$UNI token surges 60% due to exciting governance offers and airdrops.

Decentralized exchange (DEX) platform Uniswap ($UNI) has the cryptocurrency community buzzing with its latest governance proposal. This proposal, which aims to encourage staking and delegation of UNI tokens by offering rewards to users, has sparked interest from investors and users alike. This surge caused the $UNI token to surge by a whopping 60%, reaching a high of $12.28.

After Ethereum surpassed $3,000 this week, today we take a look at one of the bigger surges in the ERC-20 altcoin.

New offer via Airdrop

This proposal, revealed via the official Uniswap blog, represents a strategic move to strengthen community participation in the decision-making process. By encouraging $UNI token holders to stake and delegate their tokens, Uniswap aims to build a decentralized, resilient, and participatory governance system that is essential to the long-term vitality of the platform.

The suggestions are as follows:

“We aim to reward UNI holders who stake and delegate their tokens… Decentralized, resilient, and participatory governance is essential for the long-term health and success of the protocol. We believe this update will strengthen and enable Uniswap governance.”

The founder of Uniswap specifically mentions: Future $UNI airdrops I agree with the suggestion.

This initiative will not only strengthen community engagement but also aim for sustainable growth to ensure the continued success of the platform. According to the report, there has been a significant increase in staking and delegation activity since the proposal was announced, indicating widespread support and anticipation for the upcoming vote.

The voting process is scheduled to begin the next day. March 1stAn ad hoc process will be followed by online voting on March 8.

$UNI Transaction

The market’s response to this proposal has been nothing short of amazing. Traders and investors quickly flocked to the exchange, anticipating the proposal’s potential impact on the project. In just one hour, the UNI token soared from about $7.15 to $12.28, recording an incredible increase of 60%, and trading volume exceeded $1.68 billion in 24 hours, a surge of 1,600% compared to the previous day.

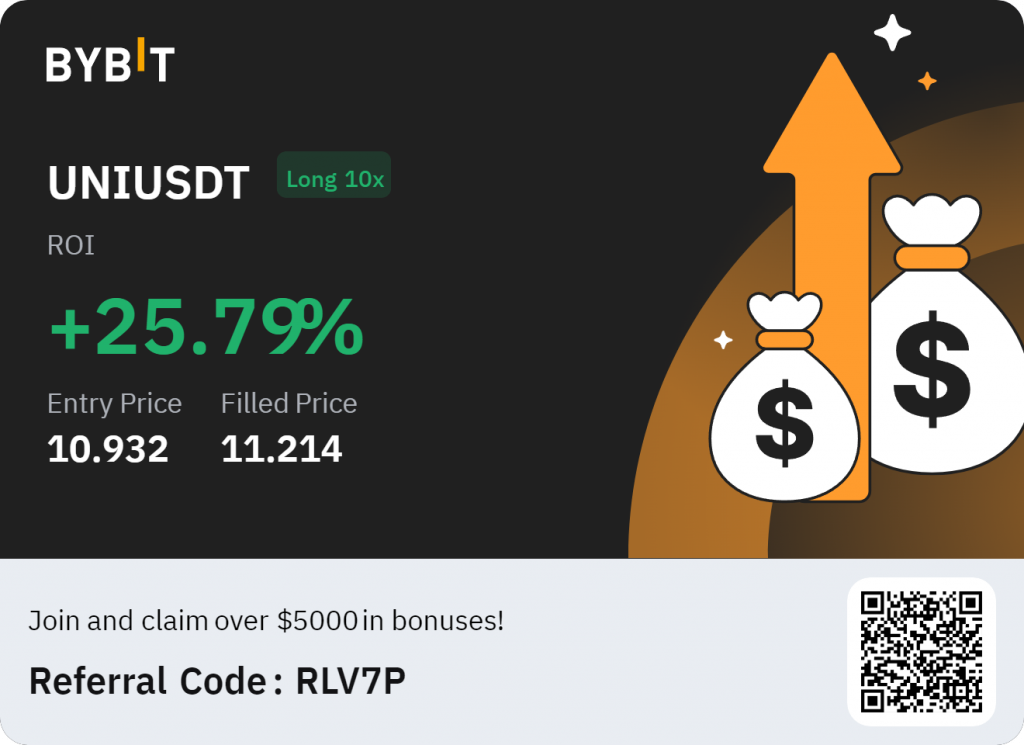

Now these types of events provide you with great trading opportunities. Whenever a coin surges like $UNi, I look for short and long term opportunities. I found two yesterday.

At this moment I look at a short time frame. 1 minute or 5 minute charts. When the volume on the green candle appears to be decreasing, I look for a sell entry point with a tight stop loss.

This is a very risky trading scenario because coins with momentum can break levels in the blink of an eye. This is why I maintain a strict stop loss strategy. On the other hand, pullbacks can be short-term, so you can use the same strategy to find long-term entries.

Both of these transactions opened and closed within 30 minutes. short and sweet

The token has recovered slightly from its highs, trading around $12 at the time of publication, but still reflects a notable 52.6% increase in the last 24 hours, indicating continued enthusiasm and optimistic sentiment among investors.

The release of the proposal is an exciting milestone for Uniswap and highlights the importance of community-driven governance in shaping the future of decentralized finance (DeFi). As the platform continues to evolve, these initiatives promise to take Uniswap to new heights in the burgeoning DeFi landscape, paving the way for a more inclusive and resilient ecosystem.

final words

If you like our content, you can support us by signing up for a Bybit account through our referral link. Don’t forget to claim your bonus if you buy/sell or trade cryptocurrencies.

You might also like our other trading content: