Will Ethereum recover above $3,000 and will FOMO lead to normalcy again?

Ethereum has once again surpassed the $3,000 level after previous attempts failed as FOMO took over investors.

Ethereum is up 3% over the past day, recovering above $3,000.

Previously, Ethereum made two attempts at the $3,000 level, but both proved short as the asset quickly retreated to lower levels. In the past day, ETH has once again been on the rise, as can be seen in the chart below.

ETH appears to have shot up in the past day | Source: ETHUSD on TradingView

This surge saw ETH recover sharply by more than 3% from around $2,900 to current levels. The coin is up 8% over the past week, making it the second-best performer among the top 10 cryptocurrencies, just behind BNB’s 10% gain.

If you look at the graph, you can see that Ethereum is on the verge of breaking its all-time high this year. However, ETH investors will be wondering whether this rally will last or if it will lose steam like previous rallies. If the data is anything to go by, market sentiment may have been the reason the last surge disappeared.

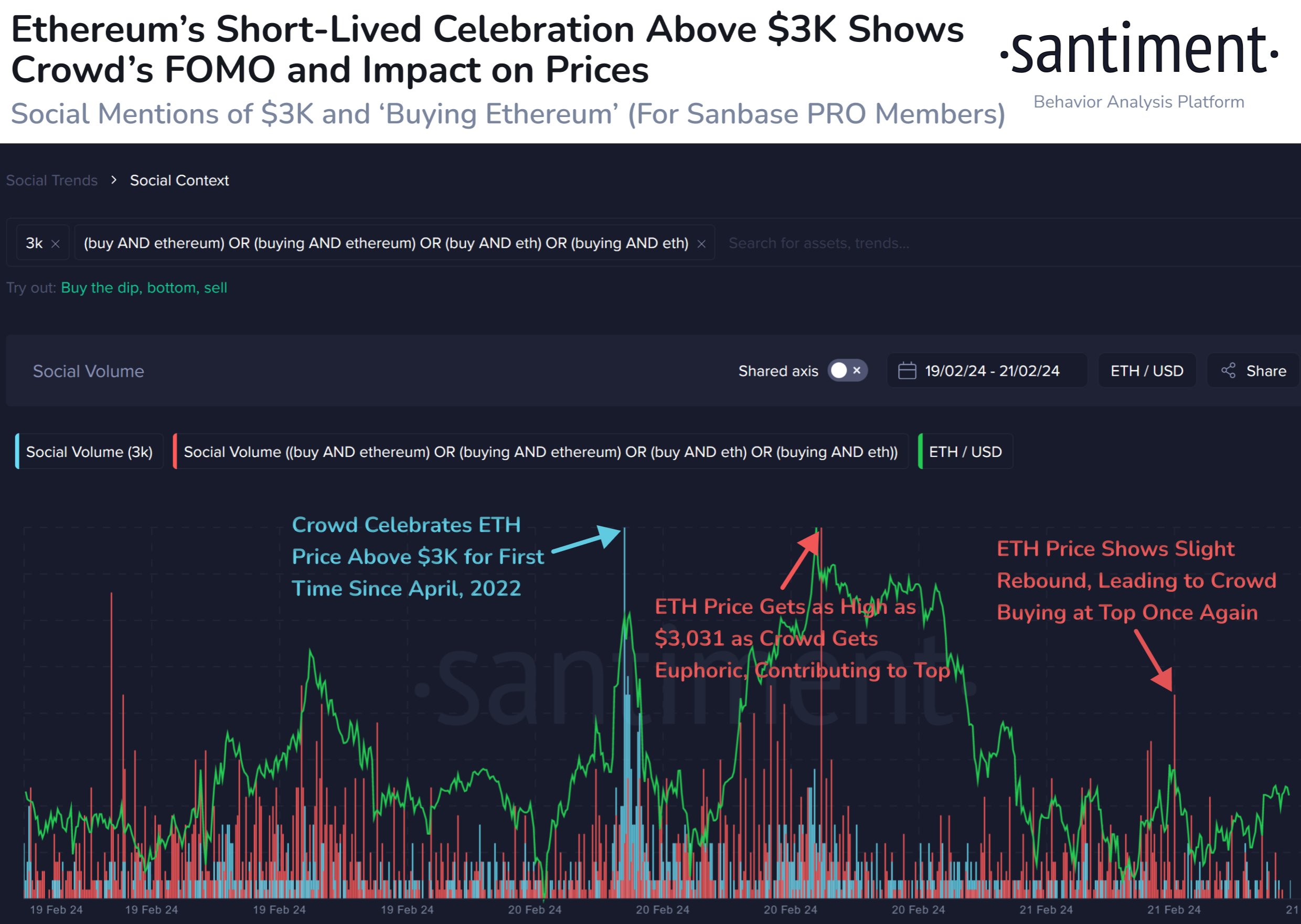

ETH’s previous surge peaked as FOMO took over traders.

According to data from analytics company st tly, the latest high above $3,000 occurred as crowd euphoria surged. The interest metric here is “social volume,” which tracks the overall amount of discussion social media users engage in around a particular term or topic.

This metric calculates this value by counting the number of posts/threads/messages on major social media platforms that mention the topic at least once.

The chart below shows social volume data related to two Ethereum topics.

The Social Volume related to the latest surges | Source: Santiment on X

The first social volume here is filtered to $3,000. As you can see in the graph, this indicator surged a few days ago when ETH surpassed $3,000 for the first time since April 2022.

This means discussion on the topic has surged as traders celebrate the break. But as it turned out, the surge was very short-lived.

The second attempt saw a significant increase in social volume associated with terms like “buy Ethereum,” suggesting that FOMO had developed among traders.

Historically, FOMO has made ETH’s price more likely to hit peaks as it has tended to move against crowd expectations. This is most likely why the top matches these spikes.

As Santiment highlights in the chart, a similar phenomenon occurred with the small recovery surge observed yesterday. It seems that greed has led to coin topping once again.

Now it remains to be seen how the market will react to the recent rally above $3,000. If FOMO surrounding Ethereum surges once again on social media, it could be a sign that this surge, too, is only temporary.

Kanchanara from Unsplash.com, featured image from Santiment.net, chart from TradingView.com

Disclaimer: This article is provided for educational purposes only. This does not represent NewsBTC’s opinion on whether to buy, sell or hold any investment, and of course investing carries risks. We recommend that you do your own research before making any investment decisions. Your use of the information provided on this website is entirely at your own risk.