Things I Wish I Knew Before Investing in REITs

DNY59

I’ve been investing in real estate investment trusts (REITs) for over 10 years, and overall they’ve done pretty well over time. My REIT portfolio has performed significantly better than the REIT sector average (VNQRMZ) And this relatively strong performance allowed me to become a professional REIT investor.

But there were many mistakes along the way, some of which cost me a lot.

In today’s article, I’d like to share some tips I wish I had known before I started investing in REITs. If so, many losses could have been avoided and performance would have improved.

Here are five important lessons for every REIT investor:

#1 – Deep value situations rarely pay off in the REIT space.

My biggest mistake was probably There is too much focus on valuation and not enough on fundamentals. This led me to invest in many deep value plays over the years, some of which worked well, but most of which did not.

CBL & Associates Properties, Inc. (CBL) is a prime example. This mall REIT traded at a low single-digit multiple of cash flow in 2018, and the mall was generating stable cash flow. Of course, we understood that the asset faced some challenges, but we felt that the extremely low valuation would provide a good margin of safety. In fact, the valuation was not that low because investment costs were not properly considered.

Other examples include Uniti Group (UNIT) and Medical Properties Trust (MPW). I still have hope for these two REITs, but they are very risky and I have definitely been wrong so far.

The point here is that markets may not be perfectly efficient, but they aren’t completely stupid either. If it seems too good to be true, it probably is.

Warren Buffett famously said, “It is far better to buy a good company at a good price than to buy a good company at a good price.”

This applies well to REITs. This doesn’t mean you should buy only the highest quality REITs and accept any price. But you probably shouldn’t approach even the cheapest, lowest quality REITs.

Being too greedy has cost me a lot of money in my REIT investment career.

#2 – Business model is everything

Investors tend to forget that REITs are active real estate investment companies, not just passive holding companies.

Therefore, it is very important to understand the business model, i.e. management’s strategy.

You want to buy a REIT that follows a unique strategy that has the potential to generate exceptional returns, not a REIT that simply follows the same stereotypical approach to real estate investing that countless other investors follow.

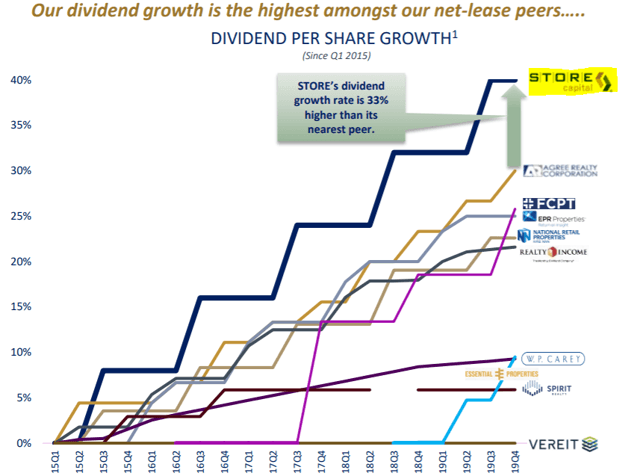

I recently discussed this topic in an exclusive interview with Chris Volk, former CEO of STORE Capital. This was a really great REIT that we owned until a private equity firm sold it.

Store Capital

Chris Volk explains: “Having played a key role in guiding three net-lease REITs, I have learned the importance of getting the business model right from the start.” (Note: If you haven’t already, I recommend purchasing Volk’s new book, “The Value Equation.” This book is very useful for REIT investors.)

In my experience, paying premium valuations for REITs with good business models is well worth it because they can create much more value over the long term.

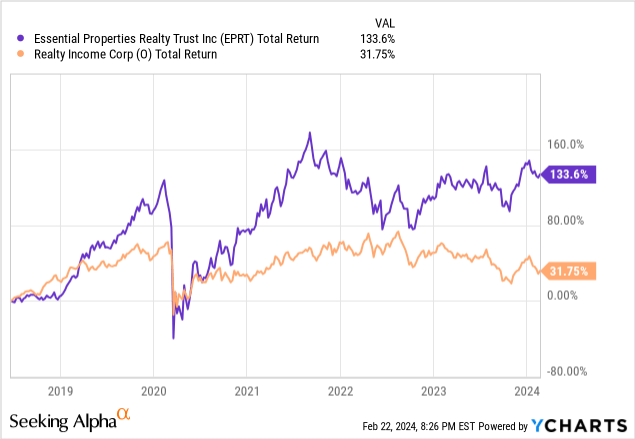

Good examples today are Essential Asset Real Estate Trust (EPRT) and Income from Realty (O). Both are net-lease REITs, but EPRT focuses on much smaller, middle-market companies and can earn larger spreads on new investments.

On the other hand, O is becoming too big for its own good and can no longer keep up with smaller, more creative peers like EPRT.

Differences in business models explain the extraordinary performance.

#3 – Volatility Can Be Futures or Curves

In the early days, I remember overreacting a few times to volatility caused by market noise. For example, I remember selling a REIT because it had disappointing quarterly earnings.

But over the years I’ve learned that good REITs usually bounce and that acting based on short-term news is often a bad decision.

This also makes logical sense.

REITs should be valued based on future cash flows expected over several decades, so the actual impact of a poor quarter or even year should not be very significant.

All REITs, without exception, experience difficulties from time to time, such as when a tenant vacates a building, preventing the REIT from meeting quarterly expectations, or when a tenant goes bankrupt, causing the REIT to lose rental income in the short term.

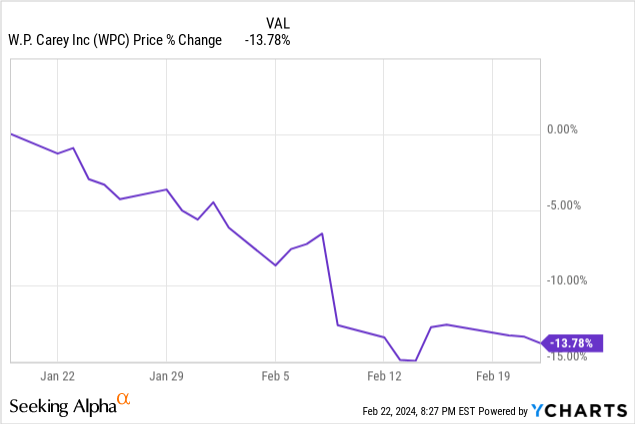

The market will often overreact to such news, sending the REIT’s stock price plummeting. We saw this with WP Carey Inc. (WPC) after the release of its fourth quarter results.

In my experience, this is often a good buying opportunity and, conversely, a very bad time to sell REITs.

Don’t overreact to short-term news. If you have a long-term perspective, you can take advantage of that volatility.

#4 – Dividends should not be a factor.

Many REIT investors focus too much on dividend yield.

They believe that high dividend yields mean REITs are cheap and good investment opportunities.

In reality, the opposite is often true, and dividends don’t say much about a REIT’s valuation.

Dividends are just capital allocation decisions. REITs may decide to use a lot of leverage and set high payout ratios to pay out more dividends. Or perhaps they simply use less leverage and retain more cash flow for growth, resulting in lower returns.

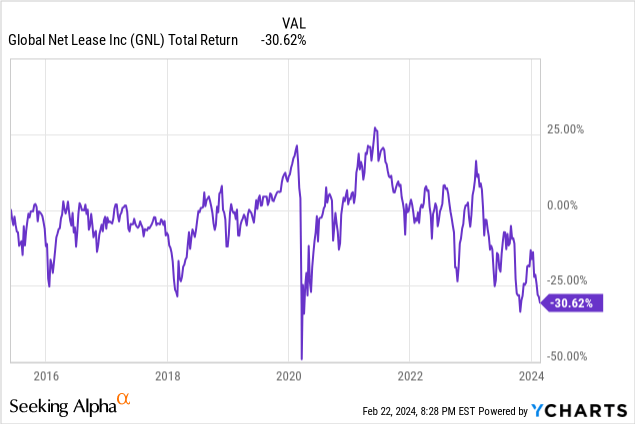

Historically, REITs with very high dividend yields have actually underperformed REITs with lower yields. A good example is Global Net Lease (GNL). REITs attract the attention of many individual investors because they offer very high dividend yields, but their total returns over time are:

What’s the point of earning a 15% dividend yield if it simultaneously destroys value?

In general, it is much better to buy a low-yield REIT that enjoys strong growth prospects than the other way around.

Closing Note

Not all REITs are created equal.

This is a broad and versatile sector with many great opportunities but also many value pitfalls.

There are significant differences in the performance of different REITs, so you need to learn how to distinguish the good from the bad.