Main Street: A Unique Self-Feeding Cycle (NYSE:MAIN)

AlexLMX

investment thesis

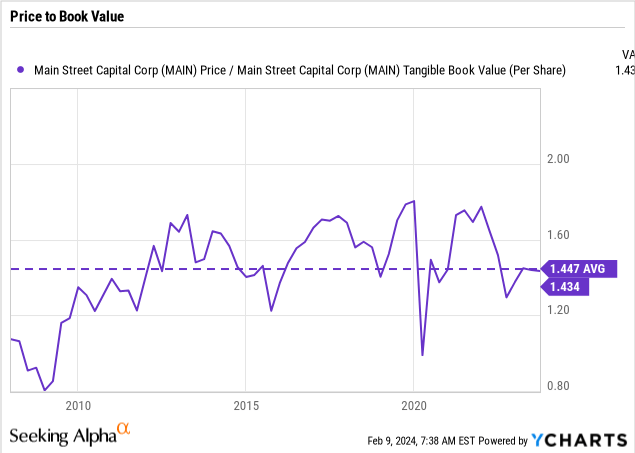

Main Street Capital (New York Stock Exchange: Main) presents an interesting anomaly within the Business Development Company ‘BDC’ sector, particularly when viewed through its price-to-value ‘P/B’ ratio, or NAV/share. Unlike most BDCs, which typically trade at a discount to NAV, MAIN consistently trades at a significant premium. this phenomenon is not a product of superior performance indicators of management investment techniques. Instead, it is a byproduct of a self-reinforcing speculative cycle in which MAIN outperforms due to its ability to raise shares at a premium to NAV, and investors are willing to buy shares above NAV due to MAIN’s outperformance.

market abundance

Investors’ willingness to pay more than the company’s book value allows MAIN to cover losses in a way that most of its peers cannot realize. BDC companies often have difficulty maintaining book value over time. We are subject to regulatory obligations that require us to distribute most of our income. This leaves little room to reserve revenue for write-offs of non-performing loans. Retaining profits to compensate for bad loans is a basic concept in finance. This allows banks and credit card companies to maintain capital despite loan defaults. Due to deployment requirements, BDC does not have this option.

Contrary to popular belief, capital losses do not lower distribution requirements. Ordinary income from interest (and dividends) is separate from capital gains/losses under the distribution method. Even if MAIN were on the brink of bankruptcy, it would have to distribute every dollar of its profits to its shareholders. This made it difficult for MAIN to maintain profits to compensate for capital losses.

Because non-performing loan write-offs are inevitable, BDCs continually raise new equity capital through a combination of equity and debt, but eventually most BDCs see their NAV/share price decline. In a previous article, we mentioned that nearly 80% of BDCs lose NAV/stock value after inception.

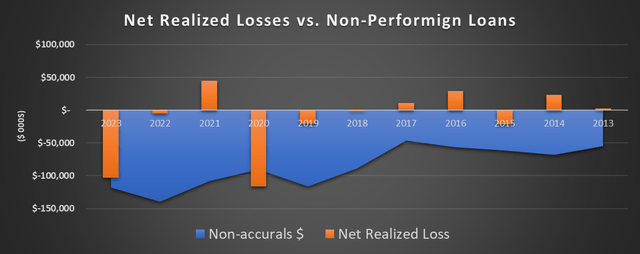

In our view, the ideal BDC is self-preserving, with capital gains offsetting losses. If we look at MAIN’s financials over the past 10 years, we see a net realized loss of $160 million, which is quite a lot for its size. Moreover, these numbers only partially capture the scope of ordinary investment devices. MAIN has a different strategy for handling underperforming loans. The latest figures show that 3.1% of the portfolio, equivalent to $120 million, is distressed. Instead of offloading these assets, as is common practice for BDCs, MAIN chooses to hold them. Therefore, these assets are not reflected in the realized loss account and remain under an opaque unrealized profit and loss balance whose value is largely influenced by subjective estimates of fair value.

Given this performance, I don’t see anything about MAIN that stands out enough to justify its share price premium over NAV. MAIN’s elevated market value appears to be a product of its own supply cycle, raising questions about the sustainability of this premium. While NAV/stock growth increases due to incremental equity growth, incremental equity growth exists because of investors’ expectations that NAV/stock will continue to grow.

main street capital

Performance in 2024

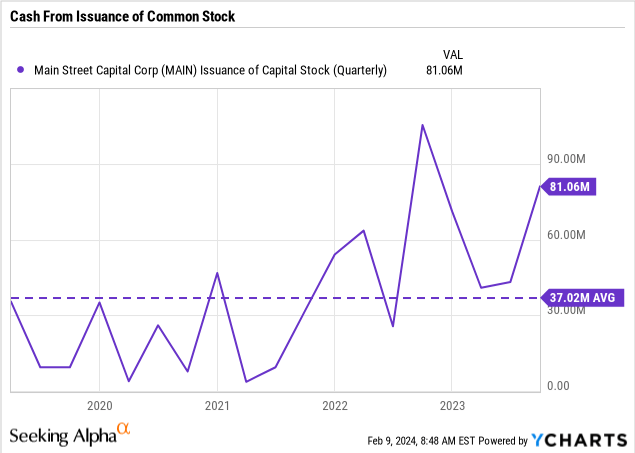

The impact of capital losses is less worrisome as long as investors are willing to pay a premium for MAIN stock, but we acknowledge that this is not a sustainable business model. MAIN’s new stock offering not only provides capital for growth, but also covers losses. Net investment income per share ‘NII’ is increasing, and furthermore dividends per share are also increasing. MAIN recently released its preliminary fourth quarter results, showing increased ROE and record NII despite near-record realized losses (over $100 million) in 2023.

During recent quarters, MAIN accelerated its issuance of common stock, raising $81 million in the third quarter of 2023 alone, as shown in the chart below. With authorized shares nearly double the outstanding shares, it’s quite possible that MAIN will raise more capital in the fourth quarter, but we’ll have to wait for certainty when the company announces its fourth quarter results on February 22, 2023. It will. NAV premium reaches nearly 50% and new share issuance increases.

The question of whether MAIN’s self-reinforcing cycle will burst in 2024 will depend on market sentiment. The Fed’s interest rate cut is likely to coincide with easing macroeconomic conditions, potentially impacting MAIN’s valuation. However, our baseline scenario is that MAIN’s NII and dividend per share will continue to rise as the company continues to raise capital above NAV. The ‘Hold’ rating reflects the absence of solid fundamentals behind performance rather than short-term concerns that the self-sufficiency cycle will be broken. For the better half of the last decade, MAIN has been trading at a premium of around 50% to NAV, and we don’t expect this level to be broken in 2024 either. We believe management will continue to capitalize on market optimism by issuing new shares.

dividend

We expect the BDC’s dividend to be consistent, reflecting the steady income from its loan portfolio. Special dividends are generally reserved for occasional net capital gains. However, MAIN has regularly paid special dividends. Although these dividends imply a particularly favorable event, in reality MAIN’s regular dividends fall short of minimum regulatory requirements.

Based on fourth quarter 2023 results, MAIN’s current income (net investment income) run rate is estimated at $90 million per quarter ($360 per year). Based on these estimates, we expect MAIN to distribute at least $3.9 per share in annual dividends in 2024 to meet its 90% distribution obligation, resulting in a forward yield of 8.7%, surpassing the 6.5% yield proposed for its regular dividend. It has yet to be confirmed whether MAIN will distribute its $3.9 dividend as a regular or special dividend, but it hardly matters.

summary

MAIN’s ability to consistently increase equity above NAV despite a mediocre investment strategy reflects the emotion-based, self-reinforcing cycle that helps the company grow. Fueled by investor optimism, this cycle allows MAIN to leverage premium valuations to turn a tepid investment strategy into a growth engine. There are no major threats to the self-fulfilling equity financing cycle as we head into 2024, but a Fed rate hike is likely to be accompanied by macroeconomic softness.

Dividends and NII per share are expected to increase in 2024. Total dividends, including both regular and special dividends, are expected to approach 9% on average per year. Although it maintains an advantageous position compared to its peers, the business model is not sustainable, so it is judged to be a ‘hold’.