Lumen Technologies Stock: Don’t Look Back on Mistakes (NYSE:LUMN)

SOPA Images/LightRocket via Getty Images

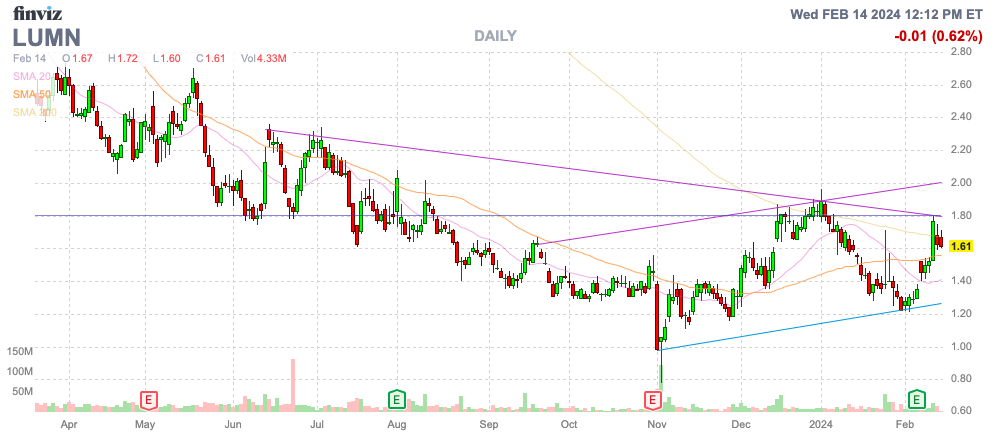

After warning investors a few months ago not to look back on opportunities to invest in broken places. Lumen Technologies (New York Stock Exchange: Rum), the positive movement in the stock price following its Q4 2024 results provided some hope. The carrier really transformed its business. A review of the results showed that not all key metrics were decreasing. my investment thesis Despite falling just $1, the stock remains weak.

Source: Finviz

Major cash flow issues

The biggest issue in the new CEO’s turnaround strategy was additional business restructuring. Lumen Technologies has been undergoing ongoing restructuring for several years.

The stock fell to around $1 as the CEO scaled back the business with a promise to boost future business with new innovative products. The problem with solving non-strategic problems is that the company is in a constant race to the bottom.

Lumen beat fourth-quarter estimates by $60 million in an encouraging sign, but the company posted another organic revenue decline in 2024. At this point, Lumen needs to retain every EBITDA-positive business it can to build momentum, but each turnaround plan involves cutting low-calorie products, selling products, or selling EBITDA-positive businesses.

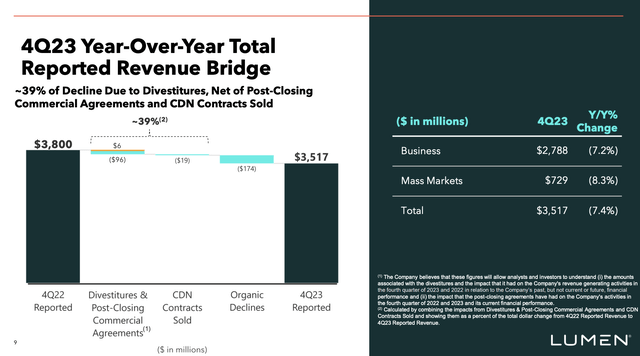

The company provided this slide on its Q4 2023 revenue bridge, again highlighting its continued slide. Organic revenue fell $174 million, while divestitures hit $3.5 billion, part of a 7.4% decline in quarterly revenue.

Source: Lumentech. 4th quarter 2023 presentation

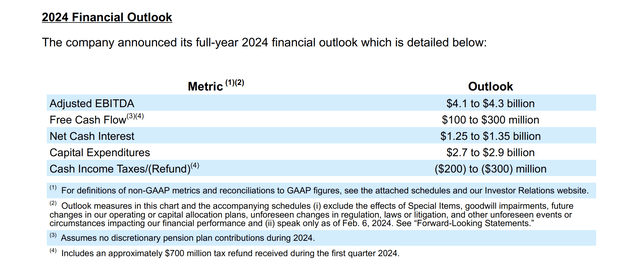

Lumen Technologies actually reported another quarter in which adjusted EBITDA plummeted again. The situation remains grim next year. The guidance is to organically reduce adjusted EBITDA by 2-5%.

Management guided for positive cash flow of about $200 million at the midpoint, but there was a big problem with that number. The company claims free cash flow of $100 million to $300 million, but that figure includes a massive $700 million tax refund it received during the first quarter. Essentially, the operating business will generate negative FCF of $400 million to $600 million.

Source: LumenTech. 2023 4th quarter performance announcement

Lumen Technologies has reduced capital spending by ~$300 million from 2023 levels of $3.1 billion, and its FCF numbers are still massively negative. The company saw its adjusted EBITDA plummet during the year between divestitures, organic revenue declines and restructuring.

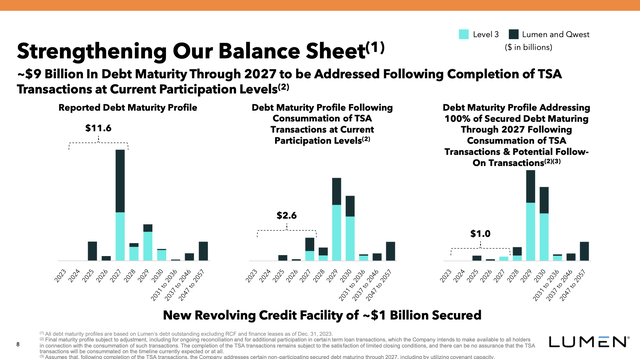

Debt restructuring didn’t help

As with a lot of positive news about Lumen Technologies, there’s usually a big negative in the news. In this case, the company restructured $9 billion of debt maturing through 2027 to improve its maturity profile and allow management to execute its restructuring plan for longer.

Source: LumenTech. 4th quarter 2023 presentation

The biggest negative was much higher interest rates, but Lumen’s creditors pledged to provide the company with $1.2 billion in financing through new long-term debt. Telcos cannot afford higher interest costs due to stressed cash flows.

In the fourth quarter 2023 earnings call, CFO Chris Stansbury eliminated the following cash flow impacts:

We expect our free cash flow to be impacted by higher interest expense associated with the new TSA contract, with our initial analysis indicating increased cash interest of $125 million to $225 million in 2023 compared to 2024. included.

Lumen estimates interest expenses will increase by $125 million to $150 million in 2024, despite debt levels remaining slightly below 2023 levels. Because the company was only producing cash flow close to breakeven going into debt restructuring, the consequences of requiring additional costs were very negative.

The updated guidance for net interest expense is for it to increase to approximately $1.3 billion in 2024, which is a large negative impact. Lumen expects to have just $1.00 of debt maturing by 2027, but the company will now be paying up to $175 million per year in higher interest costs.

Until the company can actually recover its business and return to earnings growth, Lumen is a stock to avoid. With net debt of nearly $18 billion, the company cannot afford negative organic growth and negative FCF.

Now, analysts estimate that the company is facing a huge revenue decline, in part due to the $1.8 billion sale of its EMEA business. The business was originally sold to Colt for $166 million, approximately 11x adjusted EBITDA from 2021.

takeout

The key takeaway for investors is that Lumen Technologies remains a stock to avoid. Given the forecast for dire cash flow in 2024, don’t make the mistake of looking back after fourth quarter results beat expectations. Debt restructuring didn’t help much as interest expenses increased significantly at a time when the company needed positive cash flow.

Investors should use minor bump ups to sell stocks.