Fintech vs. Regtech vs. Suptech – Key Differences

The three new technologies, fintech, suptech, and regtech, have emerged as innovative advancements for the banking and financial services industry. The fintech vs. regtech vs. suptech debate has emerged as a primary concern for business owners and users. Such types of financial services solutions are connected to each other through different similarities. However, they are also different than each other in a few aspects.

Almost every business relies on digital financial systems for executing business transactions. Digital technology has enabled new and innovative approaches for ensuring universal accessibility of financial services. The three terms fintech, regtech and suptech are the three distinct stages for implementation of digital finance. Each term has a specific role in empowering the domain of digital financial services.

Fintech focuses on implementation of technology for transforming financial services. Regtech emphasizes the use of technology for regulatory monitoring, compliance, and reporting. The term ‘suptech’ combines supervision and technology, which focus on regulation of fintech and regtech. As the financial landscape continues evolving at an exponential pace, it is important to stay updated with such buzzwords.

Each term serves a distinct objective in the domain of financial services technology for challenging the conventional banking systems. A clear understanding of the differences between regtech, fintech, and suptech ensures that you can identify the role of each term in driving the financial services industry. Let us learn more about the differences between regtech, fintech, and suptech.

Why Should You Learn about Differences between Fintech, Regtech, and Suptech?

Fintech or financial technology seems to have caught the attention of almost every onlooker in the domain of financial services. At the same time, regtech and suptech have also made their way to the headlines in the world of tech. It is important to learn about the difference between fintech and regtech alongside bringing suptech into the equation for uncovering the importance of each term.

Digital financial services do not rely only on transformation of traditional financial systems with better options for accessibility. For example, regtech and fintech differ in terms of their purpose. You could not utilize regulatory technology for purposes served by fintech solutions and vice versa.

At the same time, you should also notice that regtech, fintech, and suptech have some similarities between them. The similarities between the terms ensure that you can implement them as distinct components within a comprehensive risk and compliance management program. As a matter of fact, the similarities between fintech, regtech and suptech create challenges for differentiating one from the other. Interestingly, you can find effective insights for differentiating them by understanding their basic definitions.

Learn the basic and advanced concept of Fintech. Enroll now in the Fintech Fundamentals Course

Definition of Fintech

Fintech or financial technology points to any technology that helps improve financial services. It generally involves strategies for using technology for automation of delivery and utilization of financial services. Fintech is different from regtech and suptech in the fact that it ensures better accessibility of financial services. Fintech can help business owners, consumers, and corporations with effective management of financial operations and procedures. The power of fintech comes from specialized algorithms and software implemented through smartphones and computers.

Fintech represents any type of technological advancement that helps in changing the conventional approaches to financial transactions. For example, fintech entails the introduction of new digital currencies to the methods for checking double-spending. The answers to “What is fintech regtech and suptech?” also draw attention to the fact that fintech gained significant popularity after the introduction of smartphones.

On top of it, the growth in internet accessibility also played a major role in expanding the user base of fintech. In traditional systems, fintech was restricted to the back offices of trading firms and banking service providers. However, smartphones and internet accessibility have brought fintech into the domain of personal and commercial finance.

The domain of fintech also covers a broad assortment of financial activities that do not require the intervention of humans. For example, transferring money, managing investments, or saving money for your business venture are some of the financial activities that have been simplified by fintech.

Develop in-depth knowledge of fintech concepts and become a part of the advancements in finance with elementary Fintech Flashcards.

Definition of Regtech

The next player in the fintech vs. regtech vs. suptech debate is regtech or regulatory technology. It refers to a technology system tailored for supporting banks, credit unions, or other financial institutions in regulatory compliance management. The evolution of the modern financial landscape has created multiple advantages alongside presenting overwhelming challenges of complying with relevant regulations and standards.

Financial institutions have to deal with many laws, regulations, and rules for working in the new market environments. On top of that, financial institutions must pay attention to implementation, enforcement, and monitoring of relevant laws and regulations across different processes.

Regtech helps streamline the compliance process in vendor management, security practices, and fair financing. The discussions on regtech and fintech showcase the possibility of accessing regtech solutions in different forms. For example, business solutions for regtech could include features for providing a real-time 360-degree view of risk and compliance management. On the other hand, you could also have single-rule regtech solutions that focus only on specific areas of compliance and risk management.

The importance of regtech in the domain of financial services extends beyond compliance. Before learning about the difference between regtech and suptech, you must know that regulations and compliance do not offer one-size-fits-all solutions. Regulatory authorities in the domain of finance empower financial service institutions to design compliance and risk management strategies according to their size and complexity of operations.

You can find different variants of regtech solutions, depending on your requirements. The best regtech solutions offer a combination of cloud-based technologies and automation alongside the experience of regulatory specialists. With the expertise of regulatory specialists, you can find easier ways to navigate through regulatory complexities.

The most effective regtech solutions identify, recognize, and analyze the dependencies between different types of risks for improving efficiency. On top of it, regtech solutions must also help financial services institutions with a better understanding of regulatory challenges. As a result, the institutions could find better and more efficient approaches for resource allocation.

Aspiring to become a certified fintech expert? Read here for a detailed guide on How to Become Fintech Certified Expert now!

Definition of Suptech

The third edition in the fintech vs. regtech vs. suptech comparison is suptech or supervisory technology. Suptech includes technological solutions that help financial regulatory authorities in verification and management of regulatory compliance. Supervisory agencies play a crucial role in the modern financial landscape for risk management alongside ensuring effective implementation of regulations.

Financial service institutions have to comply with numerous rules and regulations. Similarly, regulatory or supervisory authorities must also ensure that financial institutions comply with the desired rules and regulations. Suptech or supervisory technology offers the technological tools for supervisory authorities to capitalize on the power of automation.

The importance of suptech in the discussions around fintech, regtech and suptech is visible in the fact that it serves as regtech for the supervisors. Suptech can help businesses as well as regulatory authorities in reducing irregularities in financial reporting. It helps in reducing the reporting intervals alongside improving data granularity. Most important of all, supervisory technology also ensures unification of data in one place for easier analysis and review. Suptech also controls the amount of data accessible to regulatory authorities and how they can use it.

Suptech can play a major role in improving the oversight of supervisory authorities by providing proactive notifications about the rise of new fraud strategies. Supervisory authorities can also find more insights into activities of fraudsters, including the frequency of fraud and financial losses.

Want to learn about the fundamentals of AI and Fintech? Enroll now in AI And Fintech Masterclass!

What are the Similarities between Fintech, Regtech, and Suptech?

The answers to “What is fintech regtech and suptech?” provide a clear glimpse of their significance in the modern financial services landscape. As a matter of fact, the definition of the terms provides a strong foundation for discovering the differences between them. However, it is important to look at the similarities between regtech, fintech, and suptech to understand the possibilities of combining them. Here are some of the prominent similarities between regtech, suptech, and fintech.

The first common thing you would notice in a discussion about suptech, regtech and fintech would be technology. All of them utilize technology to improve effectiveness, accuracy, and speed of financial operations.

Fintech, suptech, and regtech focus on collaboration between regulators, technology providers, businesses, industry players, and consumers to achieve desired goals.

Another common highlight between regtech, fintech, and suptech is the emphasis on ensuring compliance with regulations. Fintech ensures regulatory compliance through automaton of compliance processes, while regtech ensures monitoring of compliance activities. Similarly, suptech also maintains regulatory compliance through improvements in regulatory reporting.

Before you discover new details about the difference between fintech and regtech, it is important to ensure that data is the common point between regtech, fintech, and suptech. All three have to depend on data to achieve their specified goals, such as better delivery of financial services, monitoring of financial activities, and ensuring regulatory compliance.

Innovation is also a common highlight between regtech, fintech and suptech, as it helps in creating better solutions that could resolve existing issues in the financial services industry.

The discussions about regtech, fintech, and suptech also point to the ways in which they maintain a customer-centric approach. All three technologies aim to improve customer experiences through the effective use of technology to ensure personalization, streamlining processes, and reducing costs.

Embrace the new generation of financial services powered by innovative technology with Fintech Skill Path

Difference between Fintech, Regtech and Suptech

The similarities between fintech, regtech and suptech provide a clear impression of the ways in which they can improve financial services. On the other hand, you should also pay attention to the differences between them on the basis of the following pointers.

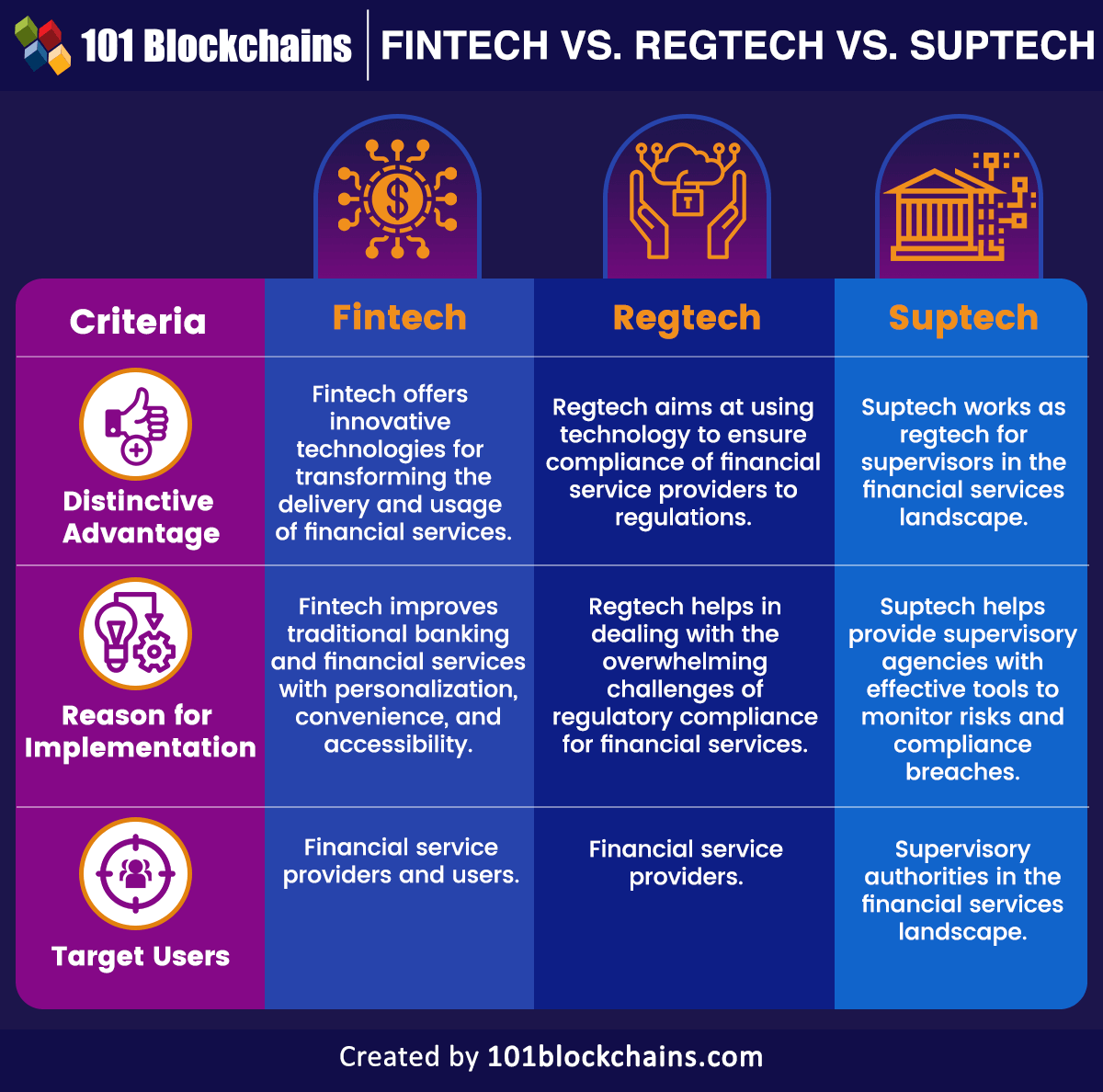

Fintech is different as it aims at offering innovative technologies that could transform the approaches through which customers interact with financial services. The difference between fintech and regtech suggests that regtech specializes in automating, managing and optimizing regulatory compliance operations for organizations. Suptech claims a distinctive advantage over the others by providing a form of regtech for supervisors.

-

Reason for Implementation

The next important factor for differentiating the entries in a fintech vs. regtech vs. suptech debate is the reason for implementing them. Fintech helps introduce a personalized approach to utilizing financial services with better accessibility, ease of use, and convenience. It also aims at improving financial inclusion.

The primary objective of regtech focuses on ensuring that financial service institutions comply with relevant standards and regulations. Regtech tools help firms manage and navigate through complicated regulatory environments that could help in avoiding fines and penalties. Suptech is essential for transforming financial reporting by enabling supervisory agencies with better tools for monitoring new frauds.

Another important point of difference between suptech, fintech, and regtech is the target audience for the technologies. Who should use fintech? Fintech is an ideal solution for banks, financial service providers, and users to improve financial inclusion and delivery of financial services. Regtech is a useful choice for fintechs, crypto exchanges, banks, brokerages, neobanks and credit unions. Suptech is recommended for financial authorities who have to use data for identifying emerging risks in the financial services landscape.

Here is an outline of the differences between fintech, regtech, and suptech.

Conclusion

The detailed outline of the fintech vs. regtech vs. suptech debate reveals that all three concepts use technology and innovation to improve financial services. Fintech helps in ensuring that banking and financial services institutions can deliver their services in better ways to customers.

Regtech emphasizes dealing with the challenges of emerging regulatory requirements in the new financial landscape. Most important of all, suptech serves as a powerful resource for supervisory agencies to check whether financial institutions follow important rules and regulations. Learn more about the three concepts and find more insights about their use cases now.

*Disclaimer: The article should not be taken as, and is not intended to provide any investment advice. Claims made in this article do not constitute investment advice and should not be taken as such. 101 Blockchains shall not be responsible for any loss sustained by any person who relies on this article. Do your own research!