Why Jamie Dimon’s $150 Million JPMorgan Stock Sale Could Be a Reason for Caution

JPMorgan Chase & Co. CEO Jamie Dimon dumped $150 million of the company’s stock Thursday in his first-ever sale, according to a recent filing. He had previously announced his intention to dispose of the stock.

Dimon sold 821,800 shares of JPMorgan stock. J.P.M.,

The average price is closer to $182.73, according to filings with the Securities and Exchange Commission. The sale was made through a Rule 10b5-1 trading plan, which allows company insiders, such as executives and board members, to sell stock under predetermined terms.

Ben Silverman, vice president of research at VerityData, which tracks insider activity, wrote that JPMorgan’s stock price “has hit record highs in recent days, so it is unclear whether this was the trigger or whether a sale plan was put in place based on timing.” .

He noted in his report that “a review of the stock’s daily chart raises some questions as to whether trigger prices have been applied.” Dimon’s sale came on the first day JPMorgan shares traded above $182, he emphasized.

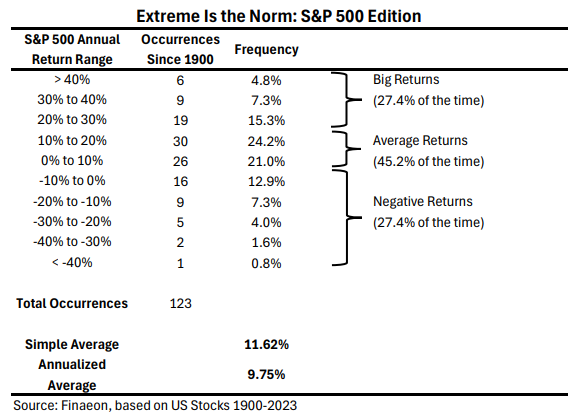

JPMorgan’s stock price has risen about 30% since Dimon adopted his trading plan, “which would be a fairly ambitious trigger for a relatively short-term plan,” Silverman said. The plan expires on August 23 and Dimon can sell up to 178,000 additional shares under the plan.

Dimon disclosed plans last year to sell up to 1 million shares for “financial diversification and tax planning purposes.” JPMorgan declined to comment Friday on the sale beyond what appeared in Dimon’s October filing.

Silverman expects Dimon to start selling around this time as a recent “cooling off” period for his trading plan has expired, but he also expects Dimon to dump stocks more “systematically” rather than through large sales initially. He said there was.

Other JPMorgan insiders also sold shares on Thursday. Chief Information Officer Lori Beer sold $716,000 of stock, and General Counsel Stacey Friedman sold $1.1 million. Troy Rohrbaugh, co-CEO of JPMorgan commercial and investment banking, sold $13.7 million in stock.

These sales were also made through trading schemes.

“This is a sale of a portion of our holdings under our 10b5-1 sales program,” a JPMorgan spokesperson said.

Before Thursday’s sale, Dimon had purchased shares of JPMorgan and the last time he bought stock on the open market was in February 2016, according to Silverman.

“Dimon’s surprising sales behavior and the fact that he has a strong purchasing history represent prudent data points along with sales clusters,” he wrote.