Weekly Outlook: NIFTY remains in defined range. Directional movement is expected only outside this level | India analysis

Some serious consolidation continued in the market as Nifty oscillated in a defined range before ending the week with moderate gains. Examination of the daily chart shows that Nifty has bounced from that level, retesting the 50-DMA and defending that point as an important support. The trading range has expanded slightly. The Nifty index has fluctuated in a range of 538 points over the last five sessions. Remaining largely in broad but defined consolidation, the headline index closed with a net gain of 258.20 points (+1.19%).

From a technical perspective, the 50-DMA level is the most important support while the market continues to consolidate. This level is currently at 21566. Currently the market is within a clear and defined trading range of 22100-21500 levels. The index may continue to oscillate back and forth in this range, but it is unlikely to have any persistent directional bias. A clear trend will emerge only if Nifty convincingly achieves the 22100 level or finally breaches 21500. Volatility remains still. India VIX fell 1.46% on a weekly basis to 15.22.

Trading is likely to begin quietly on Monday. Although a flat opening is expected, Nifty is likely to find resistance at 22150 and 22300 levels during the week. Support is provided at the 21800 and 21620 levels.

Weekly RSI is 71.14. RSI remains in a slightly overbought zone, but remains neutral and shows no difference relative to the price. The weekly MACD continues to be bullish and is above its signal line.

Analysis of the pattern on the daily chart shows that the nice break above 20800 continues to be valid and effective. However, the current price action shows that Nifty is consolidating near the highs in the defined trading range. If Nifty passes 22100 or slips below 21500 level, a directional trend will be indicated. Until this happens, we will see the market continue to consolidate.

Next week will see Nifty staying in the defined range as mentioned. We’ll continue to see some defensive pockets continue to perform well. Apart from this, the breathless PSU/PSE stocks are expected to see fresh relative performance along with stock-wise movements in the private banking space. However, it is best to avoid large leveraged positions until a clear trend emerges. Additionally, unless the uptrend expands significantly in the future, all profits should be carefully protected at higher levels.

Next week’s sector analysis

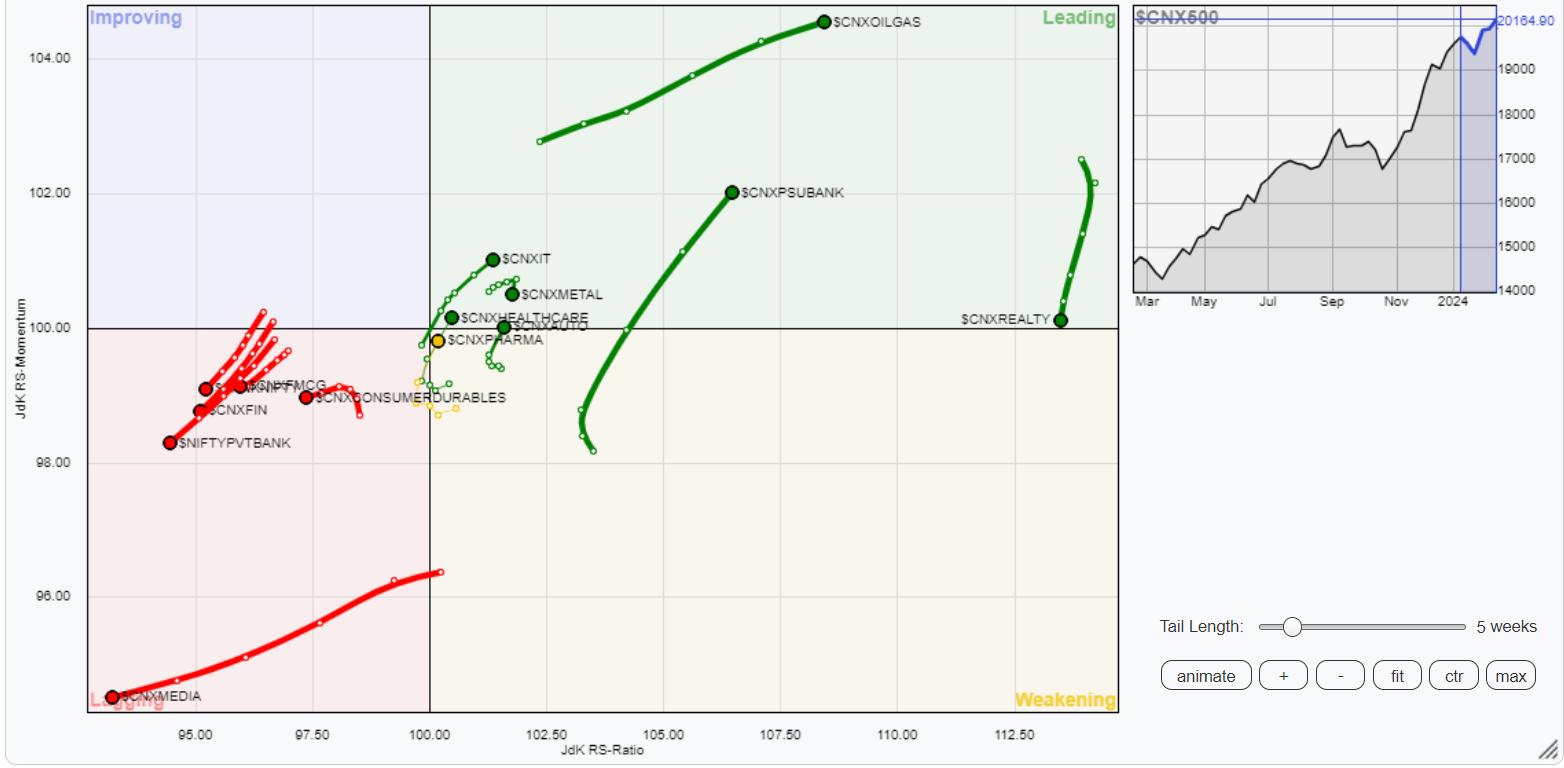

With Relative Rotation Graphs®, we compared various sectors with the CNX500 (NIFTY 500 Index), which represents over 95% of the free float market capitalization of all listed stocks.

The Relative Rotation Graph (RRG) continues to show similar sectoral setups with no major changes compared to last week. Nifty Energy, PSE, PSU Bank, Infrastructure, Metals, Commodities, IT and Real Estate indices are within the leading quadrant. Although the real estate indices appear to have given up relative momentum, this group is likely to outperform the broader Nifty 500 index comparatively.

Staying in the bearish quadrant, Nifty Pharma Index appears to be improving its relative momentum to the broader market. Apart from this, Nifty Midcap 100 index is also within the bearish quadrant.

Nifty Media, Banknifty and Financial Services indices continue to slump within the lagging quadrant along with Services Sector indices.

Nifty FMCG and consumer sector indices also remain within the lagging quadrant.

Important note: RRG™ charts show the relative strength and momentum of groups of stocks. The above chart shows relative performance against the NIFTY500 index (broad market) and should not be used directly as a buy or sell signal.

Milan Vaishnav, CMT, MSTA

Consulting Technology Analyst

www.EquityResearch.asia | www.ChartWizard.ae

Milan Vaishnav, CMT, MSTA is a capital markets expert with nearly 20 years of experience. His areas of expertise include portfolio/fund management and advisory services consulting. Milan is the founder of ChartWizard FZE (UAE) and Gemstone Equity Research & Advisory Services. With over 15 years of experience in Indian capital markets as a consulting technology research analyst, he has been providing India-focused, premium, independent technology research to his clients. He currently contributes daily to ET Markets and The Economic Times of India. He also writes A Daily/ Weekly Newsletter, one of India’s most accurate “daily/weekly market forecasts”, now in its 18th year of publication. Learn more