Why Grayscale Says It’s Different

The countdown to the much-anticipated Bitcoin halving event has begun, with less than 10,000 blocks remaining as of February 12th.

According to bitcoin halving clockApproximately 9,843 blocks remain before the event occurs, which is estimated to occur by April 17th.

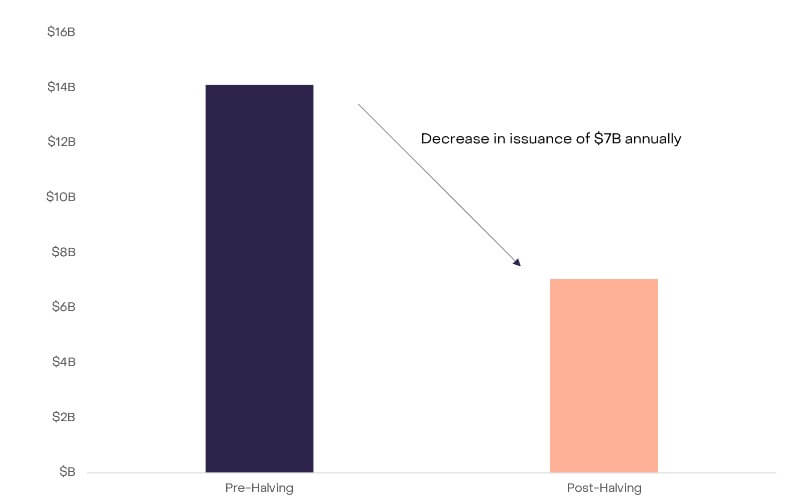

Halving events are important to the cryptocurrency industry because they reduce miner rewards, increasing the scarcity of Bitcoin. CryptoSlate Insight reports that this event will reduce the number of BTC miners produce each day from 900 BTC to 450 BTC.

Historically, BTC halvings have generally increased the difficulty of mining the best cryptocurrency asset and increased its price.

The upcoming Bitcoin halving is ‘different’

Crypto asset management firm Grayscale said the impending halving event has distinct implications compared to previous events as BTC’s utility has seen a notable surge over the past year.

“Despite near-term miner revenue issues, fundamental on-chain activity and positive market structure updates have fundamentally changed this half,” Grayscale wrote.

According to the company, the recent introduction of a Bitcoin exchange-traded fund (ETF) provides a stable demand outlet to counter downward pressure from mining issuance.

It said:

“ETFs typically provide Bitcoin exposure to a larger network of investors, financial advisors, and capital markets allocators, which could lead to increased mainstream adoption over time.”

Grayscale also highlighted the importance of ordinal inscriptions such as Non-Fungible Tokens (NFTs) in the BTC ecosystem. The company said these assets “offer a new path to securing the network by increasing transaction fees.”

Additionally, the emergence of ordinal inscriptions has boosted on-chain activity, generating over $200 million in transaction fees for miners as of February 2024. This trend is expected to continue, driven by new developer engagement and continued innovation within blockchain.

Additionally, Grayscale noted that miners have been actively preparing for the financial impact of the halving by liquidating BTC starting in late 2023. This proactive stance gives you an advantage ahead of the halving event.

Grayscale said that even if some miners leave the network, the resulting hashrate reduction will lead to mining difficulty adjustments and protect network stability.

“(BTC) has long been known as digital gold, but recent developments suggest it is evolving into something much more important,” Grayscale concluded.

At the time of reporting, Bitcoin ranked first in market capitalization and the BTC price was consolation 3.52% In the last 24 hours. BTC’s market capitalization is $980.27 billion With 24-hour trading volume 30.81 billion dollars. Learn more about BTC ›

BTCUSD Chart by TradingView

Market Summary

At press time, the value of the global cryptocurrency market is as follows: $1.86 trillion with 24 hour volume $62.28 billion. Current Bitcoin dominance is 52.66%. Learn more >