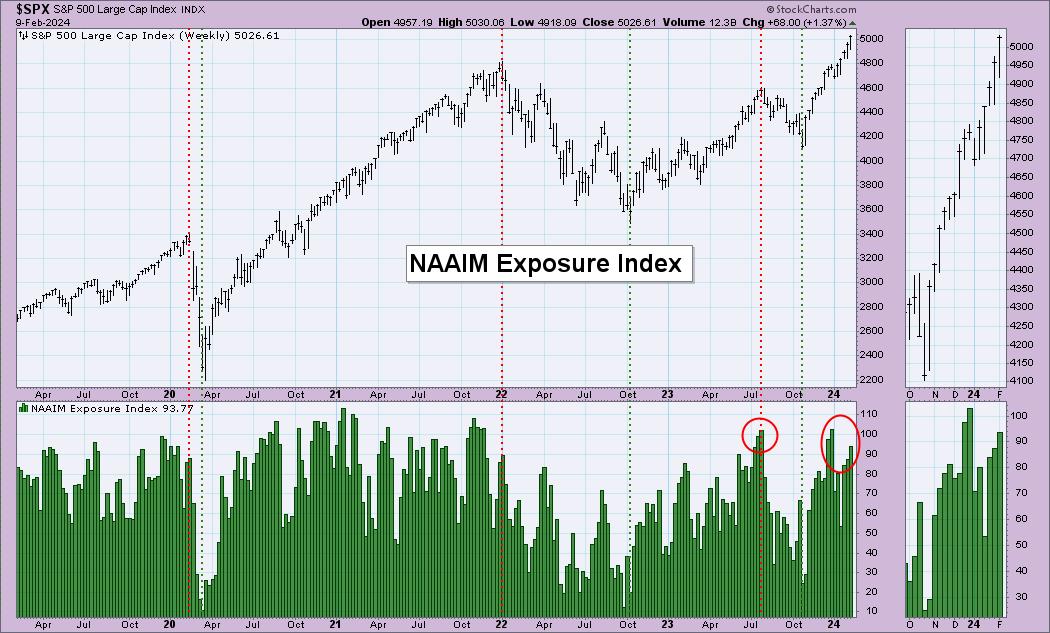

We regularly review our emotion charts, and today I’m featuring two. One is the results of a public opinion poll by the American Association of Individual Investors (AAII), and the other is the exposure level of the National Association of Active Investment Managers (NAAIM).

In both cases, sentiment is starting to tilt towards the bulls. That’s not surprising. Given the rebound from the October lows, investors should be optimistic. However, optimistic sentiments become problematic in extreme cases. The emotions are the opposite. If investors get too optimistic and get on the wagon, the wheels will eventually fall off. The reverse is also true when extreme bearish sentiment usually leads to higher prices. This is evident when we look at the major highs and lows in the market.

The Bull/Bear Ratio is what the AAII chart focuses on. Ratios are clearly weighing on the uptrend, but overbought levels may increase further.

The NAAIM Exposure Index shows high exposure figures. We would like to point out that while a strong bull market is in motion, as we saw in 2020-2021, these numbers are very overbought and may not lead to a downtrend. Please note that the problem occurred the last time the reading reached this level.

conclusion: The sentiment readings are lopsided in favor of the bulls. However, we note that these numbers can persist in a strong bull market move. Although this is likely to be the case right now, it is important to note that the current situation appears to be overbought on psychological indicators. It might be worth watching further.

Watch the latest episodes. DecisionPoint Trading Room On DP’s YouTube channel here!

Try it for 2 weeks with a trial subscription!

Use coupon code DPTRIAL2 at checkout!

Technical analysis is a windbreaker, not a crystal ball. –Carl Swenlin

(c) Copyright 2024 DecisionPoint.com

disclaimer: This blog is written for educational purposes only and should not be construed as financial advice. You should not use any of our ideas and strategies without first evaluating your personal and financial situation or consulting a financial professional. All opinions expressed herein are solely those of the author and do not in any way represent the views or opinions of any other person or entity.

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletter, blog or website materials should not be construed as a recommendation or solicitation to buy or sell any security or to take any particular action.

Useful DecisionPoint links:

trend model

Price Momentum Oscillator (PMO)

balance volume

Swenlin Trading Oscillators (STO-B and STO-V)

ITBM and ITVM

SCTR Ranking

Bear market rules

Erin Swenlin is the co-founder of the DecisionPoint.com website with her father, Carl Swenlin. She started the DecisionPoint daily blog with Carl in 2009 and currently serves as a consulting technical analyst and blog contributor at StockCharts.com. Erin is an active member of the CMT Association. She holds a master’s degree in information resources management from the Air Force Institute of Technology and a bachelor’s degree in mathematics from the University of Southern California. Learn more