Snapshot of projected future S&P 500 earnings for winter 2024

SOPA Images/LightRocket via Getty Images

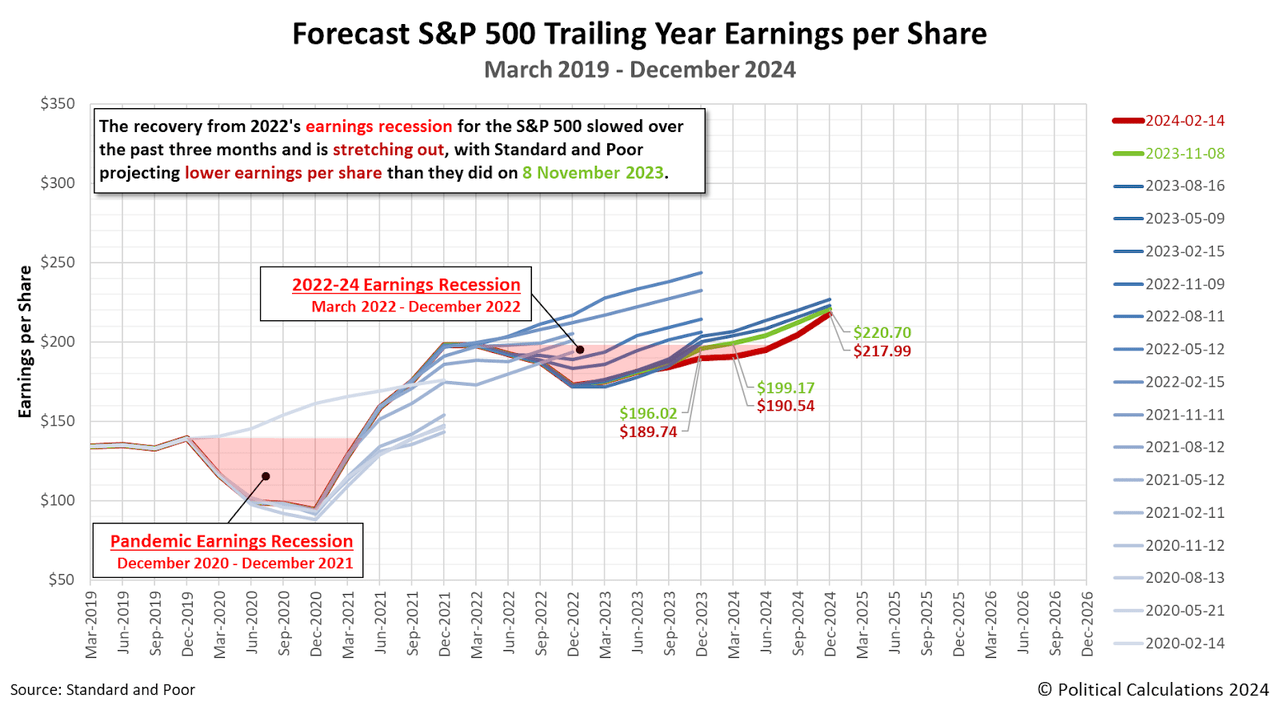

Every three months we take a snapshot of our expectations for the future earnings of the S&P 500 (SPX) at roughly the midpoint of this quarter, shortly after most U.S. companies announced their relocation plans. Quarterly earnings.

Since our last update three months ago, earnings expectations for the S&P 500 have plummeted in the near term and the recovery from the 2022 earnings slump is prolonged. S&P 500 earnings per share were expected to return to the March 2022 high of $197.91 in the first quarter of 2024, but a full recovery now appears likely to be delayed until after June 2024.

The following chart shows how the recent earnings outlook has changed relative to the previous snapshot.

Below is a summary of the key observations from the changes. S&P’s earnings forecast for November 8, 2023 through February 14, 2024:

- 2023-4Q revenue decreased to $189.74 from estimates of $196.02. These earnings are still being reported, so these values are not final yet.

- Projected revenue for Q1-2024 decreased from $199.17 to $190.54. This change means revenue growth will be close to zero during the first quarter of 2024.

- S&P expects faster earnings growth in the second half of 2024.

- Despite these rapid growth projections, S&P 500 earnings per share are still expected to fall from $220.70 to $217.99 by the end of 2024.

If we look at the historical earnings expectations shown on the chart, especially for the period beyond 2021, we can see a negative pattern in which subsequent earnings expectations are less optimistic than prior expectations. With expected earnings per share for the 2024-Q1 expected to be little changed from 2023-Q4 levels, if this pattern holds, the spring update could show the start of a ‘double-dip’ earnings downturn for the S&P 500.

Revenue recession information

Depending on who you talk to, an income recession falls into one of two definitions. An earnings slump exists when earnings decline for at least two consecutive quarters or year over year for at least two quarters. This chart shows the period during which we see a quarterly decline in the revenue definition for a revenue downturn, for both the Pandemic Revenue Downturn (December 2020 to December 2021) and the New Revenue Downturn (March 2022 to December 2022). Identify . First definition. The area of the graph shaded in light red corresponds to the entire period in which the S&P 500’s earnings per share have remained (or are expected to remain below) pre-recession levels.

Let’s define what a “double-dip” revenue downturn is, if it’s relevant at the time of our next update. This term describes a situation where, after a recovery begins, the S&P 500’s earnings per share stop rising and fall without ever returning to pre-recession levels.

The next snapshot of the index’s expected future returns will be available in three months.

reference

Silverblatt, Howard. Standard & Poor’s. S&P 500 earnings and estimates. (Excel spreadsheet). February 14, 2024. Accessed February 17, 2024.

original post

Editor’s note: The summary bullet points for this article were selected by Seeking Alpha editors.