Liberty All-Star Equity (US): Top CEF for consistent income generation

Moments via Javier Ghersi/Getty Images

outline

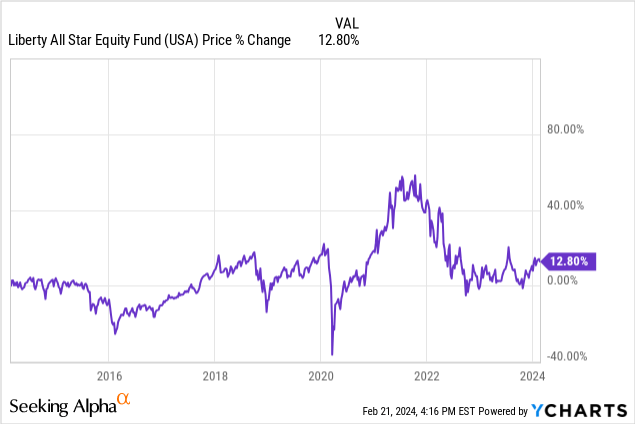

Closed-end funds are still an investment vehicle that doesn’t receive much attention. This is understandable because they are structured more complexly than traditional types of funds such as ETFs. And many more Many investors seem to abandon these types of funds almost immediately because the price charts look scary. For example, take a look at this price chart of Liberty All-Star Equity CEF (New York Stock Exchange: USA) Starting in 2015. A price return of 12.80% is not something to be excited about.

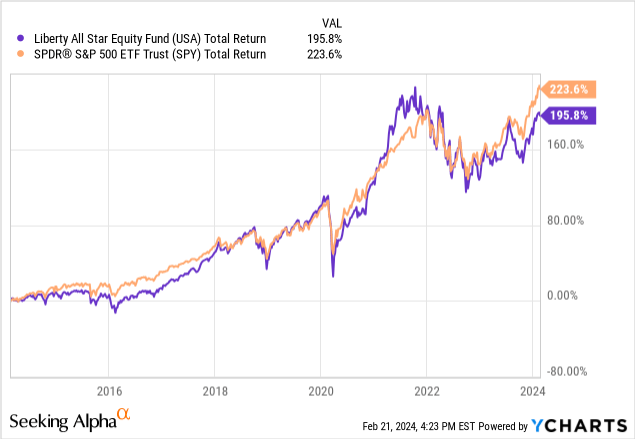

But when you look at the total returns for these types of funds, things start to change. CEFs typically have much larger distribution yields because they are structured to prioritize providing a sustainable income stream. Over the past five years, the United States has had an average dividend yield. About 10%. As a result, this high distribution has helped total returns approach 200%. Needless to say, total returns are nearly identical to the S&P 500 (spy). Total return is a good result for the fund, but I think a fund like America is more valuable for investors who prioritize income above all else.

To briefly summarize, the U.S. Liberty All Star Fund focuses its portfolio on the U.S. stock market. The fund’s objective is to invest in a number of different sectors while pursuing large-cap value and growth stocks. The fund targets long-term capital appreciation and aims to provide stable returns to shareholders. Capital appreciation targets have been very moderate since inception, but the return aspect is where the fund shines.

America is a great fund for people who rely on income, such as retirees. America is also a great fund if you want to invest in its growth over the next decade. This is because the fund has exposure to many of the world’s best US-based companies.

Updated Portfolio Review

All Star Fund

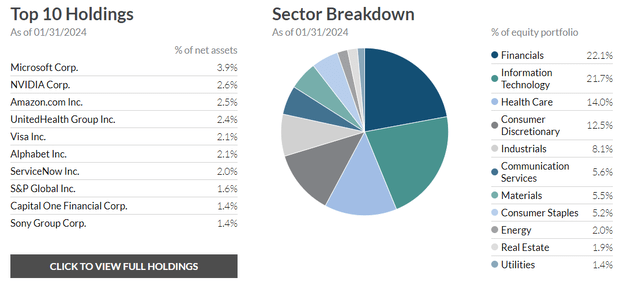

The fund’s top holdings consist of top companies like Microsoft (MSFT), NVIDIA Corp. (NVDA), and Amazon (AMZN), which I recently rated a Strong Buy. The portfolio has the highest weightings in the financial sector (22.1%) and technology sector (21.7%). The portfolio itself is diverse in nature, with exposure to most industries. But true diversity comes from how the strategies are implemented and how the funds themselves are managed.

This is because American management is divided into five individual managers. They each specialize in a different field and focus only on that field. Therefore, the Fund’s performance is the result of the following joint efforts:

- Fiduciary Management – Value Based

- Pzena Investment Management – Value Based

- Aristotle Capital Management – Value Based

- Sustainable Growth Advisory – Growth Focused

- TCW Investment Management – Growth Focused

Value-focused companies are tasked with identifying promising opportunities from a pool of high-quality companies. These companies must price themselves at low valuations while also having a catalyst for positive change. Growth-focused managers, on the other hand, target companies with predictable earnings and cash flow growth trajectories. I think this is very unique in that they are combining power and expertise for our benefit. They do so with an expense ratio of just 0.93%.

Some recent changes to the fund include the addition of two new companies and the liquidation of one company. The two new additions are CVS Health Corp (CVS) and Quest Diagnostics (DGX). The company being ignored is SAP SE (SAP).

Dividends and Comparisons

As of January 2024, the announced quarterly dividend is $0.17 per share, a recent 13.3% increase compared to the previous dividend of $0.15 per share. Management said it plans to pay out about 10% of the fund’s total value. Unlike high-yield business development companies (BDCs) such as Blue Owl Capital (OBDC), which offer returns close to 10%, this fund does not rely on factors such as net investment income (NII).

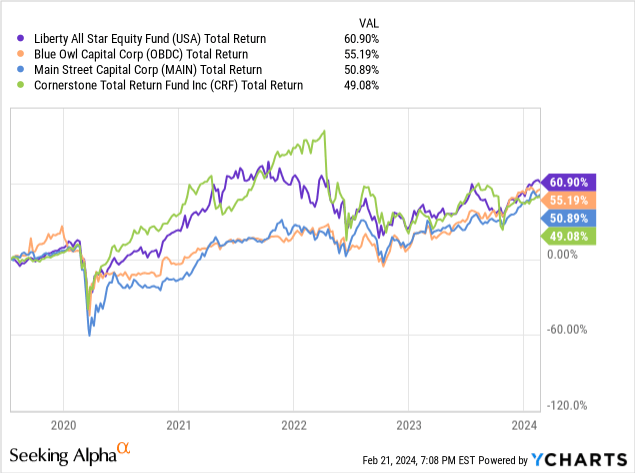

Speaking of BDCs, let’s quickly compare their distribution and gross margin rates with the US. Although their business strategies, structures, and goals are different, both offer double-digit returns and high total returns, so we think it’s a reasonable comparison.

The comparison between CEFs and BDCs can go deeper depending on which fund we look at, but ultimately, we want to convey that there are a variety of high-yield asset classes to choose from. Let’s compare its distribution and performance in the US with the previously mentioned OBDC, the popular Main Street Capital (MAIN), and Cornerstone Total Return Fund (CRF).

Over the past four years, the United States has actually outperformed this group in total return. Although the performance was very modest, the United States emerged victorious here, likely due to strong growth in both technology and finance. However, BDCs seem to be a better choice when it comes to dividend growth. This is especially true in a high interest rate environment where debt-funded cash flow is strong.

Meanwhile, CRF’s dividends have been declining over the past decade. Meanwhile, OBDC’s dividend was recently increased by 5.7% and is a regularly distributed supplement. Likewise, MAIN’s dividend has also increased recently, with supplementary dividends continually issued. Over the past five years, US dividends have ranged from $0.15 to $0.21 per share.

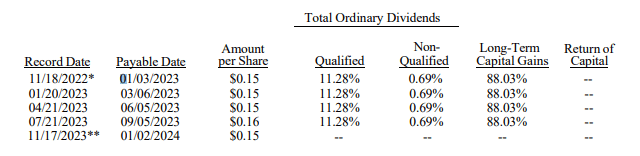

US Tax Distribution Information

Finally, under the structure of the United States, these distributions will likely be taxed as ordinary income based on the amount earned by the fund. The fund has not yet disclosed its tax information, but here is its transparent history for us to reference. You can see that the last distribution was mainly classified as long-term capital gains.

evaluation

We believe now is a good time to open a position in the US as the price is currently trading at a discount to NAV (Net Asset Value). The current NAV discount rate is approximately 4%. For reference, it has been traded at an average premium of 1.93% to NAV over the past three years. When prices surged in 2021, the premium was as high as 15%, and for a brief period after prices fell in 2020, the discount fell to -15%.

CEF data

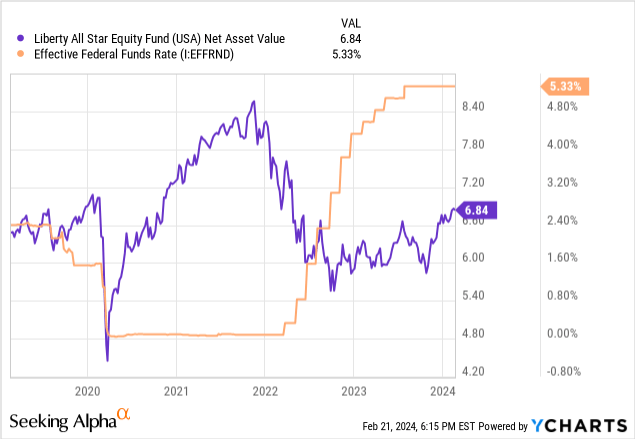

However, if you look more closely, you will see that NAV is slowly decreasing as interest rates start to rise starting in 2022. If you look at the graph below, you can see the inverse relationship. Interest rates are expected to be lowered around the middle of this year. If this happens, NAV and stock prices are expected to rise over time. Therefore, it is attractive to enter here as there is likely to be upside potential in addition to the high dividend income stream.

danger

The biggest downside here is that it underperforms compared to larger indices. I believe that income-focused investing like in the US means that the excess return margin for the S&P 500 expands over time. However, if you are only interested in earning money to fund your lifestyle, this may not be a big deal. However, if price increases are also important to you, there are better options.

takeout

In conclusion, the Liberty All-Star Fund offers a unique opportunity to earn high distributions and total returns. The stock price has not fluctuated much since its inception, but this is not necessarily a bad thing as it means you can earn steady profits while keeping some of your principal intact. The dividend yield is over 10% and was recently increased.

The portfolio is diverse and focuses more on finance and technology. Overall, the United States is a great choice to fund your retirement and accumulate a high level of income while gaining exposure to some of the best companies in the world. Current prices are below the average discount/premium to NAV, so entry here is ideal. However, we will be watching to see what effect future interest rate cuts will have on price movements.